Spend Within Your Means

Spending within your means isnt just a good budgeting tactic, its also a way to build good credit.

If youre spending beyond your means and putting that money on credit cards, youll be putting yourself in deeper debt via compound interest, which is interest on top of interest.

If, on the other hand, youre spending less than what youre taking in, you can use whatevers left over to pay down whatever debt you have. Its also a great opportunity to pay off your credit cards in full every month if you only charge as much as youre able to afford within that period.

This will keep you current on your monthly payments and help improve your credit score. The longer you can maintain a history of consistent on-time payments and low account balances, the better off youll be because the length of your credit history accounts for 15% of your credit score.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

My Credit Score Is 800 Now What

by The Ascent Staff | Updated July 21, 2021 – First published on Nov. 16, 2018

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

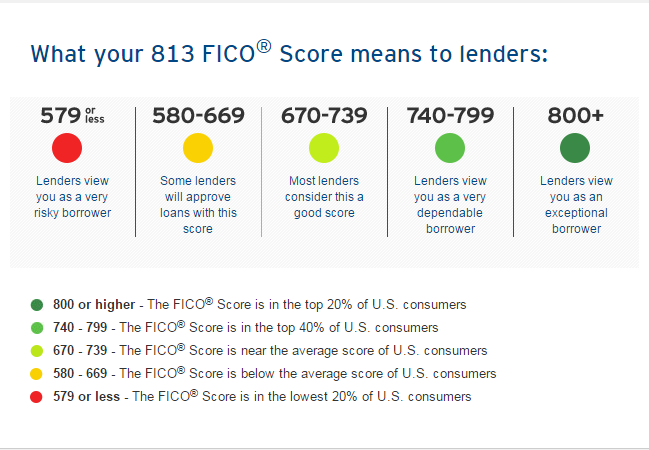

Having a credit score of 800 or higher puts you in an elite tier of borrowers, given that only about 20% of people have a credit score in this range. People who have scores above 800 enjoy extraordinary credit card perks, low loan rates, higher borrowing limits, and other financial benefits that aren’t offered to people who have lower credit scores.

Read Also: Credit Score Needed For Les Schwab Credit

The 800 Credit Score: What It Means And How To Get One

The Balance / Caitlin Rogers

Your is one of the most important numbers in your life. This three-digit number indicates your creditworthiness or the likelihood that you’ll repay the money you borrow. Credit scores generally range from 300 to 850. The higher your credit score, the more likely it is you’ll be approved for new and better credit.

As of April 2018, 21.8% of Americans had a FICO score above 800, according to data from FICO. This makes a record-high percentage of people with credit scores over 800 and correlates directly to fewer blemishes on people’s credit reports, from improvements in payment history to fewer inquiries.

Since payment history makes up 35% of the credit scoring calculation, there’s a strong relationship between having a high credit score and a low number of late payments.

Mortgage Rates For Excellent Credit

Having excellent credit is one of the first steps to getting a great mortgage rate. But there are other factors at play here too, like the total cost of your home and your debt-to-income ratio.

Once youve got a sense of how much house you can afford and the type of mortgage you want, its time to shop around to understand the rates that might be available to you. Getting a mortgage preapproval can help you understand how much you can borrow and make your offer more competitive.

Compare current mortgage rates on Credit Karma to explore your options.

You May Like: How To Remove Items From Credit Report After 7 Years

Tips To Build And Maintain An 800 Credit Score

Learning to build and maintain a good credit score is vital in a person’s financial life. A credit score is a three-digit number that lenders base on when deciding to grant a loan or credit card. It reveals how likely they can repay them on time.

If a person receives a high credit score, they can likely be more eligible for credit cards and loans at the most advantageous terms. However, if their credit history is not as good, they might have some trouble qualifying for credit.

For those seeking to build and maintain an exceptional credit score, keep on reading! This article will discuss the benefits of an 800 credit score, how a credit score is computed, several tips to build and maintain an 800 credit score, and how long it might take to achieve.

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

Don’t Miss: Syncb Ppc Credit Card

How To Improve Your 800 Credit Score

A FICO® Score of 800 is well above the average credit score of 704. It’s nearly as good as credit scores can get, but you still may be able to improve it a bit.

More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range . A Very Good score is hardly cause for alarm, but staying in the Exceptional range can mean better chances of approval on the very best credit offers.

Among consumers with FICO® credit scores of 800, the average utilization rate is 11.5%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

Get A Secured Credit Card

If your credit score is very low or nonexistent, and you dont have any credit cards, then consider getting a secured credit card.

A secured credit card is a low-limit card that a bank can issue to you, that requires you to pay them a security deposit up front. That way, their risk is low and they can afford to give a small credit line to people with low or no credit. Many of the major issuers, like Discover and Capital one, have good offers on secured cards.

Typically, the credit limits are tiny, like $200 or less. Pretty much the only reason secured credit cards exist is to help people build credit. Start making some purchases with the card, and pay it back in full every month. Over time, youll start building a positive credit history. Make sure your other payment types are paid on time as well.

Eventually, when your credit score is higher , ask your issuing bank to convert your account to a normal, unsecured card. This way, you can get a higher limit, get better rewards, and get your security deposit back.

Whatever you do, dont close your secured card, unless for some reason you absolutely cant handle having credit. You want to start building a long-lasting credit account, because average credit age is a big factor for your credit score. So, once your score is up, convert it to a better card.

Recommended Reading: What Credit Score Does Les Schwab Require

Redefine Credit Card Usage

Thirty percent of your credit score consists of your credit utilization rate, which is your debt divided by your total available credit. Typically you’ll want to have a credit utilization rate of 30 percent or less, so if you have a credit card with a limit of $1,000 and you currently owe $300, you’re at that limit. Obtaining more debt could negatively impact your credit score.

Importance Of Higher Credit Scores

While having a credit score of 800 seems lofty, even scores in the 700s can help home buyers get lower mortgage rates.

Many loan programs have a minimum credit score requirement to get approved for a mortgage. For example, most lenders will require a credit score of 580 to get approved for an FHA loan. Other programs, like USDA mortgages and conventional loans, will require scores of at least 620.

Even though aspiring borrowers only need the minimum amount, a credit score thats well above the minimum requirement can save you money and stress. Your credit history isnt the only criteria that mortgage lenders consider when determining your interest rate, but its a big one.

Your mortgage rate will be determined by the size of your down payment, your debt-to-income ratio, current mortgage rates and your credit score.

For example, a potential homeowner with a credit score of 760 who is planning on making a down payment of 20 percent will have a lower mortgage rate than someone with a score of 620 putting down 10 percent.

The size of the mortgage rate you can get depends on other factors as well, but keeping a high credit score is the best way to ensure buyer-friendly rates.

Don’t Miss: Speedy Cash Credit Check

Is A Credit Score Of 700 Good Or Bad

VantageScore® is another commonly used credit score, which, like FICO®, runs on a scale from 300 to 850. Generally, good credit scores range from 700 to 749. If you have a score between 750 and 850, then you fall in the great range.

With a credit score of 700, youre likely to be approved with favorable loan terms. If you have a credit score of 700 or higher, you should feel confident applying for financing.

Monitor And Manage Your Exceptional Credit Score

A FICO® Score of 800 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.

Also Check: Opensky Credit

Check Your Credit Score

Your credit score is influenced by five factors: your payment history, credit utilization, account age and type, new accounts, and credit mix. Each factor is weighted differently for both FICO® and VantageScore, with payment history having the most impact on your overall credit score.

Knowing whats influencing your credit report can make it easier to create a plan for how to get your credit score closer to 800. Whether thats paying down existing debt or making consistent and on-time payments, the journey to excellent credit requires knowing what you need to work on in the first place.

Check your credit score through any of your credit providers or visit sites like myfico.com for a free FICO® scores estimate.

Action Steps: How To Increase Credit Score To 800

Step 1 and 2 of how to increase credit score to 800 we check your credit reports to see if we can erase the past.

1. Know Where You Stand And Gather Your Info

The 1st step to how to get to an 800 credit score is to be prepared and organized

Get whatever information you deem necessary.

In general, the most important piece of intel youll need is your credit report.

Get to know your credit report and look through it thoroughly . If you see anything fishy or false make a note of the inaccuracy.

You can get your report here

2. If You Find Errors, Dispute and Remove Them

People in the 800 credit score club have little to no blemishes on their credit reports. So, you have to aim for that type of perfection.

‘Shoot for the moon. Even if you miss, you’ll land among the stars.’- Norman Vincent Peale

This is where we attempt to erase the past ourselves and have a few options to recruit others. You are looking for errors or inaccuracies in your report.

What types of errors are on credit reports?

- Wrong Names, addresses, a loan or credit amounts, etc

- Incorrect dates or payment dates

- Identity Theft: Unknown accounts

- Furnisher Errors

- Re-aging of Old Debts

To find these derogatory marks on your credit report you can get a copy from each credit bureau: Experian, Equifax, and TransUnion.

You want to check all three and if something is on all three reports, then you write and send a dispute letter to all three credit bureaus.

Or…

You Can Hire A Credit Repair Service To Do This For You!

Don’t Miss: What Credit Score Does Carmax Use

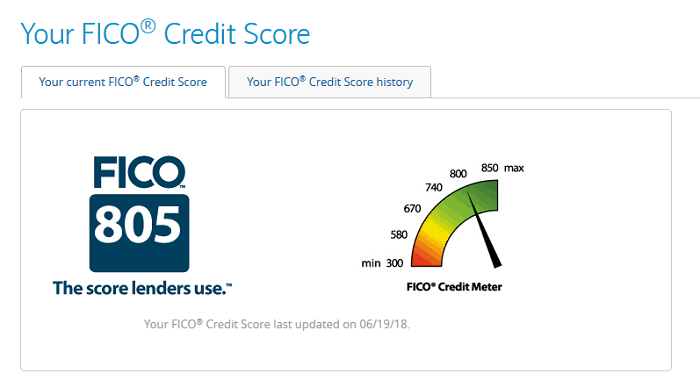

How To Check Your Fico Score

Financial legislation requires the three big credit bureaus, Equifax, Equestrian, and TransUnion, to issue you with one free credit report each year. Therefore, if you spread out your credit report requests, its possible to get a free update on your credit score three times a year. Consumers also have access to a federally mandated credit report once a year from AnnualCreditReport.com.

Unfortunately, your credit report doesnt show your FICO score. The report only shows you nay outstanding disputes, collections, or judgments against your name. This report allows you to check for any mistakes on your credit profile, allowing you to the opportunity to dispute any inaccurate information thats reducing your credit score.

If you have a credit card facility, then its possible to check on your credit score if the issuer is a part of the FICO Score Open Access program. More than 170-financial service providers participate in the program, collating data from Citi, Chase, BOA, HSBC, Discover, and many others.

When you log into your online account with a participating institution, youll see your score on your statement. However, if you bank with an institution that doesnt take part in the program, then youll have to check your FICO score at myfico.com.

Habit : They Use Credit Freezes

Credit freezes are a popular tool among people with nearly perfect credit scores. A blocks access to your credit reports, making it harder for scammers to apply for credit in your name. You can contact each of the three credit bureaus to set one up. As of September 2019, its free to freeze and unfreeze your credit.

This used to cost $10 per action, Chen said. Since its now free, there is no reason to not freeze your credit. It protects you by prohibiting unauthorized access to your credit file and is an effective way to protect your credit.

Also Check: Is Chase Credit Score Accurate

How People With Short Credit Histories Can Achieve 800+ Scores

Being older can make it easier to earn a good credit score, as youve had a longer time to achieve a good payment history and to keep accounts open. The oldest active account for those with scores of 800 or higher averages more than 27 years. While younger consumers cant reach such steady account ages just yet, an 800 credit score is still obtainable.

Benefits Of A High Credit Score

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

Blue Cash Preferred Card From American Express

Earn up to 6% cash back on everyday expenses with the Blue Cash Preferred® Card. Right now, the card offers 6% cash back on groceries and streaming services, 3% cash back on transportation expenses and gas and 1% cash back on other purchases. Along with that, the card has an intro APR of 0% for the first 12 months and users can earn a $300 statement credit if they spend $3,000 in purchases in the first 6 months. After the first year, users must pay an annual fee of $95. To get this credit card, youll need to have a credit score of about 700 or higher.

Benefits Of An 800 Credit Score

After working so hard to learn how to get 800 credit score and eventually achieving it, how does it help? How do you benefit from the high credit score?

-

Higher Chances of Loan Approval

With a credit score of 800, you only need to meet the other lenders requirements, like income level and maximum debt balance. Otherwise, the lender will be quick to approve your application.

-

Better Interest Rates

A high credit score means a lower risk to the lender. For this reason, they are willing to give you the best rates available as they are almost sure that you will repay the debt. And, in good time!

-

Better Credit Card Offers

Learning how to get 800 credit score is not in vain. With such a credit score, even credit card issuers are ready to offer you better interest offers. For instance, you qualify for the free-interest promotions, which allow you to use the credit card for even up to 21 months, interest-free. But you must be able to repay the entire balance before the end of the promotion.

If you love traveling, you might also enjoy using some incredible travel cards, offering the best discounts and bonuses. But you must also meet the requirements.

-

Discounted Insurance Premiums

Some insurance companies will include your credit score in their premiums calculations. With a higher credit score, you might be able to enjoy lower premiums. This, however, depends on whether your state allows such kinds of premium calculations.

Also Check: How To Remove Repossession From Credit Report