The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Keep Paying Old Bills

That old student loan may feel like an albatross around the neck, but years of on-time payments and the age of the account will boost your score. An account in good standing factors into your score until 10 years after it’s paid off and closed, so dont miss payments or pay late.

Pay off collection accounts, too, since the newest version of the FICO score ignores paid collections .

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

Read Also: Does Paypal Credit Report To Credit Bureaus

Pay On Time And Stay Within Your Limits

Lenders want to know they can rely on you to make regular repayments. A missed payment is likely to negatively impact your credit score.

Your payment history in the last 12 months will be most important to lenders. If you’ve missed payments in the past, but have since become more reliable, your credit score might not be affected as much as you think.

And spending near, or over, your every month is going to give the impression you’re struggling to manage your finances. So, try to keep within your limits.

Raising Your Score Depends On Your Starting Point

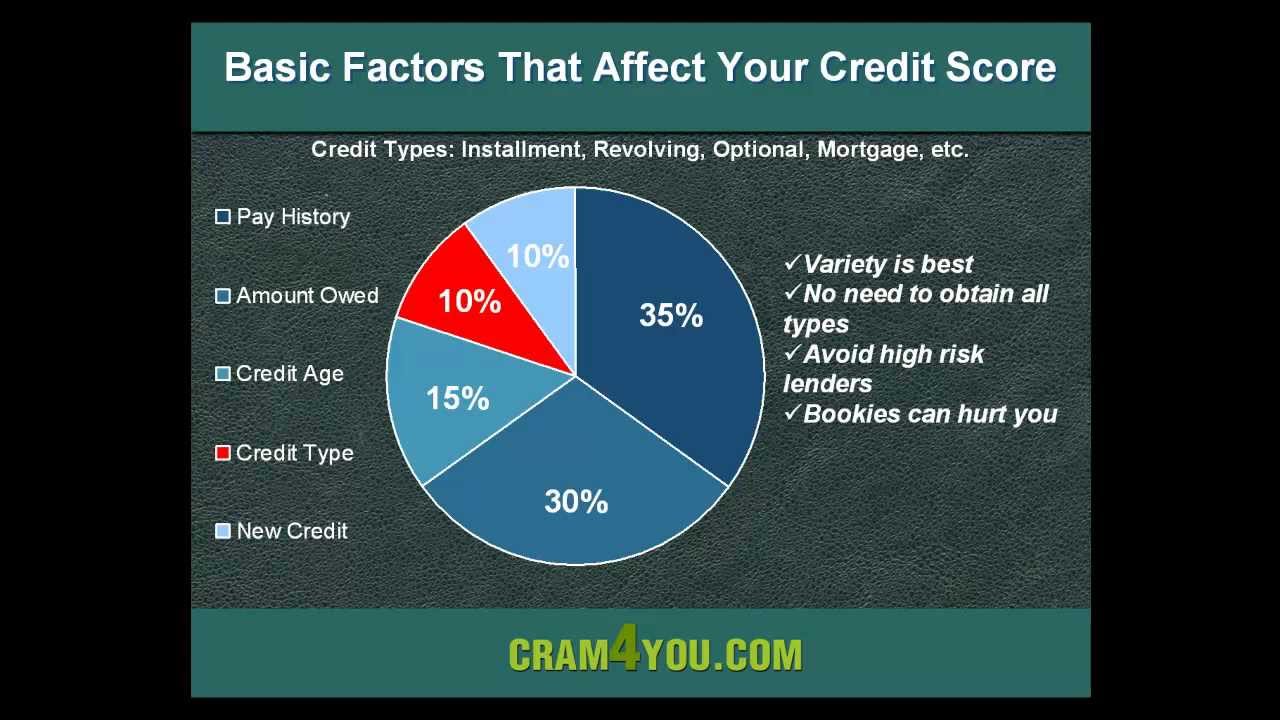

Your credit score isnt just a judgment call its determined through a formula considering five different factors. Listed in order of importance, each of the following factors can raise or lower your :

- Payment history

- New credit

With a history of consistent payments being the most influential factor, a great opportunity is offered to those new to credit cards. Every month you pay your cards bill on time will bump your credit score up, so set a routine and you can grow your creditworthiness quickly as long as you can avoid missing a credit card payment.

Your credit utilization ratio is how much of your total credit limit you use. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing. Opening up new card accounts or getting a credit limit increase can help build credit by decreasing this ratio, but that isnt all it takes. By making the effort to pay off your outstanding balances youll help your credit utilization, thus improving your credit score.

The length of credit history is fancy-talk for the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit. There are cases where canceling a credit card account is the right move, but as a general rule youll benefit from keeping old ones open.

Learn more:How to check your credit score

Read Also: Does Paypal Credit Affect Your Credit

Create Credit History By Choosing Different Forms Of Credit

If you havent borrowed funds in the past, you wont have a credit history, and as a result, your CIBIL score will be low. So, ensure that you borrow a healthy mix of credit, both secured and unsecured loans, of a long and short tenor to build a strong credit score. This will help you access low interest rates and higher loan amounts in the future whenever you choose to apply for a personal loan.

These are some habits that you can weave into your life to improve your credit score over time. However, it is essential to note that these steps will not lead to an immediate change in your score. After implementing them, it will take around 6 months to a year for your credit score to improve.

Bajaj Finserv brings to your pre-approved offers on all of its financial products such as business loans, home loans, personal loans, etc. With pre-approved offers, not only is the process of availing a loan simplified but it helps you save on time as well. You can check your pre-approved offer by simply adding some basic details.

*Terms and conditions apply

Costa Coffee To Shake

3 September 2021

Everyone should take time to manage their credit score, especially during this time of coronavirus uncertainty. It’s no longer just about whether you can get a mortgage, credit card or a loan, it can also affect mobile phone contracts, monthly car insurance, bank accounts and more. Here’s what you need to know about credit checks and how to boost your credit score.

Don’t Miss: Does Paypal Credit Affect Credit

You Don’t Have A Uniform Credit Rating

There’s no such thing as a credit blacklist. This is a myth. In the UK, there’s no uniform credit rating or score, and there’s no blacklist of banned people.

Each lender scores you differently and secretly.

This means just because one lender has rejected you, it doesn’t automatically mean others will. Though after a rejection, it’s always important to check your credit file for errors before applying again.

Of course, if you’ve got a poor credit history, or had problems, it can feel like you’re blacklisted. Credit scoring is intuitive would you lend to someone with a history of not repaying? However, on occasion there are firms that specialise in lending to those who have had past problems though they then charge a whacking rate.

The tools that lenders use to decide aren’t universal either. As well as your credit file, they also look at application information and any past dealings they’ve had with you, and use the three sources of information to build up a picture of you.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

Recommended Reading: Does Zzounds Report To Credit Bureau

What Is A Good Credit Score

There’s no single, universal credit rating or score that a lender will use when deciding whether or not to accept you as a customer. Neither is there such a thing as a ‘credit blacklist’.

The scores you may have seen advertised by credit reference agencies , such as Experian, are simply indicators of your creditworthiness, which is based on the information held in your credit report.

Each of the UKs three main credit reference agencies has a scale for what it considers a ‘good’ or an ‘excellent’ credit score.

- Equifax 531 to 670 is good 811 to 1,000 is excellent

- Experian 881 to 960 is good 961 to 999 is excellent

- TransUnion 604 to 627 is good 628 to 710 is excellent

While it can help to have a ‘good’ or ‘excellent’ credit score, on its own, its not a guarantee that all lenders will extend credit to you or treat you in the same way. Each lender has its own system for deciding whether or not to lend to you – meaning you could be rejected by one, but accepted by another.

If you have a low or bad credit score, you’ll more likely find you are turned down when you apply to borrow money and you should take steps to improve your score. Read on for 12 tips to improve your rating.

Find out more:how to check your credit score for free

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Read Also: Credit Score Without Social Security Number

Avoid Making Multiple Credit Applications In A Short Space Of Time

Every time you make an application for credit, a ‘hard search’ is carried out on your account and a mark is left on your credit report. If you make too many credit applications in a short space of time, this could negatively impact your credit score, as it makes lenders think you’re desperate for credit.

So if you’re rejected for credit, try to resist the temptation to apply multiple times. Instead, wait a while before you apply again. And before you do, check your credit report information is accurate to boost your chances of success.

Do You Have A Good Or Bad Credit Score

, which may range from 300 to 850, take into account a number of factors in five areas to determine your : your payment history, current level of indebtedness, types of credit used, length of credit history, and new credit accounts.

A bad credit score is a FICO score in the range of 300 to 579. Some score charts subdivide that range, calling bad credit a score of 300 to 550 and subprime credit a score of 550 to 620. Regardless of labeling, youll have trouble obtaining a good interest rate or getting a loan at all with a credit score of 620 or lower. In contrast, an excellent credit score falls in the 740 to 850 range.

Recommended Reading: Does Zebit Report To Credit Bureaus

Check Your Cibil Report For Mistakes And Rectify Them

In certain cases, CIBIL may make mistakes when it comes to updating your records, note incorrect information against your report, or delay recording details. This will also bring down your score. So, ensure that you check your CIBIL report from time to time. This will help you identify any errors and correct them by submitting a CIBIL dispute resolution form online. As a result, your credit score will improve. You can get your free credit score by simply adding some basic details.

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Read Also: What Credit Score Does Carmax Use

Ways To Rebuild Your Credit Score

Now that weve covered how long it takes to grow credit and how long it takes to recover from negative strikes, lets get into the fun stuff.

How to rebuild your credit!

First you need to know what elements make up your credit score. Weve already covered this topic in our What Credit Score Do You Start With? post, but to summarise:

-

Payment history

-

Length of credit history

-

New credit

Knowing this is a great way to know what will have the biggest effect, and thus what will be faster in rebuilding your credit score, i.e., lowering your credit utilization will rebuild credit faster than simply not taking out new credit cards .

Following on from that, lets get into the best ways to rebuild credit.

Register For Experian Boost

Experian Boost lets you add on-time phone, utility and streaming payments to your credit report, which could lead to a hike in your FICO® Score. It’s free, but it will only affect your Experian credit report and scores. The average Experian Boost user who sees a credit score increase improves their credit by 13 points.

Recommended Reading: How To Remove Verizon Collection From Credit Report

Get On The Electoral Roll

Getting on the electoral roll can help improve the way you’re viewed by lenders, and boost your chances of getting accepted for credit. This is because credit reference agencies are able to verify who you are, which can make you appear more stable to lenders. You can register for the electoral roll here. If youâre not sure if youâre registered, youâll need to check with your local authority which you can do here.

Figure Out How Much Money You Owe

Gather all your bills and come up with a plan to pay them off. The snowball method focuses on paying off the lowest balances first, while the avalanche method focuses on paying off the balances with the highest interest rates first. If you have too many credit cards to keep track of, you could also consolidate your credit card debt into one balance transfer card to make it easier to manage your monthly payments.All three strategies could help you pay off your credit card debt more quickly, lower your credit utilization ratio and raise your credit scores. So, choose the plan that works best for you, and stick with it.

You May Like: Does Paypal Credit Report To Credit Bureaus

How To Rent With No Credit

While itd be fantastic if everyone could have a perfect credit score, that simply isnt the reality. Credit scores exist entirely because your credit history can come back to bite you, possibly through no fault of your own.

We understand – sometimes circumstances largely out of your control will make you take a hit to your credit rating. Maybe you had a credit link to someone who declared bankruptcy, or maybe you inherited debts that you couldnt reasonably keep up with.

These things happen.

However, the following tips can help you to secure a new apartment without the need for a good credit score.

Before we dive in, its worth noting that all of these are part of negotiations rather than any set-in-stone rules. Some landlords will be happy to rent to you with a lower credit score if youre willing to pay more up-front, while others will steadfastly refuse.

Its a case of working out conditions that are acceptable to both you and the landlord.

What Can Affect How Long It Takes

Your score is determined by the three credit bureaus , but its up to your lenders to contact them to report information about you. It can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debt or decreased your balances. These are all positive influences on your score, but there may be a slight lag in timing due to the reporting process.

In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years. Unfortunately, the more harmful events are often the ones that stick around the longest, so its best to know what actions will be the biggest burdens:

| Chapter 7 bankruptcy | 10 years |

This may seem ominous, but heres the good news: recency bias is alive and well in the credit scoring world. Even if theyre still present, the old items that appear on your report have less weight than your newer ones.

You May Like: 611 Credit Score Mortgage

Make Your Rental Payments Count

Tenants sometimes pay out much more in monthly rental payments than homeowners yet still find it difficult to prove they could borrow and afford to repay loans such as a mortgage.

But now private, council and social housing tenants can get this record of making regular payments onto their credit report and improve their credit score via a rent reporting platform.

Council or social housing tenants should ask their landlord to report the rental payments they make to a free scheme called The Rental Exchange and information will appear on their Experian credit report.

Tenants renting through a private landlord or letting agent can also ask them to report rental payments to The Rental Exchange or they can choose to self-report via or Canopy .

Example of how rental payments will appear on an Experian credit report.

CreditLadder and Canopy use open banking, which allows them to track the rental payments being made each month through your current account – with your permission.

If you make your rental payments on time, getting your rent on your credit report is likely to boost your Equifax or Experian credit score.

How long will rent reporting take to boost your score?

However, lenders might be slower to factor rent reporting into their assessments of creditworthiness. In 2018, Which? asked major lenders how they would be using rental payments data for making lending decisions and many said they hadn’t incorporated the payments into their scoring yet.