Negotiating With Collection Agencies

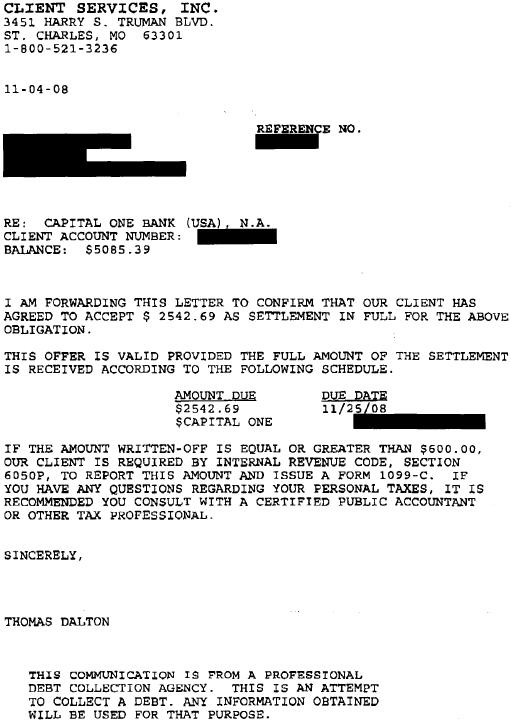

The wording used on your credit report, as discussed in the last section, can certainly be a factor in the negotiation process. For example, if a debt collection agency offers you a settlement in writing, you can call them and say that you’ll write them a check right now if they’ll agree to permanently remove the account from your credit afterward.

If they say no, ask if they’ll at least report it as “paid in full” instead of “settled.”

You can often successfully negotiate a removal by offering to pay the debt in full — as this would be a win-win for both you and the collection agency.

In my experience, most collectors will jump at the chance for a quick payday. After all, once they get their money, what do they care what your credit report says? Just be sure to get the agreement in writing before paying the account.

How To Remove Capital One Collections From Your Credit Report

To remove Capital One Collections from your credit report, you first need to know who currently owns the debt.

In other words, has Capital One sold your unpaid credit card debt to another collection agency, or is the debt still with Capital One?

You can find out who owns your Capital One debt by getting a current copy of your credit report and taking a look to see who is listed as the creditor on the entry.

Visit AnnualCreditReport.com to download copies of your credit reports from each of the three credit bureaus.

Because of the Covid-19 pandemic, you can get a free credit report each week until further notice.

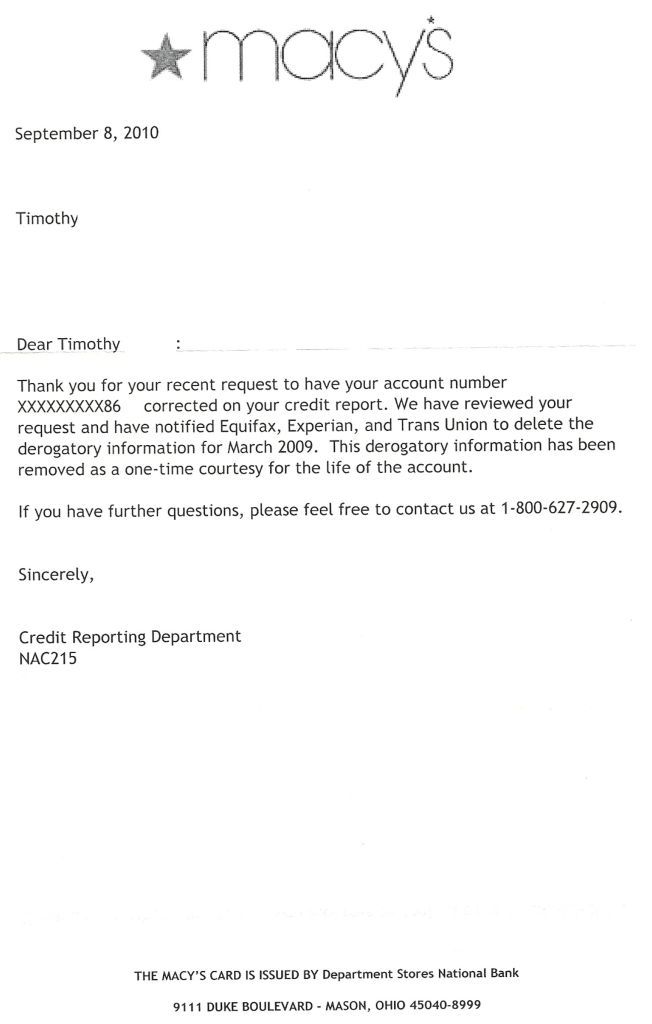

Request Goodwill Deletion From Capital One

If you would like for Capital One to remove the collection entry from your credit report, try asking nicely.

The direct phone number for Capital One is 1-800-955-7070.

If you have already paid off the debt and would like for the entry to be removed, asking Capital One directly can sometimes yield results without the frustrating back and forth.

Explain the reason for your tardiness on your bill. If you had an extenuating circumstance, such as job loss or injury, they might remove the entry out of benevolence, even wave the late fees.

When asking for a goodwill deletion, be sure to be kind and truthful.

While a collection agency is more likely to delete a collection report if you missed your bill for a special circumstance, lying to them will not make your life any easier. If fact, it may work against you.

Again, this will typically only work if you have already paid off your debt. If you havent made any payments, your request will likely be ignored.

Don’t Miss: Are There Any Real Free Credit Report Sites

How Will A Charge

Your credit score is a direct reflection of your financial habits. Thats why people who pay their bills on time and dont carry a balance from month to month typically have good credit. Having a charge-off on your account is one of the biggest financial missteps, so it will have a major impact on your credit score.

A charge-off can cause lasting damage to your credit score, as it takes up to seven years for it to fall off of your credit report, according to Tayne. However, your score will likely start to dip the moment you miss a payment, and continue to go down with each passing month that you dont pay, she adds.

What Happens If You Dont Pay The Charge

Unpaid charge-offs show as outstanding debt on your credit reports. It makes it extremely difficult to get approved for mortgage or auto loans, credit cards, apartments, and more when you have outstanding debt.

The creditor or debt collector will continuously try to obtain the owed money from you and might even try to sue you for the debt . After seven years, the charge off will no longer show on your credit reports, but you still technically owe the money.

The statute of limitations for debt varies by state. After your states limit has passed, collection agencies can no longer threaten to sue you.

Related:

About the Author

Riley Adams is a licensed CPA who works at Google as a Senior Financial Analyst overseeing advertising incentive programs for the companys largest advertising partners and agencies. Previously, he worked as a utility regulatory strategy analyst at Entergy Corporation for six years in New Orleans.

Riley holds a Masters of Science in Applied Economics and Demography from Pennsylvania State University and a Bachelor of Arts in Economics and Bachelor of Science in Business Administration and Finance from Centenary College of Louisiana.

Disclaimer

I have not been compensated by any of the companies listed in this post at the time of this writing. Any recommendations made by me are my own. Should you choose to act on them, please see the disclaimer on my About Young and the Invested page.

Recent Posts

Also Check: How To Report Car Payments To Credit Bureau

Beware Of Forced Arbitration Clauses

If you choose to download your credit reports online, look out for a forced arbitration clause! The credit reporting agencies have been sneaking these in the fine print when you download your report. Lets say you have proof that something on your report is being reported in error, and the credit reporting agency decides they WILL NOT remove it. These clauses say you agree to go to arbitration if there is a dispute and you WILL NOT SUE THEM.

If they do have an arbitration clause, immediately send them a certified opt-out letter stating you do not agree to be bound by this clause. In 2016 TransUnion was successfully sued because their forced arbitration clause was buried in the fine print on their site. It was somewhat unclear that the clause pertained to downloaded credit reports. So forced arbitration has been fought successfully. But why go thru all of that trouble. Read the fine print and if you find an arbitration clause . Opt out!

Confirm The Age Of Sold

One point that confuses even the experts: No matter how many times a debt is sold , the date that counts for the seven-year credit report clock is the date of delinquency with the original creditor.

If a collection agency bought your 10-year-old retail card debt and has started putting it on your credit report with a different date, thats a no-no.

Why this is important: Again, its the original date of when the debt was incurred that determines when it falls off your credit report. You want that to be as accurate as possible.

Who this affects most: Those with older debts are more likely to have their debts sold to a collection agency.

Don’t Miss: How Often Does Wells Fargo Report To The Credit Bureaus

Can You Be Sued For A Charge

Selling your debt to a collection agency isnât the only option a creditor has, though. Lenders also can sue you in civil court to get you to pay the balance. Debt collectors can sue you, too, if theyâve purchased your debt from the lender.

You may not face a lawsuit right away: Creditors may wait up to 18 months before filing a case against you. But it can happen in as little as six months, as well.

If you receive a summons to appear in court, you usually will have 30 days to respond. If you donât respond, the court may grant a default judgment in favor of the creditor, allowing them to garnish your wages or bank account.

The good news is that most creditors want to avoid the cost of going to court and can be open to a settlement if you show a willingness to negotiate.

Remove Inaccurate Late Payments W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today

Also Check: Is 663 A Good Credit Score

How Collection Agencies Acquire Your Debts

It’s important to note that debt collectors buy debt for pennies on the dollar. When an original credit account is very delinquent, it’s viewed as unlikely to ever be paid. This type of debt is typically sold to a collection agent at a steep discount.

For example, say a debt buyer pays just $0.04 for every dollar of a debt’s face value. If that debt was $5,000, a debt collector would pay around $200 for it.

Because the debt collector paid so little to buy someone’s debt in this scenario, there would be significant room to negotiate a settlement. It’s not uncommon for a $1,000 collections account to be settled for $300 or so, for example.

How To Avoid Repossession

Even if youve missed payments and been threatened with a repo, you could still avoid this outcome.

But you have to communicate with your lender before youve missed a long string of payments. Lenders dont want to repossess your vehicle. They almost always lose money when they have to cancel a loan and reclaim the car.

Because of this, a lender will usually work with you to avoid repossession. You could refinance the car for lower payments or maybe even skip a payment, with permission, to help you catch up and start making timely payments again.

The key is to get ahead of the curve. Once the banks designee has shown up at your door with plans to drive off in your car, youre almost out of options.

Read Also: What Hurts Your Credit Score The Most

What You Can Do About Late Payments On Your Credit Report

While having late payments on your credit report is tough, there are ways to minimize the impact â and protect your credit. Things like:

- Write a goodwill letter – Writing a goodwill letter explaining your situation and taking responsibility is one method to get a late payment removed. However, creditors don’t have to accept it, and it often works best if you already have a good credit history.

- Negotiating a settlement – Another way to get late payments removed is to negotiate a settlement with the collection agency. Agreeing to pay a partial settlement or the debt in full may get the mark removed, but be sure to get everything in writing first.

- Dispute errors on your credit report – If a late payment shows up on your credit report as an error, you have the right to dispute it. Disputing unverified debt yourself means contacting credit bureaus, which is a lengthy process.

- Partner with a credit repair pro – Checking your credit report for errors and disputing them yourself is challenging. Working with a credit repair expert is an easier alternative to fixing your credit yourself.

Will Capital One Remove Charge Off

Answer

A charge-off is a negative mark on your credit report that occurs when you fail to make a payment on a loan or credit card. A charge-off may remain on your credit report for up to seven years, and it can seriously damage your credit score.

Capital One will not remove a charge-off from your credit report, but you may be able to get it removed through dispute resolution.

Also Check: How To Get A Detailed Credit Report

Why Are Repossessions Bad For Your Credit

Of all the negative marks that can build up on your credit report from late payments to missed payments to high loan balances a repossession can have the biggest negative impact.

A repossession means you probably missed three or four car payments in a row and didnt respond to phone calls and letters from your lender. It means your lender has lost money on your loan.

Plus, for you, repossession isnt the only negative mark that results from the ordeal. Your credit history will also show the monthly payments you missed leading up to the repossession.

If the lender hired a collection agency, the same debt may appear twice on your credit file, exacerbating the problem even more.

Thats why a repo could drop your FICO credit score by 100 points and possibly more.

How Long Do Collections Stay On Your Credit Report

Collections and charge-offs stay on your credit report for seven years. The clock starts on the date of delinquency. When the collection or charged-off account first appears in your credit file, your score will take a big hit. The better your score was, the bigger the hit will be. If the creditor has already been reporting late payments on the account for several months, your score might not be hurt much more when the account is converted to a collection account or reported as charged off.

The damage to your credit score diminishes over time, especially after the first two years. At that point, the negative account will have a smaller and smaller effect on your score.

Don’t Miss: How Long Do Things Stay On Credit Report Canada

Can I Remove Capital One Na From My Credit Report With A Pay

Even after you pay off debt in collections, it can still be reported as a negative item on your credit report for years. You can attempt to remove it from your credit report by sending the collection company a pay for delete letter. A pay for delete letter is a negotiation tactic where you offer the collection company to pay off your entire debtoften morein exchange for removing the negative item from your credit report.

If youre considering sending a pay for delete letter, make sure you have the funds to pay off the amount in collections. We also recommend that you research if your collection company has been receptive to pay for delete letters in the past.

Wait For It To Go Away Naturally

Negative information will remain in your credit history for several years, the length of which depends on the incident and credit bureau. Common examples of negative information include:

- Late/missed payments = 6 years

- Consumer proposals = 3 6 years

- Bankruptcies = 6 14 years

In these cases, the simplest way to deal with the negative information is to wait until Equifax and/or TransUnion clears it from your report. As mentioned, whether the incident was intentional or accidental, neither bureau will remove it immediately, because it was technically your responsibility to pay your debts on time.

Read Also: What Is A Remark On A Credit Report

Will You Be Sued By Capital One Collection

Its always possible that you could be sued by a collection agency especially if you actually owe money on a neglected bill or account. Even if this is the case, though, its highly unlikely that an agency will actually go through the trouble of suing you unless you owe a lot of money.

Instead, focus on the matter of verifying and paying the debt and then cleaning up your credit report. That will do the most good for your financial status over the long term.

What Is A Collection Account

A collection account is what happens when a creditor has unsuccessfully tried to collect a debt from you for some time. Accounts usually don’t go to collections until they are three to six months old. In this case, what generally happens is the creditor sells your debt to a collection agency for pennies on the dollar. Then the collection agency assumes responsibility for collecting the debt. You get a collection letter and a big ding on your credit score.

Don’t Miss: Does Klarna Help Your Credit Score

File A Dispute With The Credit Bureaus

Unfortunately, if you were responsible for the incident, theres not much you can do. However, if you find an error or sign of identity theft on your credit report, you can file a dispute with the bureau that holds it . This can be done easily by completing the proper forms and mailing or faxing them to the bureau.

While you may have to fill out different forms or details with Equifax and TransUnion, the basic dispute process is similar and typically goes something like this:

- Once the bureau receives your forms, they will review your claim, as well as your personal and financial information to confirm your identity.

- For the dispute to be taken seriously, be sure to provide any proof you have that shows that the incident was not your fault

- Next, one of their agents will investigate your case, which could involve contacting the business or lender that you claim has reported the error.

- If the error was the bureaus responsibility or your identity was stolen, the matter will be resolved internally .

- If your dispute is acceptable, the bureau will inform you of the results, then update the appropriate documents.

How To File A Dispute With TransUnion?

You can initiate a dispute with TransUnion online, by phone or by mail.

TransUnion Consumer Relations Department

P.O. Box 338, LCD1

TransUnion Centre de relations au consommateur

CP 1433 Succ. St-Martin

Laval, QC, H7V 3P7

How To File A Dispute With Equifax Canada?

Equifax Canada Co.

Box 190 Jean Talon Station

Montreal, Quebec

H1S 2Z2

Re: Capital One Charge Off Help

I’ve been in this situation before, as I had a CO with Cap One. They usually work with a CA, but the CA doesn’t own the debt. What I did was make an offer to settle on the remaining balance. The reporting was updated to “settled in full” and the balance updated to $0.

Did this help my scores? Absolutely. My scores went up around 20 points. What paying/settling on a CO does is two things: it stops monthly reporting and it improves your UTIL. COs are factored into your UTIL, based on the original CL of the account.

As for PFD, Cap One won’t do them. GW Removal is very rare for Cap One, especially in cases of COs. I tried periodically, but I basically just had to let the CO age off .

Good luck, OP!

619 798

wrote:Thanks guys!!! I guess my biggest fear is that they will not report the account as settled and will report it as settled/charged off which isn’t any better than it reporting as CO. It’s like I’d be paying for no improvement.Any recommendation to make sure they mark it as settled or payed off?

In my situation, ARS sent me letters that clearly stated that my payment would settle my account in full. They should just offer this, but you can always request this. If they fail to update your CRs timely , you could always use the letters to open disputes with the CRAs

619 798

They’ve improved on this in recent years. In past years, that wasn’t the case. Anyway, GW efforts are worth it you’ll never be any worse off after asking.

619 798

Read Also: Does Klarna Report To Credit Bureaus