How To Handle Unauthorized Credit Card Charges

Once youve taken the steps above, you shouldnt need to do anything else unless your card issuer contacts you for more information, or law enforcement reaches out to you about an investigation.

Federal consumer protection laws give credit card holders an extra safety net in the event of fraud: They ensure that consumers arent liable to pay for any unauthorized credit card charges once theyve reported them, and they prohibit card issuers from charging interest on unauthorized purchases while theyre being investigated. You will, however, need to pay any portion of the bill thats made up of legitimate charges you made.

If theres no evidence showing the charges arent actually unauthorized, your credit card issuer should reverse them, and the law requires them to do so within two billing cycles.

Tips To Prevent Credit Card Fraud

Remember these tips when using your credit card in public places or at places of business:

- keep your credit card in a safe place

- limit the number of credit cards you carry with you

- cover the keypad with your hand or body when entering your PIN so no one can see it

- keep your credit card in sight at all times when making a purchase

- report anything you think is suspicious about a credit card device at a business or ATM to the businesss head office and your credit card issuer

At home

Protect yourself from credit card fraud at home by doing the following:

- lock your mailbox if you can to prevent someone from stealing your credit card statements or replacement cards

- sign the back of a new credit card immediately after you get it

- destroy old credit cards that are no longer valid by cutting them up

- keep your credit card statements in a safe place

- shred credit card statements when you no longer need them

Online

When banking or shopping online, look for websites with addresses starting with https or ones that have a padlock image on the address bar. These are signs that your information will be secure.

Protect yourself from credit card fraud online by also doing the following:

Over the telephone

Legitimate credit card companies dont ask for personal information over the phone. Use the telephone number found on the back of your card when you want to contact your credit card issuer.

Protect yourself from credit card fraud when on the telephone by also doing the following:

In general

How Credit Card Fraud Happens

- make a purchase at a place of business

- make a purchase or transaction online

- make a purchase or transaction by telephone

- withdraw money from an automated teller machine

A person can steal your credit card or credit card information by:

- going through your garbage or mailbox to find credit card statements or other banking information

- swiping your credit card through a device that copies the information stored on the magnetic stripe of your card

- hacking into the computers of companies and stealing credit card information

- installing small devices on payment terminals that record your credit card information

- phishing, that is, sending you an email that looks like it comes from a real business asking for credit card information

- asking you to use your credit card on an illegitimate website to make a purchase

You May Like: When Does Citi Card Report To Credit Bureaus

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Your Order Was Split Into Multiple Shipments And Billings Or Shipping Was Delayed

Orders with multiple items are sometimes split into different shipments and billed per shipment, especially when items are pre-orders, on backorder, or come from separate locations. If an item is out of stock, shipping delays can cause a billing delay.

To check:

Sign in to your;Order history.;If you have more than one Microsoft account, sign in to each one to check your order history.

Compare your order history to your statement to find out how your order might have been split into different charges. Also check if the shipping dates are different for each item.

There might be a delay between the date your card is billed and when you see the charge on your statement. Contact your bank or provider for more info.

Recommended Reading: How Long Does Debt Settlement Stay On Your Credit Report

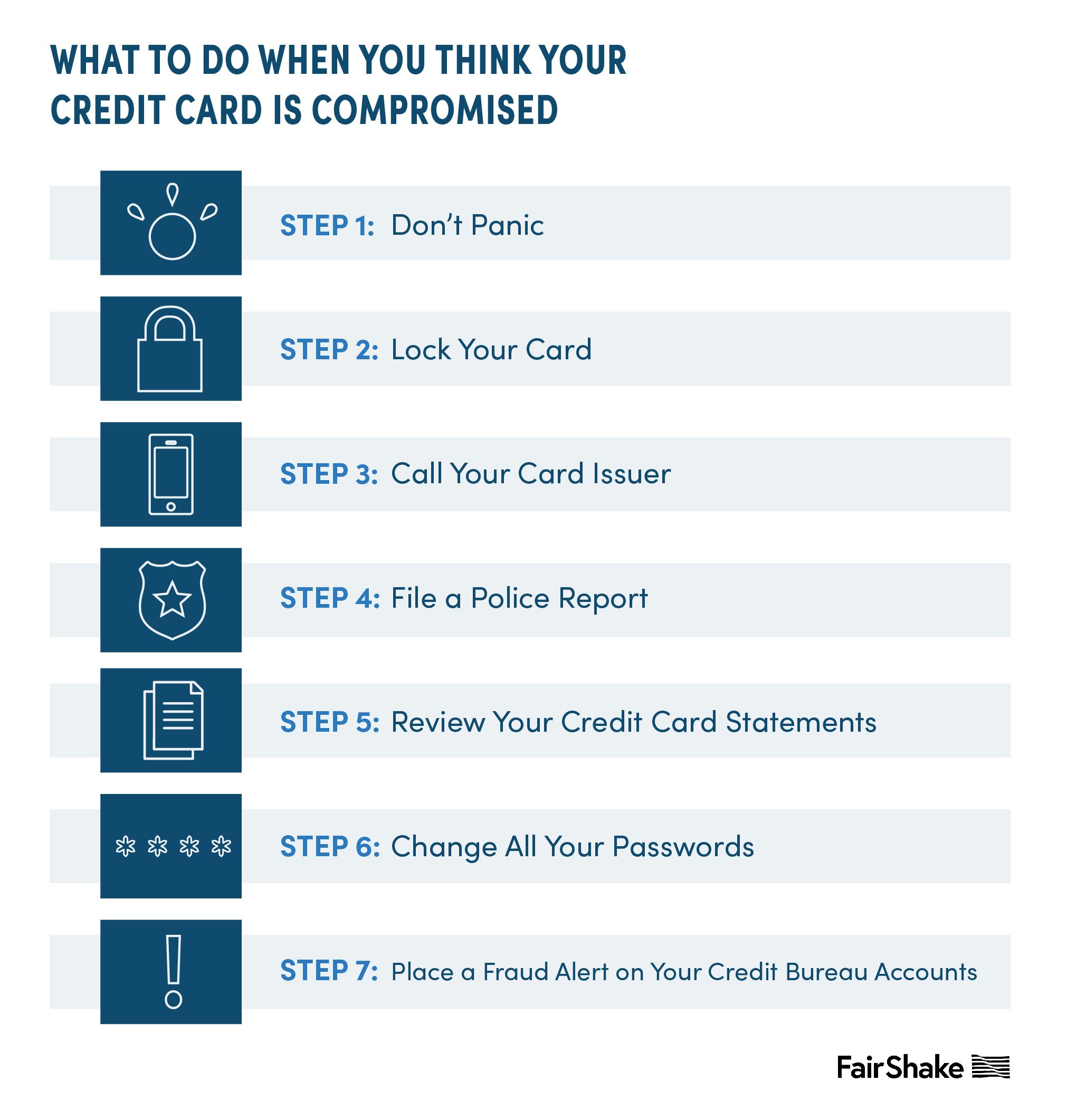

If Your Credit Card Is Stolen

Whether the card itself was stolen or the credit card number has been compromised, you need to take immediate action. Here’s how to get back on track: ;

1. Contact your credit card company

2. Place a fraud alert on your credit report

Contact a major credit reporting company. Tell them your credit card is stolen, and you can either place a fraud alert or freeze your credit file.

Note: There is usually a nominal fee for placing a freeze. You may order one free credit report from each of the credit reporting companies every twelve months.

While you’re in touch with these companies, check your credit report. Look for any suspicious or unapproved activity.;To order a credit report, visit annualcreditreport.com, call 322-8228;or complete the Annual Credit Report Request Form from the Federal Trade Commission, available here and mail it to:

Annual Credit Report Requesting ServiceP.O. Box 105281

Reporting An Unauthorized Credit Card Charge

Also Check: Does Checking Your Credit Score Affect Your Credit Rating

Contact The Merchant First

Before contacting your credit card company, seek to resolve the issue by speaking with the merchant. Record the name of the person you speak with, as well as the date of the phone call. If the person on the line cannot help, ask to speak with a manager. If a merchant does not provide a solution, move on to your next step.

Did I Become A Victim To This 6am Credit Card Scam

The phone call woke me up at 6am. The professional-sounding automated voice said two charges had been made to my Visa. It described them, then asked me to press 1 to approve the charges or 2 to decline them. Of course I pressed 2. It then said it was transferring me to a Visa representative who would help me.

At this point, I was so tired I didnt think I could speak to someone, and I had already indicated they should decline the charges. So I hung up.

At no point did I think this call was fraudulent!

Later in the day, I phoned the number on the back of my Visa cards.

The first bank rep recited the most recent purchases, which were legitimate, and did not include the items listed when I got a call from Visa this morning.

So I called the second Visa number. This rep said, Were getting a lot of calls about early morning credit card scams! There were no suspicious charges on this card either.

Thankfully, I unwittingly did the right thing! I hung up on the scam call, and phoned my bank using the number on the back of the card.

I did NOT become the next victim of a credit card scam.

2021 update: I have received the same scam phone call several more times. These calls from the Visa Mastercard alert system seem to be more prevalent than ever.

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

Vigorously Monitor Your Reports

A great way to monitor activity on your accounts is to order your credit reports for each credit card reporting company. In fact, federal law states you are allowed one free credit report per year, but if your card has ever been stolen, you may be able to get your reports for free more frequently. Some experts recommend ordering one report every four months, in essence staggering requests via each of the main companies. This is a great way to keep a lookout for fraud. A weekly or monthly check-in of credit activity via your card’s main website can also provide insight into any potential fraudulent activity.

Learn How To Limit Your Liability For Unauthorized Credit Or Debit Card Charges

Updated By Amy Loftsgordon, Attorney

If your ATM, debit, or credit card is lost or stolen, don’t panic. Federal laws and bank policies limit your liability for unauthorized charges. But it’s important to notify the bank or card issuer of the loss or theft as soon as you discover it. Read on to learn about your notification duties and maximum liability for each type of card.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Tip #2: Write A Letter To Your Credit Card Company Describing The Charge

If you use online banking to manage your credit; card account, you may be able to dispute the charge by clicking a link on the banks website, but the traditional way to dispute a charge is by writing a letter. The billing rights summary on the back of your monthly credit card bill will include a mailing address to write to. In your letter, include the precise amount of the charge that youre disputing and why youre disputing it. Be very detailed. If you have any documents to support your case, such as receipts or invoices, make copies and attach them to your letter as enclosures.

Past Lawsuits Show That You Could Receive A Refund

If you receive a surprise bill for your child’s unauthorized credit card purchases, you’re not alone. It would be far from the first instance of kids making expensive purchases on their smartphones or tablets without their parents’ authorization.

In 2014, the Federal Trade Commission filed several lawsuits against major corporations Apple, Amazon and Google that billed parents for millions of dollars for their kids’ in-app game purchases that were made without consent.

In these complaints, parents cited that the companies didn’t provide any warning that purchases could be made without requiring a password every time. When parents approved a one-time purchase and entered their passwords, most were unaware that their child could continue to make purchases for 15 to 30 minutes without additional authorization.

Thankfully, all three major lawsuits were settled, with the companies paying upwards of $19 million , $32.5 million and $70 million back to parents.

In the case against Apple, the company received tens of thousands of complaints from parents about their kid’s unauthorized in-app purchases. Most notably, one kid spent $2,600 on in-app purchases for the game “Tap Pet Hotel.”

As part of the settlement, Apple was required to modify its billing practices by making sure to receive consumers’ explicit consent for current and future in-app charges and that the consent could be withdrawn at any time.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Protect Your Credit Card Info

If you take a few simple steps, you can greatly reduce the chance that your credit card number can be stolen:

- Do not keep your PIN number written down with the card.

- Don’t let clerks put your card where you can’t see it. There are dishonest clerks out there!;

- Confirm that the amount on the receipt is correct.

- Draw a line through any blank lines on the receipt .

- Never give your card number over the phone unless you made the call.

- Never reply to mail or email with your credit card number.

- If paying online, check the top area of your web browser for “https://”which means the site is secure to use. Without the “s” in the website address, you’re not on a secure website.;

- Check your card statements every few weeks to confirm every charge was approved by you. ;

- Keep track of your cards by listing the names, card numbers and phone numbers of the companies. Keep the list in a safe place from your cards.;

The law requires that businesses hide all but the last four digits of a card number on receipts and documents .;

If you know a business that is failing to conceal card numbers, please file a complaint with our office.;

How To Get A Refund For Unauthorized Charges Made By Your Kid

If you find yourself with a bill for in-app game purchases or other items that you didn’t authorize, don’t think all hope is lost and you have to pay for it you have options, which we explain below.

Here are the steps you’ll have to take to get a refund:

Step 1: Contact the merchant

The first step you should take is to contact the merchant.

“You might find the company’s refund policy covers your situation or allows for refunds or cancellations within a certain time frame,”;Jason Adler, assistant director of the Federal Trade Commission’s midwest regional office, tells CNBC Select. “You’d want to explain the circumstances to the seller and ask for a refund,”

If your kid purchased physical items and not virtual coins or other app-related charges, you will likely need to return the items first before you see a refund. If the item is nonrefundable or open, you’ll likely need to contact the retailer and explain the situation.

However, there is no guarantee you’ll receive a refund or even a reply at, so you may have to take further action, which we outline in the next two steps.

2. Dispute the charges with your credit card issuer

You can try to contact your card issuer and dispute the purchase, which may work.

3. File a complaint with the FTC

You May Like: How Much Does Transunion Charge For Credit Report

Detect Unauthorized Credit Card Charges Early

Unauthorized credit card charges include any type of charge to your account for which you didnt give permission. Often, unauthorized charges result from either from a stolen credit card or a compromised card number. Sometimes, unauthorized charges result from clerical error or a computer glitch. Either way, its your responsibility to find and report these charges as quickly as possible to minimize your liability for charges you didn’t make.

Before reporting charges to your credit card issuer, make sure the chargers weren’t made by a joint account holder or authorized user on your account.

Many unauthorized credit card charges go unnoticed for several months because cardholders dont thoroughly review their credit card statements. But early detection is crucial when it comes to correcting unauthorized charges. You could be liable for the charges if too much time passes from the time the charge is made to the time;you report it. Specifically, the Fair Credit Billing Act says that you should report unauthorized charges and other credit card billing errors to your card issuer within 60 days of the date the statement containing the error was submitted.

For example, if an unauthorized charge was made on February 15 and your statement was submitted on March 1, you have until April 29 to dispute the charge in writing.;The credit card issuer isnt legally required to handle your dispute favorably if you report after 60 days.

Can The Bank See Who Used My Card

Find out who charged your debit card. You can rest assured knowing that anyone who can process a debit card charge must have a merchant account, which is linked to personally identifiable information about the account holder. Banks make it fairly easy to find out exactly who charged your debit card.

Don’t Miss: What Credit Score Does Carmax Use

Protect Your Information Online And Off

Shred any piece of paper that has your credit card number on it, and don’t write down your card number anywhere that thieves might be able to access it.

Also, be vigilant about protecting your card use online by only filling out card information on websites you trust. You can look for the lock icon in your browser’s address bar to be sure you’re buying from a secure site.

Reporting An Unauthorized Transaction

If you think an unauthorized transaction was made using your card or your account, or if there is a risk of this happening:

- change your passwords immediately

- notify your bank or credit card issuer immediately

- report any transactions you didn’t make or approve

- check your credit report for any credit you didn’t apply for

In some cases, you may need to report the incident within a specific amount of time, as specified in your agreement. If you dont, you may be held responsible for the transaction and you may not get the full amount back.

For deposit accounts, such as chequing or savings accounts, you usually have 30 days after the date of your statement to dispute a transaction. However, this could differ from one bank to another.

When you report an unauthorized transaction, credit card issuers must always thoroughly investigate the incident.

Also Check: What Credit Score Do You Need For Paypal Credit