Tips For Improving Your Credit

Checking your credit score regularly is essential if you’re working on building or rebuilding your credit history. As you look for opportunities to improve your credit, here are some tips to help you get started:

- Get caught up on overdue payments, if applicable, and pay all of your debts on time every month going forward.

- Keep your credit card balances lowremember, the key is to keep your utilization rate below 30%, but the lower, the better. If you have high balances, focus on paying them down as quickly as possible.

- Consider asking a family member to add you as an authorized user on their credit card account. Before they submit the request, however, make sure the account has a positive history that can help improve your credit score.

- Avoid applying for new credit unless you need it.

- Get credit for paying your utility and phone billsthese payments typically don’t get reported to the credit bureaus, but with Experian Boost, you can allow Experian to connect your bank accounts and use the data to identify utility and phone payments. Once you verify the accounts, they can be added to your Experian credit file and may help boost your credit score.

As you use these tips and other good credit practices, you’ll be well on your way to a better credit score.

How Often Can You Check Your Credit Score

You can check your credit score as often as you want without hurting your credit, and it’s a good idea to do so regularly. At the very minimum, it’s a good idea to check before applying for credit, whether it’s a home loan, auto loan, credit card or something else.

When you do this, you can help make sure there aren’t any problems that could make it difficult to get approved for a new loan or credit account. By checking at least a few months in advance, it can also give you time to address anything that could be hurting your credit score.

It’s also a good idea to check your credit report at least once a year. While your credit score is a numerical snapshot of your overall credit health, your credit report provides the actual information used to calculate your score.

As you check your credit report, look out for anything you don’t recognize. If you find something odd, contact the lender to make sure it’s legitimate. Sometimes, a lender may operate under a different name and report a name you’re not familiar with to the credit bureaus; if you’re applying for a car loan, the dealership may submit a credit application to multiple lenders.

If you find information you believe is inaccurate or even fraudulent, report it to the credit bureaus.

You can get a free credit report from each of the three credit bureaus every 12 months through AnnualCreditReport.com. You can also get a free copy of your Experian credit report online every 30 days.

Will Checking Your Credit Hurt Credit Scores

Reading time: 2 minutes

Highlights:

-

Checking your credit reports or credit scores will not impact credit scores

-

Regularly checking your credit reports and credit scores is a good way to ensure information is accurate

-

Hard inquiries in response to a credit application do impact credit scores

Many people are afraid to request a copy of their credit reports or check their credit scores out of concern it may negatively impact their credit scores.

Good news: Credit scores aren’t impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

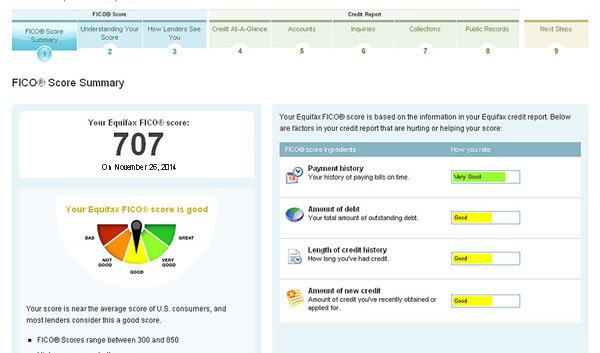

Impact of soft and hard inquiries on credit scores

When you request a copy of your credit report or check credit scores, thats known as a soft inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

The other type of inquiry is a hard inquiry. Those occur after you have applied for a loan or a credit card and the potential lender reviews your credit history.

Getting your credit reports

Recommended Reading: How To Report Unauthorized Credit Card Charges

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Being Removed As An Authorized User On Your Partner’s Credit Card

An is an additional card holder on someone else’s credit card account. Even if you aren’t obligated to make payments toward your partner’s credit card bill, being an authorized user on their credit card can improve your credit score if they spend responsibly and make consistent, on-time payments. This can be especially beneficial for a spouse who hadn’t previously had any open accounts on their credit report.

However, if you’re removed as an authorized user on your spouse’s credit card, your credit utilization can be impacted and you could see a decrease in your credit score.

You May Like: How To Get Charge Offs Off Of Your Credit Report

How Your Initial Credit Limit Is Determined

To determine your initial credit limit, Goldman Sachs uses your income and the minimum payment amounts associated with your existing debt to assess your ability to pay.

In addition, Goldman Sachs uses many of the same factors that are used to assess whether your application is approved or declined, including your credit score and the amount of credit you utilize on your existing credit lines.

Learn how you can request a credit limit increase.

Why Isnt My Credit Score Listed On My Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you pull your credit reports online, you may be surprised to;realize;your credit score;is not;showing up.

Why isn’t;your credit score on your credit reports,;and what can you do about it?

Also Check: Does Debt Consolidation Affect Your Credit Score

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

How Multiple Inquiries Impact Your Credit

The impact of some hard inquiries may be negated depending on when and why they occurred, and the credit-scoring model being used.

Some credit-scoring models will ignore certain inquiries due to deduplication, or deduping. With FICO credit scores, multiple inquiries for auto loans, student loans, and mortgages are considered a single inquiry for credit-scoring purposes if the inquiries happened within a 45-day window .

VantageScore does something similar with its credit scores, although it counts all inquiries within a 14-day window as a single inquiry.

FICOs scoring models also wont consider auto, student or mortgage loan inquiries that occurred within the last 30 days. The 30-day buffer can make it easier to shop for a loan without worrying about hurting your credit.

Recommended Reading: Does Bluebird Report To Credit Bureaus

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.;

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like;the ACLU.

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

Don’t Miss: A Credit Score Tells A Lender How

Fixing Errors In Your Credit Report

The information on your credit report impacts your ability to get a loan, an apartment, and many other important things in your life. You want to make sure that whats on your report is correct. If you find errors on your credit report, both the credit bureau and the person, company, or organization that provided the wrong information are responsible for correcting it. But there are steps you need to take first.;

- If your credit report has errors, but you havent experienced identity theft:;First, tell the credit bureau, in writing, what information you think is inaccurate. Include copies of documents that support your position. The credit bureau must investigate your claim. It also has to contact the business that put the information on your report. If that company finds that the information was, in fact, inaccurate, it must tell all three credit bureaus to correct your file.;

Second, contact the company that reported the wrong information to the credit bureau. Do this in writing. Tell them that youre disputing an item in your credit report. For more information and sample dispute letters, see Disputing Errors on Credit Reports.;

Who Cares About Your Credit History

Lenders, landlords, insurance companies, and potential employers are a few who might look at your credit history. Your credit history can make a big difference when you:

- apply for a loan or credit card

- look for a job

- try to rent an apartment

- try to buy or lease a car

- try to get rental or home insurance

Because these lenders, landlords, and others care how you handle your bills and other financial decisions, you might want to care about your credit, too.

Don’t Miss: Does Capital One Report Credit Limit

What Is A Soft Inquiry

A soft inquiry, sometimes referred to as a soft credit check, can occur for a few reasons, including:

- When you check your own credit score

- When an employer or landlord runs a credit check with your permission

- When a lender runs a credit check to preapprove or prequalify you for an offer

Soft inquiries don’t have an impact on your credit score because you’re not officially applying for credit. So when you fill out a form to get prequalified for a mortgage, student loan, personal loan or credit card, there are no strings attached.

Once you take the next step and apply, however, the lender will make a hard inquiry, which will show up on your credit report for others to see and can temporarily lower your credit score.

About American Express Credit Guide

What information can I find on MyCredit Guide?

MyCredit Guide provides your VantageScore® credit score by TransUnion®, refreshed weekly upon login. MyCredit Guide also includes a range of information and tools to help you understand your credit score better and plan for the future. Some of the features include:

- Score Factors impacting your score

- Up to 12 months of score history

- Detailed TransUnion credit report

- Email alerts about critical changes to your TransUnion credit report information to help you identify potential fraud

- Score simulator to help you assess the possible impact of financial choices before you make them

How often is the credit score in MyCredit Guide updated?;;;

Your VantageScore credit score is updated weekly, upon login.;;

What are the “Score Factors” impacting my VantageScore credit score?

The “Score Factors” impacting your VantageScore;credit score tell you what information from your TransUnion credit report is impacting the calculation of your score. These are some key factors that could affect your credit score:

- Your history of making payments on time

- How old your credit accounts are

- How much credit you are using

- Recent inquiries for credit

- Recently opened new credit or loan accounts

- How much credit you have available

What is the Credit Score Simulator?

Please note the results of Credit Score Simulator are estimated and dont necessarily show the exact results a given behavior will have on your score.;;;

How accurate is the Credit Score Simulator?

Read Also: Does Having More Credit Cards Help Your Credit Score

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

A Dispute Wont Always Remove Hard Inquiries

A negative item will only be removed from your credit report if you file the dispute and the credit bureau or data furnisher finds that the item was indeed incorrect, outdated or the organization cant verify the item.

Since an inquiry is a record of when someone checked your account, not when you opened a new account, a hard inquiry from a declined application isnt an error and you may not be able to successfully dispute it.

You may also find multiple hard inquiries for an auto loan or mortgage on your reports if you recently applied for an auto loan or mortgage with a dealership or broker. Its not uncommon for a dealer or broker to submit multiple applications for you in an attempt to find a loan with the lowest interest rate and best terms. These may be valid, and you dont need to worry too much about these, as theyll generally occur with the dedupe window.

In some cases, you may see a hard inquiry from a financial organization you dont recognize, but that may not be an error either. The company you apply for credit might have a parent company, or a different associated company, that funds the account and checks applicants credit.

Recommended Reading: What Credit Score Does Carmax Use

Understand Exactly What’s On Your Credit Report

Whether you’re married or not, knowing what’s on your credit report will help you understand what debts are impacting your credit score. But it’s especially important to keep an eye on your credit report when you’re going through a divorce so you know which debts you’re both responsible for and which cards need to be cancelled.

“Once the agreement is made on who will pay what, people tend to think they’re off the hook if the other person is responsible for paying the debt,” Droske said. “But a late or missed payment will impact your and your spouse’s credit. “People think they can just call up the creditor and say they aren’t responsible for the payments anymore because they’re getting a divorce, but it doesn’t work that way.”

It also helps to monitor your credit for any new credit accounts or loans you don’t recall opening yourself. New, unfamiliar accounts on your credit report can be a sign that someone is using your name to get a new line of credit. Experian can also help you monitor your credit, but our roundup of some of the best credit monitoring services can provide other options.

How To Spot Credit Report Scams

AnnualCreditReport.com is the only site sanctioned by the government, and there are a number of lookalike websites that the Federal Trade Commission calls imposters. Some include terms like free report in their names; others purposely misspell AnnualCreditReport.com so the URL is nearly the same.;

These sites may attempt to collect your personal information or direct you to other sites that want to sell you something. Or they may try to get you to sign up for a seemingly free credit report for which youll later be charged.

Use caution if youre asked to enter your credit card or bank account number, as this could be used to bill you at the end of a free trial. Also, check the sites security certificate, and be wary of sites with HTTP rather than HTTPS in the address. HTTP means the site is less secure.

Make sure to steer clear of sites that contain spelling or grammar errors, and be wary of phone calls or emails from senders claiming to represent AnnualCreditReport.com or one of the three major credit bureaus. The FTC says these companies wont contact you, so anyone claiming to be them is likely a scam.

You May Like: How To Get A Debt Collection Removed From Credit Report