Is A Fico Score The Same As A Credit Score

As with all credit risk scores, FICO® Scores predict the likelihood that someone will fall 90 days behind on a bill within the next 24 months. FICO® does this using complex algorithms based on information in your from each of the national credit bureaus: Experian, TransUnion and Equifax.

FICO® periodically releases new versions of its scores, and it creates different versions of its scores to work with each bureau’s databases, which is why there are many FICO® Scores. Other companies, including VantageScore®, also create credit risk scores that similarly analyze consumer credit reports to calculate scores.

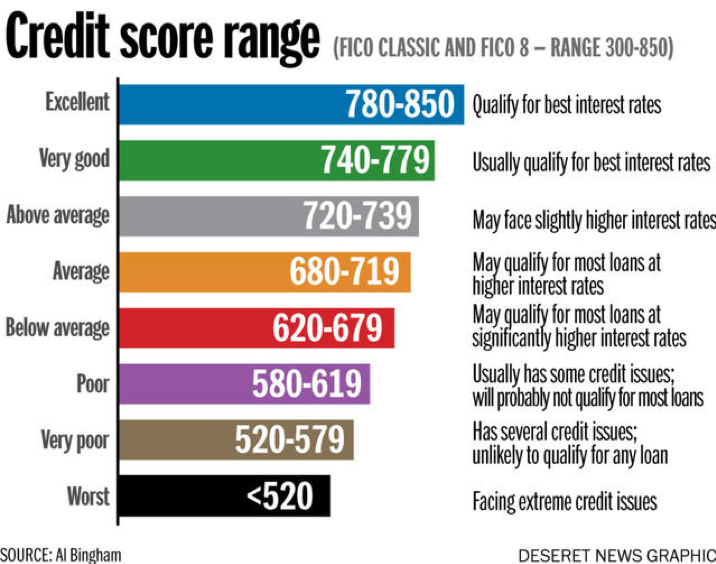

FICO® and VantageScore credit scores range from 300 to 850, and group consumers by . For example, a FICO® Score of 800 to 850 is considered “exceptional.” However, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score.

FICO® also creates other types of scores that are based in part, or entirely, on your credit reports. For example, FICO® offers and bankruptcy scores, which try to predict the chance you’ll file an insurance claim or declare bankruptcy, respectively.

What Information Is Kept In My Credit File

Your credit file contains information on all of your credit accounts submitted to the credit bureaus, including balances, limits, payment history, etc, as well as identification information such as your name, address, age, social insurance number, marital status, spouses name and age, number of dependents, occupation, and employment history.

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Also Check: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

What Is A Poor Credit Score Range

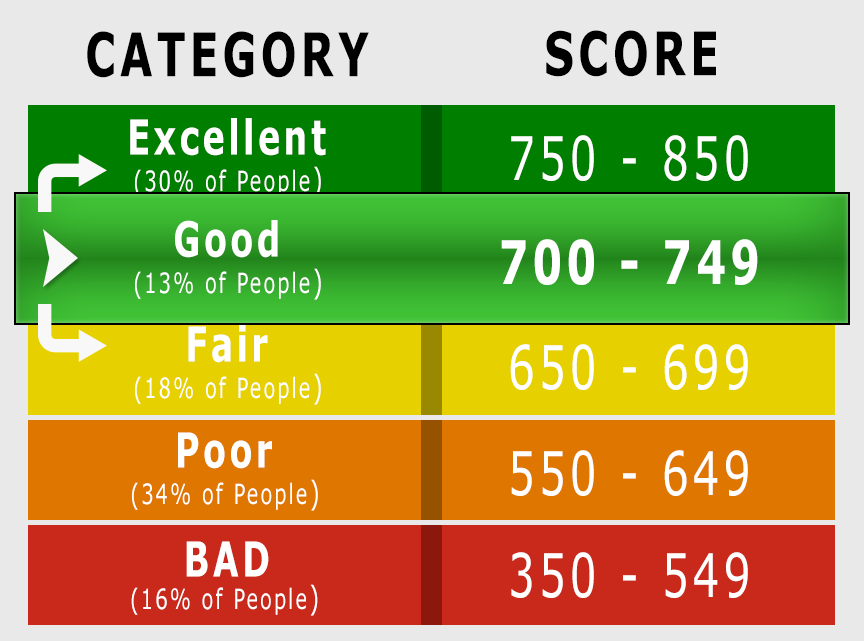

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Cnbc Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, CNBC Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

Also Check: Does Checking Your Credit Score Affect Your Credit Rating

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

You’re Not Labeled For Life

There’s lots you can do to make sure you have a good credit score. Most important, make your credit card and loan payments on time. Thirty-five percent of the FICO score is based on your payment history. Check;our other tips.

Those with thin or subprime credit histories might consider signing up for one or both of the new credit improvement programs, Experian Boost and the Fair Isaac Corporation’s UltraFICO. Boost, which launched in March, includes utility payments in the score calculation, and UltraFICO, expected to roll out nationally later this year, reviews banking history. For more information, check these;new ways to improve your credit score.

Keep in mind that a major downturn in your luck or behavior could drop your credit score by 100 points, but it’s unlikely to dip it into the 300 range.

Indeed, McClary says he’s never actually seen a 300 FICO scoreor an 850 score, for that matter. The lowest score he’s ever seen was 425, he says, and in that case the holder had already been in bankruptcy and was delinquent with several creditors.;

“Obsessing over perfecting your score might be a waste of time,” Ross says. “Your efforts should be more focused on maintaining your score within a healthy range.”

Don’t Miss: Will A Sim Only Contract Improve Credit Rating

What Information Is Used To Calculate My Credit Score And What Factors Will Lower My Score

If you have tried looking on the consumer reporting agencies websites, you have seen they provide VERY little information as to how your credit score is calculated. They believe this information is proprietary and therefore their secret. They do, however, provide a list of the main factors which affect your credit score:

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be;used to determine;some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering;71 percent of Canadian families;carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Read Also: How Are Account Numbers Displayed In A Credit Report

What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

Read Also: How To Remove Items From Credit Report After 7 Years

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Also Check: How To Remove Chapter 7 From Credit Report

How Is A Canadian Credit Score Calculated

While we dont know the exact formula for how each of the two Canadian credit bureaus calculates;your credit score, we do know the five most important factors that affect it.

- History of payments. Do you make all your credit and loan payments on time all the time?

- Debt level. How much debt do you carry month to month? Are you using up more than 30% of your total limit?

- How long have you been a credit user? The longer the better for the health of your credit.

- New inquiries. Every time a potential lender or your score drops a few points. Too many pulls within a short period of time is a bad sign.

- Diversity. Are you responsibly using more than one type of credit account?

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set;their own standards on what “good credit” means as they decide;whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

-

To check your credit history and past record

-

To see whether you are capable of repaying debts

-

To review your credit balance and understand the risk level of your profile

-

To judge whether you qualify for the loan

-

To decide on the loan amount to offer you and interest rate applicable

How Can You Maintain A Good Credit Score

A good credit score comes with responsible credit behaviour. Here are some of the factors which will help you in maintaining a good credit score:

- Consistent Repayment: Credit score calculations lay nearly 35% weightage on your payment history. If you want to maintain a good credit score all the time, your repayment record should be 100% positive. For this, you must ensure to never miss a repayment.

You May Like: How Long Does Debt Settlement Stay On Your Credit Report

What Is A Fair Credit Score Range

Fair credit score = 620- 679:;Individuals;with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

A Good Credit Score: What Is It And What Does It Mean

Charlestien Harris is a HUD Certified Housing Counselor employed by Southern Bancorp. Harris writes to distribute factual information about financial topics of interest to banking markets and surrounding local communities. You can find these articles at;. If you have any questions email at;.

I am often asked what a good credit score is. Having a good score is important, but managing your finances, setting goals and living within your means is equally important. There is no absolute standard that creditors use to approve or deny credit. However, the credit score is used by creditors to determine your ability to repay a loan. Staying informed and making better financial choices is the best strategy to increase your score.

Having a good credit score matters because it touches so many aspects of our everyday lives and it can determine our quality of life. A good credit score takes time and patience. Whether you decide to rent or buy a home, both landlord and mortgage lenders usually require a good credit score. Even prospective employers, insurance agents, debt collectors, utility companies and government agencies use your credit history as a way to gauge character and responsibility.

*Pro Tip: Whether you are planning a major purchase or applying for a loan, do not close a credit card account within six months of that application. You want as much credit history as possible to strengthen your chances of approval.

You May Like: What Credit Score Do You Need For A Conventional Loan