What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

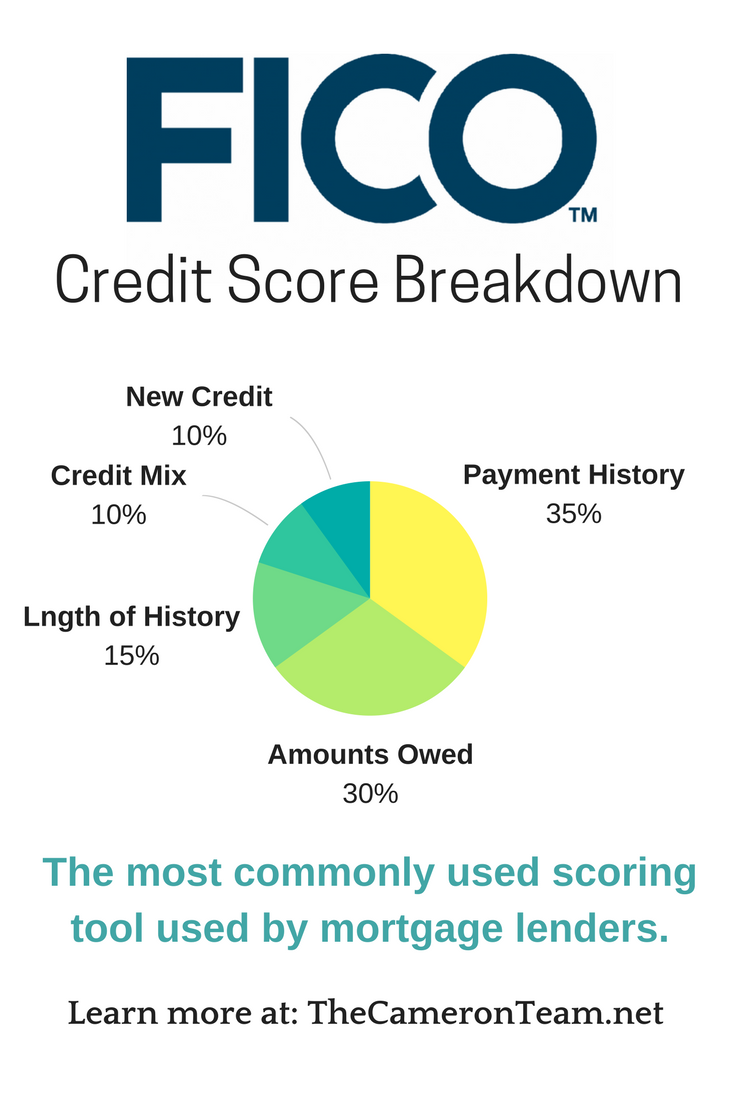

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

- New credit

How Lenders Decide Whether To Give You Credit

When you apply for a loan or other type of credit, such as a credit card, the lender has to decide whether or not to lend to you. Creditors use different things to help them decide whether or not you are a good risk.

On this page you can find out:

- how your credit rating is decided

- what information a creditor can find out about you to help them decide whether to lend to you

- what you can do if you are refused credit, including how to correct wrong information on your credit reference file

- how to get a copy of your credit reference file

- how fraud can affect your credit rating

- how to get credit if youve got a low credit score.

To find out more about taking out a loan or other types of credit, see Further help and information.

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

You May Like: Do Pre Approvals Affect Credit Score

How Can A Mortgage Advisor Help Me

Buying a home, whether it be for the first time or applying for a second mortgage can be daunting.

The advice of a professional who has negotiated mortgage contracts and overseen the application process many times can be really helpful.

A mortgage broker can:

- Oversee the exchange of contracts and give guidance for how to avoid delays or withdrawals

- Advise you about how to keep your credit score intact ahead of final credit checks before completion

- Find alternative lenders who are more likely to accept your application if final credit checks after an exchange result in a mortgage rejection

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Also Check: Which Credit Bureau Does Capital One Pull

What Credit Score Do I Need To Get A Mortgage

There isnt a minimum credit score you need to get a mortgage. Because there isnt a universally recognised credit score, there isnt a universally recognised credit score that you need to have to be accepted for a mortgage.

There are a few different credit referencing agencies in the UK who can give you a credit score. Because of this, you could have a different score depending on which credit reference agency you have an account with. That means there isnt a particular credit score you need to get a mortgage.

In this Guide, youll find all the information you need for understanding what kind of credit score you might need to get a mortgage, plus links to lots of other helpful guides to how your credit affects your mortgage application.

In this Guide, youll find:

Improve Your Credit Scores Before Applying

The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

For all these scoring models, which use the information from one of your credit reports to determine your score, a higher score is better. As a result, you may notice similar trends in all your scores. This is why making on-time payments can help raise all your credit scores, while missing payments could hurt all your scores.

However, there are also differences between the scoring models. For example, the latest FICO® and VantageScore models ignore paid collection accounts and give less weight to medical collection accounts. But the older FICO® Score models continue to count collection accounts against you after you pay off the balance.

In general, whether you’re looking to buy a home or take out a different type of credit, there are a few things that can help improve all your scores:

- Pay your bills on time.

- Pay down credit card balances.

- Don’t apply for other types of credit in the months leading up to your mortgage application.

In addition to getting your application, you want to get your finances in order as well. Saving up for a larger down payment, increasing your income and paying off debts may all help you qualify for a mortgage with better terms.

Also Check: What Credit Bureau Does Capital One Report To

I Was Refused A Mortgage Because Of My Credit Score

If youve been declined because of having bad credit, there may still be hope. Applicants are often declined not solely because of their credit, but mainly because the lender you applied with wasnt suitable.

Although having bad credit is enough for a lender to decline you, a lender with different criteria may still approve you. Each lender has its own unique assessment so its possible to be declined by one lender and accepted by another.

If youve been declined, well take a look at your mortgage application in further detail. Its important to get as much information as possible from your existing lender as to why they declined you.

Read more: What should I do if Ive been declined a mortgage?

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Also Check: Paydex Score Chart

Why Your Credit Score Matters To Lenders

Your credit score helps lenders determine your ability or inability to repay the mortgage. As part of your scores, they examine your debt-to-income ratio. It is the percentage of monthly debt obligations relative to how much you make.

To illustrate, if you earn $4,000 per month, and have $1,250 in credit card, loans, housing, and other payments, your ratio would be 31 percent. The ideal ratio is less than 36 percent, though some lenders will accept more with a higher down payment.

What Scores And Models Are Used When Applying For A Mortgage

FICO® created different scoring models for each credit bureauExperian, TransUnion and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or, if you’re applying jointly with a partner, the lower middle score.

Keep this in mind when you’re trying to figure out what . If you’re looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based one these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that aren’t secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you don’t have a credit history or score at all.

Additionally, there’s a review underway that could open up the use of different credit scoring models for mortgages, even if they’re secured or bought by Fannie Mae or Freddie Mac. However, until there’s a change, many mortgage lenders will continue to use these three classic FICO® Scores.

Don’t Miss: Carmax Credit Score Requirements

What Information Do Credit Reference Agencies Have

-

The Electoral Roll. This shows how long you’ve been registered to vote at your given address

-

Public records. This shows any county court judgments, bankruptcies, IVAs, Debt Relief Orders and Administration Orders.

-

Account information. This shows the financial status of your existing accounts, how much you’ve borrowed and whether or not you’ve paid on time

-

Home repossessions. This shows if you’ve information This is information from members of the Council of Mortgage Lenders about homes that have been repossessed

-

Associated financial partners. This shows all of the people who you are financially connected to. For example, you could have a joint bank account

-

Previous searches. This shows companies and organisations who you have looked at in the last 12 months. For example, if you made an application for credit in the last 12 months, it would show here.

How The Two Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person.

But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first generalpurpose credit score in 1989.

Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game.

The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

According to VantageScore reports, there were approximately 10.5 billion VantageScores used between June 2017 and June 2018.

Read Also: Does Klarna Report To Credit Agencies

How Many Years Of Credit Do I Need To Have A Good Score

Mortgage lenders will typically look back over the last six years of your credit history. If youre young and only have a couple of years credit to examine, lenders may be more cautious to lend to you. However, theres no set timeframe that will automatically boost your credit score. A 25-year-old in regular, stable employment who uses their credit card sensibly could have a better credit score than a 50-year-old with lots of debts.

The key thing to remember here is that you dont just need years of credit to improve your score those years of credit have to be good credit. Bankruptcy, CCJs, IVAs and other bad marks will stay on your file for six years, so its highly likely youll need to wait for these to be wiped before being accepted for a mortgage.

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

Recommended Reading: Navy Federal Car Loan Credit Score

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

| $3,408 | $102,183 |

In this example, boosting your credit before you get a mortgage could save you $284 per month, $3,408 per year, and $102,183 over the life of your loan! What would you do with all of that extra cash?

Pro tip: Use our to learn more about what could impact your credit scores.

Don’t Miss: Mortgage Tri Merge Credit Report

How To Get Your Credit Score Ready For A Mortgage

No matter what type of mortgage you seek, it’s always advantageous to apply with the highest credit score you can manage. Meeting the minimum score requirement for a loan is just the start. Lenders also use your credit score to help set interest rates and fees on the loan, and generally speaking, the higher your credit score, the better your borrowing terms will be and the less you’ll pay in interest and fees over the life of the loan.

If you’re planning to apply for a mortgage in the next 12 months, you may be able to take steps starting today to spruce up your credit score so your loan application reflects the best credit score you can get.

Any credit score that helps you qualify for a mortgage you can afford can be considered a good score. Even so, most of us have room to improve our scoresand reap potential savings over the lifetime of a mortgage loan.

Can I Get A Home Loan With A 450 Credit Score

A credit score of 450 is categorised differently depending on the credit checking agency youre using. For example, a credit score of 450 on Experian or TransUnion is categorised as Very Poor, which means youll have less options available to you when you apply for a mortgage than you would if you had an Excellent rating. But, there are specialist mortgage lenders who will consider your application. You just need a specialist broker. We can help with that. Get in touch and get matched to the perfect mortgage broker for you now.

If your credit score is 420 and youre with Equifax, youre categorized as having an Excellent rating, so shouldnt struggle to get a mortgage from most lenders.

Recommended Reading: Does Qvc Easy Pay Report To Credit Bureaus