Will My Score Be The Same At All Three Credit Bureaus

The three major credit bureausTransUnion®, Experian and Equifaxare responsible for collecting and maintaining consumer credit reports in the U.S. These reports are then provided to subscribers, such as landlords, mortgage lenders, credit card companies and others who are deciding whether or not to extend you credit.

It can be confusing when your score seems high but you still get denied for a new line of credit. Chances are you’re not looking at the same score as your bank or finance company. Subscribers dont work with every credit reporting agency, so the credit report information included in one report might be slightly different from that in another.

Check your credit scores and reports from each bureau annually to ensure all the information is accurate. By law, you’re entitled to one free annual credit report. You should also use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, like Credit Lock and Instant Alerts. These services will help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

What Is A Good Credit Score What Are The Credit Score Ranges

The most commonly used credit scoring models range from 300 to 850. Each lender sets its own standards for what constitutes a good credit score. But, in general, scores fall along the following lines:Excellent credit: 720 and higher Good credit: 690-719Fair credit: 630-689 Bad credit: 629 or lowerIf you’re just starting out or haven’t used credit in at least six months, you might not have a score. Don’t worry, NerdWallet has a guide to help you get started with building credit.

Very Important: Credit Usage

Credit usage is also an important factor, and its one of the few that you may be able to quickly change to improve your credit health.

The amount you owe on installment loans such as a personal loan, mortgage, auto loan or student loan is part of the equation. But even more important is your current .

Your utilization rate is the ratio between the total balance you owe and your total credit limit on all your revolving accounts . A lower utilization rate is better for your credit scores. Maxing out your credit cards or leaving part of your balance unpaid can hurt your scores by increasing your utilization rate.

Sarah Davies, senior vice president of analytics, research and product management at VantageScore, says that for VantageScore® credit scores, your overall utilization rate is more important than the utilization rate on an individual account.

But utilization rates on individual accounts can also affect your credit scores. This means you should pay attention to not just your overall credit utilization, but also the utilization on individual credit cards. Having a lot of accounts with balances might indicate that youre a riskier bet for a lender.

Read Also: What Day Does Opensky Report To Credit Bureaus

What To Do If You Don’t Have A Credit Score

If you want to establish and build your credit but don’t have a credit score, these options will help you get going.

- Get a secured credit card. A secured credit card can be used the same way as a conventional credit card. The only difference is that a security deposittypically equal to your credit limitis required when signing up for a secured card. This security deposit helps protect the credit issuer if you default and makes them more comfortable taking on riskier borrowers. Use the secured card to make small essential purchases and be sure to pay your bill in full and on time each month to help establish and build your credit. Click here to learn more about how secured cards work and here to browse Experian’s secured card partners.

- Become an authorized user. If you are close with someone who has a credit card, you could ask them to add you as an authorized user to jump-start your credit. In this scenario, you get your own card and are given spending privileges on the main cardholder’s account. In many cases, credit card issuers report authorized users to the credit bureaus, which adds to your credit file. As long as the primary cardholder makes all their payments on time, you should benefit.

Want to instantly increase your credit score? Experian Boost helps by giving you credit for the utility and mobile phone bills you’re already paying. Until now, those payments did not positively impact your score.

Option : Apply For A Secured Credit Card

A secured card is nearly identical to an unsecured card in that you receive a credit limit, can incur interest charges and in some cases can even earn rewards. The big difference is you’re required to make a deposit in order to receive a line of credit. The amount you deposit usually becomes your credit limit.

Deposits typically start at $200 and can range up to $2,500. If you want a higher credit limit, you’ll usually need to deposit more money.

The amount you deposit acts as collateral if you default on payments, but it’s completely refundable if you pay off your balance in full and close your account or upgrade to an unsecured card.

When you use a secured card responsibly , this information will be sent to the credit bureaus , which helps raise your credit score and put you on the path to qualifying for an unsecured card.

Here is our top pick for the best secured credit card with low interest from a major bank:

See our methodology, terms apply.

Read Also: Do Student Loans Fall Off Your Credit

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Recommended Reading: Does Qvc Easy Pay Report To Credit Bureaus

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Don’t Miss: What Credit Score Does Care Credit Require

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

How Your Credit Score Is Used

When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not. The credit score gives a snapshot of how reliable you are as a borrower, which lets lenders know whether you are a good risk for a loan or credit card or not.

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are.

These higher interest rates are designed to lower the risk that lenders take on by offering loans or credit cards to less reliable borrowers.

Don’t Miss: Does Paypal Credit Report To The Credit Bureaus 2019

See What You Qualify For

Answer a few questions below to speak with a specialist about what your military service has earned you.

Chris Birk is the author of The Book on VA Loans: An Essential Guide to Maximizing Your Home Loan Benefits.

An award-winning former journalist, Chris writes about mortgages and homebuying for a host of sites and publications. His analysis and articles have appeared at The New York Times, the Wall Street Journal, USA Today, ABC News, CBS News, Military.com and more.

More than 300,000 people follow VA Loans Insider, his interactive VA loan community on Facebook.

How Long Youve Had Credit: 15% Of Your Score

A lengthy credit history shows lenders that youve been disciplined about making payments on time, but even a short history without late payments or other negative factors is helpful. To keep older cards active, you may want to put a recurring cost, like a utility bill, on those youre not using regularly. It can have a negative impact on your credit score when you close older lines of credit or have them canceled, which can be detrimental if you plan to make a big purchase like a house.

Also Check: Does Paypal Bill Me Later Report To Credit Bureau

About The Author: Brad Wright Cfp

Brad Wright, CFP®, is co-founder of Launch Financial Planning, LLC, a fee-only firm located in Andover, MA. He is a frequent contributor to WCVB-TV and Mix 104-1 Radio. Brad is past-president of the Financial Planning Association of Massachusetts. Learn more about Brad at www.LaunchFP.com

The opinions penned here are for general information only and not intended to provide specific advice or recommendations for any individual.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Any opinions are those of Brad Wright.

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart. Make sure you conduct thorough research on the best credit card for your needs before applying.Check your credit reports and dispute errors.

Don’t Miss: Credit Score Of 524

Option : Apply For A Card Marketed Toward Consumers With Poor Or Average Credit

In addition to secured cards, there are some other credit card options for people with no credit or poor credit who don’t want to or are unable to put down a deposit. After you open a credit card, make sure you spend within your means and pay your balance on time and in full. In some cases, like with most Capital One cards, paying your bills on time for several consecutive months will automatically entitle you to a higher credit limit .

Here is our top pick for the best credit card for building credit:

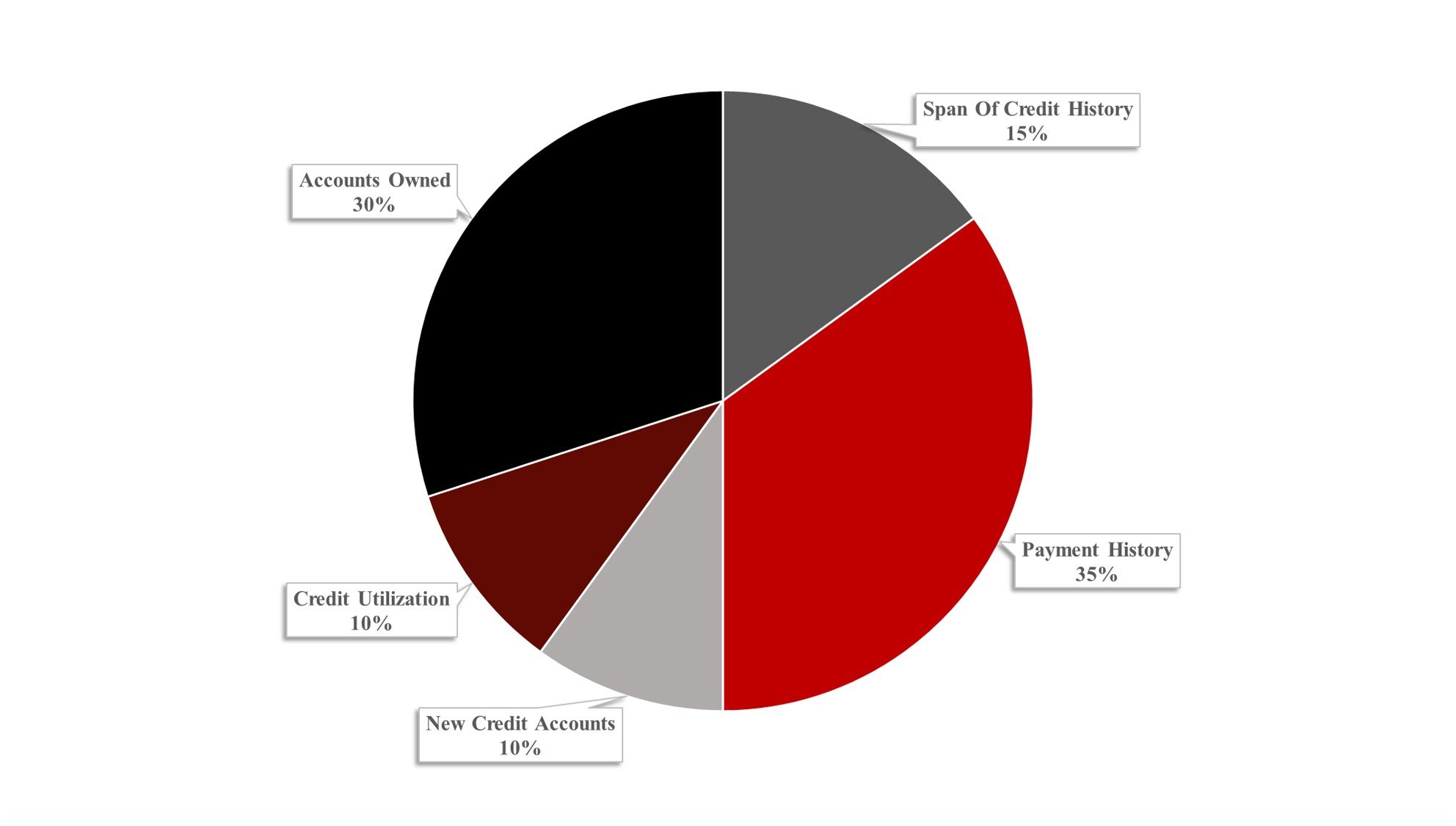

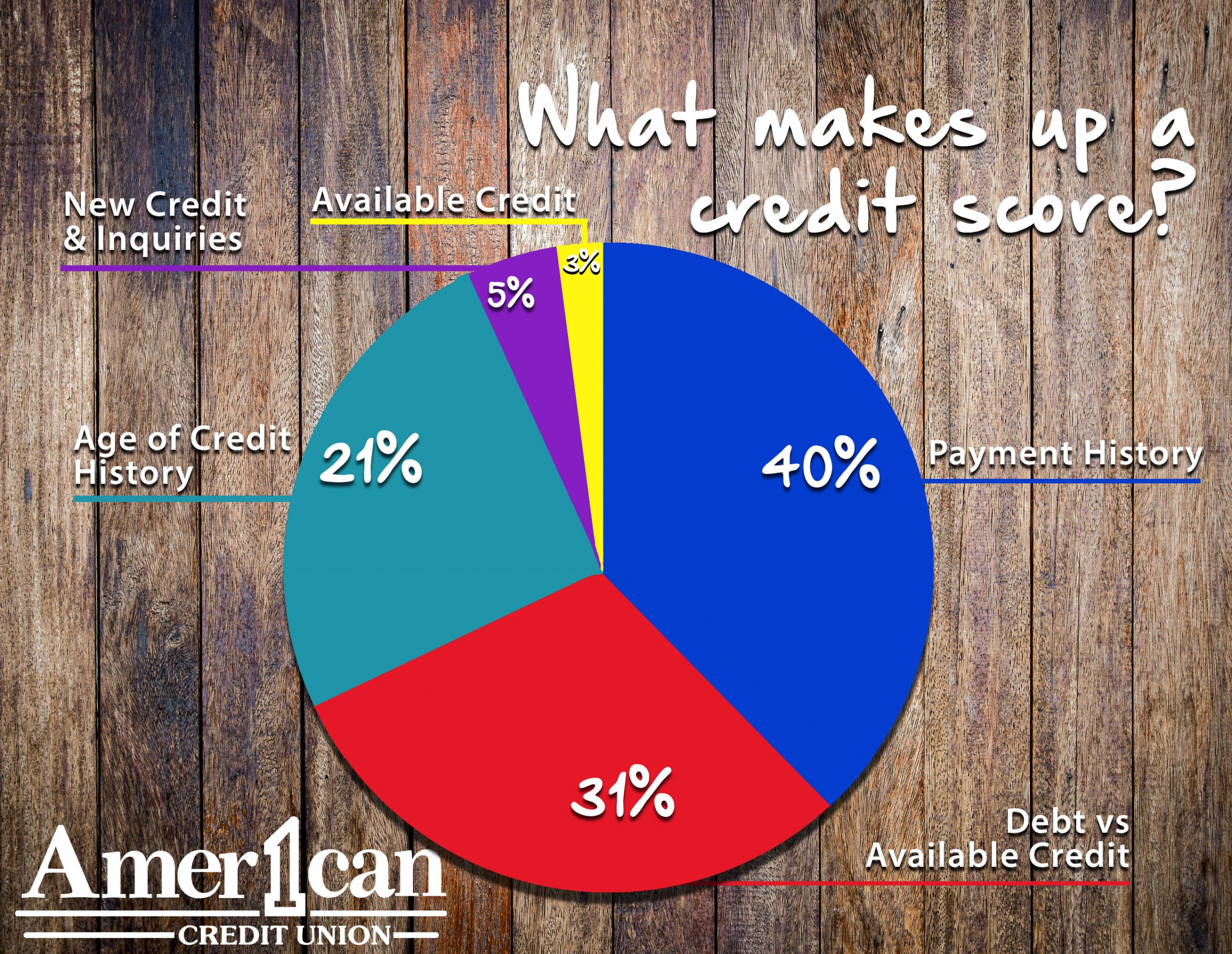

What Makes Up Your Credit Score

For example, your bank account balance doesnt appear on your credit report. Neither does your income or your net worth. None of these factors play a role when a scoring model calculates your credit score.

Factors that do impact your FICO Score fall into one of the following five categories.

- Payment History: 35%

- Length of Credit History: 15%

- New Credit: 10%

In each category, a scoring model will ask questions about your credit report. For example, Does the report show any late payments? These questions are known as characteristics in the credit scoring world. The answers to these questions, called variables, determine the number of points you earn. When the scoring software adds all of those points together, you get your credit score.

Related: Understand The 5 Cs Of Credit Before Applying For A Loan

You May Like: Repo On Credit Report

How To Use Your Newfound Knowledge

Credit scoring companies review your credit reports to see how youre doing on all these factors. Then they build your scores from that data. You can see the same things they do by checking your credit reports.

Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores. You can track your score and get personalized tips with NerdWallets free credit score dashboard.

What’s In My Fico Scores

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

Also Check: How Many Authorized Users Can Be On A Capital One Credit Card

Debt Burden Or Accounts Owed

The other major component category of your credit score is the break up of your existing debt burden including how much you owe in total, what types of loans you have and any other quantitative indicators about your overall debt/credit profile. As an indicator of your creditworthiness how much you owe and how it’s broken up across the different types of loans acts as a signal about your capacity to manage your existing debt.

When it comes to how this plays into your credit score, it’s probably not worthwhile to think of it was higher/lower = better. In all likelihood, the FICO calculation doesn’t evaluate your debt burden in isolation but considers it in relation to things like your payment history. For instance, let’s consider a credit profile of someone who has large amounts of debt but a long and spotless payment history. This might indicate that the person is financially well off and the debt burden is a signal that any additional loans might be obligations they can easily handle.

Take the same level of debt on a profile with a recent history of payment problems, and the higher quantitative factors should be a major red flag. This consumer may be having difficulties making ends meet and even a small amount of additional credit might be a risky proposition.