What Is California Law Sb 1157 And Its Requirements

California law SB 1157 mandates the reporting of rent payments for a tenant who has been verified as having an income of under $24,000 per year or is receiving public assistance. The goal is to help low-income renters build a credit history without having to go into additional debt by using a credit card or other high-interest loans in order to build credit.

With this law, landlords have to give their tenants the option of reporting their monthly payment history and amount owed to major credit bureaus. This is true only if the tenants lease was signed after July 1, 2021, however. If a tenant wants to stop reporting rent payments to credit bureaus, they will have to give their landlord a written request. Once that tenant stops participating in the service, they cannot restart it for at least six months.

Now, this bill obviously has its pros and cons. When it comes to the cons, it can harm renters who fail to pay on time. If the landlord is reporting payments and a tenant gets behind, credit bureaus will be notified. This can then lead to higher interest rates for loans or even decreased eligibility to receive housing assistance due to late payments.

In the next section, we will cover some pros of the bill.

How To Report A Delinquent Tenant To The Credit Bureau

Posted by Aaron Cox& filed under Landlord-Tenant Law.

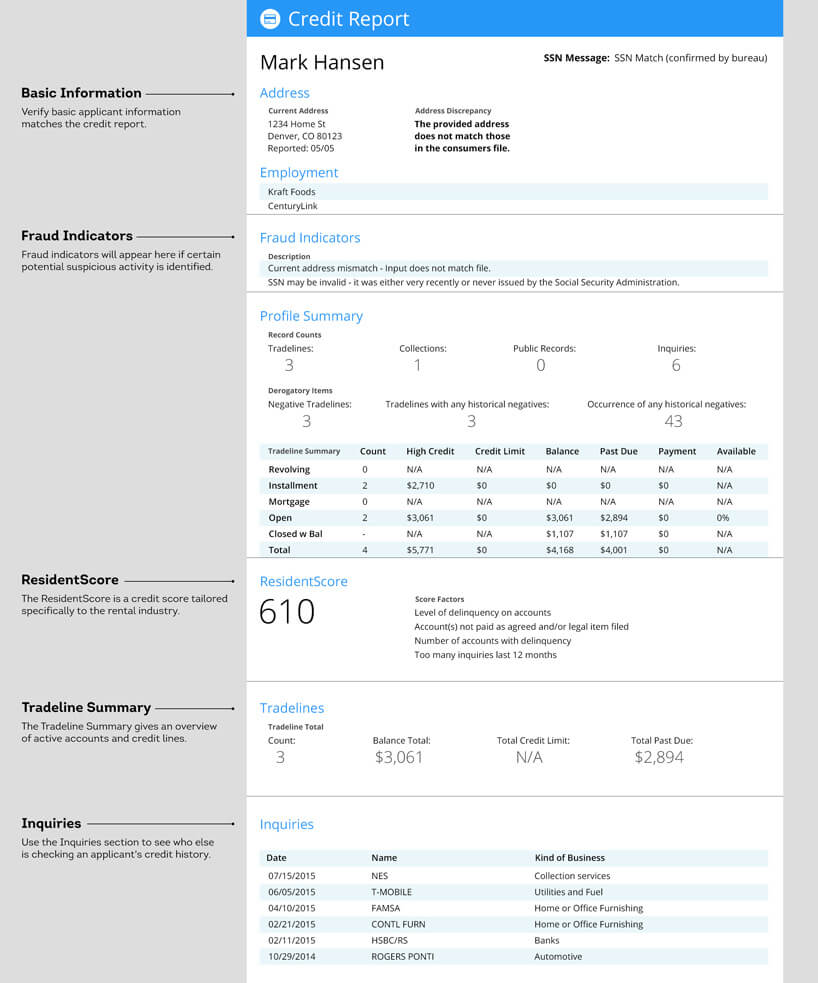

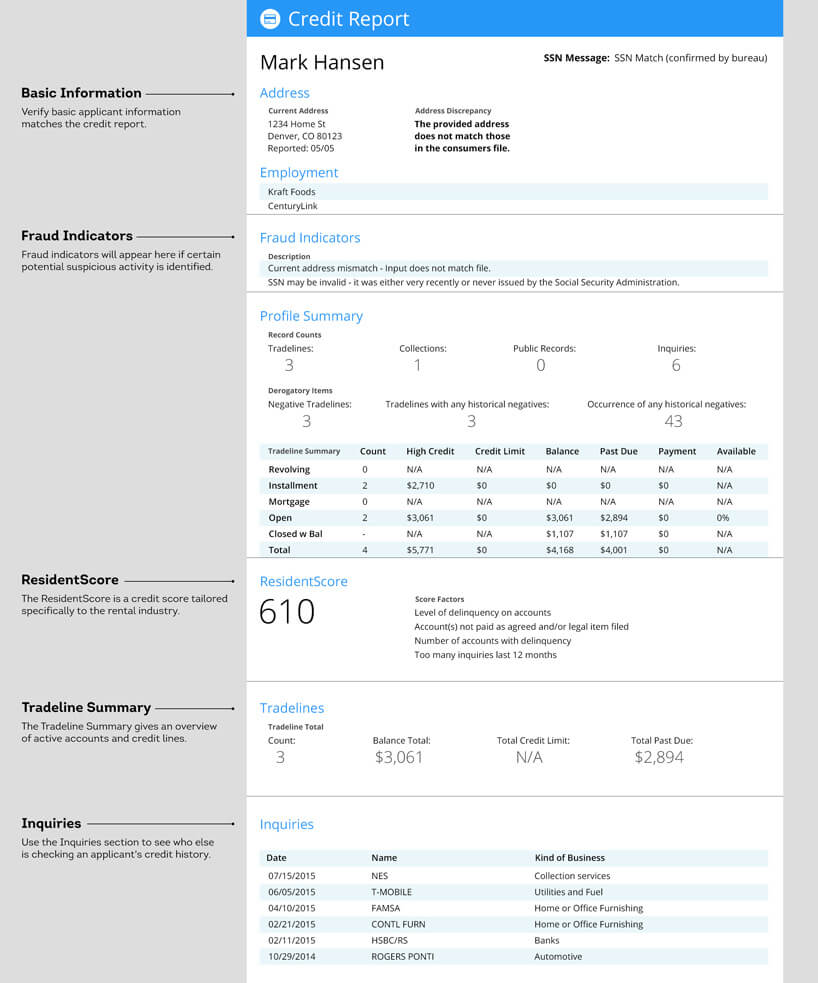

No landlord wants to deal with delinquent tenants. A tenant who doesnt pay their rent is not only a problem for you but a problem for future landlords as well. Reporting delinquent tenants to the credit bureau can indicate to other landlords that they shouldnt rent to this particular person.

However, reporting a delinquent tenant to the credit bureau is more complicated than simply filling out a form. Heres what you need to know:

How Does Reporting Rental Agreements Compare

If youre using rental payment reporting to rebuild your bad credit, its worth seeing if its worth your effort. In short, if youre looking to build or repair credit and can get a secured credit card or a specified credit builder loan, you may be better off.

Rental payment information can help prospective lenders find individuals that may be overlooked. However, most lenders have a bevy of customers that they can already deal with and are less likely to stumble upon someone using rental payments to rebuild their file over time.

You May Like: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Which Property Management Software Platforms Report Rent Payments

Over the past few years, property management software platforms have started providing landlords and renters the opportunity to report on-time rent payments to a credit bureau. As some states begin requiring landlords to allow renters to report rent payments, its always a good idea to see if your landlord is already utilizing landlord software that can help you report your rent.;

There are a few property management software platforms that offer rent reporting capabilities, but they may require your landlord to pay a fee or can only help with a small handful of tasks. With Avail, renters can report their monthly rent with CreditBoost for a low fee, and landlords can easily collect rent payments and manage various properties in one place for free.;

Yes: Your Landlord Reports Your Rent Payment As Delinquent

A landlord can report any missed payment to a credit bureau, which will land on your credit report. That missed rental payment will act as a negative mark on your payment history and as payment history is one of the most important factors in calculating your credit score, your score will likely go down.

Recommended Reading: Why Does My Credit Score Go Down

Do Rent Payments Help Build Credit

Rent payments do have the possibility to help you build credit, but thats only if you are actively making sure that your payments are being reported. If your payments are being reported, they can have a positive effect on your payment history and add another element to your credit profile, increasing your credit mix.

But remember, rent payments will only really have a positive effect if you are consistent with your payments. Falling behind on your rent payments can lead to negative reporting and a decrease in your credit score, especially if your debt is sent to a collections agency.

Where Can I Get A Free Copy Of My Credit Report

If you have been denied credit , you are entitled to a free copy of your credit report. Simply request a copy from the credit-reporting agency that supplied the report to the creditor/landlord.

According to the Fair Credit Reporting Act, as of September 20, 2010 all Wisconsin residents may request one free credit report per year from each credit bureau. Your FREE annual report MUST be ordered through a central clearinghouse:

Annual Credit Report Request Service – FREE Annual Credit Reports here!;PO Box 105281 Atlanta, GA 30348-5281

NOTE:;You can pay for additional copies of your credit report by contacting any of the three major credit bureaus. By law, they may charge up to $12.50 for each credit report . Please note: These are the same bureaus that supply the free annual credit reports, but they ONLY offer those through the central clearing house listed above.

1-800-888-4213

Don’t Miss: How To Remove Repossession From Credit Report

Rental Kharma At A Glance

To review Rental Kharma, NerdWallet gathered six data points, reviewed the online application process and pricing information, interviewed executives at the company and compared its services with others that serve the same customers.

Rental Kharma might be a good fit for you if:

You have a limited credit history and want to lengthen it. It will depend upon which credit score a potential lender uses;to evaluate you.

Rental Kharma may be less valuable;if:

You have been using credit responsibly for more than six months. If so, reporting your rent;is unlikely to significantly change your score.;Credit card payments and credit-builder loan repayments, when reported to credit bureaus, are reflected in all credit scores.

Rental Kharma Review: Get Credit For Your Rent

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Many people assume rent payments are already part of their credit reports, but thats almost never;the case. The credit-scoring giant FICO says rent is an entry called a tradeline on less than 1% of credit files.

Yet theres some evidence that these new rent tradelines can be a stepping stone to achieving the kind of credit scores traditionally used to, say, qualify for a car loan or a mortgage.

A year or two of rent payments can create a credit history without the lump sum of cash required for a secured credit card or the additional monthly payment of a , two common ways to;build;credit history.

Credit reports are the raw material for credit scores. Calculating rent into your credit scores is an idea that is gaining traction. VantageScore considers it, and so do FICO 9 and FICO 10,;newer versions of the FICO score. The trouble is that earlier versions of FICO are in much wider use than the scores that factor in rent.

Its possible that having rental information in your files could improve your credit profile, particularly if you are still relatively new to credit.

Recommended Reading: Why Does Credit Score Drop When You Pay Off Debt

Do Rent Payments Affect Credit

All three major credit bureaus Equifax, Experian and TransUnion will include rent payment information in credit reports if they receive it.

-

The most commonly used versions of the FICO score dont use rental payment information in calculating scores.

-

Newer versions of FICO, such as the;FICO 9 and FICO 10, do consider rental information if it is in your credit report.

-

VantageScore, FICOs competitor, also considers rent payment information. .

Does Paying Rent Build Your Credit Score

Your credit score is a number that tells lenders if you usually pay your bills on time, are able to keep your credit card balances low, and are able to manage different types of credit, among other key factors. So, when you make on-time payments, your credit score may improve or remain the same if it is high. Based on your credit score, lenders may be willing to extend new credit or a loan to you.

The latest versions of VantageScore® and FICO® Score use rental payments that land on your credit report as elements to generate your credit score.

Don’t Miss: How To Check Credit Rating

What Is Landlord Credit Bureau

Landlord Credit Bureau specializes in reporting rent payments. Rent payment history provided to LCB each month is associated with the tenants consumer credit report with Equifax.;By providing a turnkey, user-friendly platform specially designed for landlords, LCB makes the process of reporting rent both seamless and affordable. LCB is committed to helping landlords minimize income loss while rewarding responsible tenants by assisting them in gaining the credit they deserve.

Other Ways To Build Credit

Reporting your rent payments can help you to build credit, but if improving your credit score is your priority, there are better methods you can use.

If your landlord offers the option, consider paying your rent with a credit card. Just watch out for costly fees and make sure you can pay off the balance each month so you dont take on interest on your rent payments.

Develop good, long-lasting credit habits using your credit cards that can boost your score, such as consistent, timely payment history and low credit utilization.

If you are unable to get a credit card at this time, look into being added as an authorized user on someone elses credit card. You can also consider applying for a secured credit card. These cards are generally easier to be approved for since youll put down a deposit on your credit card that serves as your credit limit. You can use the card to make small purchases that you can easily pay off, in order to build up your score credit history over time.

Recommended Reading: How To Unlock My Experian Credit Report

Reporting Monthly Rent Payments To Transunion Makes It Matter To Your Residents Credit Scores

Encourages residents to pay on timeOnly TransUnion ResidentCredit accepts and discloses both positive and negative data. This motivates residents to pay on time and lets you see delinquencies in real time as you screen applicants not just as collections or public records.

Everyone benefitsBy paying online and on time, residents can build their credit history and see the potential impact to their credit score. As for property managers, the on-time payment incentive for residents has shown to help improve cash flow through reduced delinquencies.

Its hassle-free

What Does Rentreporters Cost

You pay a $94.95 fee for setup, and then ongoing reporting costs $9.95 a month. You can pay by credit or debit card, and you can add previous landlords for $50 each. If you want others on the lease, like a roommate or spouse, included in the reporting, you pay an additional $50 setup fee.

One year of basic service setup and monthly reporting only adds up to $214.35. You could pay less if you cancel the service as soon as you qualify for the credit product you hoped to get.

Our advice: Rent reporting can be useful if its more affordable for you than coming up with the deposit for a secured credit card or making the payments on a credit-builder loan. But use it only as long as it takes to qualify for a credit card or loan, ideally one that reports to all three bureaus.

Once you have a traditional credit line, that should be your main tool. Using credit lightly and paying on time will influence your score more powerfully than having rental payment history on your reports.

Read Also: What Does Bankruptcy Petition Mean On Credit Report

Maybe: If Enrolled With A Rent

If you and your landlord have enrolled with a rent-reporting service, your monthly rental payments will be reported to credit bureaus and appear on your credit report.

But just because your rental payments are reported to credit bureaus and exist on your credit report doesn’t mean that your credit score will immediately increase. To understand why, let’s talk about how on-time payments are used to generate credit scores.

Rentreporters At A Glance

To review RentReporters, NerdWallet collected pricing and other information, reviewed the online application process, interviewed company representatives and compared the company with others that target the same customers.

RentReporters might be a good fit for you if:

-

The credit bureaus have little or no credit data on you, and you have been paying your rent on time

-

You have been at your current address for several months and wont have to pay extra to include previous landlords in order to build length of credit history

-

You have a credit score thats in the mid-600s or lower

RentReporters may be less valuable if:

-

Youve had rent payments that were 30 or more days late

-

You already have a loan or credit card; thats a very effective route to credit-building, if you pay on time and keep low

-

You havent been at your current address for long and would have to pay more to include previous landlords

Recommended Reading: What Is The Ideal Credit Score To Buy A House

How Do Landlords Report Late Rent To Credit Reports

Related Articles

As a property owner, tenant rental payments can serve as an additional source of cash flow. Unfortunately, not all tenants make their rent payments on time. You may want to have those late payments appear on the tenant’s credit report when this happens. You must take certain steps, however, before you can report this information to the credit bureau.

Easiest Way To Report To The Bureaus

- We recommend using our company www.CanRentBuildCredit.com;

- Our service works with both tenets and you the landlord.;

If you are a landlord and want to report your tenants rent to the three credit bureaus, we are here to help. Your tenets rental payments never benefit their credit score if they are NOT reported to the three bureaus. Until recently, there was no way for your tenets to get better credit scores by paying their rent on time.;

That changed with the three bureaus about a decade ago.;So now, the credit bureaus;can take your tenets positive payment history and have it reflected to the national credit bureaus. By doing so, it will help build their credit profile and raise their credit score.;

With your help as their landlord, we can get this information to the bureaus to help them get better car loan or credit card rates. Your tenets will be more likely to move in or stay with a landlord that helps them every month. Plus they will be more likely to pay their rent on time, knowing it is immediately reported to the credit systems.;

Also Check: What Is A Good Credit Score For My Age

Warning: Alternative Data Isnt Always Helpful

But be careful. Adding more information to your credit profile can help. But it can also work against you.

For example, a credit score that takes into account alternative data, such as your bank account information, could potentially rate you more negatively if you have limited funds in your account or have recently had a lot of big expenses.

Similarly, just as a missed payment on your credit card can hurt you, so can a late electricity payment or a lapsed phone bill.

Before you share more information about yourself and your financial history, think carefully about whether you really want to show that much information to lenders.

If you prefer to have more control over your information, you can also choose to only work with self-reporting services, such as Experian Boost or a rent reporting service, that let you choose exactly what gets reported.

Setting Up Your Reporting Profile

So, what do you do when you want to learn how to report rent payments to the credit bureau?

Many landlords are not aware that they can report rental payment information to credit bureaus even if they arent dealing with an eviction situation. The payment history between you and your tenants is part of their credit history, and for that reason it can help to improve the accuracy of the tenants credit score.

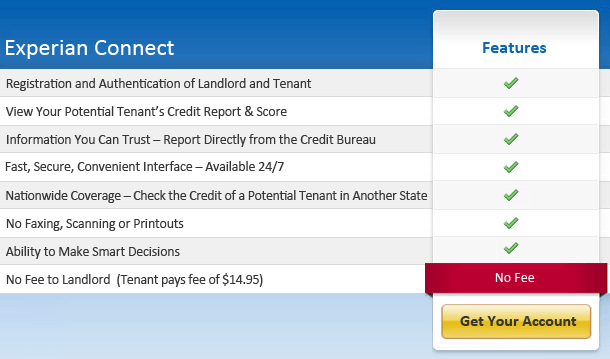

There are a number of different websites out there that you can use to report information to the credit bureaus. Each site reports to one or more credit bureau. Typically, you must make a profile before your tenants can have their payments reported. Once you have a profile, the tenant can register to self-report or you can report for your properties.

Every site is set up a bit differently, so the best way to find out how to set up your profile is to visit one of these sites and explore it yourself.

You May Like: Is 584 A Good Credit Score

Crbc Verifies Payments & Reports Credit

After your account is established with CanRentBuildCredit.com, you will pay your rent through our online portal.; Once the funds have been received, we will verify that the funds meet or exceed the amount due for your monthly rent.; Then, we report to all three of the national credit bureaus: Experian, Equifax, and TransUnion. This can show on your credit report in as little as 7 days.;;

Note:;Processing payments through our system can take up to 5 days.; We suggest that all renters make payments a minimum of 5 days before the past due date.