Does Buying A House Affect Your Credit Score

Yesbut the short-term and long-term effects of getting a mortgage are different. Your credit score will at first go down after you buy a home. A hard credit inquiry will lower your score, which is what takes place when lenders are determining what kinds of loans and interest rates they can offer you. Furthermore, actually getting the loan after the inquiry will cause your score to drop further, because the amount of overall debt you have will greatly increase.

In order to prevent further drops once you have a mortgage, its a good idea to not apply for too many credit cards or run up high bills on them. Its also crucial to remember to pay existing bills on time. That saidif you make your mortgage payments on time consistently, it will greatly increase your score in the long run. Holding on to the equity in your home once you have it will also help your credit score.

How Much Credit History Is Needed To Buy A House

There is no definitive number of years of credit history needed to buy a house, but its important to keep in mind that your length of credit history makes up about 15% of your credit score. There are some mortgage options for people with no credit history sometimes referred to as no credit score mortgages or no credit mortgages. Although you can get a mortgage with no credit history, its worth building one and improving your overall credit profile before applying for a mortgage.;

The Credit Score Needed To Buy A House Nerdwallet

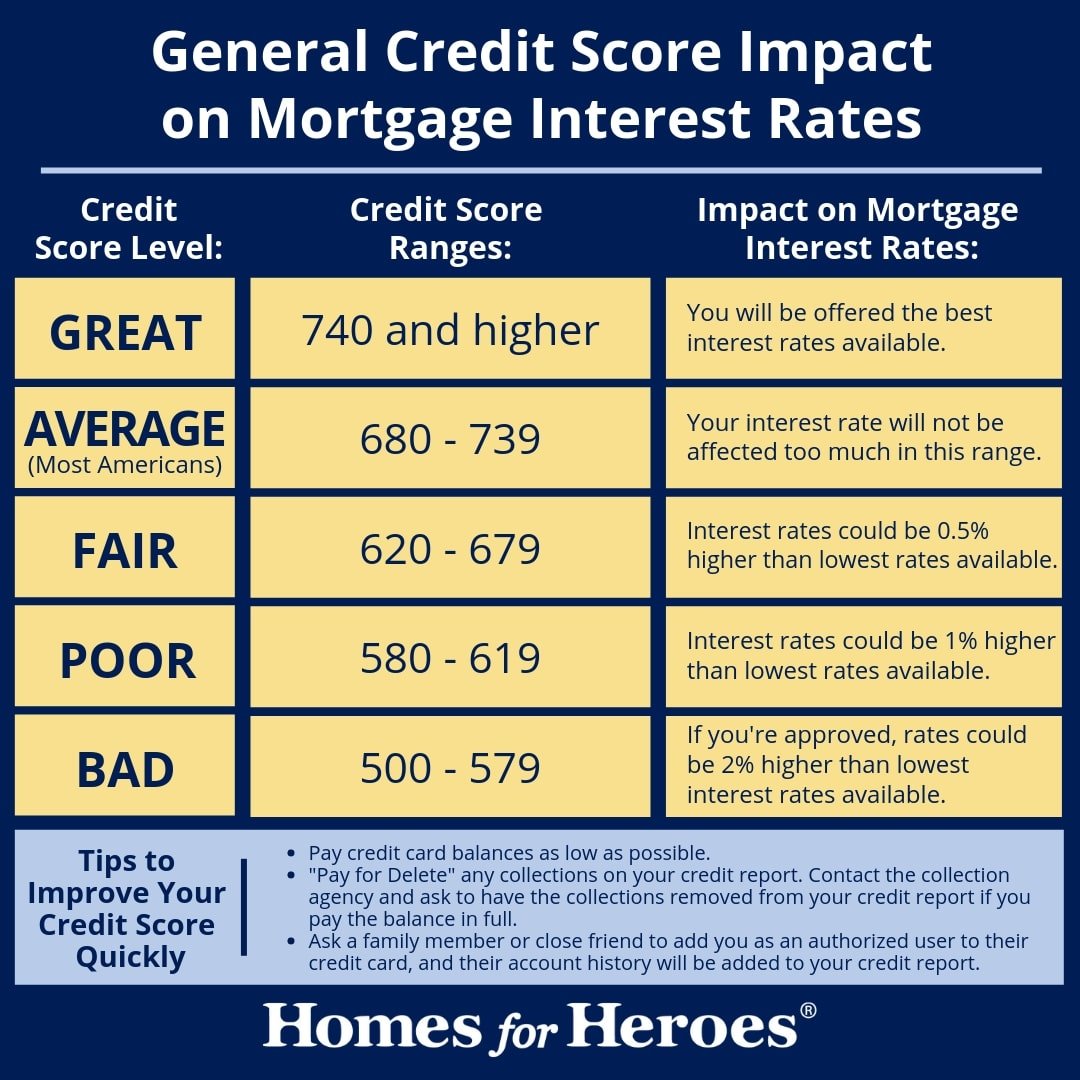

Nov 9, 2020 For most loan types, the credit score needed to buy a house is at least 620. But higher is better, and borrowers with scores of 740 or more;

Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages. However, the minimum credit;

May 14, 2021 Its recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, you might be;

You May Like: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

How Credit Score Affects Your Rate Mortgageloancom

Easier approval on FHA, VA loans A good credit score doesnt just help you get a home loan. It can also have a big effect on your mortgage rate as;

On the other hand, a lower FICO score could make it harder to qualify for certain loans and result in higher interest rates. What is a good credit score? When;

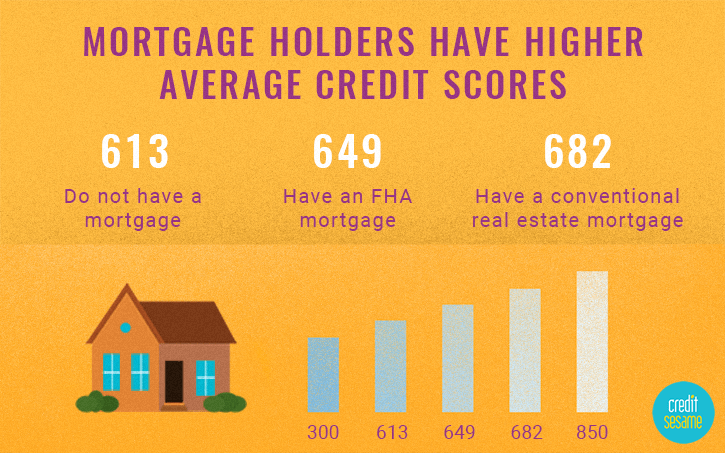

Credit Score Requirements by Mortgage Loan Type FHA loans: Minimum 500, with an average score of 680; Conventional loans: Minimum of 620 to 640;

Feb 11, 2021 The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed;Loan Type: Minimum FICO Credit ScoreUSDA: No set minimum from the USDA althouFHA: 580 with a 3.5% down payment or 500 wiConventional: 620 to 640

Feb 12, 2021 To get the best interest rate on a mortgage loan, borrowers should have a credit score of 760 or greater, which is considered good on;

Dec 16, 2020 You dont need a great credit score for a home loan. Well-qualified buyers can get a conventional mortgage with a FICO® Score of 620 and an FHA;

Feb 15, 2021 The credit score needed to buy a house depends on the type of loan. See the minimum, average & maximum credit scores needed for a home loan.

Mar 24, 2021 Hard credit inquiries which lenders will pull when you apply for a loan, mortgage, or credit card can ding your credit score and stay on;

How To Build Credit To Buy A House

Now that you know what lenders look for in a home borrower and what the minimum credit score requirements are for mortgages, its now time to figure out where you stand. Heres how you can improve your creditworthiness and increase your candidacy for homeownership.;

Review the following tips for building credit before you buy a house.

Read Also: Does Opensky Report To Credit Bureaus

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure its accurate and remember to consistently pay your bills on time. You can check your credit for free with our tool if youre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So heres a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You dont have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youre house hunting and talk over your options with a mortgage loan officer who can help.

Connect with us to make homeownership a reality.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

Get Your Hands Off My Assets

My friend and fellow BPer Kevin McGuire has a retirement savings plan in his native Canada. His well-trained plan advisor dutifully manages Kevins portfolio. Like most managers, he prefers individual stocks. But Kevin knows this is not his safest and most profitable plan.

He had studied the benefits of boring ETFs . These benefits come in the form of both predictability and performance. And they were hands-off; they require virtually no oversight. Yawn.

Kevin had a hard time convincing his advisor to move his funds to ETFs. It was an ongoing fight until Kevin finally put his foot down. He instructed his advisor to take his hands off his assets. Set it and forget it.

You see, Kevin learned the pain of betting on individual stocks years ago, watching his options in his employer seesaw up and down hourly. He lost sleep and a chunk of his life over this, and it might have cost him a good chunk of change, as well see below.

Kevin also noticed his most boring real estate investments performed best. It wasnt the shiny objects that caught the eyes of newer investors; it was long-term holds that produced steady returns.

And there has never been a better time to think about long-term holds, as I mentioned in my post about growing wealth by acquiring low-rate debt on real estate in an inflationary cycle.

Read Also: What Is A Good Credit Score For My Age

Home Appraisals From A Sellers Perspective

If the rooms are not clean or are cluttered, the appraiser may not be able to get an accurate feel for the homes condition. Too much in the room may cause it to feel smaller or hide improvements you want to consider in the appraisal. Some clutter to watch out for is:

Clothing, especially in the bedroom. Clothing has to be put away in your closet or armoire or bureau. You do not want them on the floor, on the bed, or scattered about.In the kitchen, your counters must be clear of clutter. Youll want to store your appliances in cabinets and put all dishes away on the day of the appraisal. You might also want to touch up the walls too.Living rooms often suffer from a lack of good lighting and using the space wrong. Rearrange your furniture a bit. Play around to see what opens up the room and what closes it off. Pick whatever makes the room look its best. Get rid of old furniture if you can and swap out old lightbulbs for new ones.

If you plan to do upgrades before a home inspection, such as to the exterior, keep a folder with documentation of those upgrades. You can take before and after photos, keep receipts to show costs, and present these to the appraiser because they need to see the work you have done on the home. Over time did you add a central cooling unit or a fence in the backyard? Did you pay a contractor to do this work? If so, keep those invoices and permits. Remember that only permanent upgrades count toward your appraisal value.

Tip #1: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

Also Check: Does Annual Credit Report Affect Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Is The Fico Score Calculated

While 90% of lenders use the FICO we will break down how your FICO score is calculated

- Payment history, 35% history of on-time, missed, or late payments

- Amounts owed, 30% how much debt you have

- Length of credit history, 15% how long you have been using credit

- New credit, 10% any recently opened loans or credit cards

Related: All You Need To Know About The FICO Score

If you have a credit score below 620 you will need to increase your credit score before you buy a home. When you increase your credit score you will get a lower interest rate and get approved for better loan terms.

Related: Best Loans For Bad Credit

You May Like: Can Student Loans Be Removed From Credit Report

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

What Else Do You Need To Get Approved

In addition to your credit scores, your mortgage lender looks at a few other factors to approve your home loan. Theyll review your employment situation to make sure you have a steady income to make your monthly mortgage payments.

Youll most likely need to submit pay stubs, bank statements, W-2s, and sometimes even a verification of employment form. If youre serious about purchasing a home, start setting these documents aside in a safe place so you have them ready to give to your lender when the time comes.

Not only does the lender look at your debt-to-income ratio and other financials, but theyll also check out the actual home youre purchasing. Some types of home loans require the house to be in a certain condition, which can take rehabilitation projects off the table.

Before making an offer, check with your lender on what types of properties you can consider. That will allow you to avoid making an offer you cant follow through on. The propertys appraisal also needs to come in at or above the amount of the loan, because a lender is not able to loan more than the appraisal value.

You May Like: How To Up Credit Score

Avoid Applying For New Credit

Virtually every time you apply for credit, the lender runs a hard inquiry on your credit report. In most cases, you’ll see your credit score drop by five points or fewer with one inquiry, if at all. But if you have multiple inquiries in a short period, it could have a compounding effect and lower your credit score even more.

Also, adding new credit increases your DTI, which is a crucial factor for mortgage lenders.

Start The Lending Process

As soon as you put a property under contract, contact your mortgage lender to start the lending process. I generally email the signed purchase agreement as soon as it is executed.

Since the appraisal can take a few weeks to complete, the lender will immediately collect payment for the appraisal and order the appraisal through a third-party appraisal service. The lender doesnt even decide who the appraiser will be.

You May Like: How To Get Charge Offs Off Of Your Credit Report

What Is The Minimum Credit Score To Buy A House

Different loan types carry different minimum credit score requirements, but credit score minimums for home loans typically range from 500 to 620. Here are the credit score requirements for the most common home loans.

| Mortgage loan type | |

|---|---|

| Varies by lender; typically around 580 | |

| Jumbo loan | Varies by lender; typically around 680 |

You can find mortgage lenders near you and submit a pre-qualification request for more information about minimum score requirements. If you have a very low credit score, you might have a better chance of qualifying if youre able to offer a higher down payment .

Benefits Of An Fha Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify.

- Competitive Interest Rates You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Lower Fees In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

- Bankruptcy / Foreclosure Just because you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

Recommended Reading: How To Get A Detailed Credit Report

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:;

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collection?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable about you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.;

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

Read Also: What Credit Report Does Paypal Pull