How To Qualify For A Loan With Fair Credit

To improve your chances of obtaining a personal loan with fair credit, try taking the following steps before you apply:

- Use a co-signer: While a co-signer adopts some responsibility for your loan and therefore some risk they may also make it easier for you to qualify. Choosing a co-signer with good credit will improve your overall creditworthiness.

- Prequalify: If you’re unsure if you’ll qualify for a loan with a particular lender, see if it offers prequalification. That way, you’ll avoid harming your credit score even further before applying.

- Pay down debt: Many lenders consider your debt-to-income ratio in addition to your credit score. By paying down credit card debt before applying for a loan, you’ll look better to potential lenders.

- Use a local bank or credit union: Your existing bank or a local credit union may be more lenient when it comes to your credit score, especially if you have a history of timely payments on your accounts.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

Do I Have Fair Credit

In addition to a score in the same range, people with fair credit tend to share other traits. For example, they usually have less than $5,000 in available credit.

You can see how you compare to the other credit tiers and to the average person with fair credit below:

| Category |

|

Never 60+ days late on payment Never declared bankruptcy |

Why Do I Need To Know My Credit Scores

You need to know your credit scores because they are often used by lenders and banks as they decide whether to offer you credit, such as a credit card, mortgage or auto loan. Having a fair credit score can influence the terms of a credit offer, such as the mortgage interest rate or how much the required down payment will be.

Read Also: What Does Charged Off Account Mean On My Credit Report

How To Improve Your Credit And Possibly Get A Better Personal Loan Deal

If you want to improve your chances of qualifying for some of the best personal loans, take some steps to boost your credit score.

Prequalify with as many lenders as possible to get an estimate of your rate, loan terms and loan amount. If you apply for a personal loan and it gets denied, a lender must give you a reason why. This will let you know what you need to work on to increase your approval odds.

You can see prequalified personal loan rates from multiple lenders in just two minutes using Credible.

Penfed: Best For Credit Union Members

Overview: PenFed is a credit union offering unsecured personal loans of up to $35,000. Its loan eligibility requirements are undisclosed, but third-party sources claim credit score requirements hover in the mid-600s.

Why PenFed is the best for credit union members:;Anyone can join PenFed, and it serves all 50 states and Washington, D.C.

Perks: The low minimum loan amount of $600 is enticing for those who dont need to borrow much but still need help.

What to watch out for:;You’ll have to become a member of PenFed to get a loan from the credit union, and the length of your PenFed membership can be a factor in determining your APR.

| Lender |

|---|

Also Check: Does Speedy Cash Report To Credit Bureaus

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Read Also: How Long Do Inquiries Last On Your Credit Report

How To Improve Your Credit Score

If you have an average credit score or worse, its worth taking steps to improve your score over time. Heres are some moves you can make:

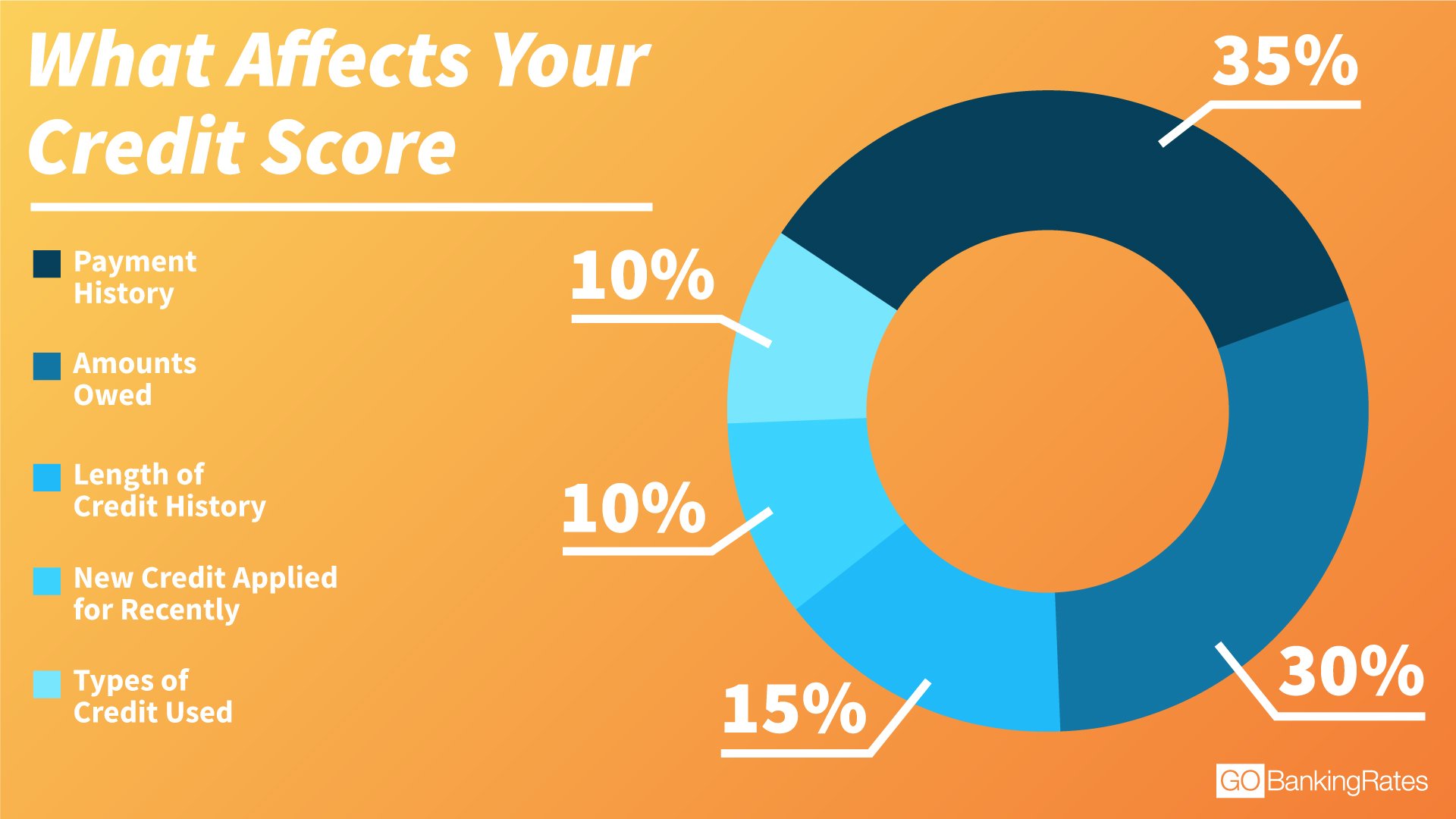

- Pay your bills on time every single month. Late and missed payments are the single biggest factor affecting your score.

- Lower your credit utilization. Credit utilization is measured by how much of your credit limit you use. For example, if you have a $10,000 limit and debt of $5,000, youre utilizing 50% of your available credit. If possible, aim for 30% or less overall and on individual credit cards.

- Check your credit report. You can check your credit reports from each of the three credit bureaus once a year for free through annualcreditreport.com . Reviewing your credit reports can help you spot any errors that may be having a negative impact on your score so you can take steps to correct them.

- Consider a secured card. If you have poor or bad credit, building a credit history with a secured card can be a good way to start. Choose a secured card that reports to all three credit bureaus for the best chance having your good payment behavior improve your credit standing.

Related: Should You Worry About No Credit Score?

Alternative Loan Options For Fair Credit

If youre unable to take out a personal loan due to your fair credit, you may want to look at other options.

- While you usually have to join a before taking out a personal loan, they tend to be more forgiving to those with fair credit. Talk to your local credit union about what you need to qualify.

- 0 percent APR credit card balance transfer: If youre looking to pay off credit card debt, consider getting a credit card with a 0 percent APR introductory offer. That way, you can move your balance over and keep interest from adding up. Keep in mind that you might not qualify for the full balance to be moved over, so theres a chance that youll end up paying off your new card while still making payments on your old one.

- Home equity loan or line of credit: If you have a home, you may be able to use that as collateral and take out a home equity loan or home equity line of credit . Remember, your home is used to secure the loan, so if you miss payments, the house could be subject to foreclosure.

Also Check: What Credit Score Do You Need For An Fha Loan

How Can You Avoid Going From Fair To Poor Credit

If you want to improve your credit, you firs tneed to know how to maintain it. Avoid making late payments and dont close any credit cards unless youre paying an annual fee.

Why? The age of your credit history is a factor in your credit score. When you close old accounts, youll eventually lose that long history on your credit report.

Also, avoid acquiring more debt. Save up an emergency fund so you dont have to use your credit cards as your financial backup.

Finally, avoid getting any public records like a judgment, tax lien, or bankruptcy. These can cause dramatic drops in your score and will likely take you from the fair category to the bad credit category.

It can be extremely difficult to dig yourself out of having bad credit, not to mention all of the limitations youll face when trying to obtain any type of new financing. Even if you qualify for a loan or credit card with bad credit, itll cost you a lot in interest, fees, and potentially security deposits.

What To Know First:

Seventeen percent of Americans have a fair credit score, or a FICO score between 580 and 669, according to Experian. With a less-than-stellar score, you might have a hard time finding ways to borrow money. Luckily, personal loans for fair credit are available. Weve named the best fair credit loans below.

Methodology

To select the top personal loan lenders, Bankrate considered factors that help consumers decide whether a lender is a good fit for them, such as credit requirements and minimum APRs. We sought lenders with low fees and a range of loan amounts for borrowers with varying budgets and credit profiles. We also looked for conveniences like online applications and fast funding.

In addition, the lenders featured here were evaluated for notable features like customer discounts and flexible repayment options.

Don’t Miss: Does Credit Limit Increase Hurt Score

Why Is It Important To Have A Good Credit Score

There are several reason why itâs important to have a good credit score. If youâre hoping, for example, to take out a mortgage to buy your own home one day, your credit score will need to be in good shape to get accepted and to get the best rates. Having a good credit score also means youâre much more likely to get the best rates when you take out other credit products. For example, youâre much more likely to get better credit card offers , low-APR loans, and even 0% finance agreements if your credit score is good. If your credit score isnât good, though, it doesnât necessarily mean you wonât get accepted for credit. However, lenders will view you as more of a risk, and as a result your interest rates will probably be higher, and any purchase or balance transfer offers you get will probably be shorter. Before you apply for anything, itâs always a good idea to check your eligibility and see your chances of being accepted.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

;Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Don’t Miss: Is 779 A Good Credit Score

Average Credit Score In The United States: 711

The average FICO® Score among American consumers is 711, according to myFICO. This is classified as a “good” score.

This is an increase of five points from 2019’s average score of 706. It continues a multi-year trend, as the average FICO score increased in nine of 10 previous years.

However, while most recent increases were one or two points annually, this year’s increase is the largest in a decade.

Good Vs Fair Credit Score

Theres a big difference between a good credit score and a fair credit score when you consider how its compounded over time. Setting up a credit scoreboard will help ensure your chances of having the best credit score, and it will ultimately save you money.

There are many benefits in having a good credit score over a fair one, such as:

- Access to cheaper and more available credit.

- A wider variety of financial products and options.

- A better financial slate.

Those who have good credit ratings tend to be favorably looked upon by the Internal Revenue Service .

You May Like: Does Opensky Report To Credit Bureaus

Average Credit Score By Age

Millennials have an average credit score of 680, while baby boomers have an average credit score of 736.

The average FICO Score tends to improve with age.

The average credit scores coincide with the financial situations facing younger generations. Its usually around the millennial age range that major expenses and debt begin to rack up such as weddings and first mortgages, among others. Despite their ages, millennials hold an average of $4,322 in .

The other age group whose average credit score skews lower is Generation Z . A contributing factor to this is the limited access to credit this age group faces. Following the 2009 CARD Act, it became significantly harder for 18- to 21-year-olds to open new credit card accounts. As a result, many young adults dont begin building a credit file until later in life driving averages down.

Americans of all ages owe debt. In fact, U.S. household debt spiked to $14.35 trillion in the third quarter of 2020 the latest available data amid the coronavirus pandemic, according to the Federal Reserve Bank of New York. And that debt is growing while more people remain out of work. The federal unemployment rate was 3.5% in February 2020 before spiking to 14.8% in April 2020.

Poor Credit Score: Under 580

An individual with a score between 300 and 579 has a;significantly damaged credit history. This may be the result of multiple defaults on different credit products from several different lenders. However, a poor score may also be the result of a bankruptcy, which will remain on a credit record for seven years for Chapter 13 and 10 years for Chapter 11.

Borrowers with credit scores that fall in this range have very little chance of obtaining new credit. If your score falls in it, talk to a financial professional about steps to take to repair your credit. Additionally, so long as you can afford to pay a monthly fee, one of the best credit repair companies may be able to get the negative marks on your credit score removed for you. If you attempt to obtain an unsecured loan with this score, be sure to compare every lender youre considering in order to determine the least risky options.

Doing things such as paying down debt, making timely payments, and maintaining a zero balance on credit accounts can help improve your score over time.

Don’t Miss: Which Credit Score Matters The Most