Here’s What You Need To Know About Navy Federal Credit Card Cash Advances:

- Location: You can get a Navy Federal credit card cash advance at an ATM or bank branch that displays the logo of your card’s network. In-branch cash advances require a government-issued photo ID, your card and account number. ATM cash advances require a credit card PIN.

- Cash advance fees: Cash advances performed at a Navy Federal branch or ATM do not incur any cash advance fees, but all other domestic cash advances are subject to a $0.5 fee. In addition to the Navy Federal fee, some ATM’s may also charge an additional fee of their own.

- Cash advance APR: The Navy Federal cash advance APR is 2% above the regular APR, not to exceed 18%. For instance, the Navy Federal Credit Union Platinum Credit Card features a regular APR of 5.99% – 18% , depending on creditworthiness, so its cash advance APR is between 7.99% – 20% . Check your monthly statement to see what your exact cash advance APR is. Cash advance APR starts accruing from the moment of the transaction.

How To Write Down An Official Does Cashnetusa Report To Credit Bureaus Letter

Well, we recognize that a press release letter is part of business enterprise letter. Hence, it ought to Adhere to the patent or common structure of a business letter. In the event you have forgotten how to arrange it, Here i will discuss The easy guides to jot down an amazing does cashnetusa report to credit bureaus letter:

- Step 1# Utilize the Official Heading

For starters, it is vitally needed to suggest your facts because the header. That you are much better To place it around the letterhead or heading Hence the reader can certainly read through your Make contact with information and facts. You may location it at the highest most A part of the letter. It incorporates your comprehensive name, firm or Businesss name, the developing tackle, e-mail account and the Lively contact number. Once you mention this information on the header, you should ensure that its reachable whenever.

- Step 2# Set the Day of Writing the Letter

Next of all, the day of ones letter is likewise imperative that you show when you write it. You might want to utilize the regular rule of producing the date in which you set the punctuation adequately. By way of example, it is possible to write 22nd August, 2020 or Might threerd, 2020.

- Step 3# Show the Get in touch with Information from the Receiver

- Step 4# Give the Salutation

You should not overlook To place the salutation before starting your letter. As always, you use Pricey Mr/Overlook as its the prevalent use in official letter.

How To Apply For The Navy Federal Credit Union Mastercard Business Card

To apply for this card, you must have an existing business membership. If you dont, youll need to become a member first.

How long will it take to get my Navy Federal Credit Union Mastercard® Business Card?

It takes two to three business days for Navy Federal to process your application. If approved, youll get your card within seven to 10 business days.

You May Like: How To Clear A Repossession From Your Credit

As Long As I Pay Off My Payment Plan How Is It Any Different From Other Retailers Plans

Unlike other retailers, zZounds payment plans are always interest-free, and we dont require you to apply for a new credit card. For us, its not about making a buck off interest or getting you to spend more money its about making it possible for musicians to invest in their dream gear now while spreading their payments out over several months.

You May Like: How Accurate Is Credit Karma Score

Whats Does Zebit Report To Credit Bureaus

Fellas! Are you currently Doing the job to be a secretary in a corporation or Corporation? Certain, you may acquire in charge in all letters problems. And Of course, a does zebit report to credit bureaus challenge is one of a issue you need to be learn in. Even Youre not an personnel, a does zebit report to credit bureaus is very important for almost any reasons if youd like to deliver a proposal to other organization, company as well as your Trainer. Recognizing how essential does zebit report to credit bureaus needs are, we have an interest to debate it nowadays. Make sure you keep tuned and revel in studying!A does zebit report to credit bureaus is a formal and Expert doc which happens to be prepared by personalized, Corporation or business to its clientele, stakeholder, organization, Business and lots of more. This letter purposes to deliver any information and facts, ask for, authorization and several far more skillfully with The fundamental and common templates among the persons all over the globe. Both a private correspondent and enterprise need to have to build the build top quality by means of your does zebit report to credit bureaus in sake of showing your Expert small business. Then how to make it? Here we go.

Also Check: Do Credit Scores Combined When Married

How Often Do Credit Reports Update

Your credit reports are updated when lenders provide new information to the nationwide credit reporting agencies for your accounts. This usually happens once a month, or at least every 45 days. However, some lenders may update more frequently than this. So, say you paid down a credit card recently. You may not see your account balance updated on your credit report immediately. If you look at the account in your TransUnion credit report, you may see a line that reads Date Updated. This would tell you the most recent day the account information was provided to TransUnion.

Because lenders dont all provide updates on the same day, new information may be added to your reports quite frequently. You can get your credit report from each of the three nationwide credit reporting agencies weekly at annualcreditreport.com. If youd like to more tools to help you manage your credit with confidence, consider a paid subscription to TransUnion Credit Monitoring. Youll get access to daily credit report and score refreshes and alerts when there are changes to your accounts, helping you better keep track of important account changes.

What Can I Do About A Bad Credit Score

Think you have a bad score? Do not stress theres good news: credit rating arent fixed! Your score will alter when the details in your credit report changes. That implies you can take control of your financial health now by making changes that will favorably impact your credit score with time. Heres a few things anybody can easily do to get started:

Recommended Reading: How To Get A Repossession Off Your Credit

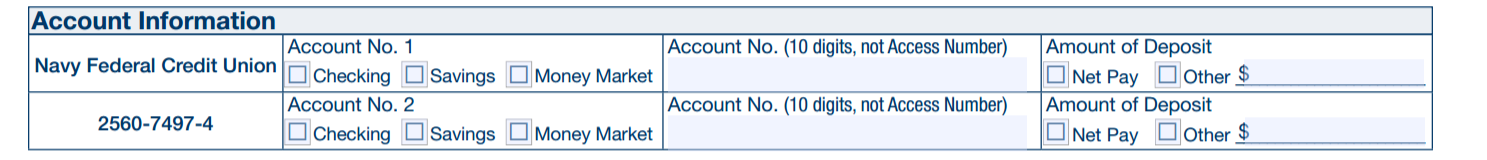

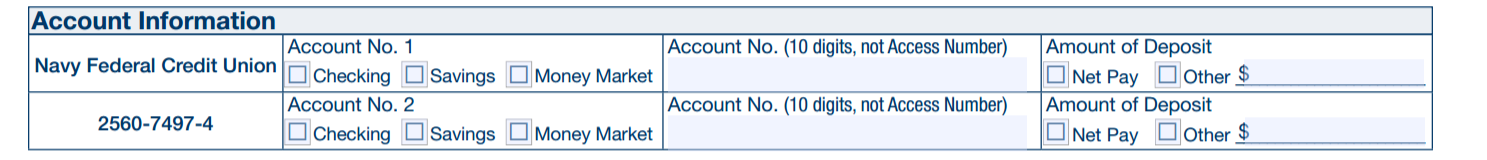

Applying For A Loan W/ Navy Federal Credit Union

Whether you’re applying for an auto, mortgage, or personal loan, Navy Federal Credit Union has extremely competitive rates. The problem? You need great credit to get those loan terms . Your first step to determine if you’re eligible for top-tier rates is to pull your Credit Report.

You can review your Credit Report and find every inaccurate , or contact a Credit Repair company, like Credit Glory, to walk you through that entire process.

You can schedule a free consultation with Credit Glory, or call one of their Credit Specialists, here 412-6805″ rel=”nofollow”> 412-6805 â).

Zzounds Is The Worst Place To Purchase

Zzounds is the worst place to purchase DJ equipment from! I had a hardship with my job due to the pandemic and one of my equipments that I purchased from them had went into collections. I had spoken with them about making a payment in the future to resolve the payment but when i woke up today i noticed a very large amount taking out of my bank account from them that i did not authorize! When i called them they told me that they did not need to have my permission to take out any payment and that they would not be refunding the money back in my account!

Read Also: How To Up Credit Score

Read Also: Does Snap Finance Report To The Credit Bureau

Does Quadpay Report To Credit Bureaus Online Video Tutorial

For our Beautiful reader, we offer a handy video clip to give you a simple tutorial how to write a great does quadpay report to credit bureaus. The sample below may just a just tutorial when you are cost-free to change it depending on your difficulties. So, appreciate observing!

Well, it is centered on does quadpay report to credit bureaus. We hope it might be practical for any small business needs you might have. Many thanks for examining and find out you before long!

Also Check: Does Paypal Credit Report To Credit Bureaus

Everything You Need To Know About Credit Scores

Your credit score has a massive influence on your ability to borrow. Find out why its so important and how it works.

Think of your credit score as a log or snapshot of your credit and borrowing history. The information it captures influences your approval and interest rate for things like mortgages, car loans and credit cards. Your credit score and report can also come into play when it comes to renting a home or getting a job. With all that in mind, its critical to understand how credit scores are calculated, what a good credit score is and how to improve it.

You May Like: Snap-on Credit Score Requirements

Navy Federal More Rewards American Express Card

Earn 20,000 bonus points when you spend $2,000 within 90 days of account opening. Expires on Nov. 01, 2021.

| $0 | |

| Rewards Earning Rate | 3 points per dollar at gas stations, supermarkets, restaurants and commuting expenses. 1 point per dollar on all other purchases. |

| INTRO BALANCE TRANSFER APR |

The Navy Federal More Rewards American Express® Card is not one of our top-rated rewards credit cards. You can review our list of the best rewards credit cards for what we think are better options.

How Navy Federal Credit Union Compares

| Navy Federal Credit Union |

With a minimum loan amount of $250, Navy Federal offers the lowest minimum compared to PenFed or Alliant . All credit unions let you borrow up to $50,000.

Navy Federal has more strict membership requirements than PenFed or Alliant, as you only qualify if you are active military member or a veteran, as well as an employee or retiree of the Department of Defense. Family members of any of the aforementioned groups are also eligible.

You can join PenFed if you’ve served in the military or worked at qualifying associations or organizations. You can also join by opening a savings account with a $5 minimum deposit. The easiest way to become a member of Alliant is to join Foster Care to Success, and Alliant will cover your $5 joining fee.

Navy Federal has a higher minimum interest rate than PenFed or Alliant, so you may get a better deal with one of the other credit unions.

Recommended Reading: How To Report A Tenant To The Credit Bureau

Should You Add Your Child To Your Credit Card To Build Credit

Most issuers will allow you to add a child so long as they are at least 13 years old. In fact, there is no restriction on who you can add as a user even if that person is below the age of 18. There are currently no regulations requiring that the authorized user be a family member, even if they are a minor.

There are clear financial benefits to your child if you add them as an authorized user. As long as the card issuer reports these users to one of the three credit bureaus, then adding your child to your credit card account will make it appear on their credit file. Also, you should only add children to accounts with good payment histories an account with a lot of late payments on record could negatively impact your childs score .

Normally, young adults need to apply for student credit cards or credit cards for users with no credit. By adding the child to your account, a score will be generated for them, helping them qualify for better cards as well as making their loan terms more favorable. For example, having a high can qualify your child for a lower and higher rewards.

Also Check: Can You Have A Bankruptcy Removed From Your Credit Report

Is Navy Federal Credit Union Trustworthy

Navy Federal Credit Union’s Better Business Bureau profile is currently not rated as the credit union is in the process of responding to previously closed complaints. Previously, the business had an A+ trustworthiness rating from the BBB. The BBB measures its trustworthiness score by looking at how a company’s responds to customer complaints, its honesty in advertising, and its transparency about business practices.

There is one recent controversy related to the credit union. A Navy Federal employee alleged that the lender pressured mortgage underwriters to approve loans even without proper reason to believe applicants could pay back the loans. She then filed a lawsuit and said Navy Federal retaliated against her whistleblowing by changing her job duties. She dropped the case in late 2020.

You might prefer a different lender if you’re bothered by Navy Federal’s recent controversy and lack of trustworthiness rating.

Don’t Miss: Does Klarna Report To Credit Bureaus

This Card Is Best For

- Resists or refuses an annual fee on principle or due to costAnnual Fee Averse

- Seeks to maximize points or miles earnings across spending categoriesRewards Strategist

The Navy Federal More Rewards American Express® card is designed for members of the credit union who want to rack up a lot of rewards on their everyday spending. Theres no cap on how much you can earn in bonus points at supermarkets and restaurants or on gas and transit.

Note that this card also doesnt charge a cash advance fee in most instances. However, its still a good idea to avoid using the card for that purpose. The cash advance APR is 2% higher than your regular purchase APR, and cash advances typically start accruing interest immediately instead of giving you a grace period as regular purchases do.

Finally, the card is available to people with average to excellent credit, which typically means a FICO credit score of 580 or higher. In contrast, most of the best rewards credit cards require good credit at the very least, which starts at a 670 FICO score.

Earn 20,000 bonus points when you spend $2,000 within 90 days of account opening. Expires on Nov. 01, 2021.” / Intro BT APR added, “0% for 12 Months”

Fees To Watch Out For

The Navy Federal More Rewards American Express® cards fees are lower on the whole than those of most credit cards. Theres no balance transfer fee or cash advance fee if you request the advance at an eligible branch or ATM, and it also doesnt charge a foreign transaction fee. Whats more, the cards late and returned payment fees are lower than most cards charge.

Also Check: What Is Syncb Ntwk On Credit Report

Navy Federal Cfpb Complaints

As consumer finance companies, student loan refinancing lenders fall under the jurisdiction of the Consumer Financial Protection Bureau , a federal agency. As part of its mission, the CFPB allows consumers to log official complaints. These complaints are publicly available on the CFPB official website.

Since December 2011, consumers have submitted 8,167 complaints about Navy Federal Credit Union to the CFPB for an average of two to three complaints per day.

Among the total complaints, up to 40 of these complaints have to do with student loan and/or student loan refinancing services.

The allegations made in these complaints are unverified, are not necessarily representative of all consumers experiences with Navy Federal, and may contain outdated information . Note that a lender with a large customer base is likely to have a higher number of complaints when compared with smaller lenders.

Below weve included the 3 most recent complaints regarding student loans and/or student loan refinancing in which the consumer consented to share their details. Some complaints may have minor edits to improve readability.

6/22/2021Texas

6/13/2021Pennsylvania

6/11/2021California

I am a victim of identity theft. The following accounts were opened without my knowledge, consent or authority. I have no idea how the theft took place, nor do I have knowledge of the suspects. I did not receive any money, goods, or services as a result of the identity theft.