Can You Buy A House With Bad Credit

Even with a bad credit score, its still possible to be approved for a home loan to buy a property, Beattie says.

There are specialist lenders in Australia that cater to borrowers that cant get approval from mainstream lenders because of their bad credit scores, although such lenders typically charge higher interest rates to account for the higher risk of default posed by these borrowers, he says.

Beattie says aspiring property buyers with bad credit scores can boost their chances if a family member with a good credit score, such as a parent, is willing to act as guarantor for the loan.

Searching for your next place could get a lot harder if you have bad credit. Picture: Kate Hunter

Frequently Asked Questions About Your Equifax Credit Score

How can I improve my Equifax Score?

There are a number of ways to improve your credit score and it depends on what your current credit position is. However, limited your credit applications and making sure your repayments are on time will help improve your credit score. If you are able to, you can also consider cancelling or reducing the limit on your credit cards. Find out more ways to improve your credit score here.

How does my Equifax Score impact my credit application?

Your Equifax Score ranks the level of risk you are compared to the rest of Australia. It could be used to help credit providers assess your ability to pay the loan back and whether or not to approve your application.

How To Check Your Credit Score In Australia

You can check your credit score or credit rating through a number of ways in Australia. The most common way is to request a free credit report from a major credit reporting body, the three major ones are Equifax, Experian or Dun & Bradstreet. You are entitled to request one free copy of your credit report from each body every 12 months.

It’s important to check your credit report regularly as it can help you keep track of and build a strong credit history and identify any potential errors or fraudulent activity. If you find any inaccuracies on your credit reports, you can contact the relevant credit bureau to have them corrected.

Other alternatives like Credit Simple exist to allow you to access your credit score for free. However you choose to access your credit score, you will need to provide some personal details to either the credit bureaus or companies so they can build your credit file. It’s important to stay on top of your credit health to maintain a good score and access to the best loan and credit products.

Recommended Reading: How To Get 800 Credit Score In 45 Days

What Is A Credit Score

A credit score, also known as a credit rating, is the number that represents your financial history. Banks and other lenders use this score to indicate your reputation as a borrower, determining your creditworthiness to pay them back.

Your credit score is based on a credit report. This is a record of how youâve handled previous credit in the past. Credit reports sit on a scale from 0 – 1,000 or 0 – 1,200, depending on which reporting agency is conducting the report.

The three comprehensive credit reporting bodies in Australia are:

- Experian: 0 – 1,000

ClearScore uses Experian’s credit score range.

What Are Some Of The Features And Benefits Equifax Offers With Its Products

Equifax helps you access and manage your credit score to improve how you look to lenders. The comprehensive Equifax database containing credit information on companies, businesses and individuals can help you minimise the risk of accruing bad credit by giving you updated information about the credit histories of your customers.

Equifax also provides analytics services that help you understand and apply financial and credit data to empower your business. The various Equifax packages on offer allow you to protect your identity and credit information, track your credit score to improve it and time your credit applications, and find solutions to personal and business financial and data analysis problems.

If you want enquiries made into an entity in your credit report, Equifax can investigate and correct incorrect information to ensure your credit file remains accurate. This helps to ensure that your credit score improves and that you can be confident to apply for credit.

Read Also: How To Update Credit Report Information

Small Business Loans For You

Our small business readership consist of:

Cafes, Bars, and Restaurants Real Estate and Construction Businesses Hair and Beauty Salons Service Providers Self-employed Sole Traders Online Sellers and Freelancers Funds and Not-for-Profit Organizations Mining and Manufacturing Companies Larger Corporations Good Credit AND Bad Credit Businesses

If your business is at least 6 months old, and you are turning over at least A$5,000 on a monthly basis, we can help you find relevant lenders promptly.

Need Help Narrowing Down Your Choices

Get in touch with one of our Car Buying Specialists today

Claim back your weekends. Well crunch the numbers and haggle on your behalf

Big savings on new cars

We buy over 10,000 cars per year which means big fleet discounts that we can pass on to you.

Discover the car for you

Weve got boot-loads of experience to help you choose the right car to suit your individual lifestyle.

Test drives that come to you

Save hours at the dealership by having your test drive brought to you at home or work.

We organise trade-ins

Save yourself the hassle of selling your old car. As us for a trade-in quote with your enquiry.

We can help you get finance

With access to a wide range of lenders, we could help you obtain finance for your next car.

Insurance quote

You May Like: Is My Credit Score Good

How Does Your Credit Score Affect Your Interest Rate

Beattie says the higher the credit score a borrower has, the better the chances are of getting a lower interest rate.

He says those with credit scores in the good-to-excellent range may find themselves eligible for market-leading interest rates, while those with below-average scores may have to resort to higher rates.

Its a sad reality, but those who are struggling financially often pay the highest interest rates, because they often have poorer credit scores, which can further entrench their struggles with debt.

Understanding Good Credit Score In Australia

What is a credit score?How is a credit score calculated?

- Your repayment history for any loans or credit cards

- A summary of how much you have borrowed in the past

- An estimate of your ability to pay bills on time

- Any credit limits currently in place

- The number and frequency of credit applications youve made in the past

- Any bankruptcies, defaults or court judgments in your name

How do you view your credit report? There are a number of reputable agencies that offer credit reports and credit score summaries. The most popular ones in Australia are Equifax, Experian and Illion, and to get your report youll need to prove your identity using official documents such as your drivers licence, passport or Medicare card. Its worth noting that these agencies sometimes offer slightly different scores to each other because different credit reporting bodies may hold different information about you.

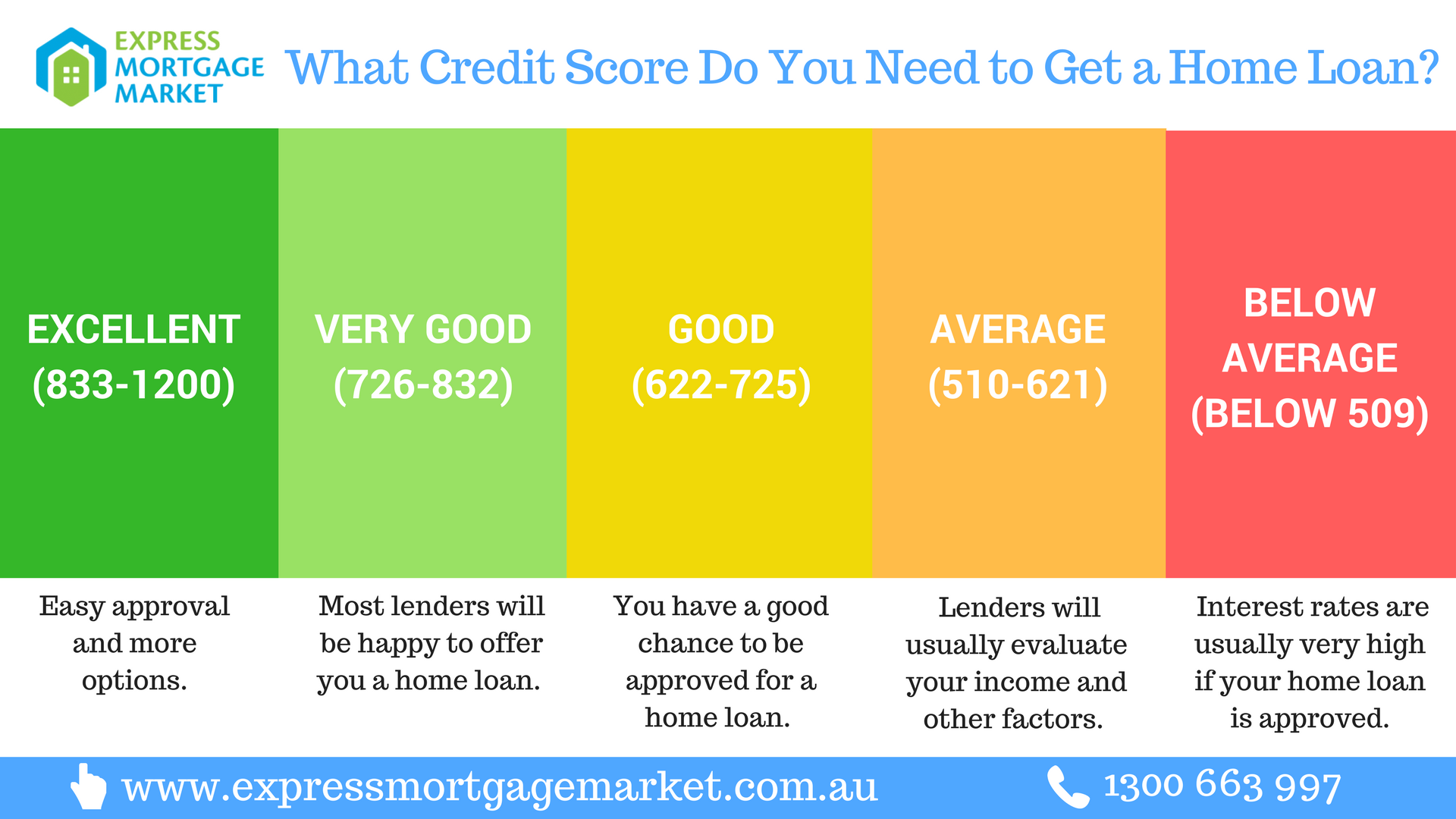

H& R Block have partnered with the leading independent provider illion to create our MoneyHub platform. MoneyHub is a free score and credit reporting platform that allows clients to take control of their finances. Once registered, users can see their report at any time, track their spending with inbuilt spend tracker tool and gain access to a range of exclusive client offers. How do you interpret your credit score? Fortunately, its easy to understand your credit score as it is graded with simple categories: Excellent, Very good, Good, Average and Below average.

You May Like: What Business Credit Cards Report To Credit Bureaus

Tips To Boost Your Creditworthiness

The better your creditworthiness, the more ways youâll have to get ahead.

We have previoulsy looked at why creditworthiness matters. We learnt that law changes in March 2014 altered what information is collected for your credit fileâand how this âpositiveâ reporting can help you.

But your credit score isnât fixed. Here are our top 10 tips to improve it.

What Credit Score Do You Need When Buying A House

10 Mar 2020, 11:55am

Its just a number, but it can be the difference between being able to buy a house or not.

A credit score, sometimes referred to as a credit rating, is used by lenders as a guide for how responsible a person is with money and whether they qualify for a home loan. In Australia, its usually a rank between 0 and 1200, depending on the credit agency.

Its based on a persons history of paying off loans and bills, as well as how often theyve applied for credit. It takes into account all credit cards, whether there is money owed on them or not, as well as other debts.

Also Check: How To Check Personal Credit Rating

Are You Struggling With Mortgage Repayments Due To Covid

âThe Australian Banking Association , which represents 22 member banks, confirmed on July 31 2020 that six-month home loan deferrals wouldn’t affect customers’ credit scores. Yes, customers can seek financial difficulty help through this COVID deferrals initiative. For example, customers who have lost their jobs or significantly lost income due to pandemics do not need to worry about their credit rating throughout this applied period. Also, banks during this time will not report the repayment history. However, after the hardship period ends, banks will “determine how to report the repayment history information” according to the ABA.

At the same time, ABA members and other players are communicating these financial assistance packages independently, with many announcing changed circumstances for personal and business financial products. They include waiving fees on early term deposit withdrawals, interest rate freezes on loans, options to defer or restructure home loan repayments, and emergency credit card limit increases.

So if you want to save your credit rating, avoid failing the lender’s credit criteria, or need any support on home loan repayments, check out the site here! You can also select your bank to find out what hardship support options are available.

How To Check Small Business Credit Score Online Free

The OnDeck business credit score service also known as the Know Your Score service will help you get a free business credit score in Australia. Through a partnership with Equifax, OnDeck have created a service that isnt only free but will leave no stamp on your credit file either. Sometimes when a credit report is run on your business it can impact your business credit score but this isnt the case with the OnDeck business credit score service.

On top of it being free the only information you have to provide is as follows:

- Your ABN

- Time in business

- Revenue

The service is available to all Australian businesses with an ASIC registered business name and theres no obligation to then apply for a loan with OnDeck afterwards.

The credit score is provided by Equifax, the worlds leading credit information provider. Founded in the US it expanded into Asia Pac with the acquisition of the data analytics company Veda. Its now the leading Credit information and analysis company for a business credit score in Australia. Its also exactly where the online lenders will go to obtain your companies credit report when you apply for a loan.

Read Also: How Long Do Hard Inquiries Stay On Credit Report

What Is A Good Credit Score According To Lenders

Lenders will favour people with an average, very good or excellent credit score. Generally anything 620 or above will be looked at favourably by lenders.

-

What is a good credit score to buy a car?

To buy a car, a good credit score is normally above 620. However, there is no “official” industry-wide minimum credit score in order to qualify for a loan. You will not automatically be ruled out for a loan if you have a low credit score but you may face higher interest rates.

-

What is a good credit score to buy a house?

If you have a credit score above 620, you have a good chance of being approved for a home loan. It’s not easy to settle on one specific number you need for a mortgage because many Australian lenders don’t publish their credit criteria. Most lenders also look at other factors to assess your risk, not just your credit score.

-

What is a good credit score for renting an apartment?

Real estate agents and landlords prefer signing a lease with someone with a good credit score, around 620. However, this is not the only thing they will look at. They will also likely look at your pay slips and previous rental history.

High Number Of Credit Enquiries

Each time that you apply for credit, an enquiry is left on your report. The number of enquiries on your report can further reduce your credit score if you have multiple accounts or short credit history.

Furthermore, a high amount of credit enquiries on a report indicate higher risk and, therefore, a lower credit score. For example, applying for multiple credit cards over a short period of time will appear on your report and affect your credit scores.

If your credit history involves these impacting factors, don’t worry! There are plenty of steps you can take to improve your credit score.

You May Like: How To Get Free Credit Report

How To Get Credit Score

Aside from the question what is a good credit score in Australia, borrowers are also curious about how to obtain their credit score. Its important to note that any credit reporting agency should give you access to your consumer credit report for free at least once every three months.

Equifax, Experian, and illion may have different information about your credit score so you may need to request a copy or use a from each of them.

As an innovative financial service provider, the application process at MoneyMe is done entirely online. Also, our approval process only takes a few minutes after you fill out our online application form. Apply today, and once approved, your funds are immediately sent to your bank account.

End Of Story: Monitor Your Credit Score And Improve Your Financial Health

â

Banks and lenders know your credit score, so why shouldnât you? Try WeMoney app to find out your credit score for free online anytime any day at your convenience. It also provides you with constant updates each month where you can track and monitor any changes with extra features like credit accounts/relationships, easy to understand insights, repayment on time, credit inquiries, and negative events. You can also add important repayment dates to our calendar to avoid late payments and dues. Plus we’ve recently partnered with Now Finance and Loans.com.au to offer you a fuss free flexible personal loan with no fees attached, or impact on your credit file.

Listen to our Podcast

To learn more about credit scores, take a listen to Episode 3 of We Talk Cents. Your hosts Dan & Blaize dive into what a credit score is, why itâs important and what factors impact your score for better or for worse. To take a listen check out the link here.

Read our latest featured articles

Watch Our Founder Dan Javevski On Channel9 News Busting Myths About Credit Scores here. Plus WeMoney was recently featured in 6PR 882 News Talk, check out the full podcast on how you can revive your credit score here.

Outside resource

Youâre also entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus in Australia, visit Moneysmart.gov.au for more information.

Things you should know

About Comparison Rates

Read Also: Is 632 A Good Credit Score

Check Your Credit Report For Any Inaccuracies

Taking some time to check your credit report can help you find details that might be negatively impacting your credit score. Take a look at reports from all three CRBs to see if anything stands out. If you do find anything that doesnt seem quite right, clarify it with your creditors or find out more from the CRB.

How Do You Improve Your Credit Score

Start early. The sooner you establish a reliable repayment history, the better so if you plan to apply for a mortgage in the next few years, or take out a major loan, you should manage your credit health now by ensuring there are no negative information such as a default listed against you for not making your debt obligations and by ensuring that you pay your bills on time.

The way in which you manage your repayments on your credit and loan accounts is one of the top factors in most credit scoring models. If you have been making repayments on your existing accounts on time, this is factored into your score and it will impact your credit score positively.

Your credit score will change over time as your credit behaviour changes e.g. if you apply for and/or take on more debt, default on your account or if your repayment behaviour changes by skipping your monthly account payments.

Lenders subscribe to one or more of the credit reporting bodies, sharing their customers comprehensive credit reporting information for inclusion in your credit report. So, not all credit reporting bodies have the exact same information, it all depends on which credit reporting body your lender shares your credit reporting information with.

Recommended Reading: What Is My True Credit Score

What Affects My Credit Score

Every positive and negative act between you and your lenders is recorded and affects your credit report and score. The amount of credit you have and the number of credit applications applied for also impact your rating.

One of the main factors affecting your credit score is your repayment history. Have you paid your home loan and credit card repayments and bills on time? If you have defaulted on any repayments or credit accounts, those actions will be recorded and affect your credit score.

Court judgements and bankruptcy will impact your credit report significantly. It may be challenging to improve your rating for quite a while, although it is possible with positive credit activity over time. Your credit history is with you for a long time so think carefully before defaulting!

The number of times you have applied for credit will also affect your credit report. A responsible borrower will give considerable thought before applying for credit. Frivolously applying for any type of credit signals to a lender that you may not be very responsible.