How Do You Buy A Car Through Carvana

The buying process with Carvana is about as simple as it gets. Go to Carvana.com to Search All Vehicles.

Youll arrive at a page where you can search for vehicles by make, model, or keyword. That means you can search for a specific vehicle or a more general category like Small SUVs.

There are also several filter options you can use to narrow down your search. These filters include:

- Price

- Transmission

- Drive Type

Once you narrow down your choices and select a vehicle, youll be taken to that cars profile page.

There, youll see an interactive 360-degree view of the actual vehicle in stock, along with multiple photos of the interior. The 360-view even allows you to highlight Hotspots, which could be minor dings or imperfections on the exterior.

When you click Vehicle Details, youll also see the cars Vehicle Identification Number , which youll want to look up to see the vehicles history. You can do that for free.

If you decide you want to buy a particular vehicle, you can click Get Started. At that point, youll be asked to create an account. Youll need to provide your name, email address, phone number, and ZIP code.

Want to move forward with a purchase? Youll just need to indicate whether you want to trade in your old vehicle, pay cash or finance. Then youll select delivery or pickup and complete the rest of the required paperwork required all online.

Things To Consider Before Refinancing

Why Doesnt My Auto Loan Show Up On My Credit Report

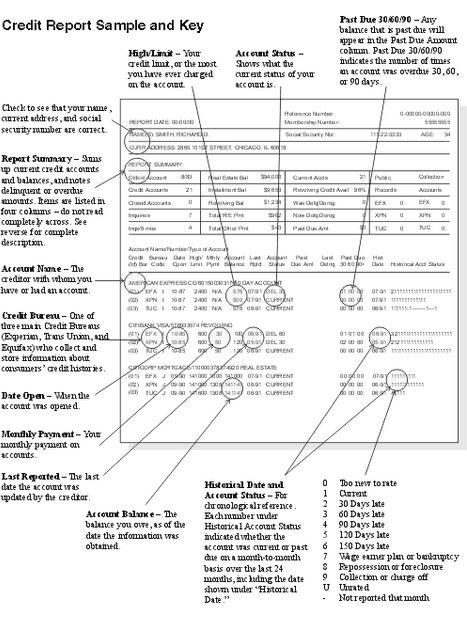

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

You recently got a new car: Congratulations! Now you may be wondering when your new car loan will appear on your credit report. If your new auto loan hasn’t shown up on your credit report yet, there are several reasons why this may be happening. An auto loan could be missing from your credit report because the information hasn’t yet been reported to the credit bureaus, your lender doesn’t report to all credit bureaus or an error has occurred. Follow a few simple steps to figure out what’s happening and resolve your issue.

You May Like: Does Paypal Credit Report To Credit Bureaus

First See What Assistance Your Lender Has To Offer

You’ll want to know what kinds of programs your bank, credit union or other auto loan provider may have available to you. Also, if there are any state laws that might offer some protections against repossession, you’ll want to find out about those, too.;

Here are the most comprehensive resources we’ve been able to turn up to help with both.

- If you financed your car through the dealer, car review and pricing guide publisher;Edmunds has compiled a list of all the major manufacturers and their coronavirus relief programs here.

- Do you lease your vehicle? Edmunds has a;.

- The most exhaustive list we came across of banks and other financial institutions — big and small — who have publicly announced coronavirus relief programs is from the;American Bankers Association, a banking trade group. Its;.

- The;National Consumer Law Center, a legal services and consumer advocacy nonprofit, has an updated list of the various coronavirus-related;protections against repossession passed by various states here.

- A broader list of all state coronavirus;executive orders and laws is available here, compiled by the digital encyclopedia of American politics and elections website;Ballotpedia.

- CNET sister site Roadshow also details relief programs for existing loans as well as incentive programs for new cars with a number of auto manufacturers.

As businesses like this soda and candy shop in Asheville, North Carolina, start to reopen, you can bet repossession companies will be back to work, too.

How Much Does A Carvana Car Loan Cost

After a successful Carvana credit score check, youll be offered financing terms that are good for 45 days. Rates vary significantly based on creditworthiness. There are also other costs to consider including local taxes, title and registration fees along with delivery fees for some areas.

You can also choose to add CarvanaCare protection, which includes roadside assistance and covers both basic and powertrain components. Most vehicle repairs covered under CarvanaCare come with a $50 deductible.

Don’t Miss: Does Paypal Credit Affect Credit Score

Something Went Wrong When Reporting The Account

Mistakes are rare, but they do happen. Your information may have been entered into the credit reporting system incorrectly. Or, maybe a technical issue or backlog has delayed your information being posted. It’s also possible that, if you have a co-borrower, the loan could have been reported to their credit file and not to yours.

Follow up with your lender about possible errors or oversights. If your loan shows up on your credit report but contains inaccurate information, you can contact your lender or submit a dispute to the credit bureau in question.

Lets Get You Back On The Road

At CarsDirect, we know how tough it can be to find auto lenders that can accommodate bad credit situations, like a past vehicle repossession. Instead of driving all over town to look for one, let us do that legwork for you.

Over the last two decades, weve gathered a network of dealerships that assist bad credit borrowers and our connections are all over the country. To get matched to a dealer in your local area and start the search for your next car loan, fill out our three-minute auto loan request form.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

What Are The Differences Between Carmax And Carvana

The biggest difference between CarMax and Carvana is that CarMax has physical lots spread out across the country. That means that you can shop local inventory in person and even test drive cars.

On the flip side, it also means CarMax has more overhead than Carvana, which could translate into higher prices.

The process for selling a car is also different. If Carvana wants your vehicle, they will make you an offer online then come to you to inspect the vehicle. If your car passes, they will cut you a check.

If CarMax is interested in purchasing from you, they may ask you to bring your car into the closest store for inspection. If your vehicle is up to their standards, they will buy it from you there.

How A New Auto Loan Can Impact Your Credit

Does it actually matter whether your new loan shows up on your credit report? It might. If you’re building or rebuilding your credit, a new auto loan can help you out in a few ways.

First, it adds to your . A car loan is considered an installment loana loan with fixed monthly payments and a predetermined payoff periodwhich is a different type of credit than a revolving credit card account. Having a car loan appear on your report shows creditors that you have experience managing diverse types of credit. It may also boost your credit score: Credit mix accounts for 10% of your FICO® Score, the scoring system used most commonly by lenders.

Your credit score will also benefit from having timely monthly loan payments show up on your credit report. Payment history is the most heavily weighted factor in calculating your score, so you want your monthly payments to count.

What are some typical reasons your new auto loan might not appear on your credit report?

Read Also: Aragon Collection Agency

What Credit Scores Do Car Dealerships Use

A dealership traditionally does not offer its own financing it may offer manufacturer financing or loans provided by a network of banks, credit unions and finance companies, and its these lenders that determine if you qualify.

Be wary of buy here pay here car lots that offer in-house financing and say things like no credit check, as they may come with high interest rates and other penalties.

Does Wells Fargo Offer Auto Loans Crm Services

Wells Fargo Auto Finance Better Business Bureau BBB. Latino usa What does wells fargo auto loan offer the perfect credit score, offering help.

Aug 23, 2021 While the Wells Fargo offers youll see in CardMatch arent technically prequalified offers, the tool does use a soft pull to your credit to;

Aug 18, 2021 Its also a good idea to charge no more than 35% of your total limit on each credit account. CNET Personal Finance. A direct deposit of news and;

Dec 17, 2020 Wells Fargo personal loans are a good fit for existing customers and those with strong credit. Compare Wells Fargo loans with other lenders. Rating: 4.5 · Review by Jackie Veling

Also Check: Paypal Credit Hard Pull

How Much Will A Voluntary Repo Hurt Credit

How Does Voluntary Car Repossession Affect Your Credit Score? Voluntary or involuntary repossession is terrible for your credit. When your auto lender reports the repossession to the credit bureaus such as Experian and TransUnion, you should expect a much lower credit score sometimes as much as 100 points lower.

Will Credit Acceptance Sue Me

If it does not get paid, Credit Acceptance sues the consumer, obtains a judgment that does further damage to the consumers credit, and then attempts to collects using methods that include wage or bank garnishments. NEVER ignore a Credit Acceptance repossession lawsuit without talking to an attorney.

Recommended Reading: Does Klarna Build Credit

Re: Carvana Experiences Interest Rate Credit Hit Etc

I’d be spending $1000-3000 cash money on a car and would never ever recommend someone take out a vehicle loan at 20%. If you can get your score up 100 points even you’d have a much better shot at sub 5% interest rates. I grabbed a 3.6% when I had a 619 so it is possible, might take some determination even then though.

Can You Get A Car From Carvana With Bad Credit

Carvana has no minimum ; however, you must make at least $10,000 annually and not have any current bankruptcies. Down payment: $1,400.

| 11.89% | 16.14% |

does Carvana do a hard credit check? Carvana uses the soft pull information to allow users to see their estimated terms on each of our vehicles, including APR, Monthly Payment, and Term. Hard Pull A hard pull is a that may affect your and will solidify your final financing terms.

Herein, is it easy to get approved with Carvana?

Financing with Carvana makes it even easier to get into the car that’s right for you. By pre-qualifying for a Carvana auto loan, you can browse our expansive inventory of vehicles with completely personalized financing terms without impacting your credit score.

Does Carvana report payments to credit bureaus?

Please note, if you’ve incurred any mileage fees, those will need to be paid before we can return your trade-in. Carvana does not report returned vehicle accounts to the where all conditions for return have been met.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Lenders To Consider After A Repo

Once your credit score falls below 660, it can be a struggle to find an auto loan approval unless you work with bad credit lenders. As a general rule, most traditional auto lenders arent likely to approve you for a car loan with a recent repossession on your credit reports.

With all that being said, you have two main options to consider for a bad credit auto loan after a vehicle repossession:

- Subprime lenders, or bad credit lenders, are likely to only consider your auto loan application if the repossession is at least one year old. If its been less than 12 months since the repo, and it may be challenging for you to get an approval. They do, however, assist borrowers with all sorts of bad credit situations caused by things like repossession, bankruptcy, or just credit thats seen better days. After its been a year since the car repo, a subprime lender could be your ticket to an auto loan even if your credit score hasnt completely bounced back.

- Buy here pay here dealerships, also called tote the note car lots, are unique in their lending process because they dont rely on a third-party lenders approval to get you into an auto loan. They do all the car selling and financing in-house, appropriately named in-house financing. A BHPH dealership may not check your credit at all which means your recent repo doesnt matter in your auto loan eligibility.

What To Do If Your Loan Doesn’t Appear On Your Report

If your auto loan doesn’t show up on your credit report after 30 to 60 days, reach out to your lender. Ask them if it’s their policy to report loan activity to the credit bureaus and, if so, whether they can follow up to make sure your loan information has been reported accurately.

Short of refinancing with another lender, you have limited recourse if your lender simply doesn’t report to any of the credit bureaus. In the future, you may want to find out what your lender’s policies on credit reporting are before you submit a loan application.

In the meantime, it can still be beneficial to monitor your credit score and report periodically to check your creditand to make sure the information in your is as accurate and up to date as possible. The information in your credit report will likely be instrumental in getting your next auto loan or credit card, whether or not your current loan information is being reported.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Factors That Influence Your Credit Score

There are five factors that influence your credit score:

- Payment history.

- New credit.

- Types of credit.

According to Afford Anything, payment history is the most significant factor that affects your credit score. It makes up 35% of your total FICO score, which is what lenders use most often.

The utilization ratio counts toward 30% of your credit score. It’s used to compare your total outstanding balance to your total credit limit. Your outstanding balance is the amount of money that you owe while your total credit limit is the maximum amount of money you’re able to borrow. The goal is to borrow 20% or less of your total credit limit. For example, if your credit limit is $2,000, then you shouldn’t borrow more than $400 per month.

When it comes to length of credit history, older is better. This is why you should always keep credit cards open, whether you’re using them or not. When a new credit account is opened, like a car loan, it might lower your score because it decreases the average length of your history. The length of your credit history makes up 15% of your score.

New credit affects 10% of your score. The more you apply for loans, especially in a short timeframe, the lower your score drops.

There are two types of credit:

- Installment.

- Revolving.

What You Absolutely Should Not Do

Whatever you do, don’t try to hide your car from your bank or the repo company. For one, you’re probably not going to beat them at their own game, and the longer it takes to find it , the more they’re going to charge you for their services in the end.;

Stop! Don’t just sit back and wait until the bank repos your car. Be proactive and ask and your lender may be able to help.

And don’t just stop paying your loan and hope for the best. Whether or not lawmakers decide the repo industry performs an “essential” function, or if the repo man has to wait for a treatment or vaccine like the rest of us before getting back to work, eventually your delinquency will catch up with you. With banks demonstrating some compassion right now for those who’ve suffered financial hardship, you might as well take advantage of one of their relief programs while you can.;

Chances are if you’re worried about making your car payment, you have other bills keeping you up at night, too. Here’s what you need to know about rent relief during the pandemic, as well as what assistance is available if you have a mortgage. For taxes, credit cards and everything else, here’s what other financial help is available.

Recommended Reading: Aargon Collection Agency Address

Before You Refinance Your Car Loan

Auto refinancing could make sense if youve raised your credit score or increased your income since taking out your original auto loan. And if youre able to lower your interest rate and or/term, you could save money over the life of your auto loan. A refinance can also help you get a lower monthly car payment.

Again, while theres no set credit score that all lenders require, a lender considering your refinance loan will most likely look at your payment history, credit utilization and other factors considered the first time around.

A Closer Look At Carvana Financing

If youre shopping around, here are a few more things tobe aware of when comparing a loan from Carvana to those from other lenders.

- Theres no prepayment penalty for paying more than the minimum due each month or paying off your loan balance early.

- To finance a vehicle through Carvana you must be at least 18 years old, earn a minimum of $4,000 per year, and have no active bankruptcies.

- Its easy to see personalized financing estimates. Once youre prequalified, your financing terms will appear under the picture of every vehicle you view on Carvanas website. But keep in mind that your estimated terms will differ based on the car you choose.

- Youll need to make a down payment, though you can add a trade-in to your purchase to help reduce the amount youll need to put down.

- Carvana offers repayment terms between 36 and 72 months, giving you the flexibility to find a loan term thats right for your budget.

- Carvana also offers the ability to buy an extended warranty and gap insurance.

Don’t Miss: Can You Get A Credit Report Without A Social Security Number