Thank You For Sharing

Ally Financial, a bank holding company headquartered in Detroit, Michigan, and Experian Information Solutions Inc. were sued Tuesday in Georgia Northern District Court for claims under the Fair Credit Reporting Act. The court action was brought by the Credit Repair Lawyers Of America on behalf of Mark Davis. Counsel have not yet appeared for the defendants. The case is 1:21-cv-04268, Davis v. Experian Information Solutions, Inc. et al.

This suit was surfaced by Law.com Radar, a source for high-speed legal news and litigation updates personalized to your practice. Law.com Radar publishes daily updates on just-filed federal cases like this one. to get started and be first to know about new suits in your Region, practice area or client sector.

Is Ally Financial Good For Auto Loans

An Ally Bank auto loan may be a good option for people who prefer to finance directly at the dealership while getting access to a variety of loan types. Keep in mind that if youre interested in buying a vehicle thats older than 10 years, or has more than 120,000 miles, you wont be able to finance through Ally.

How Ally Bank Auto Financing Works

To apply for Ally auto financing, you first need to find a participating dealership. On the Ally website, you can enter your location and the type of car youd like to buy/lease, then Ally will give you the names and addresses of nearby dealers that offer its products. You can then decide on the vehicle youd like to buy and apply for your loan/lease.

The exact application process and requirements will depend on the dealer but expect to submit the typical documents for an auto loan, including:

- Proof of identity: Drivers license, a state ID or passport

- Proof of income: Pay stub or W-2 form

- Proof of residence: A recent bill, bank statement, mortgage/lease statement or other addressed mail

- Banking and credit history: The dealer could ask about your current financial situation, including what kind of debt you owe and how much you have in savings and investments.

As part of the application, the dealer could pull up your credit report through a hard inquiry. Since the dealership is setting up your financing, there is no guarantee that it will recommend an Ally loan, especially if the dealer finds a better option.

Ally even suggests that you shop around before visiting a dealership as it acknowledges the benefit of comparing multiple lenders ahead of time.

Also Check: How Do Evictions Show Up On Credit Reports

What To Do If Your Loan Doesn’t Appear On Your Report

If your auto loan doesn’t show up on your credit report after 30 to 60 days, reach out to your lender. Ask them if it’s their policy to report loan activity to the credit bureaus and, if so, whether they can follow up to make sure your loan information has been reported accurately.

Short of refinancing with another lender, you have limited recourse if your lender simply doesn’t report to any of the credit bureaus. In the future, you may want to find out what your lender’s policies on credit reporting are before you submit a loan application.

In the meantime, it can still be beneficial to monitor your credit score and report periodically to check your creditand to make sure the information in your is as accurate and up to date as possible. The information in your credit report will likely be instrumental in getting your next auto loan or credit card, whether or not your current loan information is being reported.

What Do Lenders Gain From Reporting

Given the expense and difficulty that comes from reporting borrowers account information to the credit bureaus, you might be wondering why any lender bothers to report to a credit bureau in the first place.

The simple answer to this question is that banks want to have some recourse if you fail to pay on a loan theyve given you. For example, if you start missing payments on your car loan, phone calls and late fees will probably only go so far in encouraging you to cough up the cash.

However, the threat of a blemished credit report carries a lot of weight. Most people know that defaults and delinquencies can follow them around for years, so the incentive to avoid this type of black mark is huge. But it only works if a bank is reporting information to the credit bureaus, which is why most choose to do so.

Read Also: Syncbppc

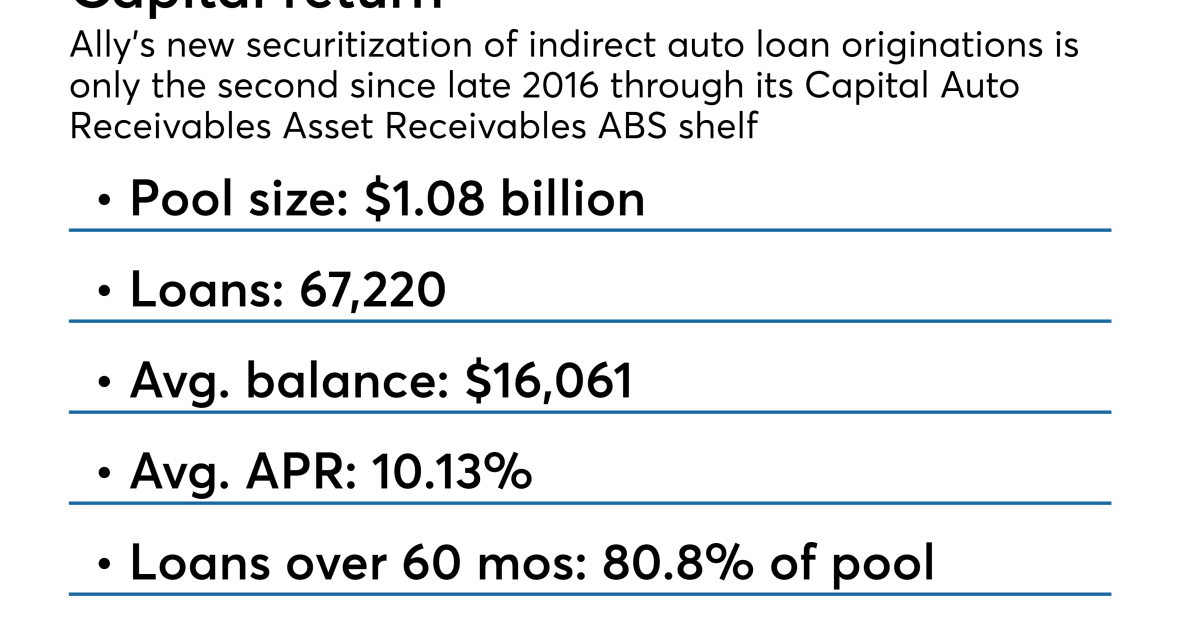

Checking Current Ally Car Loan Rates

First you want to check out the interest rate chart we put this one below to give you an idea of what the chart looks like

| Dates | |

|---|---|

| 3.93% | 4.38% |

The above chart gives you an idea of the starting interest rate based on the term of a loan. As you can see, the longer time you plan to take to pay the loan off, the higher the rates become.

While the monthly premiums will be lower if you select a longer payoff period, you are going to end up paying much more interest.

How Does Deferring A Payment Work

When you request a loan deferment and your lender agrees to the arrangement, you’re allowed to temporarily stop making payments on the loan. You don’t need to worry about late payment fees or your loan servicer reporting missed payments to the credit bureaus.

Generally, you’ll need to apply if you want to put your loan into deferment. The process can vary depending on the type of loan you have and which creditor or loan servicer you send your payments to each month.

- If you have a federal student loan, you can submit your request to your loan servicer. You can review the eligibility requirements for loan deferment or forbearance on the Department of Education’s website. Your loans may automatically be put into deferment if you enroll in an eligible school with at least a half-time course load.

- With an auto loan, the lender may refer to the arrangement as a loan extension or postponement. Each lender will have different criteria you must meet before they grant an extension. For example, you may need to show that you’re requesting the extension due to a temporary setback, such as a medical emergency.

- If you’re having trouble with mortgage payments, you can contact your mortgage servicer to discuss your options. One option may be able to place your loan into forbearance and temporarily stop making payments or make smaller payments. You can get free assistance from a Department of Housing and Urban Development counselor who can help explain your options.

Recommended Reading: Affirm Credit Score For Approval

Sample Letter: Credit Bureau Late Payment Dispute Request

You can use this sample letter to dispute information in your credit report. Just insert the appropriate information, like your name and address, the credit bureau name and address, and specific details in the body of the letter. If youre disputing more than one item, youll need to adjust the language to refer to multiple accounts.

Only include copies of documents, not the originals. If you choose to provide a copy of your credit report, circle the delinquent account in question.

Send your dispute request by certified mail, with a return receipt requested, so youll be sure that they receive it.

Enclosures:

How Long Does It Take For A New Credit Card To Show Up On Your Credit Report

You can expect credit cards to show up on your report within a couple of months. The exact timing will depend on when your credit card company reports information to the credit bureaus. All companies do so roughly once per month. If you happen to get a new card just after the company has reported information to the credit bureau, you may have to wait until the end of the next billing cycle for the information to appear on your credit report.

Read Also: How To Remove Repossession From Credit Report

How Much Of A Payment Can I Afford

Just like with purchasing a home, you should sit down with your budget and figure out how much you can realistically afford to pay each month based on your income and expenses.

A good rule of thumb is to go into the bank or dealership intending to spend less but know your ceiling and stick to it no matter how good a higher-payment deal seems.

Things To Consider Before Refinancing

You May Like: Remove Repossession From Credit Report

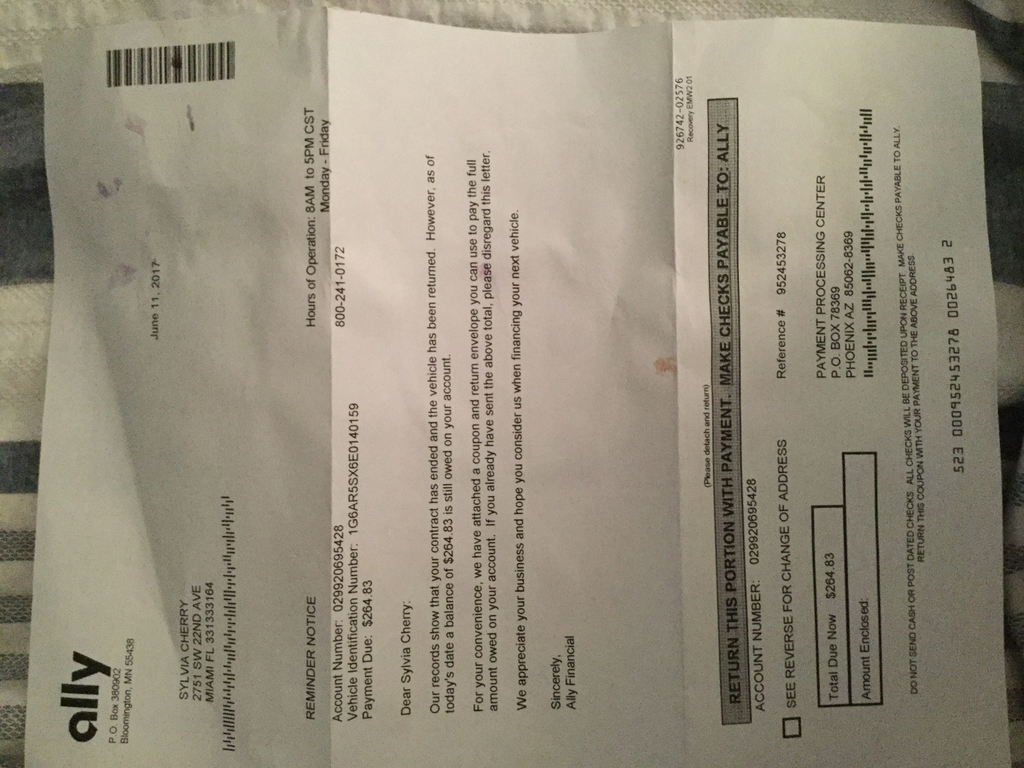

Negative Ally Auto Finance Reviews

Negative Ally auto financial reviews come from customers who range from mildly unhappy to downright irritated.

yet to fix a $20k error on my credit report that they submitted on a car loan. I submitted a dispute, and its been over a month.

Christina S. via Trustpilot

Filed a GAP claim on Feb. 23, 2021. It is 4/28/2021, and still no payment. Very poor and unresponsive customer service.

Darryl F. via BBB

List Of Lenders That Pull Equifax Transunion Or Both

Ally Auto Review” alt=”Ripoff Report > Ally Auto Review”>

Ally Auto Review” alt=”Ripoff Report > Ally Auto Review”> ilove wrote: Alright, would you fellow RFDers find it might be useful to compile a list of lenders that pull either Equifax, Transunion, or both when inquiring your credit file?Maybe a master thread would be helpful for this purpose. Here we go:Amex Bank of Canada: but only reports on Capital One: BMO: Canadian Tire: Feel free to add your own info into this thread and I will try to update the OP as diligently as possible.

BMO reports to TD reports to CIBC reports to Future Shop/Chase reports to RBC from what I know reports to AMEX reports to Nyd

May 16th, 2012 6:45 pm

- 149 upvotes

May 16th, 2012 9:27 pm

ilove wrote: Alright, would you fellow RFDers find it might be useful to compile a list of lenders that pull either Equifax, Transunion, or both when inquiring your credit file?Maybe a master thread would be helpful for this purpose. Here we go:Amex Bank of Canada: but only reports on Capital One: BMO: Canadian Tire: Feel free to add your own info into this thread and I will try to update the OP as diligently as possible.

Licensed Credit Bureau member, S1, FI Automotive, CCP13

- +1

Paulfistinyourface wrote: And lastly, can someone please tell me what creditor does NOT report to both bureaus?

mikeymike1 wrote: Is the OP looking for data on bureau pulls or bureau reporting? I think its ‘pulls’ as its stated in his/her first sentence.

National BankLaurentian BankVancityScotiabankBMOAlly

- +1

Also Check: How To Get Car Repossession Off Credit Report

Final Thoughts: Ally Auto Finance Loans

If you have good or excellent credit and dont mind applying for an auto loan in person, Ally can be a solid choice. Also, if youre a business owner and want to finance commercial-use vehicles, Ally offers plenty of financing options.

| Ally Auto Finance Loan Pros | Ally Auto Finance Loan Cons |

|---|---|

| Good choice for mid-level credit | Few options for subprime borrowers |

| Multiple options for personal and commercial-use vehicles | High number of customer complaints |

| Mobile app has strong reviews among Apple users | Must apply through a dealership for new car purchases |

| Clearlane only available for lease buyouts and refinancing |

One of the biggest knocks on Ally is that the company doesnt offer many ways to compare rates without filling out an application. Clearlane can be helpful for refinancing or getting a lease buyout, but getting prequalified doesnt mean youll know your rate. Ally offers very little information about any bad credit car loans it may offer.

Allyauto Finance Customer Reviews

AllyAuto Loans strength is getting its customers in vehicles quickly.

They are not focused on anything beyond getting you to sign their high APR rate car loan.

Consequently, their customer service, once you have obtained your loan, leaves a lot to be desired. Customers complain of long delays to receive responses to requests and disorganization throughout all departments.

Below are some of the My Ally Auto Loan reviews:

As part of the process of this review, we read countless hours of Ally Auto Loan reviews and while it is not uncommon for a large company to have negative reviews, these were especially troubling.

Looking closely, it doesnt take long to realize that Ally auto customer service consistently shows a callousness to problems they have created and will make the minimal amount of effort necessary to correct a problem.

If you are one of the lucky people who never has to contact Ally Auto customer service then you will probably have a fine experience but if there are any problems along the way

Below we have gathered the most trusted customer Ally Auto Financial reviews from sites such as Yelp, Google, and BBB for the Ally Auto Finance Division.

|

Ally Auto Loan Reviews |

|---|

Recommended Reading: Leasingdesk Hard Inquiry

Myfico Proved Ally Auto Loan Lies

Hi, I’m new here, so apologies if this is a redundant topic that has been covered. I’ll try my best to keep it as short and succinct as possible!

Anyways, I decided to purchase a second car and so I applied for a new auto loan on Nov 2015 through Ally, the bank through which I’ve been making payments on my first car since 2014. After receiving a letter of denial at the dealership from Ally stating that my FICO Auto Score at the time of the inquiry was 642, I began tracking Credt Karma in desperation to raise my credit scores for the past few months. My CK currently shows me at 655 and 665 . My Ally Auto Enhanced FICO shows me at 642, exactly what the dealership pulled. I opened a Discover Secured Card this month and my first statement shows my Discover FICO score at 710! Hmmmm…

After researching and recognizing this forum’s opinions against FAKO’s, I decided to purchase myFICO today. My FICO 8’s on this website are 710 , 734 , and 765 – 50 to 100 points higher than CK! And, my auto enhanced FICOs are around 710-750 on all versions! HMMMMMMMM!!!!!

If myFICO’s scores are really the real FICO scores that lenders use, I can’t understand how Ally shows me at 642 while myFICO shows me consistently in the low-mid 700s. Even though I’m holding off on buying my second car, I’m thinking about having a different dealership run a credt check – through Ally as well as other banks. What do you guys think?

Can Deferred Payments Affect My Credit

When a lender approves your deferment request, it should report that your payments are currently deferred to the credit bureaus. While this appears on your credit report, the deferment mark won’t directly help or hurt your credit scores.

The accounts can continue to impact your credit scores, though. For example, your account will continue to age, which lengthens your credit history and could help your scores.

Also, keep in mind that if you apply for deferment and stop making payments, but your lender denies the deferment request or a payment is due before it’s approved, the late payment could still get reported to the credit bureaus and hurt your scores.

If you missed payments before putting your loan into deferment, those late payments won’t be removed from your credit history. However, if your account was past due when you entered deferment, their impact may temporarily be ignored while your loan is in deferment.

Read Also: How To Check Credit Score Usaa

Change Due Dates Or Consolidate If Helpful

Most credit card issuers such as Capital One and Discover will let you change your due date to avoid payment conflicts with other bills such as your rent or auto loan payment.

Sometimes a simple change like this can create the relief you need to keep your credit score on the up and up.

You could also consider consolidating several smaller credit card balances into one larger credit card or personal loan.

Youd have fewer due dates to remember, and you could probably pay less in interest charges, too.

Account Not Showing On Your Credit Report Here’s Why

When you’re reviewing your , you may notice that some of your financial accounts don’t show up. In some situations, you may see accounts on your credit report from one bureau but not on the other two. Or, there may be accounts that dont appear on any of your credit reports from any of the major credit bureaus.

There are a few explanations for this, and it’s all based on how credit reporting works.

Recommended Reading: Comenitycapital Mprc

Who Is Ally Auto Finance

Ally Auto Finance was originally GMAC Financing until 2008 when they became a bank and changed to their present name, Ally Financial.

Ally Auto Financial is the largest auto lender by volume in the U.S. with over 6 million customers. Today Ally is the 23rd largest bank in the United States.

Ally auto loan offers a variety of auto loan options through GM, Chrysler, Mitsubishi, Saab, and Suzuki dealerships.

What Is A Soft Inquiry

A soft inquiry occurs when a creditor checks your credit history without your permission. This could be a lender with whom youve talked to for a pre-approval quote but havent actually applied for a loan. Sometimes a soft inquiry might even be pulled by an existing creditor just checking on your current credit situation.

Soft inquiries do not have an impact on your credit scores.

Recommended Reading: What Bank Does Carmax Use