Should You Apply For A Dental Credit Card

If you don’t have the cash to cover a dental procedure, getting a dental credit card can make a tight financial situation even worse.

The medical credit card company CareCredit offers cards with promotional periods with 0% interest lasting anywhere between six and 24 months. As long as you pay off your balance before the promotional period ends, you won’t have to pay interest. But with such an offer, also known as a deferred interest offer, interest isn’t waived it’s just put off until later. If you don’t pay the entire balance before the promotional period ends, you’ll be on the hook for all of the interest not just the interest on the remaining balance.

If you’re absolutely sure that you can pay off the bill before the promotional period ends, taking out a dental credit card might be a good way to pay for your treatment. But if there’s any chance you won’t be able to pay, consider other options first.

» READ: 3 medical debt mistakes to avoid

How Medical Credit Cards Are Different

Medical credit cards look a lot like store credit cards. Most allow you to charge only certain medical procedures to the cards and are accepted only by a limited number of providers. Some medical credit cards have more lenient underwriting standards and accept all patients, regardless of credit. Some never report payments to the credit bureaus.

Also like many store credit cards, medical credit cards 0% introductory offers come in the form of deferred interest charges. This means that, if you dont pay off your entire balance by the end of the promotional period, you may owe interest charges for some of all of your original balance retroactively from the day that you charged a medical procedure to the card.

Cards With A True 0% Introductory Period

If you have good or excellent credit, you will probably be able to qualify for a credit card that offers waived interest on new purchases for a year or longer. Unlike the deferred interest you’d find on most medical cards, interest doesn’t start to accrue on cards with waived interest until the introductory period is over. So if you’re unable to pay off the entire bill before the promotional period runs out, you’ll have to pay interest only on whatever is leftover.

» MORE:Should I put my medical bills on a credit card?

You May Like: How To Make Your Credit Score Go Up Fast

Healthy Smiles Membership Club

In an effort to help our patients that dont have insurance, we offer in-house financing at our office. This membership will allow you to save money on preventive dentistry like exams and cleanings, as well as any additional dentistry that you need. for more information about our Healthy Smiles Program or call our office today to review the details of our membership plan.

Is Carecredit Right For You

CareCredit can be an extremely useful financing option if youre facing a big bill, which your insurance wont cover. Medical and dental bills can be a massive financial burden, and CareCredit can make the expenses more manageable. CareCredit is a great alternative, so you do not need to compromise on your care when dealing with expensive treatments.

Even if you have funds available, CareCredit can be to your advantage. Many practices offer installment plans, but theyll often require you to pay a significant proportion of the fee within a relatively short space of time. Paying in monthly installments with a healthcare and dental care credit card can be better for your bottom line, and your state of mind.

So, who does CareCredit work best for? If youre a student, a single parent, or a low-income earner, a healthcare credit card could be the perfect alternative, or addition to your existing health insurance policy.

Are you interested in paying for your next Dentist Appointment with Care Credit? Call 1-800-DENTIST today to find the CareCredit Dentist for you!

Read Also: 611 Credit Score Mortgage

Build An Emergency Fund

An emergency fund is meant to cushion your life against unexpected expenses along the way. At some point, an emergency will happen. Whether it is dental work or a flat tire, life will throw some unexpected expenses your way.

Take action and start saving to prepare for these minor emergencies along the way. Learn how to save $1,000 in 90 days here.

Apply For A Medical Credit Card

You may also research special credit cards designed to meet specific health needs, such as people who need dental services. CareCredit is one example of a medical card. If you have a fair credit score , you can get special medical financing.

These cards are also quite helpful for individuals looking to cover medical or cosmetic procedures that may not be covered by their existing insurance. They can also be used to help pay for deductible costs associated with insurance coverage.

Going for an unsecured card for bad credit is usually not recommended since their fees and rates are usually expensive.

Recommended Reading: Removing Child Support From Credit Report

Dental Credit Card Terms

Dental financing companies sometimes offer incentives that sound impressive for their dental credit cards. Common selling points are no up-front costs, low payments, or instant qualification. Instead of having a minimum payment due each month, many offer the option of paying a fixed amount. Knowing that your payment will be the same every month for a set period of time is helpful for budgeting.

Another popular marketing tool is a zero-percent interest promotion. This is a great deal if you are able to pay off the balance within the agreed-upon time frame. But if you cant it will cost you. If you have a balance due at the end of the contract, you will owe interest dating back to when the card was first used. And the interest rate on dental cards can be higher than a regular credit card.

Just like a regular credit card, getting a dental credit card requires a credit check. And having one will affect your credit history. Missed or late payments will not only cost you interest but can harm your credit score too.

If your dental bills will exceed your usual credit cards credit limit, a dental credit card gives you another financing option.

Re: Omg I Got Approved For Carecredit

I haven’t seen many people getting a CLI directly after approval for CareCredit in a long while. I think it was about 4 months in that I got my first one, and then again after another 4-5 months. I received two CLIs through using their chat online. Went from 800 to 7K, then from 7K to 12K both were SPs

Don’t Miss: What Is Credit Bureau Report

Select Your Preferred Doctor

Select from the three options to choose a doctor. You may choose a doctor after the application is complete if you have not selected a doctor or if you are not ready to select a doctor. Check whether your doctor is already enrolled as a CareCredit provider by searching for her name in the provider locator on the CareCredit website. You can also conduct the same search for a veterinarian or animal hospital that accepts it, though if you are applying for credit for vet care, most offices will let you know if they accept CareCredit or not.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Recommended Reading: Zzounds Payment Plan Denied

Carecredit Health Wellness And Beauty Credit Card For Dental Procedure Financing

Think of CareCredit as your own health, wellness and beauty credit card. Whether it’s oral surgery, getting a crown or a general check up, you shouldn’t have to worry about how to get the procedures you want. Thats why we’re pleased to accept the CareCredit health, wellness and beauty credit card. CareCredit lets you say “Yes” to recommended surgical and non-surgical dental procedures, and pay for them in convenient monthly payments that fit your financial situation.

CareCredit is a healthcare credit card that helps you pay for treatments and procedures for you or your family that may not be covered by insurance. With special financing options* You can use your CareCredit card again and again for your dental needs, as well as at 200,000 other healthcare providers, including dentists, optometrists, veterinarians, ophthalmologists and hearing specialists.

Its free and easy to apply and youll receive a decision immediately. If youre approved, you can schedule your procedures even before you receive your card. With more than 21 million accounts opened since CareCredit began nearly 30 years ago, they are the trusted source for healthcare credit cards.

Saving For Future Medical Care

If you are able to either defer care or budget for future medical care, putting money aside for future healthcare can ensure that you have the cash flow to cover medical expenses. This can be as simple as socking away a few dollars a month into a savings account, but there are also a number of tax-advantaged ways to save for health care.

Depending on the nature of your procedure and your insurance, you may have the option to defer part of your income into a Health Savings Account or a Limited Purpose Flexible Spending Account and pay for it with pre-tax dollars.

Don’t Miss: Credit Score 575

Re: Care Credit Approval Odds And Starting Limit

You probably have a decent chance of getting approved, but I doubt they’d approve you for 11k to start. I was approved for $800 SL in January 2017 then it grew to 12K as of Feb 2018. At the time I was approved I had 20some accounts in collections, all medical bills, probably 1 or 2 secured CCs and score in the low 600s. Now my TU score hovers around 660s and I still have 20 medical collections on my reports but many more credit cards now with better limits than I had when I first applied for Care Credit. Over time I went from $800 to $6436 to $12,000 with SP CLIs.

Medical Credit Cards Are Costly If Youre Not Careful

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medical credit cards can provide a safety net when you need health care services you cant afford or that arent covered by your insurance or Medicare. But if you don’t understand how they work, that net could snap and send your finances into free fall.

Medical credit cards are available at the offices of health care professionals and veterinarians. You may even have seen applications from issuers such as CareCredit and Wells Fargo Health Advantage at the reception desk at your dentist or eye doctor. You can apply and be approved for the card right in the office.

Recommended Reading: Aargon Collection Agency Bbb

What Is Carecredit For Dental

CareCredit is a third-party payment service that allows you to pay for dental financing using a private-label credit card. This service covers:

- Emergency dentistry: Periodontal disease prevention, endodontics, extractions and more.

- Restorative dentistry: Including dental implants, root canals, ceramic crowns, and more.

- Cosmetic dentistry: Including Invisalign, Lumineers, veneers, headgear, and more.

Are Dental Credit Cards A Good Idea

One of the biggest obstacles to getting dental work done, outside of worries about pain and a general fear of the dentist, is the sheer cost of many dental procedures. Dental work can be expensive, and even those with a solid income might find that needed procedures easily surpass their budgets. So what is the best way to pay for the dentist?

If you dont have the cash to pay out-of-pocket, here are some alternative ways to pay for dental care:

- Dental insurance policies can help defray at least some of the costs for routine and emergency treatments.

- Some dentist may work with patients to come up with an installment payment plan.

- Third-party financing companies that offer credit cards specifically for dental care. Some examples are the CareCredit program, iCare Financial, or Citi Health Card.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

What Is Dental Financing

If you cant afford to pay for necessary dental care all at once, you might be considering financing. This could mean borrowing money to pay for your treatment and then making monthly payments until its paid off. Financing also typically involves paying fees and interest on the money you borrow.

Here are some options if you need financing for necessary dental work.

Alternatives To Personal Loans For Dental Care

Personal loans are the most common option when you are looking for dental loans for bad credit. But that does not mean you are restricted to a personal loan. If you do not qualify, are not comfortable with, or cannot afford the terms of a personal loan, there are alternatives. Here are a few to consider.

Read Also: Does Applying For Paypal Credit Affect Score

Can You Finance A Mommy Makeover

United Medical Credit can help you finance a mommy makeover with a medical loan that is right for your financial situation. Interest rates vary based on your credit profile. Many patients choose to use a medical loan to pay for a mommy makeover so that they can get the body they want today, without waiting, and enjoy the results right away.

Lines Of Credit For Dental Health

If you already have a credit card or are planning to get one, you can use it to pay for your dental care. Many dental services allow credit cards as their payment method, and it is also one of the simplest ways to immediately borrow money without waiting for your loan request to be processed.

Aside from accessibility, credit cards have a lower interest rate compared to short-term and commercial loans. If you are opening a new line of credit, you may even get promos and discounts with your card, such as 0% interest.

However, there is a drawback to this payment method repayment duration is usually short, shorter than short-term loans. As a general rule of thumb, you have to pay your credit card bills every month to avoid getting a higher interest rate.

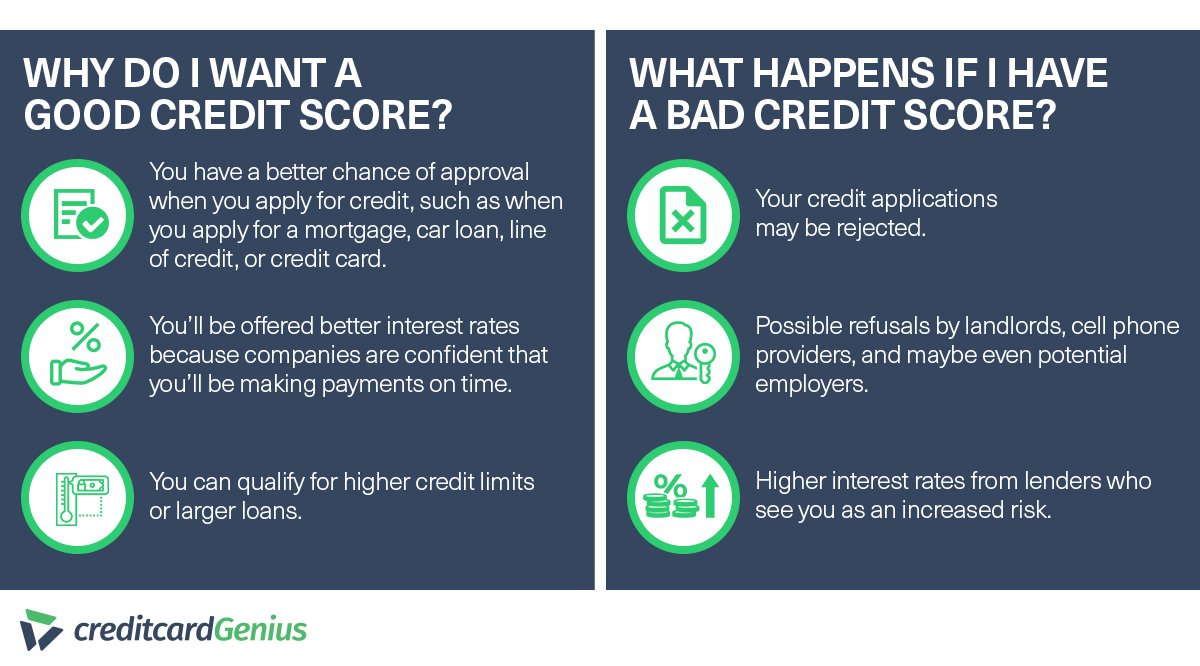

You also have a grace period from your billing date, which usually lasts for 21 days. However, keep in mind that if you fail to make your payment within the billing date and grace period, it can affect your credit score.

If you already have a bad credit score and are not confident you can pay the amount in time, this may not be a good option. However, if you know you can pay off the balance after a month, this can help increase your credit score.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Re: Care Credit Questions

I’m sorry I do not know the exact answers you are looking for but I can tell you that when I went to my dentist they are offering the Care Credit Card to apply and the way the lady explained it to me is that you can call and apply and explain the amount you need and for what and you would then make payments . I look forward to other replies as I want to get this card down the road as well

Can You Get A Loan For Dental Work With Bad Credit

If you have bad credit, you may have fewer lenders to choose from, but you will most likely still have some options available to you.

SuperMoney’s loan engine lets you compare loans for dental work from various providers, some of whom offer personal dental loans for bad credit or no credit, and some of which offer personal dental loans with no credit check.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Do Dental Loans Work

Online lenders want to loan you money as part of their business. It doesn’t matter what you want the money for, but it does usually matter if you have good credit or not. If you decide you want to take out a personal loan for dental work, you will need to compare competing lenders based on interest rates, the amount offered for the loan, eligibility requirements, and customer service.

The process of taking out a loan involves the following:

How Do You Pay For Major Dental Work

At Gold Coast Dental Moreno Valley, we understand that dental insurance doesnât fully cover all of the dental work you need. In the case of dental implants or dentures, it may not even be covered at all. In these cases, you donât have to pay everything upfront out of your own pocket. With our accepted dental financing options, Care Credit, LendingClub, and Denefits, you can always get the denture or dental implant financing assistance you need to make all of your necessary treatments affordable.

Recommended Reading: What Credit Score Do You Need For Affirm

Intro 0% Apr Credit Card

Rather than using a medical credit card, you may be considering paying for your healthcare with a regular credit card.

There are credit cards that offer an introductory 0% APR for purchases and balance transfers for a set period of time. After the introductory period ends, the card will have an APR based on your credit and other factors.

If youre able to pay off the amount you owe within the established time frame which is usually somewhere between 12 and 21 months you could finance your dental care interest-free. But you can end up paying interest on any portion of the balance you dont manage to pay before the end of that period, or you could lose your intro rate if you dont repay according to the card terms. And keep in mind that each intro APR offering can vary based on the lender and your credit.

As with a personal loan and a medical credit card, a regular credit card issuer will typically check your credit profile when considering you for a card.