Should I Ask Someone To Co

If you find yourself on the other side of this equation and in need of a co-signer, you should carefully consider your options. This may be a signal that you should reconsider the loan. It may be a better financial decision to save enough money to make the purchase without a loan. You should also take steps to fix any problems on your credit report that prevented your approval.

However, if you absolutely need the loan or were denied because you’re young and have yet to establish a credit history, a co-signer might be a good option. In this case, look for a co-signer who is financially responsible. If you do run into trouble on your payments, that person will have to pay on your behalf. If they don’t, you’ll be responsible for the loan.

When you use a co-signer, make sure you understand the terms and conditions of the loan, such as when your co-signer would be notified of your inability to pay, and which of you would be responsible for missed payments.

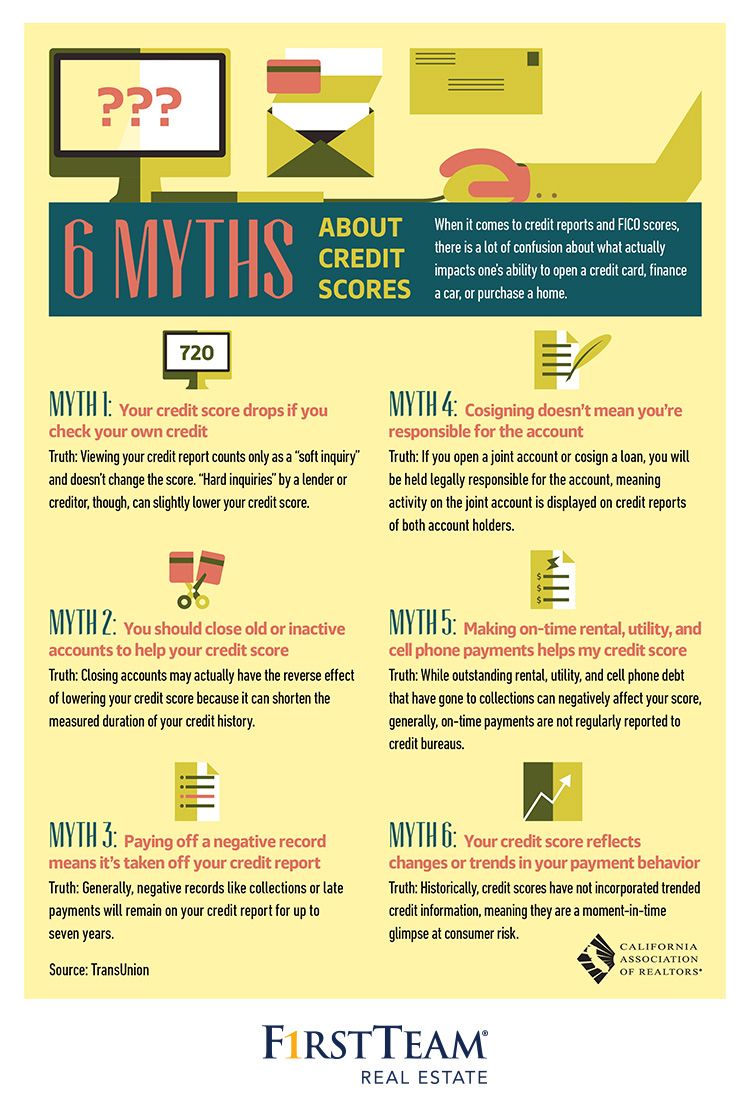

Can Cosigning A Loan Affect Your Credit

Cosigning for a loan can potentially hurt your credit with few rewards to offset this risk. The primary borrower will receive a boost to their loan application and the use of the funds. However, the cosigner is unable to use the loan for their own purposes and leaves their own credit in a vulnerable position.

Lets take a closer look at how your credit can be affected by cosigning a loan.

Equal responsibility for the loan. When you agree to cosign a loan, you are agreeing to pay off the loan if the primary borrower cannot pay it back. If a primary borrower requires a cosigner, then they likely have a poor credit history or a very short credit history. In either scenario, you are trusting that the primary borrower will repay the loan. If they dont, then you will be on the hook for the outstanding amount. Once youve cosigned on a loan, that loan will appear on your credit report and affect your credit score just as though you were the primary borrower, said Logan Allec, a certified public accountant in Los Angeles. Every negative and positive move of the loan repayment process by the primary borrower could affect your credit.

Your Ability To Borrow Money Is Affected If You Co

Your ability to borrow money for yourself is affected when you co-sign for someone else to get credit. This is because a co-signed loan is treated as if you had borrowed the money for yourself. When you apply for your own credit, lenders will consider the fact that you could have to make payments for the co-signed loan at any time.

The bottom line is that co-signing for someone else could get your own application for credit declined, which could set your financial goals back.

You May Like: Syncb/ppc Account

Do You Want To Take On A Long

Youll be responsible for repaying the loan throughout its entire term if your loved one defaults unless the person you co-signed the loan for refinances the car loan. This might give the original applicant the option to remove the co-signer from the loan. If they improve their credit by making on-time payments and paying down their debt, they might be able to refinance their car loan in the future. At that point, they might be able to remove you as the co-signer by refinancing the new loan in their name only.

An Unusual Time When Co

If you have no credit score and a financially-able close relative, you both may benefit from a co-signing arrangement.

In a case described by one of the major U.S. credit reporting bureaus, a lucky person with no creditnot bad creditwas able to find an auto loan for 0% interest. The loan was made in the relatives name and with her as a co-signatory. In this example, the lucky person was able to start building a credit score because of the help of the trusted relative. If you find yourself in a similar situation, it might be worth discussing such a plan with relatives rather than despairing at the prospect of not being able to take out a loan at all.

Co-signing a loan is fraught with risk and can cause a lot of stress. If all goes well, however, it could also be a positive experience that strengthens personal bonds. Just be sure that you fully understand the potential pitfalls before you agree to co-sign. And remember, if you are not completely comfortable with the arrangement, dont be afraid to say No. You may end up saving an important relationship.

Read Also: Remove Credit Inquiries In 24 Hours

Possible Disadvantages Of Cosigning A Loan

Who Can Be A Cosigner

A student loan cosigner is usually a parent, but not always. Anyone with good credit can be a cosigner, including a spouse, guardian, relative, or friend.

In general, these are the eligibility requirements to be a cosigner:

-

Must be a U.S. citizen of legal age, cosigning without duress

-

Only one person can be a cosigner for a private student loan

-

Must agree to be equally responsible for repaying the student loan in full

You May Like: Affirm Financing Credit Score Needed

When Can Cosigning Hurt Your Credit

When you cosign a loan, credit card or rental agreement, you take on a legal obligation to make payments if the primary borrower can’t or doesn’t follow through. Cosigning may hurt your credit if:

- A payment is over 30 days past due. The creditor can report the late payment to the credit bureaus. Every late payment can then show up in your credit reports and hurt your credit scores.

- The cosigned vehicle is repossessed. If the vehicle you cosigned for is repossessed, that can also hurt your credit regardless of whether you used the vehicle.

- The account is sent to collections. A collection account can hurt your credit even if you weren’t aware that the primary borrower was behind on payments. This can happen with rental agreements as well, even when the landlord wasn’t reporting the on-time rental payments.

Opening a new account can also hurt your credit scores if it adds a hard inquiry to your credit report and brings down the average age of your accounts. These are relatively minor scoring factors, but you may see a dip in your scores right after the account is opened and reported.

Keep An Eye Out For Trouble

If you have co-signed on a loan, check your credit reports from TransUnion, Equifax and Experian regularly to see how the other person is maintaining the account. If you notice a late payment, call the person and talk about his/her financial situation. Addressing a potential problem early can help prevent credit problems later.

Now that you know more about the hazards of co-signing on a loan, get your Credit Report & Score.

You May Like: Procedural Request Letter To The Credit Bureaus

How To Know If Cosigning Is A Good Idea

If youre having trouble deciding whether to cosign, think about what likely effect the cosigned account will have on your credit scores. If youre at all concerned about your friend or family members ability to pay, and are not in a position to cover all of his debt in the event that he starts defaulting, dont cosign. It is best to only cosign with a close friend or relative that you know is trustworthy.

Remember: The cosigned account will affect your credit report and scores no matter what because ultimately you are just as responsible for the debt as your friend or family member. If you are a cosigner on someone elses account, its very important that you check your credit reports . And by monitoring your credit score regularly which you can do for free once a month using any unexpected changes in your score could point to potential problems with that account. By being aware of potential problems with the cosigned account, youll be better able to help prevent even greater damage to your credit.

Should You Cosign A Loan For Friends And Family

Cosigning a loan puts your hard-earned savings and your hard-won credit score at risk.

But how do you say no when a friend or family member you love asks you for help?

Maybe you dont. Maybe you say yes. But be sure you read to the end of this article first. At least youll then know what youre putting on the line.

Also Check: Aargon Collection Agency Ripoff

Care For The Relationship Too

But is that enough? Only you can decide, based on your knowledge of yourself and the one you love enough to lend your good credit.

If you have grounds to suspect that person might let you down, say no to cosigning. Because beyond the financial risk theres also a risk to your relationship.

Might your friend or relation avoid seeing or speaking to you if he or she feels guilty about the damage to your credit?

Might you end up feeling resentful every time you see a social-media post where that person you cosigned with is out in a bar, or in a restaurant, or taking a weekend break or vacation?

Its appropriate to have these concerns. You may well still think that agreeing to be a cosigner is the right thing to do. But at least you now know whats at stake.

The Difference Between Co

A co-borrower is different from a co-signer because the co-borrower has a right to the property or money that is part of the loan, whether its an auto, home or personal loan. In contrast, a co-signer does not get any rights to the property covered by the loan.

For example, spouses often co-borrow on mortgage loans, and business owners might go in together on a personal loan that helps their business. As with co-signing, both parties are responsible to pay back the loan, but the property obtained by co-borrowingsuch as a car driven by both spousesis likely used by both.

Recommended Reading: Can A Closed Account On Credit Report Be Reopened

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Ask About A Cosigner Release

Some loans include the option for a cosigner release. Ask the lender if they do and find out what the requirements are.

The primary borrower might have to make a certain number of payments on time. Find out what the requirements are before you sign and make a plan to release yourself as soon as those are met.

Many lenders dont offer the option, so its in your best interest to shop around and find one that does.

Recommended Reading: Does Kornerstone Credit Report To The Credit Bureaus

Does Cosigning A Student Loan Affect Credit

Cosigning a loan impacts both you and your childs credit score. Any party who applies for the loan gets a hard credit pull, which can temporarily cause your score to dip a few points.

Luckily, after a few months, your credit will likely head back up, assuming all else stays normal. You may want to limit applying for new credit, like a credit card or another loan, soon after cosigning a private student loan. This will help keep your hard inquiries low, so your credit wont be impacted as much.

A private student loan can help your credit in a few different ways, including:

- Adding to your credit mix. A private student loan diversifies the type of credit you have, which can increase your score. Showing off both revolving credit and installment loans looks healthy to credit bureaus.

- Having new credit. While the longevity of your credit history is important, so is adding to it. Even though it has a low impact, new credit can sometimes give your score a boost.

Aside from a hard inquiry, private student loans can hurt your credit in ways like:

Why Cosigning Is A Bad Idea For The Borrower Sometimes Too

What happens to a loan youve cosigned if you die or go bankrupt? In some cases, it could automatically go into default and become immediately payable in full. And that might often leave the borrower in an impossible position.

Back in 2014, the CFPB highlighted this issue for student loans. Most private ones were cosigned, usually by a parent or grandparent. And the regulator was receiving complaints from borrowers who were facing defaults as a result of cosigners deaths or bankruptcies even when their payments were current and their loans were in good standing.

The CFPBs advice? Get a cosigner release.

Some lenders offer a cosigner release after a specified number of consecutive, timely, monthly payments. But you have to apply for one. The idea is that the borrower has proven that he or she can sustain the loan without the cosigners support.

Fourteen months later, the Bureau issued a news release under the headline, CFPB Finds 90 Percent of Private Student Loan Borrowers Who Applied for Co-Signer Release Were Rejected. Ho, hum.

But dont let that put you off. Apply for a cosigner release the moment youre eligible if the loan agreement says you are. You may be among the 10% of lucky ones. And, if youre not, persistence may reward you.

Recommended Reading: How To Get A Repossession Off Credit Report

Evaluate What Problems Are Impacting The Credit Score

Are there a lot of late pays on loans or credit cards? Are above 50% of the available credit limit? Does the person have recent run-ins with collections? Are there accounts that should be reported in good standing that show a late payment or went into collections for non-payment? If yes, these need to be rectified in order to improve the score.

Can A Cosigner Be Removed From A Car Loan

Removing a cosigner isnt easy the primary borrower cant just take their name off the loan because its a binding contract. What they can do is refinance, but that can only happen if their credit has improved since taking out the original auto loan, which typically takes at least a year or two of on-time payments. Refinancing gives the primary borrower the ability to remove a cosigner, as well as possibly qualify for a better interest rate.

Refinancing requirements to remove a cosigner. If the primary borrower is considering refinancing, they need to be aware of these five things before sitting down with their lender:

You May Like: Paydex Score Chart