How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

When To Write A Goodwill Letter Instead

A goodwill letter is a request that asks a lender or creditor to remove derogatory information from your credit report. Unlike a dispute, the creditor has no obligation to take any action in response to a goodwill letter or assist your credit repair efforts.

Goodwill letters are most effective when consumers had some temporary difficulty that resulted in failing to make timely payments. For example, your goodwill letter may explain that you suffered a severe injury or illness that prevented you from working and created struggles with paying bills.

The effectiveness of a goodwill letter that cites extenuating circumstances is further increased when the account has since been back into good standing. Accounts that have been forwarded to a collection agency and left unpaid are less likely to be successful using a goodwill letter.

Keep in mind that some goodwill letters involving unpaid accounts may be open to a compromise. The creditor might respond to the goodwill letter stating they will consider removing the negative credit entry if the debt is paid however, these arrangements should always be first put in writing.

The pay-for-delete option has risks because the organization is not legally obligated to remove the entry from your credit report regardless of whether the debt is paid. Also, if the debt was sold to a third-party collector the original creditors negative entry may remain and affect your credit score.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Also Check: Aargon Collection Agency Ripoff

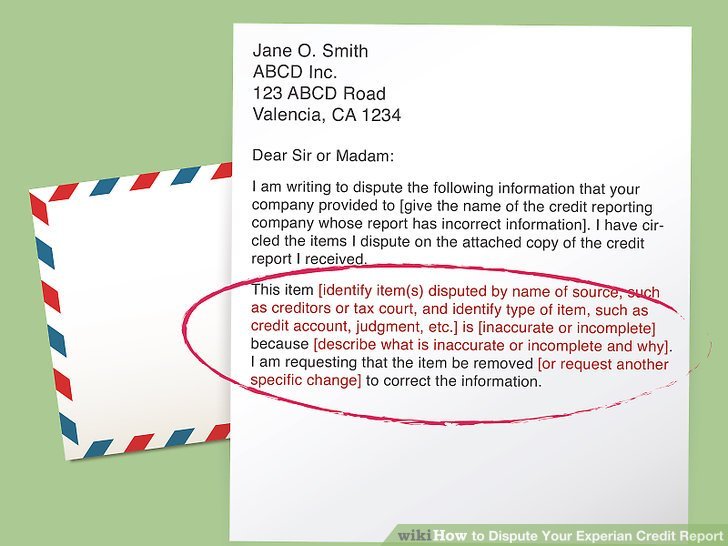

How Do You Dispute An Item On Your Credit Report

To dispute an item on your credit report, you’ll need to contact each credit bureau and file a dispute. You can file your dispute online, which is typically the fastest option. If you have supporting documentation, you can upload that, as well. You can also make a dispute by mail be sure to use certified mail if you do.

Closed Accounts And The Credit Reporting Time Limit

Even though the credit card account is closed, it will remain on your credit report at least for the duration of the credit reporting time limit. If you’re still making payments on the balance, the payment history and timeliness of your payments will also be reported.

It’s important that you keep making at least the minimum payment on time each month, even after the account is closed, to protect your credit score. Late payments will hurt your credit score just as if the credit card was still open.

If you have an account reported as closed and it’s still open, contact your credit card issuer to find out why. If the accounts say the creditor closed it even though you were the one who closed it, you can use the process to have your credit report updated to show that. Remember, it doesn’t hurt your credit score either way, whether you or your credit card issuer closed the account.

Read Also: Verizon Late Payment Credit Report

Removing A Closed Credit Account Online

She can start this process online using the credit bureaus dispute forms, which you can find at:

- To dispute TransUnion, use the TransUnion dispute form

Once she fills out a dispute form for each of the three major credit bureaus, theyll each contact the agency related to the reported misinformation. In this case, the credit bureaus would ask Citibank to verify that the consumers credit card account had actually been closed. After the information has been verified or disproved, shell receive the results of her dispute . Results can be sent by mail or email, depending on which credit bureau is handling the dispute.

Closing a credit account online is generally the easiest method since most of our users manage their finances digitally. But, if youd consider yourself more analog, you can also get rid of closed accounts on your credit card by phone or by mail.

Why Do Closed Accounts Stay On Credit Reports

Both open and closed credit accounts stay on your credit report because they are a crucial factor in calculating your overall score.

Your report contains a lot of detailed information about your financial behavior, including your expenses and, most significantly, how you handle any money you’ve borrowed.

The three major credit bureaus, Experian, Equifax, and TransUnion, constantly amalgamate this data to produce your score. For consumers, the credit reporting agencies are there for educational purposes so you can stay abreast of the state of your financial health. For creditors, the information generated is used to help them determine creditworthiness in regard to significant ventures, like applying for a mortgage or a car loan.

Recommended Reading: Syncb Bp

Time Frame For Removal Of Credit Entries

|

Currently active accounts in good standing |

Ongoing/indefinite |

|

Hard credit inquiry |

2 years |

Based on the above data, often a consumer may choose to simply wait it out until the negative entry is due for removal from credit bureau reports. Keep in mind that it might take a few months for all the credit bureau reports to be updated after reaching these limits.

How Closing Accounts Can Hurt Your Credit Score

The act of closing a credit account has its own effects on your credit score, depending on the type of credit account it is. For example, closing a credit card will probably hurt your credit by increasing your credit utilization ratio .

To a lesser extent, the same thing can happen when you close an installment loan. Specifically, paying off debt can sometimes hurt your credit because some credit scoring models reward consumers for having loans that are mostly paid off. 2

You May Like: How To Get A Repossession Off My Credit Report

Can I Have Closed Accounts Removed From My Credit Report

If you have closed accounts on your credit report that are not delinquent or hurting your credit, then there is no need to remove them. They may actually be helping your credit, even though they are closed.

Accounts that were closed in good standing should automatically fall off your after 10 years, while delinquent closed accounts will fall off your credit report after 7 years.

Your Credit Utilization May Increase

Your credit utilization rate is the portion of revolving credit youre using compared to how much you have available generally expressed as a percentage. If you close a revolving account, such as a credit card, the total amount available decreases.

When that happens, your credit utilization could increase, which may lower your credit scores. In general, most experts recommend keeping your rate below 30%.

Don’t Miss: Ntwk Synchrony

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Closing A Credit Card Can Raise Your Credit Utilization Ratio

When an installment loan, for say a car or furniture, gets paid off that account is closed. However, I want you to think twice before closing a revolving account just because you havent used it in a while.

Dont get me wrong there are good reasons to close revolving accounts, like a high annual fee or poor customer service but generally speaking, I recommend not closing accounts especially for someone with a limited credit history.

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Closing an account reduces your overall available credit, which is used in the utilization calculation. Utilization is figured two ways. First, the ratio of balance to credit unit is used, and second, the ratio of all your credit limits on all your cards to all your balances is factored in. Closing an account reduces the value of the second ratio.

Don’t Miss: Does Affirm Report To The Credit Bureau

Should You Remove Closed Accounts From Your Credit Report

You should attempt to remove closed accounts that contain inaccurate information or negativeitems that are eligible for removal. Otherwise, there is generally no need to remove closed accounts from your credit report. Inaccurate information could be pulling down your credit score and should be addressed, but older accounts with a good history may be helping your score.

Even after closing an accountlike a personal loan or credit cardthe information related to your balances and payment history stays on your for many years. In fact, both accounts closed in good standing and negative items or collection accounts may remain on your credit report for seven to 10 years.

Your credit score is calculated based on five main factors: payment history , credit utilization , length of credit history , different types of credit and new credit .

Because a credit report includes both open and closed accounts, some of these credit factors can be affected by a closed account being removed from your report. For example, if you made payments on a personal loan for a number of years and that account is removed from your report, yourlength of credit history could decrease.

Having a closed account removed from your report may not affect your score, but in many cases, it is wise to leave accounts in good standing on your report, as they could have a positive impact overall.

Read on to learn how to get rid of closed accounts from your credit report.

How Closed Accounts Affect Your Credit

Your FICO credit score is determined by a wide range of factors including your payment history , how much debt you owe , the average length of your credit history , new credit and your credit mix . compile this information on your credit reports, which they use to determine where your score falls.

The two main areas where closed accounts can affect your credit score are the length of your credit history and the amounts you owe. Heres how:

- Certain closed accounts can increase your credit utilization rate. When you close a credit card account specifically, you are reducing the amount of open credit available to you. This can cause your credit utilization rate to increase, which could have a negative impact on your credit score. Note, however, that installment loans like personal loans do not affect your credit utilization. For this reason, a closed personal loan account would not affect your credit utilization rate.

- Closing an account can decrease the average length of your credit history. The length of your credit history is partially determined by the average age of all your credit accounts combined. As a result, closing an account can reduce the average length of your credit history, and thus impact your credit score in a negative way.

Recommended Reading: How To Raise Your Credit Score By 50 Points

Understanding Why Its There

All too often, people assume that by paying off a creditor in full this automatically means it is taken off their credit report right away. This isnt true at all, as your credit report will show all your credit accounts, no matter if they are open or closed. What this could also mean is that you can potentially have accounts that have been closed sitting on your report for months, even years before you realize and do something about it.

Now where this closed account sitting on your credit report can hurt you is if the account had any delinquencies on it. It is just sitting there bringing down your entire score, regardless of the fact you cleared it up and paid it all off.

Send Your Dispute To The Credit Bureau

In order to learn how to dispute a credit report and win, youll likely want to include as much information as possible to support your case. That said, youll need to include some items in addition to your dispute claim and your credit report.

Depending on what type of things you want to dispute on your credit report, your case may require different documents. For example, if you are trying to remove a closed account from your score, you might include a record of the closed account with your documents. If you want to dispute a collection amount, you should provide proof of the settled debt or a receipt that shows you made the required payments.

Once you have all of your documents put together, there are a few ways you can approach the dispute process:

- Online: For many, the easiest way to go through the dispute process is by simply uploading your dispute and relative documents online .

- Equifax: 1-866-349-5191

- TransUnion: 1-800-916-8800

Chester, PA 19016

You May Like: Paypal Credit Report To Credit Bureau

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Closed Accounts Continue To Be Reported

Closed accounts that are in good standing stay on your credit report for up to 10 years. Those that have any negative history, such as collection items, could sully your report for seven long years .

Putting in a dispute with a credit bureau to get this closed account off your report would be an option if there is any inaccurate information reported.

If there is nothing incorrect reported about this closed account, you could try putting in a goodwill request with the lender to have this account removed from your credit report. It is up to the lender whether to accede to such a request, which would depend on whether they want to remain in your good graces.

Danny, depending on whether you have other credit outstanding, it seems any credit impact from this closed card has already occurred. Having this closed account appear on your credit report doesnt seem like something that would do any additional harm.

Anyway, good luck to you in rebuilding your credit!

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news from product reviews to credit advice with our newsletter in your inbox twice a week.

Read Also: When Does Hard Inquiries Fall Off

Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

How to remove negative items related to identity theft

If you believe youve been a victim of identity fraud, file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

To prevent further damage to your credit history, these are the steps you should take:

- Notify the incident to Transunion, Experian and Equifax through phone or mail

- Place a security freeze and fraud alert on your credit report

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service