Does World Finance Offer Payday Loans

No. At World Finance, we only offer personal installment loans. Payday loans only carry you until your next payday, when the repayment process begins. With a World Finance personal loan, you have the same monthly payment amount, your fixed interest rate will not change and the term of your loan is set from the beginning. Payday loans can charge you up to 700% APR. According to the Consumer Financial Protection Bureau, the majority of all payday loans are made to borrowers who renew their loans so many times that they end up paying more in fees than the amount of money they originally borrowed.

How Do I Pay My Loan

Customers can make a payment on their loan in 3 different ways: Online, over the phone, or you can visit your nearest branch to make a payment.

What Do You Need To Qualify For Loanme Personal Loans

To qualify for personal loans with LoanMe Personal Loans, applicants need a minimum annual income of $24,000 or higher. LoanMe Personal Loans will consider borrowers regardless of their employment status if they can prove their ability to repay their obligations.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. APRs for the LoanMe Personal Loans product fall outside of the MLA limits, and as a result, the product cannot be issued to these applicants. Active duty service members and their covered dependents are considered covered borrowers” under the Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by LoanMe Personal Loans. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Applicants must have an active and valid personal checking account

- Recent pay stubs

| – 850 |

Read Also: Does Having More Credit Cards Help Your Credit Score

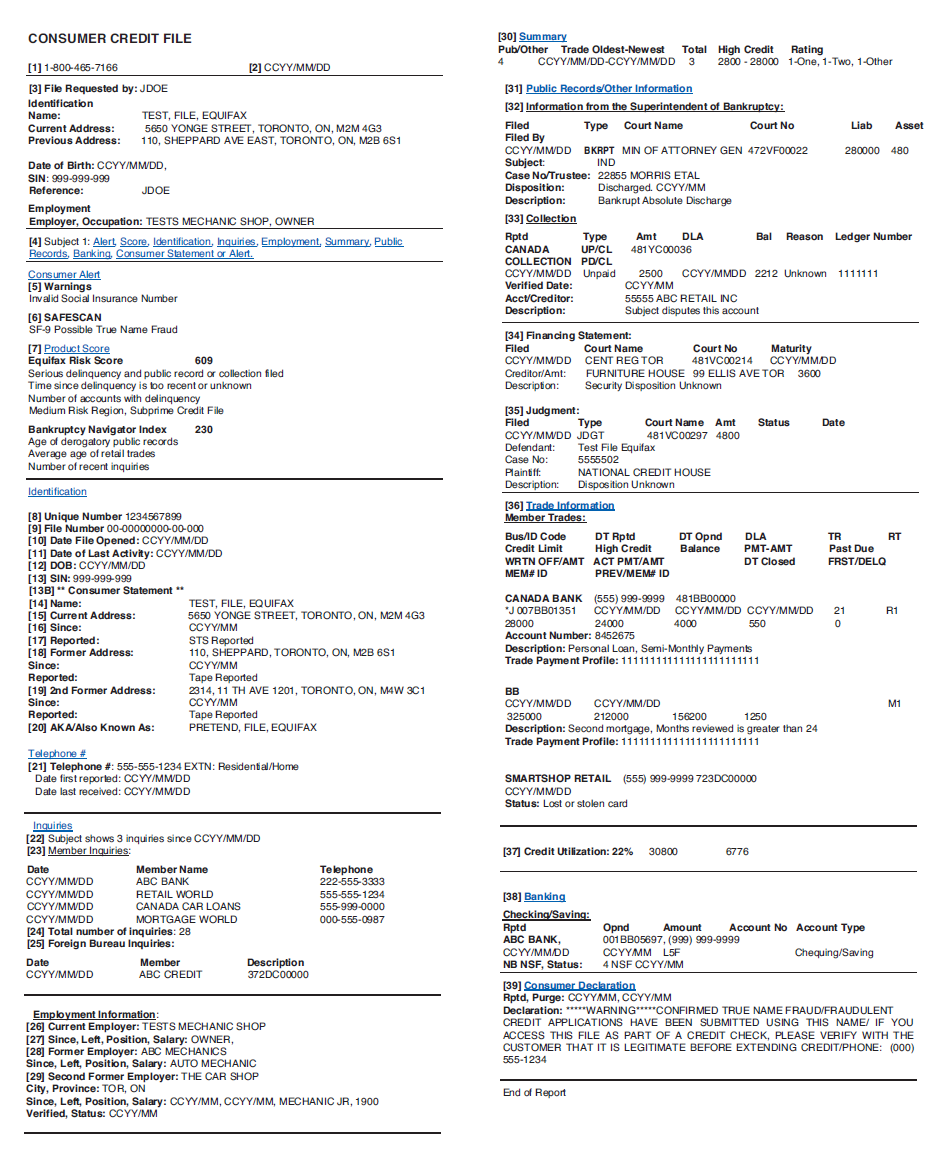

What Is A Credit Score

A credit score is a numeric figure that represents your credit risk at a particular point in time. The credit-reporting agencies, Equifax and TransUnion, use a scale from 300 to 900. The higher your score, the lower the risk for the lender, so it’s easier to get approved for a new loan.

Factors that influence your credit score include:

Easy Ways To Get Your Loan

After completing the inquiry, a Security Finance team member will contact you to discuss your loan needs. Should you choose to continue with a loan application, we will complete a verification and underwriting process to determine if you qualify for a loan in the amount you requested. Our personnel can assist in finding an installment loan within your budget and suited to your specific needs.

Don’t Miss: How To Report A Death To Credit Bureaus

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Can I Borrow More Money With My Personal Loan

In some states, customers who borrow less than their full approved amount or who have paid off a significant portion of their current personal loan may be eligible to top off their current loan amount with an additional disbursement amount. The existing loan balance along with the new disbursement will be refinanced into a brand new loan with a new contract and repayment schedule.

Eligible customers in the following states may be able to borrow more money: Alabama, California, Delaware, Georgia, Idaho, Illinois, Louisiana, Missouri, New Mexico, North Dakota, South Carolina, South Dakota, Utah and Wisconsin.

to your account or call us at 392-2014 to check if you’re eligible.

Eligibility requirements may vary by state.

Don’t Miss: Does Bluebird Report To Credit Bureaus

How To Get Your Credit Report And Credit Score

You can request your credit report at no cost once a year from the top 3 credit reporting agencies Equifax®, Experian®, and TransUnion® through annualcreditreport.com. When you get your report, review it carefully to make sure your credit history is accurate and free from errors.

It is important to understand that your free annual credit report may not include your credit score, and a reporting agency may charge a fee for your credit score.

Did you know? Eligible Wells Fargo customers can easily access their FICO® Credit Score through Wells Fargo Online® – plus tools tips, and much more. Learn how to access your FICO Score. Don’t worry, requesting your score or reports in these ways won’t affect your score.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Don’t Miss: What Credit Score Do You Need For A Conventional Loan

How Lenders Report To Bureaus

Each lender must have a paid subscription with each credit bureau it reports to. Experian, Equifax and TransUnion each have separate reporting systems. Since it’s not mandatory, a lender may choose not to report to all three credit bureaus. Each month your mortgage payment, if reported, is reported as paid on time, or late if the lender receives it 30 days or more past the due date. In most cases, if your payment is made before the 30-day period, the lender will not report it as late, even if you’re charged late fees.

What Your Credit Score Means

Your credit score reflects how well you’ve managed your credit. The 3-digit score, sometimes referred to as a FICO® Score, typically ranges from 300-850. Each of the 3 credit reporting agencies use different scoring systems, so the score you receive from each agency may differ. To understand how scores may vary, see how to understand credit scores.

Also Check: How Long Do Late Payments Stay On Your Credit Report

Building Credit By Paying Phone Bill Rent

Mobile phone service providers and landlords typically do not report payment information to credit bureaus, but they dont face as many regulatory barriers as utility companies. Many in the credit reporting industry believe more data on rent and cellphone bill payments could help consumers build or improve their credit. However, Experians Griffin said some consumer advocates are concerned that reporting this information could hurt those who dont always pay their bills on time.

We think the positive impact outweighs the potential negative impact for some consumers, he said. If you dont pay your cellphone bill and it goes to collections, it will be reported anyway.

Griffin said cellphone providers embrace of bill payment reporting may simply be a matter of them getting more comfortable with the process. Meanwhile, there are now online services, such as RentTrack, RentPayment and Rental Kharma, that allow consumers to have their on-time rental payments reported to the bureaus. TransUnion and Experian also have their own services that property managers and landlords can use to report renters payment histories.

We encourage people to talk to their landlords and have them report that information, especially if youre trying to establish credit for the first time or rehabilitate a credit history thats had some problems, Griffin said.

Requirements & Application Info For Loanme Personal Loans

Category Rating: 3.8/5

- Minimum credit score: Not disclosed, but LoanMe does consider applicants with bad credit.

- Minimum income: LoanMe personal loans have a minimum income requirement of $24,000, according to company representatives.

- Age: You must be at least 18 years old.

- Citizenship: You must be a U.S. citizen, permanent resident, or immigration-visa holder.

- Identification: You must have a Social Security number or Individual Taxpayer Identification Number. You must also have a valid ID.

- Bank account: You must have a verifiable banking account.

- Residence: You must live in one of the 21 states where LoanMe operates.

- Pre-qualification: LoanMe lets you see what rates you might qualify for online. Pre-qualification will not affect your credit score, though applying will.

- Ways to apply: You can apply for a LoanMe personal loan online or by calling 415-2775.

Recommended Reading: How Much Does Transunion Charge For Credit Report

Hiring A Collection Agency Or Credit Reporting Service

Loanme Personal Loan Rates & Fees

Category Rating: 0.8/5

- Overall APR range:9% – 98%. LoanMe personal loans tend to be very expensive, but the rates are fixed, so they will not go up or down over the life of a loan.

- How rates are determined: The exact rate you will get depends on many factors, including your credit score, state of residence, and choice of LoanMe personal loan options.

- Fees: LoanMe personal loans come with an origination fee of up to 10% of the loan amount. LoanMe also charges a fee of up to $15 for late payments. There are no penalties for repaying a loan early.

- Loan amounts & timelines: LoanMe offers personal loans of $1,000 to $30,000, depending on the state. Loan terms range from 12 to 84 months.

Recommended Reading: Can Student Loans Be Removed From Credit Report

How A Personal Loan Affects Your Credit Depends On How You Manage It Learn About Ways A Loan Could Help Or Hurt Your Credit

Whether you want to make a big purchase, consolidate high-interest debt or need cash quickly, you might be considering a personal loan. If you are considering a personal loan, itâs worth keeping in mind that it could have long-term effects on your âdepending on how you manage the loan.

But how exactly it could affect your credit scores is hard to predict. Thatâs because there are many different credit scoring models from companies like FICO® and VantageScore®. And it also depends on your own unique financial situation. But generally, a personal loan could either help or hurt your credit scores. Read on to find out how.

Can I Work With A Debt Management Company If I Am Unable To Make My Payments

You may work with a debt management company if you are falling behind on your payments or are experiencing financial hardship. However, we strongly encourage you to reach out to us directly before enrolling with a debt management company . We offer a variety of payment relief options directly to you that can help keep you on track and can answer any questions that you have without the need to engage a debt management company. Contact us at or call us at 877-392-2016.

3 Questions to ask yourself before working with a debt management company :

- For-profit DMCs typically charge fees for their services ranging anywhere up to 20-25% of your outstanding balance.

- To avoid additional fees, consider working directly with NetCredit or non-profit credit counseling services.

- Working with for-profit DMCs itself will not impact your credit score. However, the for-profit DMC that you work with may advise you to take certain actions that could adversely affect your credit.

- Depending on your situation, NetCredit has relief options that may allow you to stay on track with your payments without the need for a DMC.

If you cannot make your upcoming payment, please contact us immediately.

For more information about for-profit debt management companies, check out informative posts by the FTC and CFPB.

NetCredit 175 W. Jackson Blvd., Suite 1000 Chicago, IL 60604

Also Check: Will A Sim Only Contract Improve Credit Rating

How A New Auto Loan Can Impact Your Credit

Does it actually matter whether your new loan shows up on your credit report? It might. If you’re building or rebuilding your credit, a new auto loan can help you out in a few ways.

First, it adds to your . A car loan is considered an installment loana loan with fixed monthly payments and a predetermined payoff periodwhich is a different type of credit than a revolving credit card account. Having a car loan appear on your report shows creditors that you have experience managing diverse types of credit. It may also boost your credit score: Credit mix accounts for 10% of your FICO® Score, the scoring system used most commonly by lenders.

Your credit score will also benefit from having timely monthly loan payments show up on your credit report. Payment history is the most heavily weighted factor in calculating your score, so you want your monthly payments to count.

What are some typical reasons your new auto loan might not appear on your credit report?

So What Is A Credit Score

Its a 3-digit number that is a representation of your creditworthinessbasically, how likely you are to pay your bills on time and if you will be able to handle an increase in credit. The credit score most widely used by the credit bureaus is the FICO® score, which provides a credit rating range from 300 to 850. The higher your credit score, the more likely you are to be approved for credit. ;

Excellent Credit

720+

If your credit score is above 720, you have the strongest credit history and qualify for the best loan terms and interest rates.

Good Credit

680-719

With a credit score between 680-719, your credit score is good. You will qualify for most loans, and probably have a solid credit history with a few missed or late payments or a shorter credit history.

Fair Credit

640-679

If your credit is between 640-679, you may have blemishes on your credit report and you might be restricted to higher-than-average interest rates on loans.

Poor Credit

580-639

If you have several accounts in collections, are no longer paying back debt, or have filed for bankruptcy, your credit might be poor or in the 580-639range. At this range, it may be difficult to qualify for a loan. If you do qualify, you may be restricted to a loan with a high interest rate.

Bad Credit

<580

A score below 580 is considered bad. You will likely need help to rebuild your credit history. At this range, it may be difficult to qualify for a loan.

Don’t Miss: Does Annual Credit Report Affect Score