Work With A Credit Repair Company To Remove The Hard Inquiry

Writing and calling creditors and credit bureaus can be quite stressful and time-consuming.

Especially if you have a more complicated credit situation.

If youd like to leave the hassle of dealing with creditors to someone else, we recommend working with a .

These companies are staffed with pros who work quickly to ensure accurate reporting, dispute your claims, and get entries removed from your report.

And if youre dealing with more than a hard inquiry, a credit repair company can be downright essential.

Syncb/ppc: What Is It And Why It’s On Your Credit Report

Have you been seeing SYNCB or SYNCB/PPC on your credit report lately?

If it seems that the acronym has popped up out of the blue, there’s no need to panic just yet. It’s likely there because you’ve recently applied for a line of credit with a store or an online payment system, such as PayPal. Of course, this means you’ve likely garnered a hard inquiry, which impacts your credit score.

This usually happens whenever you request to open a new line of credit. However, you will want to monitor your credit reports closely to ensure that the SYNCB or SYNCB/PPC activity that’s showing up is legitimate and has been authorized by you.

In this article, we’re going to explain what SYNCB and SYNCB/PPC stand for, where it came from, and how to remove it from your credit report. Read on to learn more.

Is Synchrony A Real Bank

You won’t find any brick-and-mortar Synchrony Bank locations, but Synchrony is indeed a real bank.

Aside from issuing credit cards, Synchrony provides a plethora of financial products , and more), plus special financing offers with select retailers.

Despite all the different card offers, you can use the basic to access any Synchrony card account. Or you can download the MySynchrony app for your smartphone. Youll be able to check your card details and pay bills with either method.

Synchrony cardholders can also access one of their FICO credit scores, based on their TransUnion credit reports. This is a good feature for anyone trying to establish or rebuild credit.

However, store cards also have some downsides . They typically come with low credit limits, like $500 or $1,000, and very high interest rates. You should always pay your statement balance in full and never carry a balance on a store card, because the interest you accrue will negate any rewards or benefits you got from the card . Store cards also tend to come with below-average customer support, as discussed in the section below.

Insider tip

The shopping cart trick is rumored to be a way to get approved for certain credit cards without hard inquiries on your credit reports, although it may not actually work. People usually try it with store cards issued by Comenity Bank, but some report that it works with certain Synchrony Bank credit cards as well, like the QVC card. We cant confirm this, however.

Read Also: Business Credit Cards That Don T Report To Personal

Which Credit Report Does Synchrony Bank Pull

Though you may not have heard of Synchrony Bank, there is a very good chance that youve interacted with the company in the past.

Synchrony Bank is a major issuer for store-branded credit cards offered by companies such as American Eagle, The Gap, Banana Republic, eBay, and Sams Club.

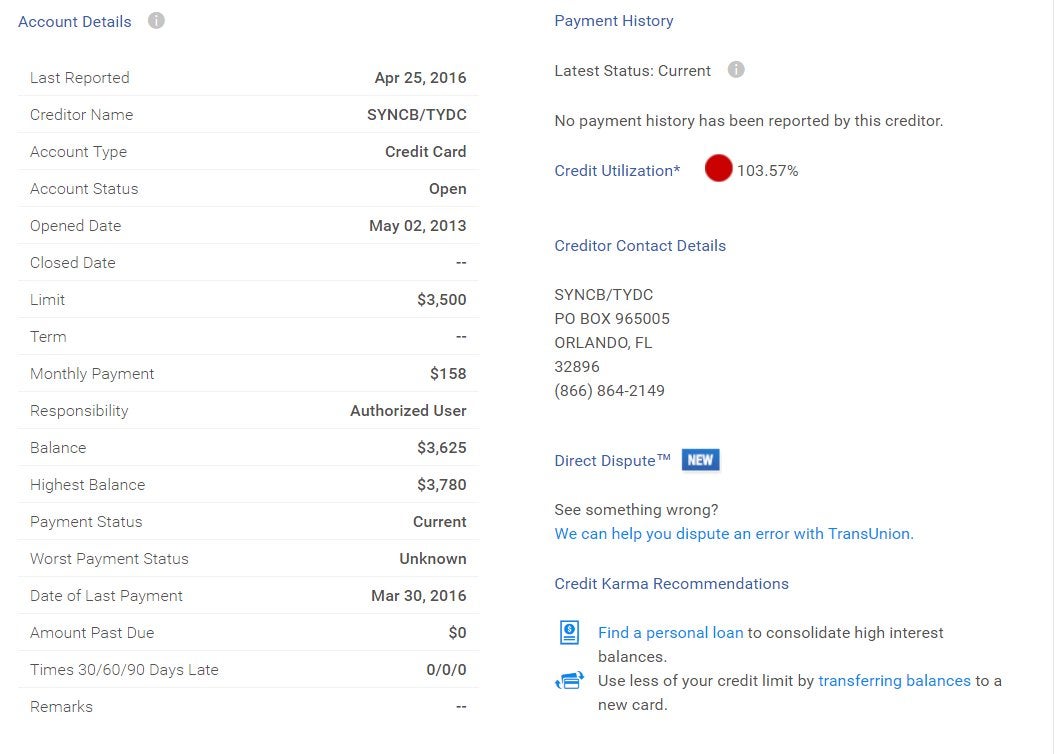

When you apply for a card from Synchrony, the lender is most likely to check your credit report from TransUnion.

In fact, Synchrony uses TransUnion nearly exclusively.

Though all three credit bureaus use your financial activities as the basis for their reports about you, there is the possibility that each bureau will have slightly different details and scores.

Thats why knowing which credit bureau will be used by a lender is important.

We learned this information by reviewing 167 consumer-reported credit inquiries from January 2015 through December 2017.

That information showed that Synchrony works with TransUnion almost exclusively.

There are some cases where Synchrony may check another bureaus report, but those cases are exceedingly rare.

How Long Does An Syncb Hard Inquiry Stay On Your Credit Report

Ultimately, anyhard inquirieson your credit report regardless of the source will remain for up to two years unless you get them removed.

While hard inquiries effects on your credit score lessen over time , they wont fully vanish until that time is up.

This is why its important to get rid of hard inquiries ASAP. They can all add up over time and make getting good loans all but impossible.

Recommended Reading: Does Lending Club Show On Credit Report

What Is Syncb Ppc

SYNCB PPC stands for Synchrony Bank/PayPal Credit. You may see this on your credit report if youve applied for PayPal Credit, formally known as Bill Me Later account in the past. PayPal Credit is a line of credit that PayPal account holders can apply for.

After Synchrony Bank bought PayPal Credit from PayPal in 2018, the buy-out included any debt owed to PayPal. Now, all of those PayPal bills are owed to Synchrony instead of PayPal.

Removing Syncb From Your Credit Report

Theres no reason an application for a credit card should hold you back from getting approved for a competitive mortgage, student loan, or any other line of credit.

Though one credit card application wont likely destroy your credit, it can have an effect on your score for up to two years.

If SYNCB, Paypal, or one of its other partners has popped up on your report and lowered your score, consider disputing your debt or hiring a credit repair company to improve your score.

If youre looking for a place to start, the credit repair companies below provide excellent services.

They have a proven track record of success, with countless reviews from satisfied customers with soaring credit scores:

Read Also: Is Chase Credit Journey Accurate

For What Reason Is Syncb/ppc On My Credit Reports

In 2018, Synchrony Bank purchased out PayPals Credit and Bill Me Later records. On the off chance that you have a PayPal Credit account or the Bill Me Later choice, your obligations are currently owed to Synchrony Bank. Besides PayPal, Synchrony Bank likewise now claims the accompanying retailer credit accounts working on both Visa and Mastercard organizations:

Altogether, Synchrony Bank claims an aggregate of 116 store Visas. In this way, in case youre seeing SYNCB spring up on your credit report however dont have a PayPal Credit or Bill Me Later record, youre probably partnered with SYNCB somewhere else. Its a smart thought to twofold check the entirety of your credit accounts and their associations to guarantee that the SYNCB on your credit report has a place with you and isnt there because of an instance of data fraud.

A few groups report that their old PayPal Credit or Bill Me Later records are currently appearing on their credit reports interestingly. So why the change?

At the purpose when PayPal Holdings possessed these records, it absolutely was likely not covering them to the authorities. Since Synchrony Bank has taken the records on, it appears to be that they are getting answered to the agencies. USA

There are a pair of varied zones of your credit reports where youll see SYNCB/PPC heres the way it okay is also appearing and what to try and do about it.

Should You Apply For A Synchrony Bank Card

Admittedly, retail credit cards can be a mixed bag. Between high interest rates and confusing deferred-interest promotions, you could find yourself deep in debt if youre not careful. That said, if you need to build or rebuild credit or youre a particularly loyal shopper who could regularly save money from purchase discounts and special sales a store-branded Synchrony Bank credit card could work in your favor.

But if youd rather avoid the temptation to overspend at your favorite retailer, you might be better off with a traditional credit-building credit card. Whichever route you take, remember the cardinal rule of responsible credit use: Never charge more than you can afford to pay in full every month.

- Sams Club® Credit Card: Anywhere Mastercard is accepted

Some of those cards also have a Visa or Mastercard version that can be used basically anywhere that takes credit cards. But they generally offer the best rewards on purchases made through the stores theyre affiliated with.

Who is Synchrony Bank? Where did this bank come from? How is it that several credit accounts that I have belong to this bank?

Ad Disclosure:

Read Also: Does Speedy Cash Check Credit

What Are Credit Reports And How Do They Work

Your credit report tells your financial story to lenders, and it allows them to make informed decisions about your creditworthiness.

Your credit report is like a report card that grades how well you manage your financial obligations, says Bruce McClary, vice president of communications for the National Foundation for Credit Counseling.

There are three credit bureaus that publish these reports: Experian, TransUnion, and Equifax. These bureaus report information from your lenders such as payment history, balanced owed, and whether youre paying on time. If you pay your bills on time and keep your balances low, youll have a higher score. Conversely, if you miss payments regularly, youll have a lower credit score.

Potential lenders use one or multiple reports to verify your information. Theyll also use this information to determine if youre eligible for financing and if you are what your terms should be. Therefore, monitoring your credit reports is an essential way to stay on top of the information presented to prospective lenders.

When Your Credit Report Is Updated

Your credit report isnt updated every day, so youll have to wait to see any changes you make reflected on your credit report.

In fact, most lenders only send information to the credit bureaus once each month, at the end of your statement period.

Ultimately, it can take several weeks for changes such as reduced balance or higher credit limits to be reflected in your credit score.

That means you need to start working to improve your credit score far in advance of applying for a loan.

Also Check: Does Paypal Credit Report To Credit Bureaus

Verizon Visa Rewards Card

Offered exclusively to Verizon Wireless customers, the Verizon Visa Rewards card is an excellent no-annual-fee card option for those who have their cell phone through Verizon Wireless. The card earns Verizon Dollars, which can be redeemed for any Verizon products or services. Each Verizon dollar is equivalent to $1 in value, and there are no caps on earning or expiration dates.

The rewards rate for the Verizon Visa card is quite strong, offering 4% back on gas and grocery purchases, 3% back on dining purchases, 2% back on Verizon purchases , and 1% back on all other purchases.

Cardholders will receive a few solid perks, too. For starters, cardholders will receive up to $100 in wireless bill credits over 24 consecutive months for monthly bill payments this breaks down to about $4.16 each month. Youll also be eligible for an auto-pay discount of $5 to $10 each month when you use your card to pay your Verizon bill, depending on the type of plan you have. This perk alone could be hugely beneficial if you plan to stay with Verizon long term, as youll save $60-$120 each year.

All in all, the Verizon card is a fantastic option for Verizon customers, that offers great discounts and great bonus categories, all for a no annual fee card!

Recommended Reading:

American Eagle Outfitters Visa Card

American Eagle Outfitters is a retail clothing store geared toward college-aged young adults. Additionally, they launched Aerie to compete with brands such as Victorias Secret.

The AEO Connected Visa Credit Card earns 15 points per $1 spent at American Eagle or Aerie stores. All other purchases earn 5 points per $1.

Once a shopper reaches 2,5000 points, they receive a $10 reward coupon that can be used toward future purchases with either brand.

Cardholders will also receive free standard shipping, a 20% off birthday coupon, a personal shopping day coupon, special cardholder events, and more.

Don’t Miss: Does Capital One Report Authorized Users

Bp/syncb On My Credit Report

BP SYNCB stands for BP Synchrony Bank.

Synchrony is a large bank that is known for its long lineup of store cards, with brands like:

- Banana Republic

- Toys R Us

- And more

BP Synchrony Bank offers two cards: the BP Visa Credit Card and the BP Credit Card.

The BP credit card is a card that rewards you at the pump and in the store, with savings on gas and cashback on your purchases at BP and Amaco stations.

BPs Visa card is even more rewarding, offering cashback at all other stores that accept Visa cards.

Any time you apply for a card like the BP credit card or Visa card, it requires a hard credit check.

Well talk about all that the process entails below.

Write A Goodwill Letter

If hiring a professional is way out of your budget, it would be best to write them a goodwill letter. To do so, your letter should include the significant reasons like why you cannot pay on time or what hinders you from paying your debts. Its a good idea to be honest when writing your goodwill letter, regardless of their decision, to establish trust and confidence.

Writing a goodwill letter and hoping it will be approved might be a rarity for some. But if your reasons for incapability to pay your debts are true, then there is a good chance that it will be approved. Just dont lose hope and keep trying. You only ask for a remedy given your situation. But keep in mind that it is still their decision to honor the letter or not.

You May Like: Cbcinnovis Inquiry

Negative Codes On An Experian Credit File

For example, here are a variety of negative credit scenarios, and the Experian codes used to describe them:

-

30 Days Past Due: 30

-

60 Days Past Due: 60

-

90 Days Past Due: 90

-

120 Days Past Due: 120

-

150 Days Past Due: 150

-

180 Days Past Due: 180

-

Collection: C

-

Voluntarily surrendered: VS

Again, none of these is a flat-out credit deathblow in and of themselves.

But if your credit reports show a repeated pattern of late payments and an inability or unwillingness to pay your obligations, then banks, credit unions and other financial institutions definitely wont be beating down your door to offer you credit.

Hard Or Soft Inquiries

Hard inquiry: If you applied for a credit card from your bank or credit union and have a hard inquiry on your credit reports from Elan Financial Services, its possible the card actually is offered by Elan Financial Services on behalf of the bank or credit union you applied through.

In that case, Elan Financial Services would likely have done a hard pull on your reports to check your credit when evaluating your application to decide whether to lend to you. A hard inquiry can have a small negative impact on your credit scores and can show up on your credit reports for up to two years.

Soft inquiry: If you applied to prequalify for a credit card from one of the banks or credit unions that works with Elan Financial Services, you could also see a soft inquiry from the company on your reports. A soft inquiry doesnt affect your credit scores.

Unauthorized hard inquiry: If you didnt apply for a credit card provided by Elan Financial Services and you have a hard inquiry from this company on your reports, its possible that youre facing a case of identity theft. Learn more about what to do if you spot an unauthorized hard inquiry.

Read Also: Does Paypal Credit Affect Credit

Can I Remove This Hard Inquiry

Unfortunately, you can not remove a hard inquiry from your credit report. The only exception is in the case of identity theft in which someone else did the hard pull on your credit rating.

In that case, working with the credit card agencies can remove the hard inquiry. Otherwise, it will stay on your credit score until it falls away naturally.

The positive is that most credit card agencies along with lenders will generally not disapprove of a lower credit score due to the presence of hard inquiries.

That means if they see the cause, they will generally account for the difference when making their decision.

However, a series of hard inquiries made over a relatively short period will raise some questions about your activities that require such inquiries to be made.

Overall, the presence of SYNCB on your credit report is meaningless as it stands for Synchrony Bank, the issuer of the card. However, you should be mindful of the hard inquiries required for all credit cards and the lenders you use to take out loans.

It is generally better to spread out such requests if possible or find another way to raise the money you need instead of affecting your credit rating with repeated hard inquiries.

On Your Transunion Credit Report

Finally, the TransUnion credit bureau also has its own codes to summarize your credit history and payment behavior.

The main code you want to see is OK as this notation means that you are current on an account.

Besides an OK listing, there are four neutral codes on a TransUnion credit file. These are:

CLO Closed

N/R which means Not Reported

X which means Unknown

None of these codes harm your credit rating, so dont panic if you see them on your TransUnion credit report.

Recommended Reading: How Can Personal Responsibility Affect Your Credit Report

Ask Syncb For Goodwill Deletion

Lastly, you can also write SYNCB a goodwill letter, asking them nicely to remove a hard inquiry or active or closed account line item on your credit report for your benefit.

Explaining your financial situation and any hardships you might be experiencing at the time will go a long way to helping their customer service representatives empathize with you.

This may seem like a long shot, but Synchrony Bank is run by regular people when it comes down to it.

They may be willing to overlook an accident or repair a hard inquiry credit error just by asking them.