Get A Copy Of Your Credit Reference File

You can ask for a copy of your credit reference file from any of the credit reference agencies. If you have been refused credit, you can find out from the creditor which credit reference agency they used to make their decision. Your file shows your personal details such as your name and address, as well as your current credit commitments and payment records.

You have a right to see your credit reference file – known as a statutory credit report. A credit reference agency must give it to you for free if you ask for it.

If you sign up to a free trial and decide its not right for you, remember to cancel before the trial ends or you might be charged.

What Factors Affect Your Credit Scores

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you’ve used credit. Understanding what factors affect credit scores helps you plan the most effective way to or protect it.

Why do you care? Because your : whether you can get a credit card or car loan, and at what interest rate whether you can buy a house or rent the apartment you want even how much you pay on car insurance and utility deposits.

The two major scoring companies in the U.S., , differ a bit in their approaches, but they agree on the two factors that are most important. Payment history and , the portion of your credit limits that you actually use, make up more than half of your credit scores. Focus your attention mostly on those two while keeping an eye on the other factors.

Here’s a breakdown of all the factors that affect your scores:

Your credit reports reveal your , or whether you’ve consistently paid bills and other obligations on time. FICO says payment history accounts for 35% of your score. doesnt give percentages, but it calls payment history extremely influential.

Costa Coffee To Shake

3 September 2021

Everyone should take time to manage their credit score, especially during this time of coronavirus uncertainty. It’s no longer just about whether you can get a mortgage, credit card or a loan, it can also affect mobile phone contracts, monthly car insurance, bank accounts and more. Here’s what you need to know about credit checks and how to boost your credit score.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Credit Limit Increase Requests

When you request a credit limit increase, your card issuer may perform a hard pull of your credit. This can temporarily ding your credit score by a few points. However, there are times when credit limit requests cause no harm to your credit score, like when your issuer does a soft pull of your credit or initiates an automatic increase.

What Not Included In Credit Score

The following points have no impact on, and are nowhere mention in credit score:

- Previous occupants at your home address make no difference whether they were bankrupt or billionaire. Creditors are only interested in your financial details and anyone you are linked to financially, like a partner with a joint bank account with you.

- Friends and family, or anyone you share your residence with are not important for lenders unless you share a financial link with them too.

- Things from your distant credit history are not important, especially if they are more than six years old.

Don’t Miss: How To Remove Repossession From Credit Report

The 5 Biggest Factors That Affect Your Credit

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

A is a number that lenders use to determine the risk of loaning money to a given borrower.

Here are the five biggest things that affect your score, how they affect your credit, and what it means when you apply for a loan.

What Information Is Kept By Credit Reference Agencies

Credit reference agencies are companies which are allowed to collect and keep information about consumers’ borrowing and financial behaviour. When you apply for credit or a loan, you sign an application form which gives the lender permission to check the information on your . Lenders use this information to make decisions about whether or not to lend to you. If a lender refuses you credit after checking your credit reference file they must tell you why credit has been refused and give you the details of the credit reference agency they used.

There are three credit reference agencies – Experian, Equifax and TransUnion. All the credit reference agencies keep information about you and a lender can consult one or more of them when making a decision.

The credit reference agencies keep the following information:

If there has been any fraud against you, for example if someone has used your identity, there may be a marker against your name to protect you. You will be able to see this on your credit file.

Recommended Reading: Sync Ppc Credit Card

Recent Changes To What Impacts Your Credit

There were some changes to credit reporting and scores over the last couple years that are positive for consumers. These may have positively impacted your credit score. These updates include:

- Tax liens are no longer included on your credit as of April 16, 2018. They dont impact your credit score anymore.

- Medical collections dont impact your credit as much as they previously did.

- A new credit score called the UltraFICOTM Score was introduced in October 2018 by Experian, FICO, and Finicity. This new score will take into account other factors like how you manage your banking accounts. It is supposed to launch in early 2019.

- Experian also announced a new product in December 2018 called Experian Boost, which allows consumers to get credit for on-time mobile phone and utility payments.

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this so it doesn’t play any role in any assessment of you.

Don’t Miss: Annual Credit Report Itin

Requests For A Credit Limit Increase

There are several reasons to request a credit limit increase on your credit card. Not only does it give you more spending power, but it can also improve your credit over time by reducing your .

But applying for a line increase will likely cause your lender to conduct an underwriting process similar to what’s done when you first applied for the credit card. This often includes a credit check to determine whether you’re eligible, which can result in a hard inquiry on your credit report.

Individual hard inquiries don’t do much damage to your credit, and it’s unlikely the addition of a hard inquiry will have a noticeable impact on your creditworthiness. According to FICO, each additional inquiry knocks fewer than five points off your score. But if you’ve submitted a lot of credit applications recently, adding another inquiry could have a compounding effect and hurt your credit even more.

Banks Score You Based On Products They’d Like To Sell You In The Future

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in the future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know.

Recommended Reading: Synchrony Bank Ppc

Defaulting On Figuratively Speaking Make A Difference To Your Credit Score

When you must be aware, routine payment of credit is just one of the biggest facets affecting your credit rating. A student-based loan is among the preliminary debts that a student avails in his life. Unusual repayments or non-payments will go on to make a large red mark-on the financing score of borrower. You might understand its never nice to start your innings with a poor or a red comment.

Landing And Keeping A Job

Employers may want to know that youre financially responsible and dont have burdensome debts that could affect your judgment. Even if youre already employed, your credit could impact your ability to get a promotion or keep your job, particularly if it requires a security clearance.

Your credit score does not impact your employment, though thats a common myth but your credit report might. The important distinction is that employers may be able to review your credit report, but the version they receive doesnt come with a credit score. It also omits other pieces of information, such as your date of birth and account numbers, because employers dont need this data to make a hiring decision.

A company cant pull your credit as part of an employment check unless you give written consent, and some states outlaw the practice altogether.

Also Check: What Credit Bureau Does Target Pull From

Council Tax Arrears And Credit Rating

Councils dont share data about your payments, be it good or bad. If youre in council tax arrears, it wont affect your credit score. Local councils dont report any data to the credit reference agencies, and lenders have no way of knowing if you are in council tax arrears.

What time you make your council tax payment, whether it is late or on time, it wont appear on your credit report.

It is, however, always wise to prioritise your council tax payments so as to avoid court procedures. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Even in situations where the debt is referred to court, it is dealt with by the magistrates court, and no fines imposed by the court appear on your credit report.

The only impact that arrears have on credit is to reduce your overall wealth, and nothing else.

Choosing The Wrong Credit Card

Its important that you choose a credit card that has a credit limit, interest rates and fees that will help you stay on top of your repayments and well within your balance limit. These are both factors that credit reference agencies use to decide your credit rating.

Our comparison tool can help you choose a card that may work for your situation.

You May Like: How Personal Responsibility Can Affect Your Credit Report

Where Credit Rating Can Affect

There are several major financial areas that might be affected by credit rating.

Some of these areas are:

- Mortgages: If your credit score is poor, youll be rejected from a mortgage.

- : Your credit score dictates whether youll be accepted for credit card or not, whether youll be given promotional rates on an already existing one or not, and the APR youll be charged afterwards.

- Loans: Your credit score matters both for acceptance of a loan application and the rate of interest you are charged on a loan.

- Utility bill: Utility companies too, have made it even more important to pay your bill on time, or it affects your credit rating.

- Mobile phones: If youre getting a contract mobile phone, the company checks your credit score. This is so because the mobile company is spending the cost of the handset over the contract, so it is a form of loan for it, for which it needs to verify whether you will pay it back or not.

- Car and home insurance: Similar is the case with insurance. If you are opting to pay monthly installments, then in practice the insurer is loaning you the money to pay upfront, spreading the cost over the year and charging you interest so it needs to perform a credit check first.

Will An Inquiry About My Credit Affect My Credit Score

An abundance of credit inquiries can sometimes affect your credit score since it may indicate that your use of credit is increasing.

However, the data used to calculate your credit score does not include any mortgage or auto loan credit inquiries that are made within the 30 days prior to the score being calculated. In addition, all mortgage inquiries made in any 14-day period are always considered one inquiry.

Visit the Understanding your credit page for more information on Understanding Your Credit Score and Report and visit our interactive TD Bank Learning Center Module on . Up your money management skills with our growing collection of tools, tips and financial education articles or have a volunteer TD Bank Financial Education Instructor visit your Organization.

You May Like: When Does An Eviction Show On Your Credit Report

Stability With Your Address And The Electoral Roll

Banks and lenders like to know that the people they lend to are reliable and stable, and therefore can be trusted to repay any debts.

One way they determine stability is to look at how long youâve lived at your address and if you are on the electoral roll. If you’ve been living in one place for a long time, this will be better for your credit score than if you frequently move between properties.

In addition to this, being on the electoral roll proves that you are who you say you are.

and that it’s showing up on your credit report.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

You May Like: Paypal Credit Report

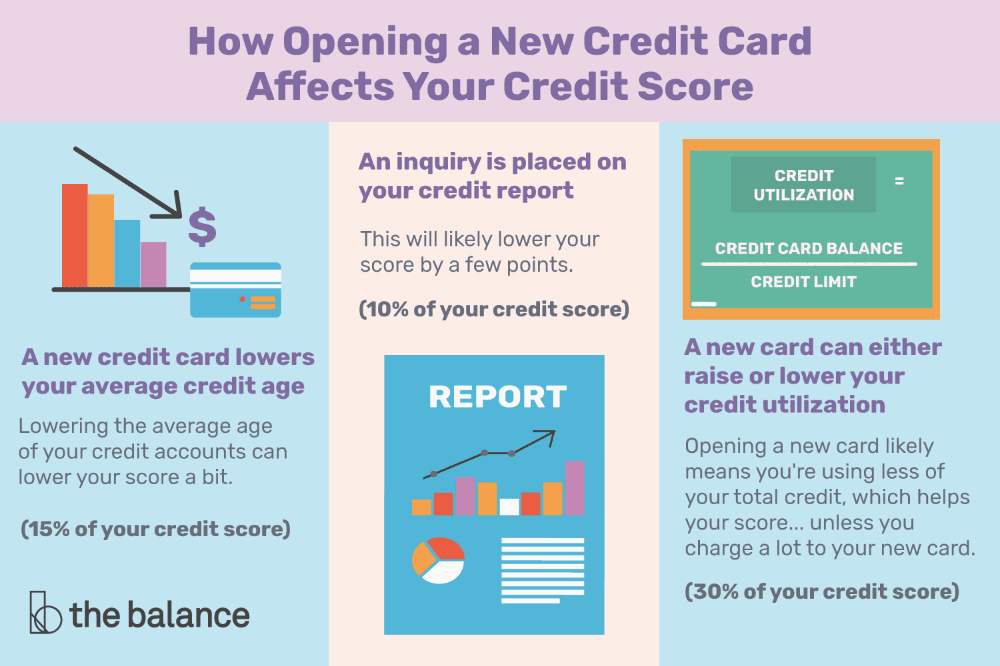

Somewhat Important: Length Of Credit History

A variety of factors related to the length of your credit history can affect your credit, including the following:

- The age of your oldest account

- The age of your newest account

- The average age of your accounts

- Whether youve used an account recently

Opening new accounts could lower your average age of accounts, which may hurt your scores. But the hit to your scores could also be more than offset by lowering your utilization rate and increasing your total , making sure to make on-time payments to the new card and adding to your credit mix.

Closed accounts can stay on your credit reports for up to 10 years and increase the average age of your accounts during that time. But once the account drops off your credit reports, it could lower this factor, and hurt your scores. The impact could be more significant if the account was also your oldest account.

Setting Up Utility Accounts

Utility companies, including gas, water and power providers, may check your credit before opening a new account for you. If you have poor credit, you may have to pay a security deposit to open an account and get your utilities switched on. Having good or excellent credit can make the entire process easier and cheaper.

Recommended Reading: How To Unlock Experian Credit

Avoid Expensive Credit Repair Companies

You might see adverts from firms that claim to repair your credit rating. Most of them simply advise you on how to obtain your credit file and improve your credit rating but you dont need to pay for that, you can do it yourself.

Some might claim that they can do things that legally they cant, or even encourage you to lie to the credit reference agencies.

Its important to not even consider using these firms.

What Does Your Credit Score Affect

Having a good credit score is important because your credit can impact many areas of your life. Good credit can make it easier to qualify for loans and credit cards, allowing you to finance large purchases with low interest rates or get a premium rewards credit card with benefits.

The benefits of a good credit score go beyond debt. Bad credit can affect your housing applications, insurance premiums and security deposits, adding roadblocks to many of lifes everyday necessities.

Heres a closer look at when and how credit scores are used:

You May Like: What Is Syncb Ntwk On Credit Report

Boosting Your Credit Score Is A Bit Like Going On The Pull

You need to make yourself as attractive as possible to lenders, in the hope you’ll fit their bespoke lending criteria.

Some borrowers are unattractive to almost all lenders . However, a small few may have a fetish for those with poor credit histories as they can charge more.

And sadly for those rejected, just as when the guys ask Sarah or Jane why they’re not interested, they just say: “‘Cos I don’t fancy you,” and that’s about it. We don’t always get to know other than: “Your credit score wasn’t high enough.”

The tips below are to make sure that lenders see you in the best possible light. So that when they’re looking at you, you’re always dressed up to the nines, looking as hot as you can, and your skirt/shirt isn’t tucked into your pants without you knowing.