Alternatives To Chase Credit Journey

Chase Credit Journey is a good credit monitoring service, but its far from your only choice.

Whether youre looking for an app that tracks your FICO score or one that gives you more expansive card offers, take a look at the top free alternatives to Chase below:

- Experian: With free access to your Experian score and alerts, Experian could be worth adding to your toolbox. You can also upgrade to see all your scores for a low monthly price.

- : Another free service, Credit Sesame gives you your Experian score and loads of credit card offers from various lenders and creditors.

- : Credit Karma has the best of both worlds, showing you your Equifax and TransUnion scores, along with alerts, card offers, and tools.

What About Chase Slate Cards

The Chase Slate card is one of the best balance transfer cards that you can get. And this card also provides you with a free FICO score so its an option to consider for checking your FICO score for free.

This means that if you have the Chase Slate you can check your FICO score and your Vantage score at the same time and easily compare the differences between the two models.

Where Is The Chase Credit Journey Login Page

Once youve signed up for an account, it isnt always easy to remember where to log in to Chase Journey.

If you have Chase products, such as a checking account, savings account or a credit card,log in to your Chase account here. Once logged in, My Credit Journey is listed on the left side of the page.

If you dont have any Chase products,. Bookmark it so you can easily find it next time you need it.

Read Also: Transunion Credit Report Without Ssn

Ink Business Cash Credit Card

For the Ink Business Cash card, youll generally need good to excellent credit, meaning a score of 700+. Thats because even though the Ink Cash is a business card, like with to the Ink Business Preferred, Chase will use your personal credit score when making its decision.

Whats great about this particular Chase business card is that its currently offering an all-time-high welcome bonus of $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening. This is an excellent deal because the Ink Business Cash has no annual fee. For more details, read our Ink Business Cash review here.

How Do You Log In

If you are new to Chase Bank Credit Journey you can become a member for free by enrolling here. ;

After enrolling you can;go;to the .;;

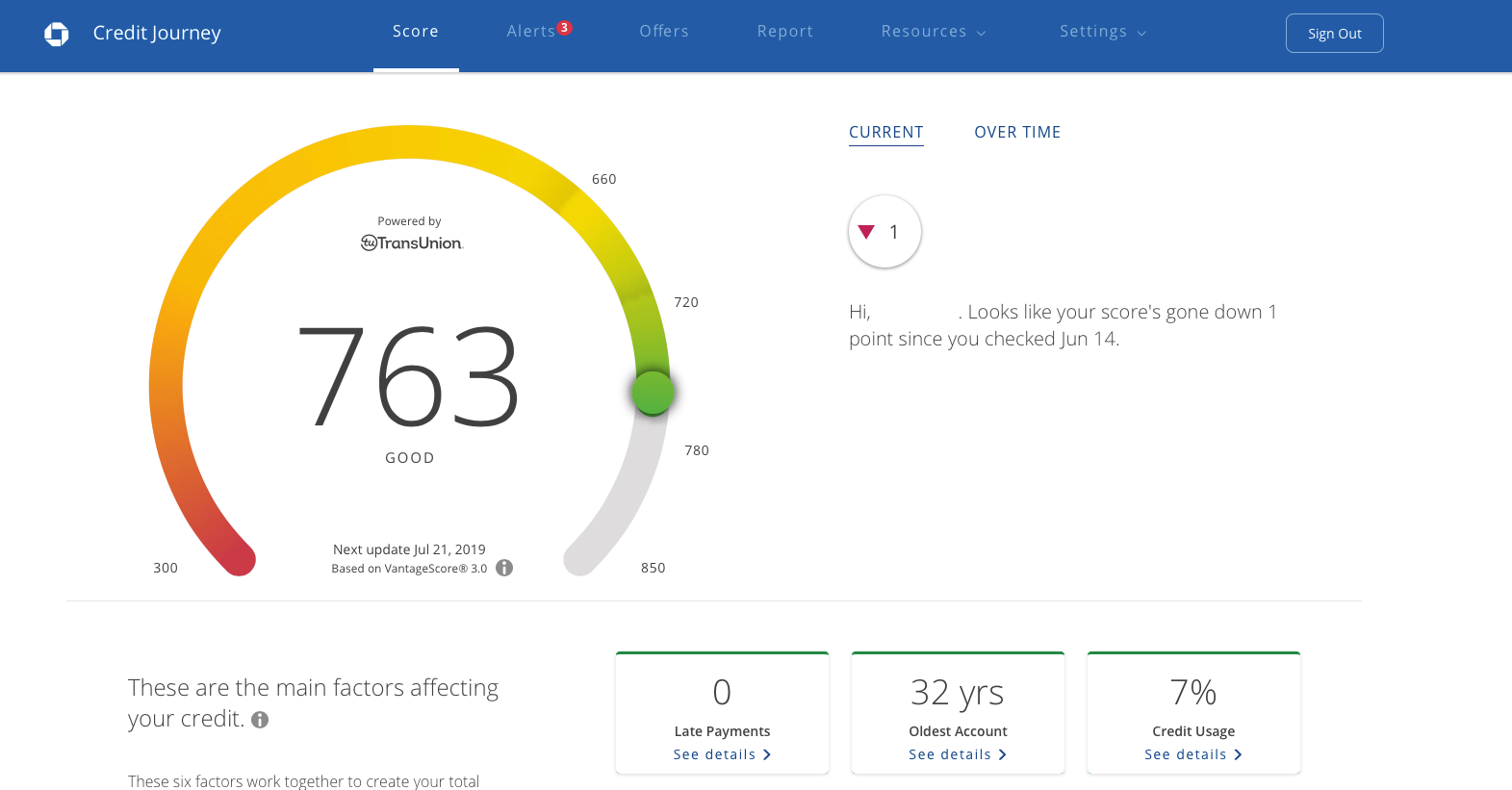

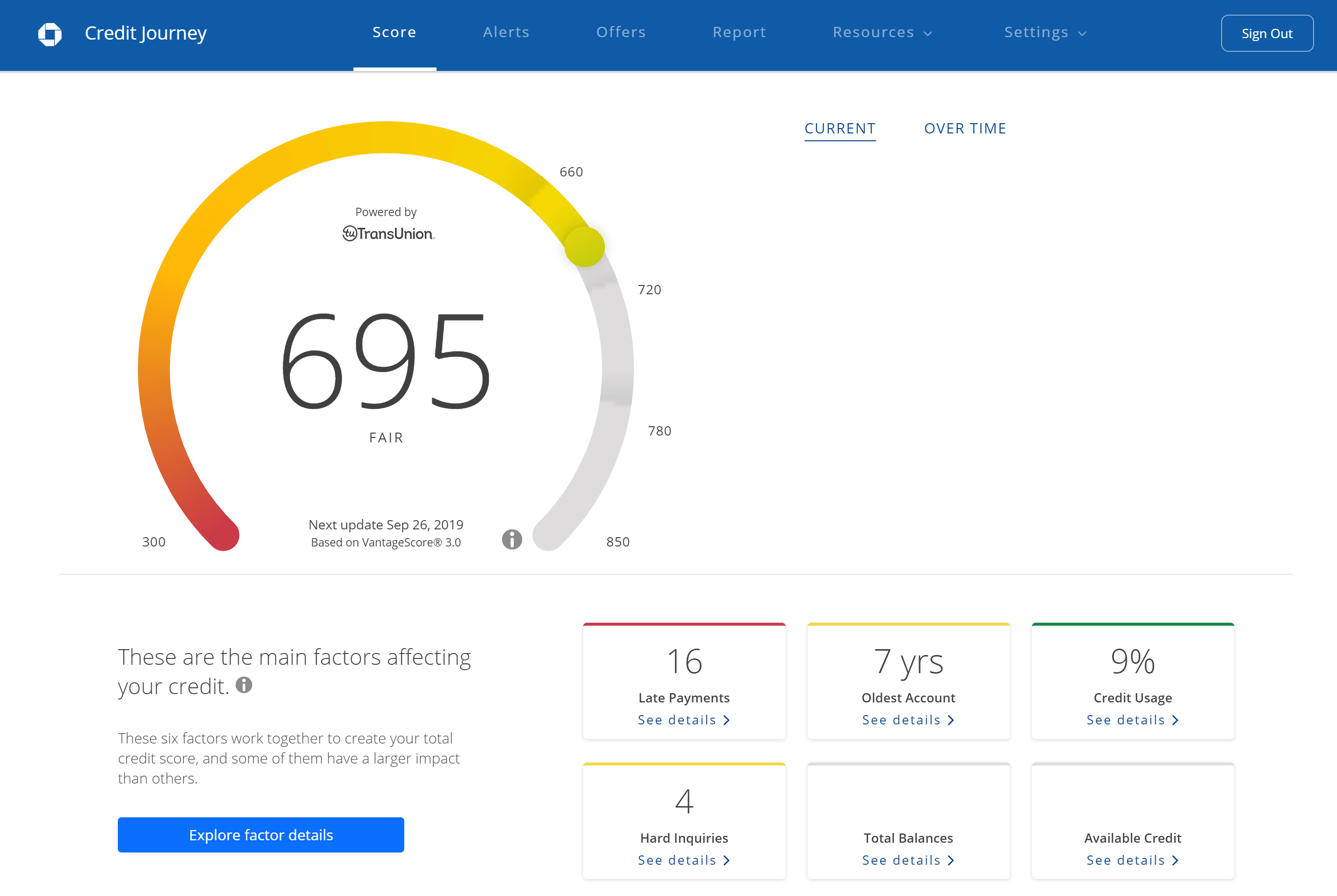

The dashboard displays your TransUnion; VantageScore;3.0 score when you log in.;;

The dashboard also provides a snapshot of the key factors affecting your credit, including; Late Payments, Oldest Account, Credit Usage, Hard Inquiries, Total Balances, and Available Credit.;;

You will also have access to a credit report alerts section when you sign in to your account.;

The alerts will show any changes, additions,;corrections,;or deletions on your TransUnion credit report.;;

You also will be able to look at ChaseCredit Journey;offers of credit cards, personal loans, and mortgages.;;

One of the nicest features of Chase Credit Journey is the TransUnion limited credit report.;;

This report is;pretty inclusive, especially since it is free. It includes most of the financial information TransUnion has collected about you and is used to determine your credit score.;

Be sure to take a good look at the information and make sure that everything is correct.;;

ChaseCredit Journey lets you view and manage information from your TransUnion credit report. Most of their competitors dont have this feature.

If you find a record that has any mistake on it, you can request to have it verified.;;

If the lender or furnisher of the information is unable to verify the record then the credit agency will delete it from your account.;

Don’t Miss: Carmax Auto Finance Defer Payment

Average Credit Score In America

By following the right credit score habits, you may make enhancements to your scores. If you need to get a really excessive score, youll wish to limit your hard inquiries which means you must solely apply for brand spanking new credit when needed. As you spend less of your available credit, your credit score-utilization Read More »

Why Your Credit Karma Credit Score Differs

There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find.

This is mainly because of two reasons: For one, lenders may pull your credit from different , whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your t is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models exist across the board.

As it states on its website, Credit Karma uses the VantageScore® 3.0 model. VantageScore may look at the same factors that the other popular FICO scoring model does, such as your payment history, your amounts owed, your length of credit history, your new credit and your credit mix, but each scoring model weighs these factors differently.

For this reason, VantageScore and FICO Scores tend to vary from one another. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

If you plan on applying for credit, make sure to check your FICO Score since there’s a good chance lenders will use it to determine your creditworthiness. FICO Scores are used in over 90% of U.S. lending decisions.

Editorial Note:

You May Like: Why Is There Aargon Agency On My Credit Report

Fico Credit Score Factors And Their Percentages

| FICO credit score factors | ||

|---|---|---|

| The average age of your active credit lines. Longer histories tend to show responsibility with credit. | ||

| 10% | The different types of active credit lines that you handle | |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily.Learn more about FICO credit score |

Why Fico Scores And Credit Scores Matter

A bad credit score can haunt you by making it difficult to rent an apartment, get an affordable mortgage, or land a job. Even if youre able to qualify for a loan, your interest rates will be higher than if you had good credit scores.

And that has costly ramifications:;On a $150,000 mortgage, for example, a 1% higher interest rate could cost you $31,000 over 30 years.

On the other hand, good credit scores open all kinds of doors. Not only will you find it easier to borrow money when you need it, theyll also qualify you for lucrative credit card offers.

Yes, irresponsible credit card use can lead to a damaging debt spiral but responsible credit card use; can reward you immensely for your everyday spending.

If you have high credit scores, you could get cards like the Chase Sapphire Reserve® , which offers a signup bonus worth hundreds in travel, or the Citi® Double Cash Card 18 month BT offer , which offers 2% cash back on every purchase .

Not there yet? Dont worry. Focus on building credit slowly and strategically. The best credit cards;will be waiting for you when youre ready.

Recommended Reading: Does Klarna Affect Your Credit Score

What Is The Vantagescore Model

The VantageScore Model was originally developed in 2006 and the;VantageScore Model;3.0 debuted back in 2013. There is currently a 4.0 model as well but it has not been as widely adopted as it has only been out since 2017.;VantageScore Model;3.0 is used for other credit services like , Chase Journey, etc.;

The VantageScore Model Credit Karma uses is pretty similar to the FICO model but it has some key differences. It uses the same FICO range of 300 to 850 for the score and stresses many of the same factors as FICO it just gives them different weight and has some slightly different criteria for calculating them.

Here are the 3.0 factors according to :

- Payment history

How Do I Use Chase Credit Journey

To access Chase Credit Journey, youll need to log in to your Chase online account. Then scroll down until you see Your credit score on the left side. Click on Free score, updated weekly to access Chase Credit Journey.

Your Chase Credit Journey home page will prominently display your credit score; the page view defaults to your current However, if you would like to see the history of your score, click on Over Time to see a graph of the previous 6 months activity.

Hot Tip: Using Chase Credit Journey will not affect your credit score.

Don’t Miss: Comenitycapital/mprcc

Myfico Gives You Multiple Credit Scores Including Your Fico Mortgage Lending Score You Can View All Your Scores For All Three Credit Bureaus

Price: There are three package options.

Basic: Only Experian is updated every month- $19.95;

Advanced: All three credit bureaus are updated every 3 months- $29.95;

Premier:; All three credit reports are updated every month- $39.95

This depends on the plan.;

Accuracy: MyFico is the most accurate place to get your FICO score.

Experian;

Experian gives you multiple credit scores including your mortgage credit score You can only view your mortgage score from Experian and not from the other two credit bureaus.;

Price: Free 7-day trial, then $24.99 per month

Experian scores- everyday.

Transunion and Equifax- once in 30 days

Accuracy: In my experience, the scores are pretty close to the real scores.

Extra Credit

Extra Credit gives you multiple credit scores including your mortgage credit score You can view your mortgage score from Experian, TransUnion, And Equifax;

Price: Free 30-day trial, then $24.99 per month

Every 30 days

Accuracy:; The First score on the list under mortgage score s the one that is most widely used . The scores are pretty close to the real scores.

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

You May Like: How Long Does Repossession Stay On Credit Report

Factors That Lead To A Higher Credit Score:

- Paying bills on time. Credit score rewards a track record of paying on time. A delay in payment by 30 days, or any missteps, stays on your credit history for up to 7 years.;

- How much you owe. The amount of your balance, relative to your credit limits, is a big factor. Its best to avoid using more than 9% of your credit card limit. The lower, the better.;

Much less weight goes to these factors, but theyre still taken into account.

- The longer you have credit, and the higher the age of your accounts, the better it is for your score.;

- Based on how many different types of accounts you might have. For ex: Credit cards, mortgages, student loans, car loans.

- How recently you have applied for credit. When you apply for a card, a hard inquiry may be done. A hard inquiry is a request to check your credit, in order to make a decision about your loan or credit card application. That can shave a few points off your score, but its temporary. Having a newly opened account show up on your credit report will also affect your credit score for the short term .

Was this article helpful?

Number Of Hard Inquiries Within The Past Two Years

This is when you apply for a credit card or other type of loan and the lender pulls your credit report as part of the decision-making process. A;hard inquiry;usually lowers your score, so the more you have, the bigger the impact.

They also remain on credit reports for about two years, so be mindful and strategic when you need to apply for new credit accounts.

Getting pre-approved for a mortgage or credit card is definitely a smart idea. The pre-approval doesnt lower your credit score and it gives you a better chance of ultimately being approved, so you wont accrue a hard inquiry in vain.

Recommended Reading: Paypal Working Capital Requirements

Where To Get Your Fico Credit Score

Because there is no shortage of companies, products, and websites offering access to free credit scores, it can be especially confusing to determine exactly where to find your FICO credit score.

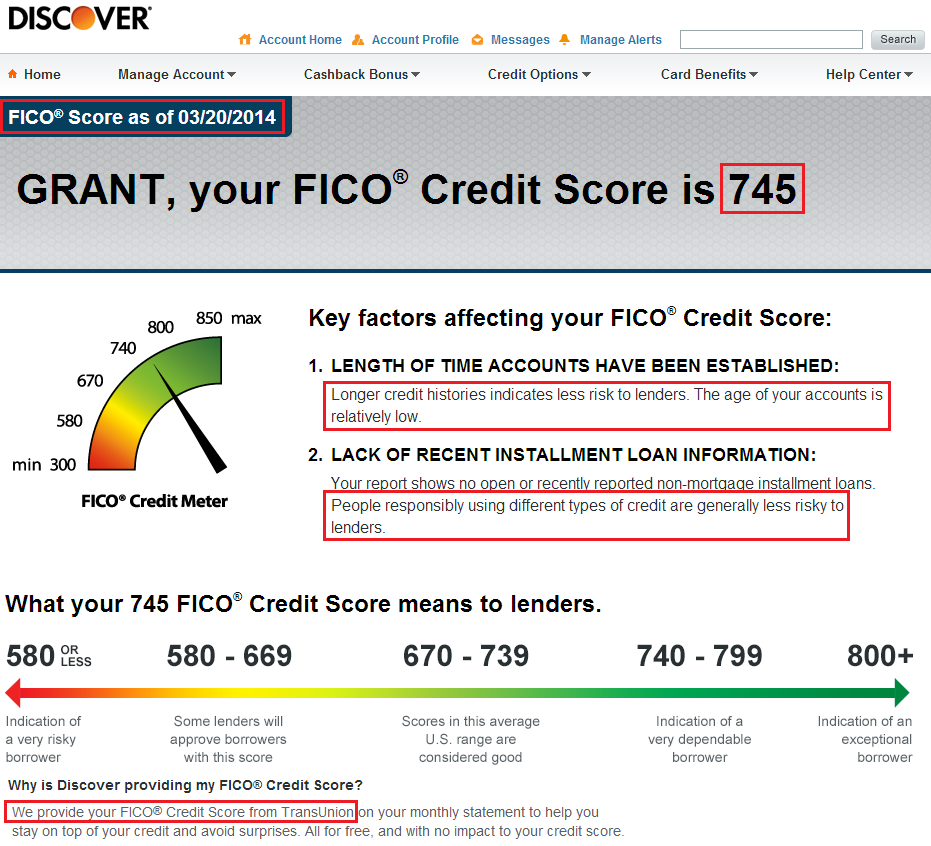

Fortunately, you can actually get your FICO score free with credit card companies such as Discover, Citi, and Barclaycard. You can also get your FICO score from MyFICO.com.

But heres the kicker:

Should You Get Chase Journey

If you take nothing else from our Chase Credit Journey review, know that the service is absolutely 100% free. You dont even have to give payment information. For that reason, you have nothing to lose by signing up.

Personally, I think there are better free credit score products out there. However, theres nothing wrong with signing up for multiple free credit score services. In fact, I suggest it.

This way, you can keep tabs on all of your credit reports and credit scores. Simply sign up for complimentary services that offer different bureaus or scores to get a better picture of your overall credit score.

Also Check: Does Zzounds Report To Credit Bureau

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO, for Fair Isaac Corp. They are the two biggest competitors in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

You don’t have a credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

Is Credit Karma Really That Inaccurate

The difference between your FICO Scores scores and your Credit Karma scores can be quite extreme. There are reports of people with Credit Karma scores over 700 with both bureaus but with FICO scores in the lower 600s.

Other times, the opposite might be true. Your Credit Karma score could be much lower than your FICO score. It all depends on the make up of your specific credit profile.

Don’t Miss: How To Get Credit Report Without Social Security Number

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .

Is Your Fico Score The Most Important Score

Although there are many different scores and numbers floating around, there is one primary score that you should keep an eye on, and thats your FICO score.

If you arent able to access your score with one of the free opportunities, you can also rely on some of the other scoring models to manage your credit and detect any problems right away.

If you are working on improving your credit or maintaining good credit, you can use any of the scoring models that are available and at least, get an idea of where you stand.

However, when you are ready to apply for a credit card, auto loan, or mortgage, it might be a good idea to go with the score most used by lenders and head straight to your FICO score first.

You May Like: Does Paypal Credit Report To Credit Bureaus

Requirements Based On Data Points

While not published requirements, we know, based on the experience of those who have applied and been denied, that you will also need to meet the following to be considered for a Chase credit card.

- No More Than 5 Credit Cards, From Any Issuer, Issued Within the Past 24 Months Also known as the 5/24 rule, Chase will not issue a new card if you have exceeded this guideline.

- 30-day Chase Card Limits If you have opened 2 or more personal Chase cards, or 1 business Chase card, in the past 30 days, you are likely to be denied.

Benefits Of A Credit Limit Transfer

A credit line transfer can be beneficial when the rewards multipliers of one card outweigh the benefits of another card.

In some cases, transferring your credit line allows you to spend more on the card that earns a higher rewards rate, without impacting your credit score by closing an account or changing your utilization ratio.

See related: The factors of a FICO credit score

Also Check: Cbcinnovis Inquiry