Next Steps: How To Recover If Your Account Is Closed

If youre worried about your credit scores dropping after an account is closed, you may want to consider these ideas.

- Getting a credit-builder loan If your account was charged off or closed because of delinquent payments, a credit-builder loan may help you establish a positive payment history and build credit.

- Rounding out your credit mix Getting a new loan just to improve your credit mix probably doesnt make sense. But if you dont have any open revolving accounts, you may want to consider getting a credit card. If you use it sparingly and pay the balance in full each month, you wont accrue interest on your purchases. And itll improve your credit mix, possibly helping to bring your scores up.

- If a revolving account was closed, reducing the balances on your remaining revolving accounts will help decrease your credit utilization rate, which may improve your credit scores.

- Have your rent payments reported to the credit bureaus Rent payments arent automatically reported to the credit bureaus. But you might be able to get them added by signing up for a rent payment service that reports your payment history. On-time rent payments might help lift your scores. But keep in mind that not all credit-scoring algorithms use them.

Why Do My Old Mortgage Accounts Still Show

If you have a mortgage that is sold or transferred to a new mortgage lender, both the account with the previous lender and the new account will appear on your credit report. The original account will show a status of “Paid” or “Transferred/Sold to Another Lender,” both of which mean the account is now closed. If the accounts were delinquent at the time they were sold to another lender, they will remain on the credit report for seven years from the original delinquency date. The original delinquency date is the date the account first became delinquent and was not brought current.

The same applies to store credit cards like the one you mentioned. When you open a credit account to receive a discount on your purchase, the lender can report that account to the credit reporting agencies. Simply closing the account does not make it negative, but any past-due charges prior to when the account was closed will still appear. Although you stated your purchase was made with cash or a debit card, some credit cards have fees associated with them. If those fees go unpaid, the credit card company can consider that amount past due.

What Is The Difference Between Derogatory And Delinquent

Derogatory remarks are worse than delinquent accounts foryour credit. Delinquent means youre simply late on the account but stillexpect to pay it off. Derogatory means youve stopped paying and will likelydefault.

The technical difference is usually 180 days. Accounts willbe marked delinquent until youre 180 days late on the payment but will switchto derogatory after that point.

Don’t Miss: How To Remove Child Support From Credit Report

Re: Collection Account Closed What Does It Mean

A closed status of a collection can mean various things, but in each case, it broadly states that collection on the debt is currently not active.

The most common meaning is that the debt collector no longer has active authority to continue collection on the debt.

That can occur if the debt collector owns the debt and then sells or assigns collection authority to another, or if the debt collector does not own the debt and their assigned collection authority is terminated by the owner.

In cases where a debt remains unpaid and the debt collector clearly has their collection authority terminated, CRA policy instructs the debt collector to delete their reported collection, so collections that are closed due to termination of collection authority on an unpaid debt should promptly be deleted, and thus not remain in your credit report.

A second common reason for reporting a closed status is payment of the debt under collection.

Once the debt is paid, there is no longer any basis for continued collection, and the debt collector should update the status to closed,and the current balance to $0.

However, unlike unpaid collections, closed status due to paid debt does not require deletion of the collection.

Once they have provided debt validation, they can then update the status back to Open.

How Long Will A Paid

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. Thats because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score.

You can check your free credit report on NerdWallet to see when an account is reported as being closed.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Read Also: Does Removing An Authorized User Hurt Their Credit Score

What Happens When You Close An Account

When you close an account, it’s no longer available for new transactions, but you’re still required to pay off any balance you still have due by paying at least the minimum due each month by the due date

After the account is closed, the account status on your credit report gets updated to show that the account has been closed. For accounts closed with a balance, the creditor continues to update account details with the credit bureaus each month. Your credit report will show the most recently reported balance, your last payment, and your monthly payment history.

What Is A Pay

A pay-for-delete letter is when you offer to settle a balance on a negative account in exchange for the debt being deleted from your credit report. The creditor or debt collector is not obligated to agree to your request, but it may be worth sending the request. If you’re sending the request to a collection agency, you’ll need to offer enough for it to be profitable for them to settle. There’s no way to know how much that is, though. If you’re close to the seven-year mark for the item to fall off your credit report, it may not be worth sending a pay-for-delete letter.

Don’t Miss: How Does A Repo Show On Your Credit

What Is A Closed Account On A Credit Report

A closed account on your is simply any credit tradeline that has been closed, whether it was terminated by the customer or the creditor.

There are several different reasons why an account may be closed.

If you dont use your account for several months, it could get shut down for inactivity. Photo by Hloom on Flickr.

If you dont use a credit card for several months, for example, you could get your credit card closed for inactivity. In this case, your credit report might say account closed by credit grantor for that account since the lender was the party who terminated the account.

Other reasons a credit card may be closed by the creditor include:

- The credit card issuer is no longer offering that type of credit card or is replacing it with a different card

- The credit card issuer determined that there was fraudulent activity on the account

- The card was stolen or lost

Consumers may also want to close their own credit accounts from time to time, in which case the account might be notated as account closed by consumer. As an example, if one of your credit cards increases its annual fee or if you no longer feel that the fee is worth it, you might decide to close that account.

Should I Try To Get Rid Of Closed Accounts On My Credit Report

Don’t try to remove a paid-off mortgage, car loan, credit card or other accounts from your credit report if they show a positive payment record. That good record will continue to help your credit scores.

If you have negative marks on the account, however, you want it off as soon as possible. You can use AnnualCreditReport.com to get free reports from the bureaus every 12 months to verify negative information has been removed as required by law. If a negative mark is lingering, you can file a dispute.

Many credit scoring models now exclude paid-up collections accounts. But because some lenders still use older scoring models, you may want to try removing collections from your reports.

Also Check: Does Paypal Credit Report To Credit Bureaus

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

How Long Will Derogatory Credit Last

Derogatory credit can follow you around for a long time. Some types of derogatory informationlike a bankruptcycan remain on your credit report for up to 10 years.

Most other derogatory informationlate payments and debt collection accountswill only remain on your credit report for seven years. Typically, these items will automatically fall off your credit report once theyre past the credit reporting time limit.

Only accurate, timely, and complete information can be included on your credit report. You can dispute an error or outdated derogatory item with the credit bureaus to have it removed from your credit report.

In some cases, having negative information removed can increase your credit score, but it depends on the rest of the information on your credit report.

Don’t Miss: Klarna And Credit Score

How Long Does A Derogatory Account Stay On Your Creditreport

Derogatory accounts will generally stay on your creditreport for seven years but can show for as long as 10 years for some accountsand in some states. This will usually depend on the laws in your state and thetype of debt.

Bankruptcies, the granddaddy of debts, will stay on yourcredit report for up to 10 years in most states while foreclosures and studentloans will drop off after seven years. Tax liens and simple late payments willgenerally drop off after seven years.

Its important to understand when the clock starts tickingon different types of derogatory accounts and how that affects when they dropoff your credit report. This is usually the date the late payment or other badmark was added to your credit but can also be the date of your last payment orwhen the collection agency took over. If you make a payment plan with thecollection agency or they file a change to the debt, that might start the clockover and it could be another seven years before it drops from your report.

Check your credit report and score with TransUnion credit monitoring. Get a 30-day free trial here.

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

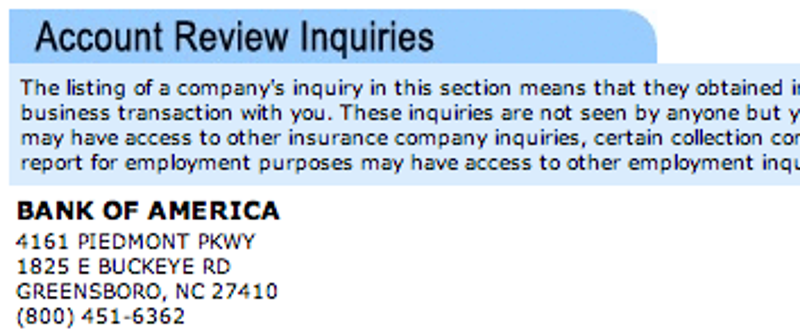

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Read Also: Does Paypal Report To Credit Bureau

Inactive Credit Card: Use It Or Lose It

Reading time: 3 minutes

Highlights:

- Paid accounts that are inactive may be closed by the lender after a certain period of time

- You may not be notified before this happens

- The cancellation may impact your debt to credit utilization ratio and your mix of credit accounts

You may not have given much thought to the credit card in the back of your wallet or in a drawer the one that was paid off and that you havent used in a while.

But after a certain period of time, which varies depending on the lender or creditors policies, they may consider your account inactive and it may be closed.

Remember that when it comes to credit, its important to show that you can handle financial commitments responsibly. A part of that is being able to use credit cards responsibly by paying them off regularly, on time, every time.

If you werent using the credit card, will the cancellation impact you at all? That depends on several factors, but here are some of the things you should know about account inactivity.

How long can my account be inactive before it’s closed?

It depends on the company. Accounts may be deemed inactive if there arent any new purchases on the card for a certain period of time. You may want to consider speaking with the credit card company with whom you have an account to learn more about its policies on account inactivity.

Will I be notified before my account is closed?

How does this affect my credit history?

What can I do?

Closed Accounts May Stay On Your Credit Reports For Up To 10 Years

One of the factors used to calculate your credit scores is length of credit history the longer the better. Old accounts in good standing remain on your credit reports for up to 10 years, which may increase the average age of your accounts and improve your scores.

But when the account falls off after 10 years, the length of your credit history may decrease, which could cause a temporary drop in your scores.

On the flip side, if you have a closed account with a negative history, such as delinquencies, the derogatory information in many cases will remain on your reports for seven years. While its there, it will negatively affect your credit history, but the impact on your scores can diminish over time.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Can I Have Closed Accounts Removed From My Credit Report

If you have closed accounts on your credit report that are not delinquent or hurting your credit, then there is no need to remove them. They may actually be helping your credit, even though they are closed.

Accounts that were closed in good standing should automatically fall off your after 10 years, while delinquent closed accounts will fall off your credit report after 7 years.

Closed Accounts And Credit Utilization

Use our tradeline calculator to calculate your credit utilization ratios.

Now that you know what a closed account is and why an account may be closed, you may be wondering what a closed account on your credit report means for your credit.

The main impact of closing an account on your credit is the effect on your utilization ratio. By closing an account, you are reducing your total available credit limit, which could increase your overall utilization ratio if you have balances remaining on your other accounts.

Therefore, if you have balances on any of your other cards, you probably dont want to close an account that is helping to keep your overall utilization down, as well as improving your ratio of low-utilization to high-utilization accounts.

On the other hand, if you pay down all your other credit cards to 0% utilization, you can safely close an account without impacting your credit utilization.

Try using our tradeline calculator to calculate your individual and overall credit utilization ratios and see how closing one of your accounts could affect your utilization rate.

Recommended Reading: How To Get Credit Report With Itin Number

What To Do If You Find A Closed Account On Your Credit Report

If you have a closed account on your credit report, what you need to do next depends on whether you know why it was closed and if the information is correct.

- No action required. If you asked the creditor to close the account or you paid off a loan, theres nothing necessary for you to do.

- Contact your lender. If you dont know why the account shows as closed, the creditor might be able to tell you. If your creditor closed it, you can ask if itll reopen the account, but its not required to. Either way, you know it wasnt a credit bureau error.

- File a dispute. If the lender didnt close the account or you dont agree with what its reporting, you can file a dispute with the credit bureaus. Youll need to explain in writing whats wrong, provide documentation that shows why you believe the information is inaccurate, and mail it to the credit bureau or bureaus. The Federal Trade Commission has detailed instructions on how to file a dispute.

How A Closed Account Might Affect Your Credit

The effect of account closure on your credit depends on multiple factors, including the amount of available credit youre using, the length of your credit history, the status of the closed account and the accounts that are still open.

Here are a few things to watch out for when an account is closed.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

How To Remove Derogatory Remarks From Your Credit Report

You have the right to remove any mistakes from your credit report under the Fair Credit Reporting Act . Under this law, credit bureaus are required to have procedures for investigating mistakes on your report and have a standard for accuracy.

That means you have the right to dispute all incomplete or inaccurate informationon your credit. Dispute forms are available online for each bureau TransUnion, Equifax and Experian. After you dispute an account, creditors have 30-days to respond or it will be removed from your report.

Of course, this doesnt help as much for legitimate derogatoryremarks. If there is a bad mark on your credit report because of late payment ordefault, there are a few things you can try to get it removed.

- Negotiate with the creditor to have it removed or marked as Paid in Satisfaction. This might mean offering to pay the entire balance in full or to get back on a payment plan.

- Ask the original lender to take the account back from collections and mark the account paid if you settle in cash.

- Dispute the derogatory account as a mistake. This can work for old and closed accounts if the lender doesnt take the time to respond to the credit bureau.

A derogatory account on your credit report doesnt have to mean the end of the world but you do need to understand how it affects your credit. Knowing the different types of derogatory remarks can help understand how it will hurt your FICO and how you can get it removed.

Read the Entire Credit Series