Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

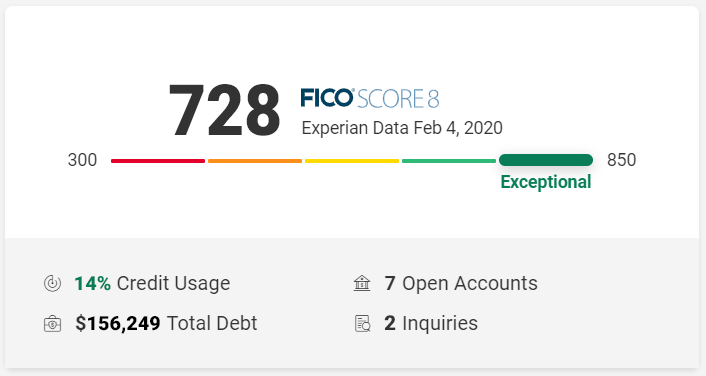

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Can I Get A Personal Loan Or Credit Card W/ A 766 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 766 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 766 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Also Check: Speedy Cash Collections

What Are The Average 766 Credit Score Car Loan Rates In 2021

For those that have excellent credit scores, they can ensure that they will qualify for just about any type of loan that they wish to take out, whether it is an auto loan or a mortgage. Personal loans are also something that are easier for them to borrow with such a high credit score. It is important to provide proof of your income when applying for any loan, though.

| FICO Credit Score |

|---|

| 3.34% |

All the calculation and examples below are just an estimation*.Individuals with a 766 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO scores were charged 14.8% in interest over a similar term.

So, if a vehicle is going for $18,000, it will cost individuals with excellent credit $326 a month for a sum of $19569 for more than five years at 3.4% interest. In the meantime, somebody with a lower credit score paying 14.8% interest rate without an upfront installment will spend $426 a month and wind up burning through $25584 for a similar auto. That is in excess of a $6015 distinction.

The vast majority wont fall in the highest or lowest class, so heres a breakdown of how an extensive variety of FICO scores can influence the aggregate sum paid through the span of a five-year loan:

| FICO Range | |

|---|---|

| $7,582 | $25,584 |

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip:;You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Read Also: Can You Have A Credit Score Without A Social Security Number

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

Her Secret To A Good Credit Score Without Ever Checking It

Though a lot of experts suggest you constantly stay on top of your credit score to know if it goes up or down, Stevens improved her score while barely checking it at all, except for certain milestones: a new job, getting married, signing for a new apartment.

But she did abide by one rule, and it’s been her secret to raising her credit score from just OK to “excellent.”

“I knew that if I paid my credit in full and on time, my would go up, and that’s always been my learning from the books,” Stevens says. “I felt like checking it wasn’t necessary if I knew I was doing the work of getting good credit.”

Stevens notes that she stuck with her Discover card for a really long time and opened up a Visa card years later to get a better interest rate. She said she never closed her oldest Discover card based on strategies she read about the importance of showing a long credit history.

Her number one piece of advice to improve your credit score? No matter how often you check it, make sure your credit card payments are made on-time and in full.

Information about the Capital One® QuicksilverOne® Cash Rewards Credit Card;has been collected independently by CNBC and has not been reviewed or provided by the issuer of the card prior to publication.

Petal 2 Visa Credit Card issued by WebBank, Member FDIC.

The regular APR variable for the Petal® 2 “Cash Back, No Fees” Visa® Credit Card currently range from 12.99% – 26.99%

Editorial Note:

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Why Is A Good Credit Score Important

Lets be real, your credit score can seem pretty arbitrary. But its nonetheless important when it comes to getting your first apartment or applying for your first credit card.

Why is this? Because your credit score can make or break whether you get approved for an apartment. It can also determine whether you get approved or denied for a credit card. It can even affect the interest rate you get. This is crucial to understand because, if you take out a loan, interest can cost you a lot of money over time. Even the difference between a few percentage points can potentially cost you hundreds or thousands of dollars in interest.

So, having a good credit score can help you save money, and help you get better interest rates.

How Can You Maintain A Good Credit Score

A good credit score comes with responsible credit behaviour. Here are some of the factors which will help you in maintaining a good credit score:

- Consistent Repayment: Credit score calculations lay nearly 35% weightage on your payment history. If you want to maintain a good credit score all the time, your repayment record should be 100% positive. For this, you must ensure to never miss a repayment.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

How To Get A 765 Credit Score

Theres no secret for getting a 765 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 765 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 765.

What Does A 750 Credit Score Mean For Your Wallet

A 766 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

Also Check: What Credit Report Does Comenity Bank Pull

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO;Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

At First Stevens Didn’t Pay Anything On Her Credit Card Bill

Stevens graduated from college with a couple thousand dollars of debt on her first-ever credit card and student loans. She wasn’t paying back either, until she realized how quickly that mistake added up.

“I remember in college I would just buy things and assume they were automatically taken care of,” Stevens says. “I’d open up the bills and see that the balance would keep going up even when I stopped buying things because I was getting all of these late fees.”;

She credits her mother for helping her realize what was happening. “It never really dawned on me that I had to actually pay the money back, and that the bill was a financial consequence, a penalty, for not doing it,” she says.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Heres How To Get A 765 Credit Score:

Improving Your Credit Score Range

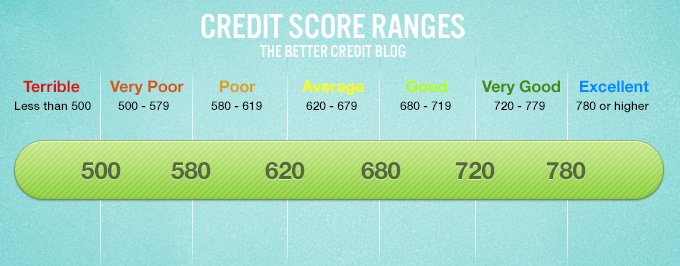

So now you know where your three-digit number falls in the credit score ranges. If you already have excellent credit ranging from 780 to 850 congratulations.

Your only job now will be to keep doing what youre doing to maintain stellar creditworthiness.

If you have very good credit, you may want to figure out how to optimize your score even more to achieve an even-better three-digit number. Keep reading to learn ways to fine-tune your credit life.

For everyone else, you probably have a little work to do to get into a better credit score range.

Like I said above, dont worry if your credit score has parked itself at the lower end of the spectrum. Ill show you exactly where to start working to achieve the best credit possible.

You can improve your credit score in no time if you dedicate some time to learning about how credit repair works.

Don’t Miss: Does Klarna Build Credit

What An 800+ Credit Score Can Mean

The advantages of having an 800+ credit score are huge. Ilene Davis, a certified financial planner with an 800+ credit score, says she did a calculation on the mortgage payments for a $300,000 home loan for various FICO scores.

If the difference between payments for borrowers with the highest and lowest credit scores were invested at 6% a year, at the end of a 30-year mortgage the borrower with the highest credit score would have accumulated around $750,000. Thats a chunk of money worth improving your credit score for.

Feeling overwhelmed or like you are drowning in credit card debt? ACCCs Debt Management Plan may be your answer!

Our Debt Management Plan will help you consolidate your unsecured debt into one monthly payment and restructures your payments to make it more affordable.

A Debt Management Plan:

- Is designed to fit your budget

- Will reduce your interest rate on most credit card accounts

- Will reduce or eliminate the penalty fees

Mortgages Where Credit Score Matters Less

With conventional loans those backed by Fannie Mae and Freddie Mac a lot of focus is put on your credit score, says Dan Keller, a mortgage professional in Seattle.

The impact of a lower score wont be as substantial on some types of loans as it would be with a conventional loan, Keller notes. For the best interest rates on a Federal Housing Administration or Department of Veterans Affairs loan, the focus isnt on a 760 score as it is with conventional loans, he says; its on 700-plus.

-

For an FHA loan, you may be able to have a score as low as 500.

-

VA loans don’t require a minimum FICO score, although lenders making VA loans usually want a score of 620 or more.

-

USDA loans backed by the Agriculture Department usually require a minimum score of 640.

So, theres some leniency on credit scores and underwriting guidelines with government loans. But the loan fees are more expensive: Youll have to pay mortgage insurance as well as an upfront and an annual mortgage insurance premium for an FHA loan.

But those credit score guidelines dont tell the whole story. Most lenders have overlays, which are extra requirements or standards that allow them to require higher credit scores as a precaution, regardless of mortgage type.

Recommended Reading: Shopify Capital Eligibility Review

You Need A Mortgage Loan

You definitely dont need a mortgage loan to have good credit. However, if you want to max out your credit score, having a mortgage loan with good payment history is a must.

Since a mortgage loan is usually a relatively large loan and more difficult to get than other installment loans such as an auto loan, a mortgage shows creditors you have been responsible enough with your credit to get the mortgage in the first place.

Fair Isaac Corporation, which provides the FICO score, recommends you have a mix of different types of credit accounts. So along with credit cards and installment loans, a mortgage loan is the last piece of the pie to round off your credit mix.

I also want to note I didnt start seeing my credit score go up because of the mortgage loan until about a year later, so it definitely takes some time.

You obviously shouldnt take out a mortgage loan just to get a perfect credit score. But a mortgage loan is normally considered to be good debt, in that interest rates are relatively low and youre financing something that usually appreciates in value.

If you dont already have a mortgage, be sure to fix up your credit report before applying for a mortgage assuming youre ready for homeownership.

How Long Does It Take To Get A 769 Credit Score

It depends where you started out.

If you had good credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

You May Like: Is 524 A Good Credit Score