On Demand Credit Report Access

Business and personal loan professionals love our software because it gives them instant access to their customer’s credit report and FICO® Score. No longer will you have to send your customer to a third party’s website and ask your customer to pay for some other service, download their credit report, and share it with you. With iSoftpull, as soon as you get your customer’s permission to pull their credit report, and with one click of the mouse, you will instantly be able to download and view their entire credit report and score.

iSoftpull delivers a FICO® Score and complete credit report in an easy to read format. The credit report includes delinquencies on all accounts such as mortgages, credit cards, student loans, etc. It also includes inquires from the the last two years, public records, and warning messages.

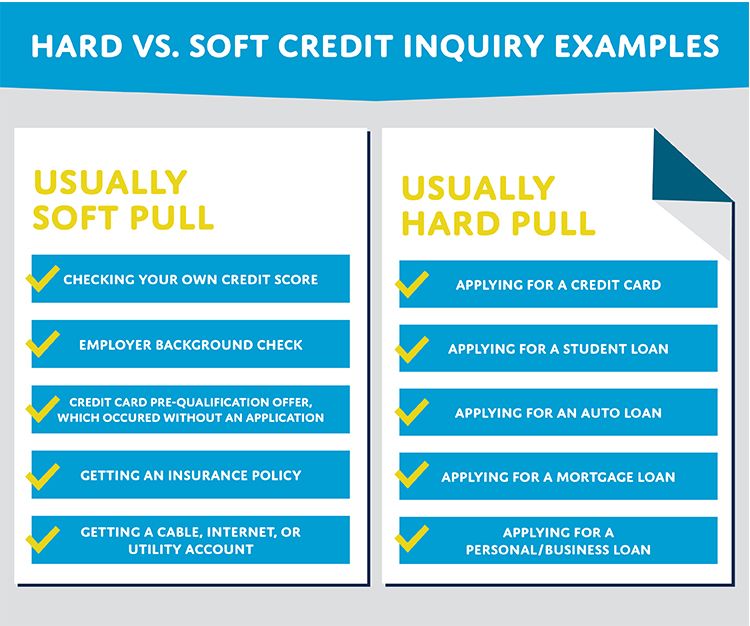

What’s The Difference Between Hard And Soft Credit Checks

The main difference between the two searches is that a hard credit check leaves a visible footprint on your credit report, which other lenders can see. Theyll also be able to check if youve been successful for any credit applications.

Keep in mind, if you apply for finance a number of times within a short space of time it could signal to lenders that you may be struggling to manage your finances and are a risk to lend to. It may also impact your credit score for a period of time.

How Many Hard Inquiries Is Too Many

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but its unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders and in effect, credit-scoring models look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when youre shopping for specific types of loans, like car loans, student loans or mortgages.

Read Also: How To Get Credit Report Without Social Security Number

Whats A Soft Credit Inquiry

According to the Consumer Financial Protection Bureau , a soft checkâalso known as a soft inquiryâis a review of your credit file and existing accounts. Soft inquiries donât impact your credit scores.

Examples of Soft Credit Inquiries

- Viewing your own credit reports and scores.

- Opening a bank account.

- Pre-qualified or pre-approved credit card offers.

Do Hard Inquiries Hurt Your Credit Score

There are two things to consider when youre applying for new credit. The first is that a hard credit check can drop your score, especially if you have a limited credit history. The second is that not all credit checks are treated the same.

For example, when you are rate shopping for a car loan or a mortgage, you may need to apply for credit with at least half a dozen lenders. If you apply within 14 days, these hard inquiries are generally treated as one credit check.

Also Check: Does Opensky Report To Credit Bureaus

Does Checking Your Own Credit Lower Your Score

No checking your credit is a soft pull and will not affect your credit score, nor will it show on your credit report. You can pull a copy of all three major credit reports once per year from AnnualCreditReport.com. Additionally, you can check your credit score through any third-party provider without hurting your score.

Soft Pull Solutions Pulls Data From The Three Main Bureaus

One seamless pull gives you access to Experian, TransUnion, and Equifax. Our Multi-Bureau Summary gives you an instant view of your applicants’ credit scores from each of the three main credit bureaus. This makes it easy to highlight your highest credit score to quicken the credit decision process. Our credit report services include all the tools you need to meet your regulatory compliance requirements. Do you feel you need hard pulls? We can help with those too! But only if you really do need to do a hard pull. Give us a call to discuss. A full file soft pull will be sufficient for most businesses.

Don’t Miss: What Credit Score Does Carmax Use

Who Can Access My Equifax Credit Report

Reading time: 2 minutes

Highlights:

-

Those with permissible purpose can access your Equifax credit report to help them make certain types of decisions about you

-

You must provide consent for lenders and creditors or employers to access your Equifax credit report

-

You can see which companies have accessed your Equifax credit report

Financial institutions, other lenders, and companies with what’s called “permissible purpose” can access your Equifax credit report to help in making certain types of decisions about you.

For example, when you apply for a loan or credit card, a lender may use the information in your Equifax credit report to help determine whether to lend you money and at what terms.

No one can access your Equifax credit report unless they have a permissible purpose.

What is permissible purpose?

Under the law, permissible purposes are the purposes established by law for which someone is permitted to access your Equifax credit report.

Your Equifax credit report can only be accessed for specific reasons. Some examples:

- Lenders and creditors you are applying for credit with

- Existing creditors you have a relationship with, to review an existing account to determine whether you continue to meet the account terms

- Debt collection companies, to use in collecting payment

- Insurance companies, to underwrite insurance involving you

- Employers or prospective employers, to offer you a job or promotion

- Rental companies/landlords, phone and utility companies, to provide a service

Hard Credit Inquiries Dont Hurt Much

Heres the good news: For many people, the damage from hard checks is minor, usually less than five points off your credit score. One or two credit checks will not significantly harm your credit.

Dont let concern about credit checks keep you from shopping around for the best deal on auto loans, student loans or mortgages. Hard credit checks that occur for specific items like these, and that happen within a certain time frameFICO calls them shopping periodsare usually treated as a single inquiry. While each lender may use a different formula to calculate a shopping period, its typically 1445 days.

Recommended Reading: Does Paypal Report To The Credit Bureaus

Avoiding Hard Credit Inquiries

While having a few credit and loan accounts is expected and can even help a credit score, consumers may want to carefully consider if they need new credit before applying for an additional account.

Youll want to weigh whether its worth a small credit score hit, for example, to apply for a department store credit card just for a discount on a purchase.

Another way to minimize hard inquiries is to ask which type of credit check a company intends to run. If, for example, a cable company usually requires a hard credit inquiry to open an account, you might ask if a hard pull can be avoided.

Why does it matter? Because a high credit score typically means more approvals and better rates and terms. Someone with a so-called bad credit score will hear more nos and will probably pay substantially more over a lifetime than one with a higher score.

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

When Soft Pulls Happen

Soft inquiries come in two types: Either youll request to see your own credit reports or credit scores on your own or an outside firm will, Chase said.

Maybe you receive a . The company behind that offer probably first made a soft pull of your credit tomake sure that your credit history is strong enough for you to qualify for that card offer they are making, Chase said. This type of inquiry one that you did not initiate will not cause your credit score to budge.

Anytime you order your credit report or your credit score from one of the three national credit bureaus of Experian, Equifax and TransUnion, your credit wont suffer, either. That inquiry qualifies as a soft pull.

Youre entitled to order one free copy of each of your three credit reports each year from AnnualCreditReport.com.Dont skip doing this because youre worried about your credit score. Checking these reports wont hurt it.

Katie Bossler, quality assurance specialist in the Detroit office of GreenPath Financial Wellness, said too many consumers let fears of a credit score drop keep them from checking their credit reports.

There is a lot of confusion about this subject,

Bossler said. It is so important to look at your credit reports. If people arent doing it because they think it will hurt their score, that is not good.

The Difference Between Hard Pull And Soft Pull Credit Inquiries

Miranda MarquitAdvertiser Disclosure:full disclosure below

Not too long ago, I switched to a different Internet provider. When I called to set up my account, the customer service rep asked for my Social Security number. I wondered why it was needed, and he told me that they would be checking my credit. Is this going to be a hard pull? I asked. He assured me that it would only be a soft credit pull, and wouldnt ding my credit score. I allowed the credit check and moved on with the switch. Not only was this a good reminder that sometimes your , but it was also a good reminder that it helps to understand the difference between a hard credit pull and a soft credit pull.

Also Check: Does Zebit Report To The Credit Bureau

Hard Vs Soft Credit Checks: What’s The Difference

A credit check or credit search is when a company looks at your credit report to see your financial history.

They may use this information to understand how reliable you are at borrowing and repaying money to determine whether they’ll lend to you.

Your credit report contains things like:

- your name

- your borrowing history

- details of anyone youre linked to financially

If youre looking to apply for finance, there are two different types of searches which can be carried out on your credit report a soft credit check and a hard credit check.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Recommended Reading: Ccb/mprcc On Credit Report

Why Does A Hard Inquiry Affect Your Credit When Soft Credit Checks Dont

The reason hard inquiries affect your score when soft inquiries dont is because the number of hard inquiries could suggest that youre a risk to a potential lender. If you have dozens of hard inquiries in the past six months, that means youve applied to numerous credit opportunities. It can be a sign youre desperately seeking funds or youre not managing your financial life well.

Soft inquiries dont necessarily mean youre seeking funding. You might be checking your own credit weekly because youre trying to repair it, for example. Or perhaps youre on a job hunt and employers are checking your credit during background checks. These dont reflect on your potential risk as a borrower.

Both hard and soft inquiries remain listed on your credit report for up to two years. Hard inquiries typically affect your score only for the first 12 months, though.

Minimizing The Effect Of Hard Credit Pulls

If youre comparing auto loans or mortgages, make sure to put in applications as close to each other as possible so it counts as a single hard inquiry. Otherwise, you can take additional steps to make sure that your credit score isnt too negatively affected. This includes ensuring you make loan payments on time and lowering your credit utilization rate.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

How The Solar Industry Uses Soft Pulls In Their Day To Day Business Operations

Our residential solar clients use our software to prequalify their candidates when their reps are in the field, or when their finance team is speaking to prospects on the phone. In short, our solar clients want to know their prospect’s credit profile prior to spending time bidding the job and sending the loan to the finance company. By running soft pulls, our clients save time and money because they are not sending representatives out their client’s houses to bid jobs, spending time writing the deal, then sending unqualified candidates to their lender partners.

Recommended Reading: What Credit Report Does Paypal Pull

How Soft Inquiries Affect You

Not only do soft inquiries not affect your credit score, they’re not even visible to lenders when they check your report. They’re only visible to you when you pull your own credit report.

Keep in mind, though, that if you pull a copy of your credit report and provide it to a business to review, the soft inquiries will appear, since it is your version of your credit report.

Soft Credit Checks: What They Are & When Theyre Used

Adam McCann, Financial WriterMar 29, 2021

A soft credit check is the type of , or , that does not hurt your . Soft credit checks happen when you check your own credit report, for example, as well as when credit card companies pre-screen you for offers. In contrast, hard credit checks can lead to credit score damage, especially when you have many in a short period of time. Hard inquiries happen whenever you apply for a new loan or line of credit.

Its important to make sure you recognize all of the inquiries on your credit report. And you can review your latest TransUnion credit report for free on WalletHub.

Below, you can learn more about soft credit checks, including when they happen, when theyll show up on your credit report and more.

You May Like: Does Speedy Cash Check Credit

How Long Do Hard Credit Inquiries Stay On Your Credit Reports

Hard inquiries may stay on your credit reports for up to two years. However, hard inquiries that are more than a year old might not affect your scores.

As Equifax®, one of the three major credit bureaus, explains, âHard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year.â

FICO confirms that this is how their credit scores work: âAlthough FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.â

Who Can View My Equifax Credit Report If I Have A Security Freeze Or Credit Report Lock

Locking or freezing your Equifax credit report will prevent access to it by certain third parties. Locking or freezing your Equifax credit report will not prevent access to your credit report at any other credit bureau. Entities that may still have access to your Equifax credit report include:

- Companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service

- Companies that provide you with a copy of your credit report or credit score, upon your request

- Federal, state, and local government agencies and courts in certain circumstances

- Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes

- Companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe

- Companies that authenticate a consumers identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud and

- Companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Who We Are

You May Like: How Accurate Is Creditwise Credit Score