Lendingclub: Best For Availability In Most States

Overview: LendingClub offers personal loans of $1,000 to $40,000 for three- or five-year terms.

Why LendingClub is the best for availability in most states: While some lenders only operate in a limited number of states, LendingClub accepts applications from borrowers in every part of the United States.

Perks: You may qualify for a loan if you have a credit score of at least 600. The lender also allows a 15-day grace period on late monthly payments.

What to watch out for: It can take 48-hours from loan approval to funding. Youll also be subject to an origination fee of up to 6 percent.

| Lender |

|---|

Tips To Improve Your Credit

This is especially important when youre in the fair credit range, for at least two reasons:

- If youre at the bottom of the fair credit range, youll want to move toward the top, and

- Your goal should be to move above the fair credit range.

When rebuilding fair credit, take time to learn the right way to rebuild credit yourselfknow your rights and the signs of a credit repair scam. If its too good to be true, it probably is.

Here are tips to help you do just that.

Discover: Best For Longer Repayment Terms

Overview: While Discover accepts borrowers with fair credit, it favors those on the higher end of the fair-credit spectrum; borrowers typically have credit in the mid-600 range to qualify for a personal loan. If youre on the lower end of fair credit, you may not qualify.

Why Discover is the best for longer repayment terms: Its relatively long repayment terms up to seven years could mean lower monthly payments.

Perks: Discover offers competitive interest rates, fast funding and no origination fee or closing costs.

What to watch out for: The $39 late fee is high compared with competitors. Additionally, Discover doesnt have a co-signer option.

| Lender |

|---|

Read Also: When Do Collections Come Off Credit Report

Good Money Habits Lead To Good Credit

You can do several things to boost your chances of;approval:

When possible, pay at least the minimum amounts due on your debt;payments.

Ensure that you have disposable income left over after your monthly debt;obligations.

Avoid submitting applications to multiple credit issuers within a short time;span.

Check your credit report;;its free to do once a year;;as it is the source material for your FICO Score 9. If something looks inaccurate, contact the creditor associated with your account and/or dispute the item with your credit;bureaus.

The length of your credit history is an important aspect of your credit score and getting new credit. You can build credit by opening an account in your name, being an authorized user on someone elses account, and periodically using the accounts you already own and paying them;on;time.

Having No Credit History

If youve never borrowed money or had a credit card, you may have a blank credit report. No credit history doesnt give the best impression to lenders, and theres nothing proving that youll repay a loan on time . It can actually be just as a bad or even worse than a bad credit history and jeopardize your chances of receiving a loan when you need it.

Also Check: What Is The Ideal Credit Score To Buy A House

A Wider Window For Approval

FICO scores may be the industrys standard for credit decisions, but they dont always tell the whole story of your financial fitness. To get a better picture of your creditworthiness, Goldman Sachs draws from a wide variety of data,;including:

TransUnion bureau data, which gives a record of your credit performance on past and current debt;obligations.

Where applicable, your available payment history with utilities such as telecom, gas, and;electricity.

The annual income you;report on your Apple;Card;application.

The disposable income left after your monthly debt;obligations.

Your history of paying down debts based on your past credit;activities.

Can You Get A Personal Loan With A 600 Credit Score

Yes, you can get a personal loan with a 600 credit score there are even lenders that specialize in offering fair credit personal loans.

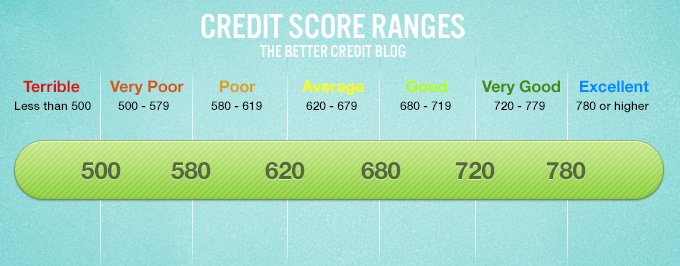

However, keep in mind that if you have a credit score between 580 and 669, youll generally be considered a subprime borrower meaning lenders might see you as a more risky investment.

Because of this, youll likely pay a higher interest rate than borrowers with good to excellent credit.

Tip:

Even if you dont need a cosigner to qualify, having one might get you a lower interest rate than youd get on your own.

Here are Credibles partner lenders that offer cosigned personal loans:

If you decide to take out a personal loan, remember to consider as many lenders as possible to find a loan that fits your needs. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan?

You can use Credible to compare rates from multiple lenders in 2 minutes. Just keep in mind, you wont be able to get a personal loan with a cosigner through Credible.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

Learn More: How to Get a $5,000 Personal Loan

Don’t Miss: How Much Does A Hard Inquiry Affect Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

BEST OF

Dont Apply For Too Many New Credit Cards At The Same Time

A hard inquiry typically occurs when you apply for a new credit card. This just means that the card issuer has requested to check your credit as part of the approval process.

A hard inquiry can have a small negative impact on your credit, but just one hard inquiry is usually not a big deal. But multiple hard inquiries in a short period of time might lead lenders to assume that youre a potentially risky borrower. Whether thats true or not, it isnt something you want weighing down your credit!

You May Like: Is 779 A Good Credit Score

Correct Outdated Or Wrong Information

Look at your credit history for any errors or omissions, any open credit lines, or negative info thats older than seven years. If you see anything wonky, get it fixed ASAP. According to Borrowell, theres a statistical correlation between regularly monitoring your credit report and improving your score.

The Age And Variety Of Your Credit

The quality of your credit makes a big difference as well. This is primarily represented by two things: age and diversity.

The age of your credit is important. You cant even get a credit score until three to six months;after opening your first lending account. After that, the older your average credit, the better your score.

In addition, the variety of your credit matters. If you only have one line of credit, it gives lenders less insight into your financial habits. Instead, showing that you can manage credit cards, auto loans, student loans, and a mortgage at the same time naturally boosts your score.

Recommended Reading: What Credit Report Does Comenity Bank Pull

How To Improve Your Fair Credit Score

Raising your credit score will give you the best chance of qualifying for a personal loan with lower rates. Ways to improve your credit score include:

- Pay off existing debt: Your makes up 30 percent of your FICO score. Lowering your total debt shows more responsible use of credit.

- Make payments on time: Payment history makes up 35 percent of your credit score, so making late payments or missing payments altogether will tank your score.

- Keep old accounts open and don’t open new ones: Keeping old, unused accounts open raises the average age of your accounts, which makes up 15 percent of your credit score. Dont open new credit accounts before applying for a loan, as that will lower the average age of your account.

Best Credit Cards For Fair Credit Of September 2021

ALSO CONSIDER:;Best credit cards of 2021;||;Best unsecured cards for short credit histories ||;Best starter cards for no credit ||;Best rewards credit cards

Credit cards for fair or average credit are aimed at those in the 630-689 FICO score range.;It’s an underserved market, so the list of such products is fairly short, and those that do exist lack the big sign-up bonuses you’d get with a card requiring;excellent credit. But they may still offer rewards.

These cards can help you if you’re just starting out with credit or are working to get back on track.;A;hallmark of cards for fair credit;is high interest rates. That’s important to keep in mind as you work to build a positive credit history, especially if you carry a balance.

ALSO CONSIDER:;Best credit cards of 2021;||;Best unsecured cards for short credit histories ||;Best starter cards for no credit ||;Best rewards credit cards

Credit cards for fair or average credit are aimed at those in the 630-689 FICO score range.;It’s an underserved market, so the list of such products is fairly short, and those that do exist lack the big sign-up bonuses you’d get with a card requiring;excellent credit. But they may still offer rewards.

- Deserve® EDU Mastercard for Students: Best for International students

You May Like: How To Get Credit Report With Itin Number

Pay All Your Bills On

A late payment here, a collection there, may seem fairly harmless at the time especially if youre having a cash crunch. But those are the stuff of fair and poor credit, and you need to avoid them at all costs.

One advantage you have with bad credit is that it becomes less important as time goes on. The sooner you begin paying your bills on time, the older the derogatory information will become, and the higher your credit score will be. So start now paying all your bills on time all the time.

Dont forget landlords and utility companies either. They will report to the credit bureaus if you have unpaid balances.

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

Don’t Miss: How To Gain Credit Score

Current Auto Loan Interest Rates

| Dates | |

|---|---|

| 4.15% | 4.49% |

Note: ;Actual interest rates are based on many factors such as state, down payment, and verification of credit score. Car loan interest rates provided by Bankrate.

How does your credit score affect you getting top APR automobile loans if you have a 611, 615, or 618?

How much is my car or truck payment going to be each month?

These questions are very common and we thoroughly answer each of them.

When you finish this article you will have a good understanding of how much your auto loan will cost you each month and all the factors that will determine your loan interest rate.

If you are looking for the best deals on an auto loan, personal loan, home mortgage loan, or credit card for a credit score between 610 to 619, check out one of these articles.

What Can You Do With A 611 Credit Score

A credit score of 611 has a lot of room for improvement. A 611 credit score is Fair and doesnt grant many benefits that a person with a 740 credit score will enjoy. Additionally, a person with a 611 credit score should increase their score rather than take on more debt. However, if you need to take a loan or a new credit card, here are your options.

FHA Loan

FHA loans are mortgage loans for poor credit;and low-income borrowers. With a 611 credit score, you can take out a mortgage with an FHA loan and pay a 3.5% down payment on the home. If your credit score is lower than 580, you will qualify for an FHA loan but will have to pay a 10% down payment.

Secured Credit Card

Using a secured credit card is the best option for those with 611 credit scores. Secured credit cards are meant for those with Very Poor or Fair credit and actively increase your credit score. Theres little to no risk of decreasing your score with a secured card.

Store Credit Card

Most store credit cards will accept anyone with a 640 or higher credit score. However, some store cards will accept lower credit scores. For example, you can qualify for a Target Red card with a credit score of 611. By increasing your credit score, you will have more options for store credit cards.

No-Annual-Fee Credit Card;

Personal Loan;

Read Also: Does American Express Report To Credit Bureaus

Can You Get A Personal Loan With A Credit Score Of 611

There are very few lenders who will approve you for a personal loan with a 611 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

Avant: Best For Very Low Credit

Overview: Avant targets bad- and fair-credit borrowers. Most of its borrowers have credit scores between 600 and 700, which covers much of the range for fair credit.

Why Avant is the best for very low credit: While Avant doesn’t advertise its eligibility requirements on its website, a representative says the lender requires a 580 FICO score and 550 Vantage score.

Perks: With Avant, you can receive your funds as soon as the next business day after approval, and repayment terms are as long as five years.

What to watch out for: The lowest APR available is 9.95 percent, which is much higher than those of competitors. Avant also charges an administration fee and late fees.

| Lender |

|---|

You May Like: What Is A Fair Credit Score Number

Pay Off Any Past Due Balances

If you have any charge-offs or collections, pay them off as soon as possible. The same is true for judgments and tax liens. Paying them off wont remove them from your credit report. But a paid delinquency is always better than an open one. Your credit score should begin to rise soon after these delinquencies are paid.

Avoid A Card With An Annual Fee If You Can

If a card has a particularly large annual fee, in combination with a low credit limit, it will effectively reduce that credit limit. It will also increase the likelihood youll be carrying a balance and making interest payments.

Some of the cards weve included on our list do have annual fees, though all are below $100. Its best to avoid these if you can, but if not, just be aware that it will raise the cost of improving your credit score.

Recommended Reading: When Do Accounts Fall Off Credit Report

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.