Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.;

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 87 votes.

Other Factors That Mortgage Lenders Consider

Anyone who has applied for a mortgage since the 2008 housing crash will tell you that the modern mortgage lender wants to know everything about a borrower short of the number of hairs on their head before giving them a loan.

Not only will they pull your credit report and examine your credit history, but theyll also thoroughly examine every aspect of your finances.

Unfortunately, that means bad credit isnt their only excuse to stick you with a higher interest rate. But on the bright side, it also means that you may get away with an average credit score if your other financial metrics are positive.

Lets take a look at the three most important factors that lenders consider in addition to your credit score.

What Is The Minimum Credit Score Needed To Buy A House

Most lenders will only approve home loan applications when borrowers have a minimum credit score of at least 580. And that FICO score requirement can increase, depending on the type and terms of the loan. Heres a list of typical minimum FICO scores by mortgage type:

- FHA loan: 580+ FICO score

- VA loan: 620+ FICO score

- USDA loan: 640+ FICO score

- FHA 203k: 620+ FICO score

- Conventional Loan: 620+ FICO score

Even if you need to improve your credit score before you apply for a mortgage, dont let the minimum credit score for a home loan stop you. There are many;simple ways to improve your credit score before you start applying.

Recommended Reading: Does Klarna Report To Credit

Using Credit For Home

Buying a house;involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card <em>after</em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

Want To Buy A House Heres The Credit Score Youll Need To Do It

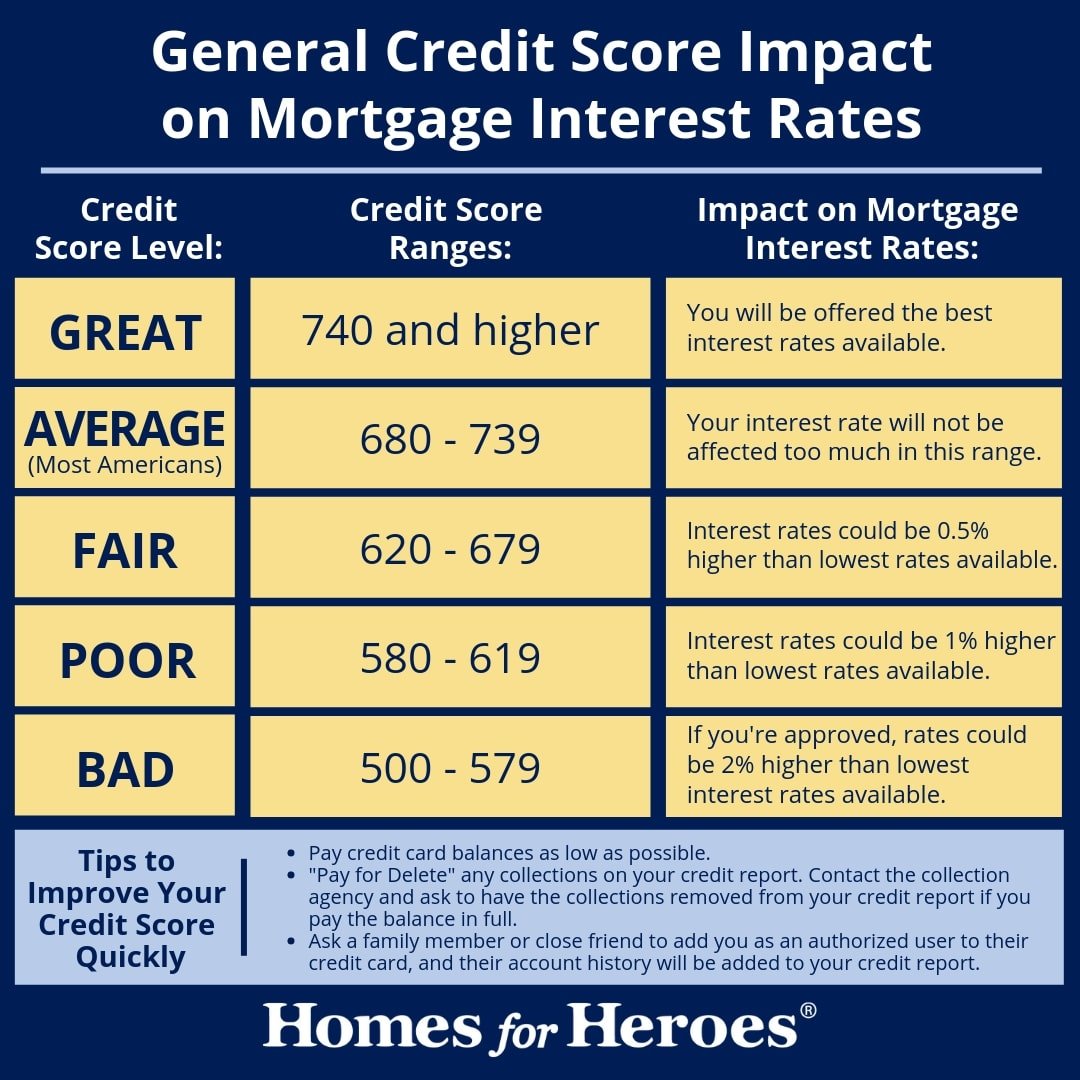

Your credit score plays a major role in your ability to secure a mortgage loan. Not only does it impact your initial qualification for a loan, but it also influences your interest rate, down payment requirements, and other terms of your mortgage.

Are you considering buying a house, and making sure your credit is ready? Heres what you need to know.

Read Also: What Credit Score Does Carmax Use

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Check Your Credit Score And Reports

Knowing where you stand is the first step to preparing your credit for a mortgage loan. You can check your credit score with Experian for free, and if it’s already in the 700s or higher, you may not need to make many changes before you apply for a preapproval.

But if your credit score is low enough that you risk getting approved with unfavorable terms or denied altogether, you’ll be better off waiting until you can make some improvements.

Whether or not your credit is ready for a mortgage, get a copy of your credit reports to check for potential problems or concerns. You can get a free copy of your credit report every 30 days from Experian or from each of the three national credit reporting agencies every 12 months at AnnualCreditReport.com.

Once you have your reports, read through them and watch for items you don’t recognize or are outright inaccurate or fraudulent. If you find any inaccuracies, you can dispute them with the credit reporting agencies. This process can take time, but it can also improve your score quickly if it results in a negative item being removed.

Recommended Reading: What Credit Score Do You Need For Care Credit

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Maintaining Good Credit Throughout The Homebuying Process

Check your credit sooner rather than later. That way, if you find any credit issues on your report, you’ll have time to take care of them and;boost your credit score;before a mortgage lender reviews your credit.

Applying for a mortgage preapproval, finding a home, getting the final mortgage approval, and then pulling off the final house closing often takes between six weeks and three months, but prepare for it to take longer. During this time, it’s important to maintain good credit so nothing throws a wrench into your final mortgage approval.

To prevent any credit issues that could result in less favourable mortgage terms, prevent a final approval, or damage your credit, remember to do the following.

- Avoid completing multiple mortgage applications with different lenders in a short time frame. This may flag you as a credit seeker and lower your credit score.

- Hold off on applying for other credit, such as a car loan or a loan for household appliances, that could increase your total monthly debt payments.

- Make all existing credit payments, including car loans, car leases, student loans, credit cards, and credit lines on time and in full.

Recommended Reading: What Credit Bureau Does Paypal Credit Use

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

What Is A Good Credit Score For Buying A Home

A good credit score falls between 670 and 739 and is the recommended range for qualifying for a mortgage. With a score in this range, you signal to lenders that you can be trusted to pay back the loan based on prior payment history, on-time payments, age of credit accounts, and other factors.;

One of the greatest benefits of a good or excellent credit score is its positive impact on the mortgages interest rate. The annual percentage rate is the annual rate of interest charged to the loan. A good APR can provide favorable monthly payments for the borrower.;

Keep in mind that that credit score isnt the only factor in loan approval. Lack of income, low savings, or a high debt-to-income ratio could cause a loan to fall through.;

Also Check: What Is Cbcinnovis On My Credit Report

What If You Dont Have A High Enough Credit Score To Buy A House

Buying a house is probably going to be the most significant financial transaction of your life. Its not something that you should try to do with bad credit.

If you pull your credit report and score only to find that youre not in the necessary credit score range, work on raising that low credit score before you apply for a loan.

One of the best ways to increase your credit score is with a . Credit Strong credit builder accounts are the ideal combination of an installment loan and a savings account. If youre looking to raise your credit score 100 points or more, theyre a good start.

When you take out a credit builder loan with Credit Strong, well place the principal balance into a savings account for you. Youll then make monthly installments to pay off the balance, as usual.

Well report your payment history to each major credit bureau so your progress is visible to every lender, whichever credit report they prefer. Unlike credit card debt, these loans wont negatively impact your credit utilization ratio while you pay them off.

After the final loan payment, well give you access to your funds, which you can then put toward your down payment.

To put that into perspective, if you were to increase your credit score from 690 to 760, you could save $22,755 in interest on a $300,000 loan.

If a credit builder loan option sounds interesting to you, take a look at our pricing and plans to begin building better credit today!

Resources

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Read Also: Syncb/ppc Closed

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you;credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but;fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

What Would Be Considered A Good Credit Score

- A score of 600+ will give you a fair chance of home loan approval. although this may vary according to which bank you use.

- A score of 670+ is considered an excellent credit score, significantly boosting your chances of home loan approval.

- Scores below 600 would be considered high to very high risk. In this case youll want to look at ways to clear your credit record.

Each bank uses both the credit bureau score and their own internal risk assessment criteria which looks at a number of factors specific to a particular home loan application, such as the loan size compared to the property value .

If you are classified as very high risk, the chances are you wont be successful in your home loan application as the banks will question your ability to pay them back.

A good to excellent credit score will have the opposite effect, possibly opening the way for you to negotiate preferential terms and interest rates.

You May Like: Does Zebit Report To Credit

How Your Credit Score Impacts Your Mortgage Prospects

If youre planning to buy a home, your credit score will play a big part in the process. At the start, it will determine which loan options you can even consider as a homebuyer. While some loan types require minimum scores as high as 640 , others go down to 500 .

Your credit score will also impact the costs of your loan, because your credit score represents your level of risk to a mortgage lender. A higher score means that you pay your bills on time and can be expected to repay your mortgage just the same. As a result, youll qualify for lower interest rates.

If your score is low, however, that means youre a risky bet for a lender. To compensate for the extra riskthat chance you wont pay your loan or might foreclose on the housetheyll boost the interest rate to protect themselves.;;

Suppose youre purchasing a $250,000 home in Texas and putting 10% down. In 2019, according to the Consumer Financial Protection Bureau, your interest rates would most likely have looked like this:

| Effect of Credit Score on Loan Rates | |

|---|---|

| 740 to 850 | 3.625% to 4.99% |

The difference in interest paid over the life of the loan could be substantial. On this specific loan amount, just a one-percentage-point difference would equal more than $11,000 less in interest over the first five years and nearly $50,000 less across the 30-year loan term.

A Good Credit Score Can Affect Mortgage Rates

A good credit score isnt just about loan eligibility; its also considered a salient factor in securing low mortgage rates. Typically, loans are structured as either 15- or 30-year loans, further delineated as fixed or adjustable rates. For fixed-rate loans, a good credit score can really make a difference in the rate that is offered. While it may not seem like a huge difference when a loan officer offers you a 2.75% vs a 3.0% mortgage rate, over the long haulespecially for 30-year loansthis distinction can add up to thousands of dollars in savings.

While the decision of what rate youre eligible for is ultimately decided by the lender, a good credit score in combination with assets, income and down payment goes a long way in demonstrating your creditworthiness. Rates above 700 are particularly helpful, and if you score in the Exceptional range youll certainly be in a strong position to ask for a mortgage rate reduction.*

Recommended Reading: How To Get Credit Report Without Social Security Number

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.;

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Is The House Im Buying Located In A Rural Area

If you answer yes, you might prefer getting a USDA loan. As you may surmise, this is ensured by the U.S. Department of Agriculture. Its a little trickier to answer this question, though, and you might want to be sure by double-checking here if your location is USDA-eligible.

Like VA loans, USDA loans dont ask for a minimum FICO Score and oblige you to make a down payment. However, note that if your credit score is below 640, you will have to go through manual underwriting, so its best to prepare documentation.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus