Does Walmart Accept Affirm

Customers can now use Affirm to make purchases and pay over time at Walmart stores and online. There are no hidden or late fees, so users will never pay a dollar more than they agree to. For in-store shoppers, they will receive a unique barcode that is scanned by a store associate at the register to complete a purchase

How Can You Use Klarna At Walmart In

The process for using Klarna at Walmart is similar to the method for Quadpay. You have to first install the Klarna app and search for the Walmart store inside the app.

Once there, you can either add items to your cart and proceed to Pay with Klarna or specify the total amount you want to pay in-store at Walmart.

Once you have completed the initial transaction, you will have the freedom to complete the purchase through 4 easy installments, with each paid once every 2 weeks.

Bed In A Box Mattress Financing With Affirm Credit

Affirm mattress financing is a way to buy a mattress online and pay in monthly installments. Its a great choice when;financing a mattress purchase so you dont have to pay the full cost up front but can get your bed right away.

Keep reading for a list of online mattresses that use financing online.

You May Like: How To Get Credit Report Without Social Security Number

Maytag Appliance Financing Options With Affirm

Get the appliances you need with the flexibility of a payment plan. Choose Affirm at checkout and receive your loan qualification decision in real time.

*Your rate will be 0% or 1030% APR based on credit, and is subject to an eligibility check. Payment options depend on your purchase amount, and a down payment may be required. Payment options through Affirm are provided by these lending partners:;affirm.com/lenders.

Make A Point To Regularly Review Your Credit Report

Everyone should make a point to get into a habit of regularly reviewing their , especially if you’re opening new financial products, whether that’s a POS loan or a new credit card.

Due to the pandemic, each of the three credit bureaus Experian, Equifax and TransUnion now offer one free credit report weekly. Just go to annualcreditreport.com, a website authorized by federal law, to request your credit report from one of the bureaus. If you have an Affirm loan, you’ll want to request your Experian credit report.

There are also a number of free services that allow you to keep track of your credit score. Most credit card companies allow you to check your score on their apps or website. You can also use a free credit monitoring program like or Experian free credit monitoring.

While signing up for a POS loan won’t necessarily improve your credit score, there are a few quick ways to improve it. Experian Boost, for example, is a free service that offers consumers the ability to connect their utility and streaming accounts to their Experian credit report. This means that if you’re timely about paying off your internet, water or Netflix® bill, you could see your FICO score improve.

Also Check: How To Get Credit Report Without Social Security Number

More Info About Affirm

Affirm is an online lender that allows consumers to purchase goods on credit. When making a purchase, consumers choose their repayment options, such as monthly payments.

Affirm was founded in 2012 and launched its consumer app in 2017. In the past several years, the company has partnered with Walmart, Shopify, Zen Cart, and BigCommerce. Consumers can use Affirm as a payment method through any of the partner sites.

Is There A Credit Limit

Affirm does not have a set . Instead, the company decides your eligibility and loan limit on a case-by-case basis, considering factors like your credit score, past payment history on Affirm loans, and your ability to pay. This means that you may be able to be approved for more than one loan at a time, depending on your situation.

You can boost your odds of approval for future Affirm loans by paying off your current Affirm loans on time and working to increase your credit score.;

Also Check: Is Credit Wise Accurate

Does Using Affirm Affect My Credit Score

Affirm is intended to help you keep your budget in balance. When you apply, Affirm will check your credit history, but the eligibility check will not affect your credit score. If you decide to purchase with Affirm, your choice of loan and payments may impact your credit score. For questions, call 855-423-3729 or visit affirm.com/help.

Buy Now Pay Later Services Offering No Hard Credit Checks

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Buy now pay later no credit check loans are increasing in popularity. Youve probably seen it on your favorite retailers websites. When you checkout theres the option to buy now and pay later, allowing you to pay in four equal installments and usually for no interest or fees and with no hard credit check.

If you have no credit or bad credit, these can seem like a great optionbut only if you know how they work, and which companies are the best options for those in search of no-credit-check online financing.

In This Post:

Don’t Miss: Aargon Collection Agency Reviews

How Does Affirm Work

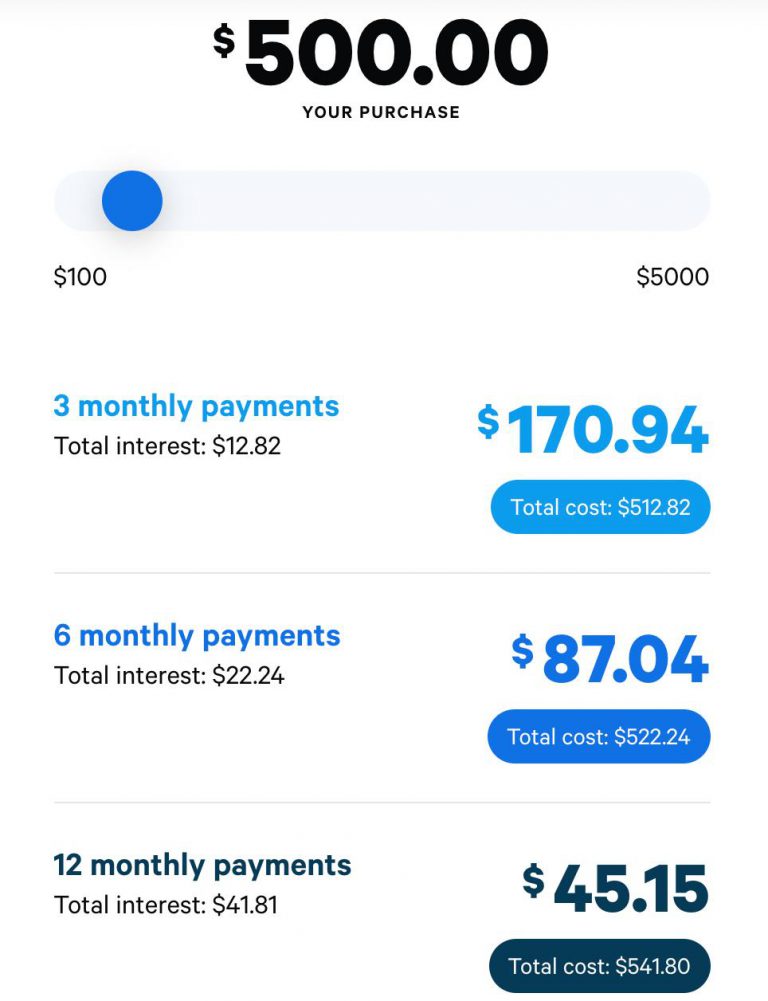

Unlike other point-of-sale companies, Affirms loan terms vary by merchant, meaning your repayment options and annual percentage rate will depend on where you shop.

Most repayment plans fall into three categories three-, six- and 12-month plans. Shorter terms of one to three months and longer terms of 48 months could be available depending on the size of your purchase. Affirm will show all available terms before you agree to a loan.

Your first monthly payment is due one month after your purchase is processed, and the following payments are due each subsequent month on the same day. You may have to make a down payment if you dont qualify for the full loan amount.

Interest rates on Affirm loans range from 0% to 30%. Like most installment loans, interest is fixed and wont compound like it does on credit cards.

Affirm doesnt charge fees, so there is no prepayment fee for paying off your loan early or late fee for missing a payment. However, Affirm may report delinquent payments to the credit bureau Experian, which could lower your credit score.

How to qualify: Affirm doesnt have a minimum credit score requirement, but it will perform a soft credit check. It also takes into account any prior payment history with Affirm, how long youve had an Affirm account and the merchants available interest rate.;If you arent approved, youll receive an email explaining why.

|

Monthly payment |

|---|

How To Use Affirm Online

There are several ways to use Affirm funding while shopping online:

- Partner retailers: Affirm partners with many retailers that allow you to add your purchases to your cart and then apply for an Affirm loan right during checkout.;

- Affirm website: You can easily find Affirm partner retailers directly through the Affirm website.;

- Affirm app: Another way to find Affirm partner retailers is by shopping through the Affirm app.;

- Affirm virtual card: You can apply for an Affirm loan for just about any merchantpartner retailer or notthrough the Affirm website. If approved, you’ll get a virtual card that you can use just like a credit card number to pay for anything up to your loan limit.;

You May Like: Zzounds Credit Approval

Is Affirm Hard To Qualify For

You wont get approved if you dont have good credit Youll need to have a good credit score to qualify for an Affirm loan. You may have to pay a downpayment For some borrowers, Affirm asks for a down payment that must be paid during purchase. This can be anywhere from 10% 50% of the cost of the item.

Are Payments Automatically Split Into Four Installments With Affirm

With some point of sale loans, your payments are automatically divided into four installments. Specifically, that means an initial down payment at the time of purchase, followed by three additional installments.

Affirm, on the other hand, allows you to choose your payment option. So, for example, you may be able to split purchases up into three payments, six payments, or 12 payments.

You May Like: Does Paypal Credit Report To Credit Bureaus

How Experian Boost Works

Experian Boost is free to use and there are no existing membership requirements to sign up. To receive a boost, individuals create a free Experian account and navigate to the products page.

From there, users will be prompted to connect the bank account they use to pay their bills. For those wary of granting third-party access to their account, Experian explains that its product can access only read-only data from a bank, and doesnt have access to any of the funds. Once an account is connected, the feature scans transactions for on-time utility, cell phone and streaming video plans, including Netflix, HBO, Disney+ and Hulu payments. Experian needs at least three months of payments within a six-month window.

Experian Boost shows users which bills are pulled and when they were paid. The feature only pulls positive payment history, which means it wont report any negative information that could lower your credit score. Users also have the option to exclude any payments they dont want to be added to their file.

Read Also: Paypal Working Capital Phone Number

How Some Pos Loans Could Decrease Your Credit Score

Depending on your loan provider, taking out a POS loan can either increase, decrease or have no impact at all on your credit score. Some of the most popular POS loan providers AfterPay, Affirm and Klarna report some loans to the credit bureaus while others don’t.

“If reported, a missed payment can be noted on your credit report for up to seven years and will negatively impact your credit score,” says Rod Griffin, the senior director consumer education and advocacy at Experian. “At the same time, if a ‘buy now pay later’ lender reports account information to credit reporting agencies like Experian, and you are managing the debt responsibly, these services can be a helpful way to build credit.”

Affirm is one BNPL provider that does report information to Experian on some loans. It doesn’t report loans with a 0% APR and four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR.;

For other Affirm loans, the entire loan history is reported to Experian. This means that both positive and negative payment history will be reported to only Experian and not other credit bureaus. Your payment history, the amount of credit you’ve used, the length of time you’ve had the credit and any late payments will all be reported to Experian.

If you default on your Affirm loan or make late payments, you risk decreasing your credit score. But your credit score could take a hit even if you’re paying your POS loan on time.

Also Check: Does Paypal Report To The Credit Bureaus

Is It Hard To Get Approved For Furniture Financing

Bad credit can make it tough to finance a furniture purchase. If youre willing to shop around, however, you can find reasonable financing deals from retailers, loan marketplaces, and credit card issuers so you can get the furniture you need. Compare personal loan rates from multiple lenders in minutes.

Does Buy Now Pay Later Financing Affect Your Credit

When youre making a purchase, you may be offered the option to buy now and pay later. This type of financing option allows you to make your purchase today and pay for it with installment payments over several months. Before you choose buy now, pay later financing, though, its important to understand how it may affect your credit.

Your credit score is a three-digit number influenced by your borrowing and payment history as reported to one or all three of the major credit bureausEquifax, Experian, and TransUnion. If you choose a financing servicer that reports to any major bureau, your credit may be affected.

Also Check: How To Unlock My Experian Account

How Does Affirm Qualify You

Affirm qualifies you through a number of factors such as:

- current economic conditions

- interest rate set by the merchant

- whether you already have an Affirm account

What I really dont like about Affirm is that you can wind up with several of these mini loans . It makes debt repayment unorganized at best, and in over your head in debt at worst.;

That said, theres no reason to feel any shame if youve tried a company like Affirm. And if you have tried Affirm and are ready to get your finances organized and on track once and for all so you can reach debt freedom, grab our FREE guide that will help you get started paying off debt.;

IMHO financing options like Affirm should be avoided when possible. If you cant afford to pay for a product in full, that means you cant afford the product. The ideal situation is to save up until you have enough money to afford the product. So long as you have enough money to afford the product, you can even pay for it with a credit card, that way you can earn credit card points and rewards for your purchase.;;

PIN THIS FOR LATER!

How Can You Use Paypal Pay In 4 At Walmart

If you are buying online through walmart.com, you can use PayPals Pay in 4 service to complete your purchase in 4 easy installments from your PayPal balance.

To do so, select PayPal as the preferred payment option at the checkout page on walmart.com, and then select PayPal Pay In 4 as the financing option once you have been redirected to the PayPal page.

After that, PayPal will set up an installment plan where a set amount will be deducted from your PayPal balance at a set frequency until you have completed the payment in 4 installments.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Can I Buy Now And Pay Later With Affirm 0% Apr Financing At Walmartcom

Affirm may offer special financing as low as 0% APR on select Walmart.com products. This means you may be able to make monthly payments with no interest with Affirm. When youre browsing products on Walmart.com, certain items may be labeled as offering “0% APR with Affirm.”? Items eligible for interest-free financing are subject to change.

Creating And Using An Affirm Account

Before you can make purchases through Affirm, you will need to have an account with the lender. You can do this easily through their website.

You will need to be at least 18 years old and be a permanent resident or citizen of the U.S. to qualify. You must have a cell phone number and agree to receive texts from the company. It is also ideal to have a credit score of at least 550.

The company has also launched a mobile app that can be downloaded at the Apple store and Google Play Store to create an account.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Is It Better To Use Affirm Or A Credit Card

If you have access to a credit card, its the better option if you make full use of the grace period but then repay your bill before incurring any interest charges. However, if youre like many Americans and prefer to keep the credit card for emergencies, Affirm is a viable alternative.

While your credit card might have a $15,000 limit, your bank or card issuing authority probably doesnt want to see you have an outstanding balance of more than $5,000 at any time. If you go over this ratio, youll end up affecting your credit score.

Since Affirm offers loans up to $17,500, its the ideal choice for financing a bigger-ticket item as opposed to using your credit card.

However, there are some issues with using Affirm. The company can charge a high interest rate, and if youre getting an 18% APR on your card, you can expect the rate at Affirm to be similar or higher. However, you get flexible spending limits, with up to 12-months to pay off your purchase.

Some retailers may partner with Affirm to offer a 0% APR on certain purchases.

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account thats six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you dont meet the criteria, the scoring model cant score your credit reportin other words, youre credit invisible. As a result, creditors wont be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where theyve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If youre brand new to credit, or reestablishing your credit, revisit step one above.

Also Check: Credit Score 584

How Do I Sign Up For An Affirm Account