Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online; you’ll just need to update your annual household income. Its possible to be approved for a higher limit in under a minute. You can also request a credit limit increase over the phone.

Recommended Reading: What Is A Good Credit Score Number

How To Interpret Your Credit Score

Checking your credit score is easy, but merely knowing the number isnt enough. To get the most out of your scoreand improve itits necessary to interpret your score and your credit report as a whole. This involves understanding the five credit score ranges and what each means to lenders. FICO scores fall into the following ranges:

Poor . A score between 300 and 579 is well below the national average FICO Score of 711. Because of this, lenders consider borrowers with a poor credit score to be risky and are less willing to extend credit to them. That said, some lenders offer bad credit personal loans tailored specifically to low-credit borrowers.

Fair . Still below the national average, fair credit scores between 580 and 669 typically qualify borrowers for loans. However, these loans or lines of credit are more likely to come with high interest rates, lower limits and shorter terms. Borrowers with fair credit may access better terms by choosing a secured loan that poses less risk to the lender.

Good . If your score is close to or above the national average, lenders consider it to be in the good range. This means youre less of a lending risk and more likely to qualify for favorable terms.

Very Good . An above-average credit score indicates to lenders that a borrower is reliable and more likely to make on-time payments. For this reason, borrowers with a very good credit score typically have access to more competitive credit cards and better loan terms.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: How To Remove Items From Credit Report After 7 Years

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: ;www.equifax.ca

Recommended Reading: What Is A Positive Entry On Your Credit Report

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

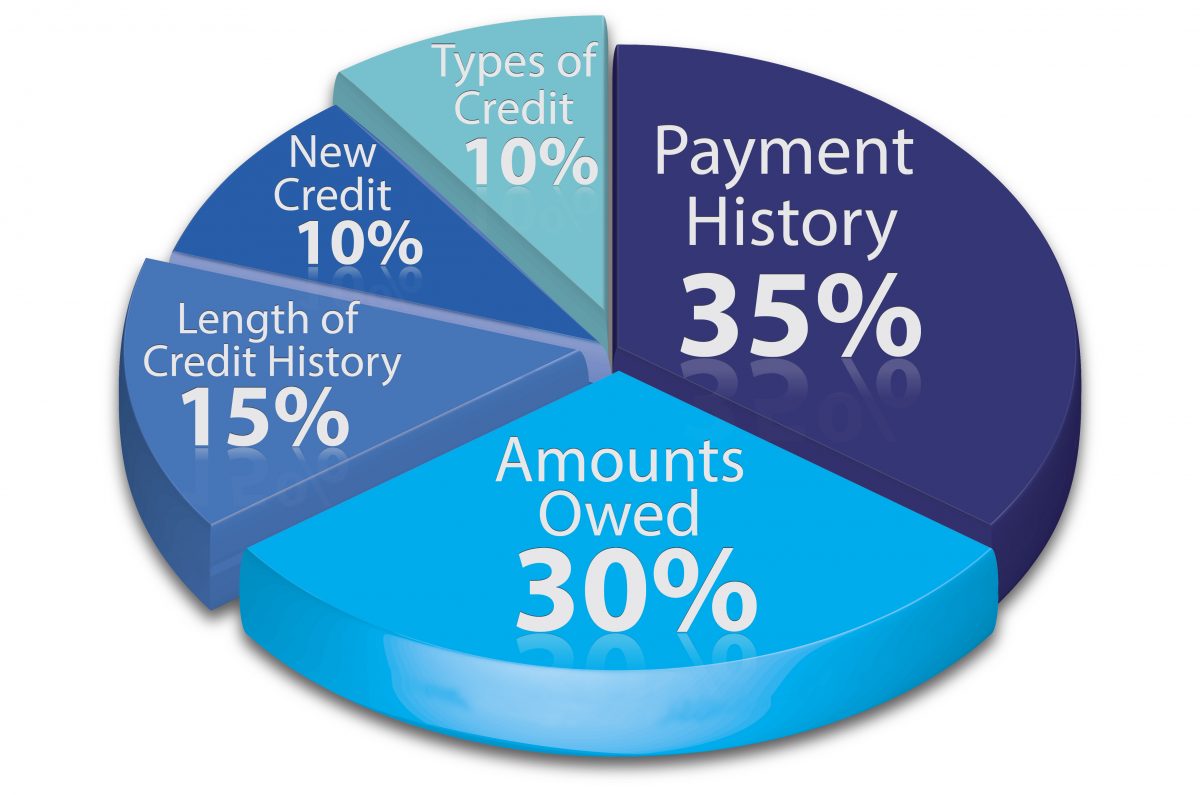

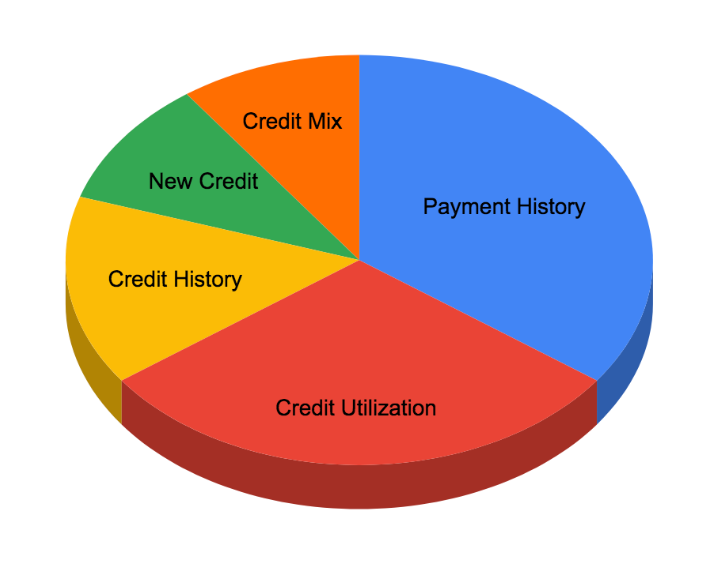

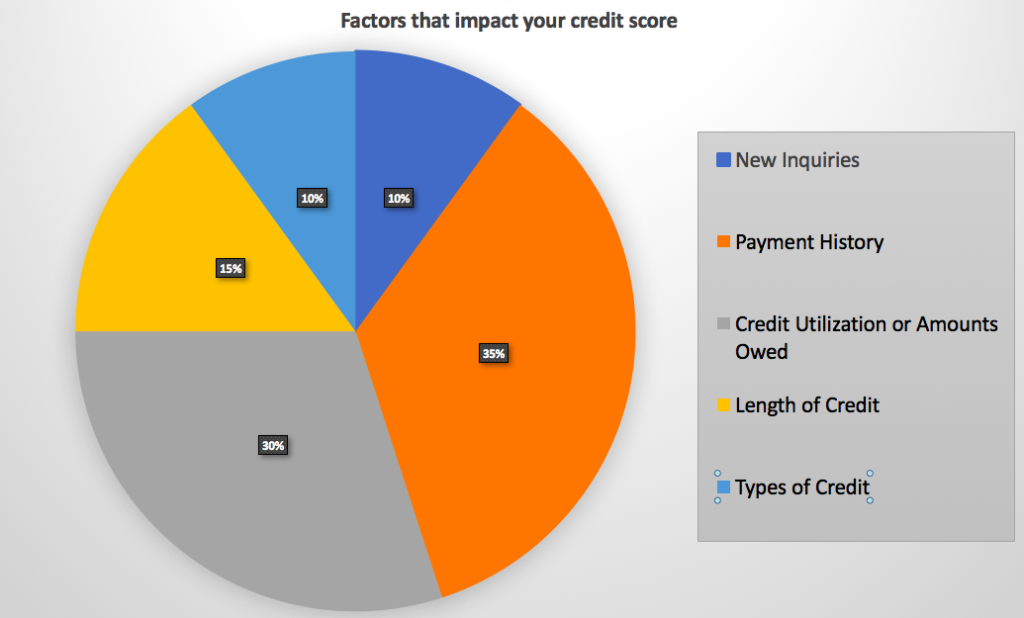

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%;

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone:; 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Recommended Reading: Does Credit Check Affect Credit Score

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

Length Of Credit History

In general, having a longer credit history is positive for your FICO Scores, but is not required for a good credit score.

Your FICO Scores take into account:

- How long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

- How long specific credit accounts have been established

- How long it has been since you used certain accounts

Read Also: Does Speedy Cash Report To Credit Bureaus

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Types Of Credit That Impact Your Credit Score

In India, credit is categorized as secured credit or unsecured credit.

- Secured credit is backed by collateral. Examples are home loan, loan against property, gold loan, car loan, etc.

- Unsecured credit is not backed by collateral and examples are credit cards and personal loans.

While no exact figures are available, you should ideally have a mix of secured and unsecured credit to maintain a high credit score. Too much unsecured credit is usually viewed as a heavy reliance on debt which can decrease your score.

Read Also: Is 603 A Good Credit Score

Factors Affecting Credit Score

The importance of a good credit score for those seeking a new loan/credit card cannot be overstressed. Hence it is important to know the;key factors affecting your credit score. Some factors which affect a persons credit score are given below:

a) Credit Utilization Ratio:;Credit Utilization Ratio is obtained by dividing the total credit availed by the available credit limit across all credit cards and loan accounts. It indicates your dependence on credit. A high credit utilization ratio indicates greater repayment burden and negatively impacts your credit score. A low credit utilization ratio indicates low repayment burden that can help improve credit score.

b) Multiple Simultaneous Loan Enquiries/Applications:;Making several loan enquiries and applications with multiple lenders within a short period of time shows you to be credit hungry. This also leads to an increase in the number of hard inquiries made by these lenders on your credit report which negatively affects your credit score.

c) Repayment History:A history of timely payment of your EMIs and credit card bills helps maintain a high credit score. Similarly, frequently missing of credit card or loan EMI payments has a negative impact on your score.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?;

Don’t Miss: Can You Check Your Credit Score Without Affecting It

How To Check Your Credit Score For Free

You can;check your CIBIL score;as well as scores provided by other credit bureaus such as Equifax, Experian and CRIF Highmark for free online on the Paisabazaar.com website. The step-by-step method to check your credit score through Paisabazaar.com is as follows:

Step1.;Visit the Paisabazaar.com home page and click on the Get Report button at the top of the page

Step2.;On the subsequent page, fill in details like your Name, Date of Birth, PAN number, etc. and click on the checkbox to agree to the terms and conditions associated with checking your credit score.

Step3.;Click on Get Your Credit Score to access to your credit report and score for free online.

Your Transunion Credit Score

TransUnion is the second largest credit reference agency in the UK. It used to be known as Callcredit. You can check your TransUnion credit score by going to Noddle.;You can also access your TransUnion and Equifax credit reports at the same time by registering for a 30-day free trial of CheckMyFile.;;Just make sure you have a look at their terms and conditions before you register. And if you want to continue with their service beyond the 30 days, a monthly fee would apply.

You May Like: How Much Does Overdraft Affect Credit Rating

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit;history. Your credit history describes how you use money:

- How many;credit cards;do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.;

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart.Check your credit reports and dispute errors.

Don’t Miss: How To Get A Detailed Credit Report

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

Types Of Credit Scores: Fico Vs Vantagescore

There are two main credit scoring models: FICO and VantageScore. However, lenders have a clear preference for FICO; its model is used in over 90% of U.S. lending decisions.

FICO and VantageScore credit scores have some similarities: In both, scores range from 300 to 850 and payment history is the most influential factor in determining your score. But they differ in exactly how they weight and rank several other factors.

Recommended Reading: How To Remove From Credit Report

Can I Get A Car With A 500 Credit Score Suburban Auto

to seeking financing. However, at Suburban Auto Finance, we give those with credit scores of 500, 400, and even 300 the chance to own their own vehicle.

A bad credit score wont necessarily cut you out of the auto loan process. You can still qualify for a loan and buy a car with poor credit; but the payments;

No matter what your credit score situation may be, the Finance Department at Fairfield Chevrolet is here to help you get a car loan. With a bad credit auto;

May 20, 2021 1. Check Your Credit Score. Auto lenders who accept an applicant with a low or no credit score will typically charge a higher interest rate or;Missing: 400 | Must include: 400

May 22, 2021 May 22, 2021 Most credit scores can get you a car loan, but your credit score will have a direct impact on the interest rate.

Best Auto Loan Rates With A Credit Score Of 400 To 409

Aug 19, 2021 It is possible to get the best car loan rates with a deep subprime credit score in the range of 300 to 499. And I am going to tell you how! To;

Jul 31, 2012 When it comes to taking out a car loan, a credit score of 400 is a poor rating that will undoubtedly hamper your chances of receiving the;

Apr 14, 2021 Americans with bad or fair credit scores under 670 have the same number of auto loans as those with higher scores.

You May Like: How To Get Charge Offs Off Of Your Credit Report

How Is Your Credit Score Calculated

Your credit score is calculated by credit reporting agencies such as Veda, Australias largest.

Although these agencies score in different ways , in general the higher the number, the more likely you are to have your request for credit accepted.

To calculate your score, credit reporting agencies look at:

- Your debt , including any problems youve experienced repaying that debt

- Loans youve taken out for household, personal or family reasons; or to buy, refinance or renovate a property; or as a guarantor for someone

- Your credit cards and store cards

- Your current credit limit

- Accounts youve opened and/or closed

They will also check if you have a court writ or default judgment against you and look out for any history of bankruptcy.