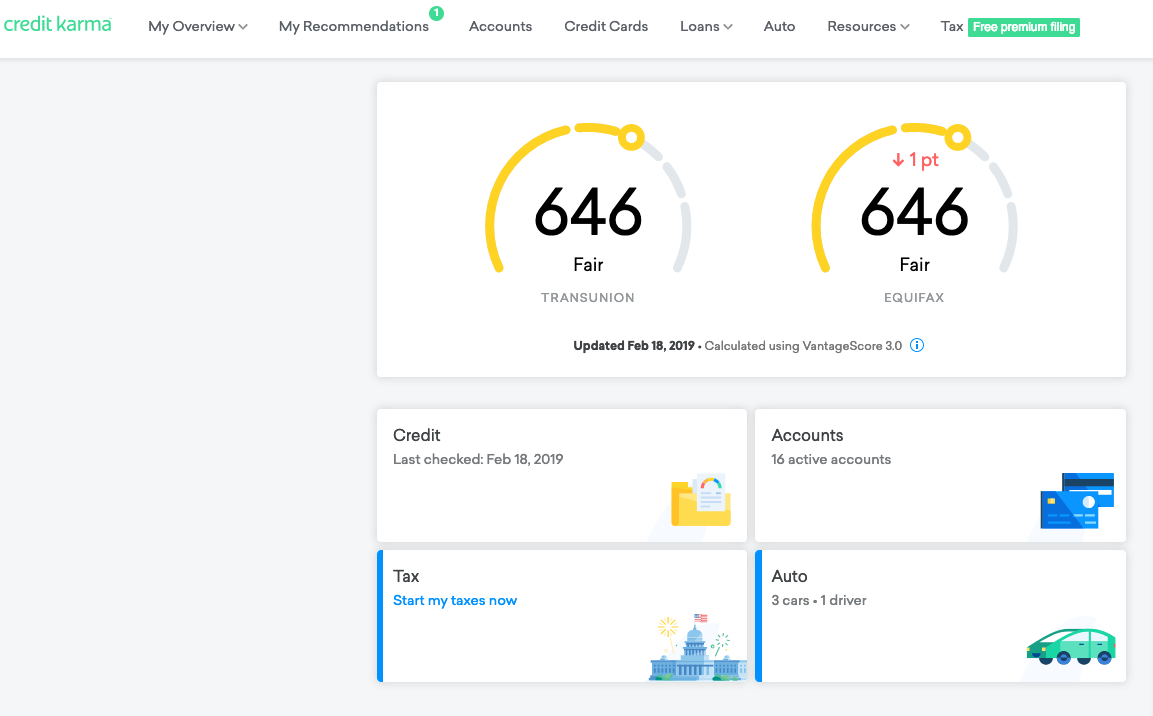

Huge Difference Between Credit Karma And Experian Score

Perhaps a more enlightened person can shed light on this discrepency: My Credit Karma TU and Eq scores have been holding steady at 605, while my Fico8 on Exprian’s site holds at 683! This seems like a huge gap. I’m currently at 95% util 15,000 total limit , no bads, 2 inquiries, 18 year oldest reporting…

What gives? Any thoughts would be appreciated

Thanks

Opening New Credit Cards All The Time

Tempted by the enormous signup bonuses;you can earn on rewards and travel credit cards? Theres nothing wrong with using credit to pursue rewards, but you may wind up with too much of a new thing.

New credit makes up another 10% of your credit score, mostly because each new credit application you make causes a hard inquiry on your credit report. Too much new credit can cause your score to temporarily drop, which could make it more difficult to qualify for loans with the best rates and terms in the future.

Why Is My Fico Score Higher Than My Credit Score Capcoa

Can be significantly different than your FICO Scores, Makes lending decisions Credit Karmas services are helpful, but some users might be in for an;

Apr 29, 2021 The difference between your FICO Scores scores and your Credit Karma scores can be quite extreme. There are reports of people with Credit Karma;

The biggest difference is the end user of the two services. CreditKarma is driven by people researching their credit scores. FICO is more typically used by;

Recommended Reading: How To Report Unauthorized Credit Card Charges

Why Is My Credit Score Different On Credit Karma

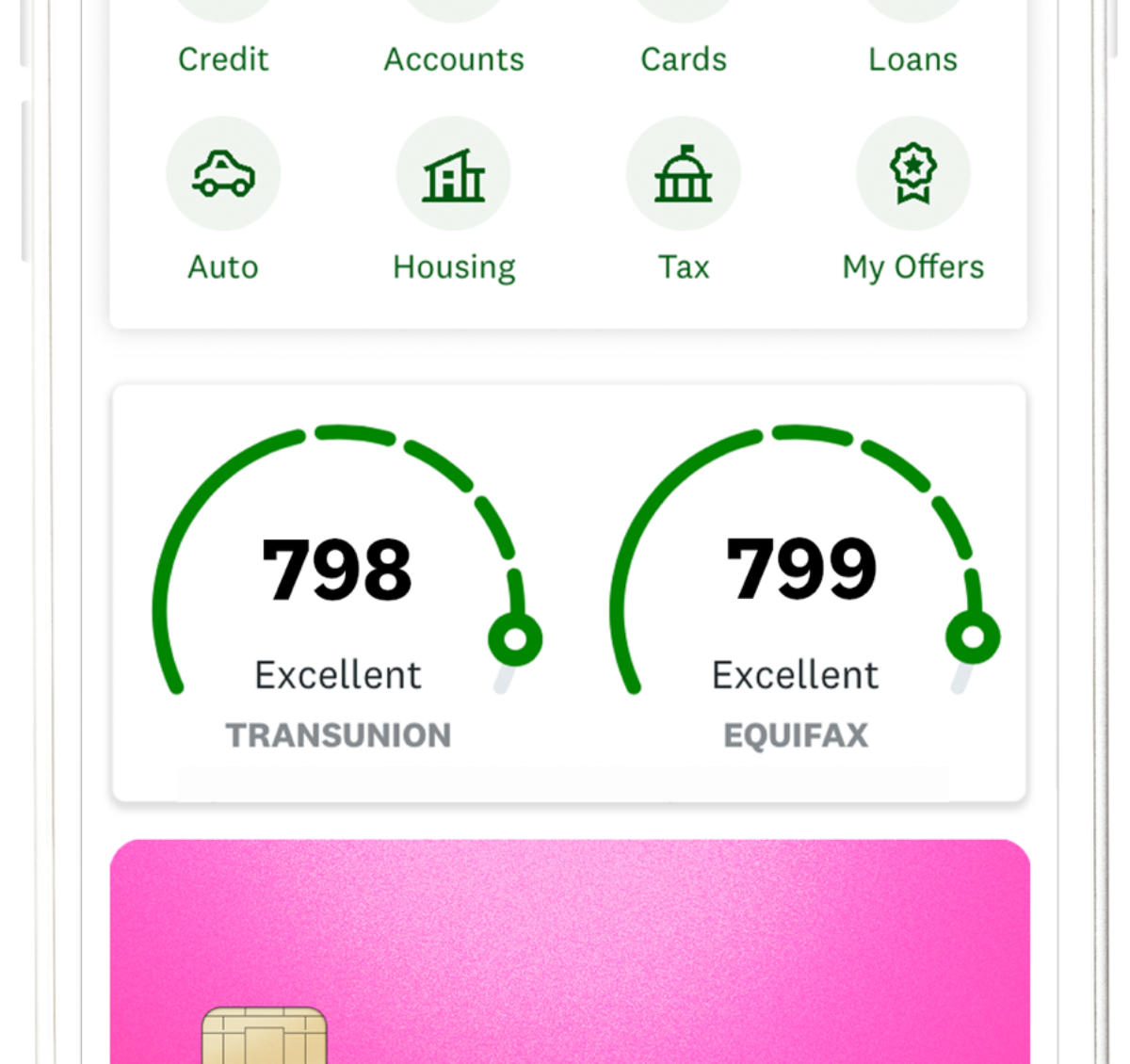

On youll see scores and reports from TransUnion and Equifax, both using the VantageScore 3.0 scoring model. And each scoring model weighs different credit factors slightly differently. When you apply for a financial product the lender may be looking at different credit factors to make a lending decision.

Why Is It Important To Monitor Your Credit Score

A good credit score can make your financial life easier. Youll have easier access to large loans such as a mortgage or auto loan with better terms. These terms can save you money over the long term and allow you to work towards your other financial goals such as retirement or building a safety net before deciding to work for yourself.

On the flip side, a bad credit score can lead to difficulty obtaining large loans with favorable terms. If you are able to secure a loan with bad credit, then you will likely be paying higher rates. Your higher payments can add up and make it more difficult to save for your other financial goals.

If you have plans to make a major purchase with the help of a loan, then you will want a good credit score. Consider whether or not you see a home purchase or auto loan in your future. If you do plan on making a major purchase with the help of a lender, then you will likely need a good credit score to make that transaction flow as smoothly as possible.

With that, is incredibly important to monitor your credit score. Not only can your actions have a big impact on your , but also mistakes on your credit report can lead to a misleading score. For example, if a creditor accidentally reports a defaulted loan on your credit report, it could lead to a big drop in your credit score through no fault of your own. That could lead to problems securing a mortgage or auto loan down the line.

Read Also: How Much Does A Car Loan Affect Your Credit Score

Learn More About Your Credit Score

A 650 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and reduced fees. You can begin by getting your free credit report from Experian and checking your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Does Checking My Credit Scores Affect My Credit

Checking your credit scores and reports on Credit Karma wont hurt your credit its a soft inquiry. In fact, keeping tabs on your credit scores is a good way to spot potential issues early. For example, if your scores suddenly drop, it could be a sign that theres an error in your credit report information or that you may be a victim of identity theft.

Don’t Miss: What Credit Report Does Comenity Bank Pull

How Often Does Credit Karma Update

Updates from TransUnion are available through Credit Karma every 7 days. Simply log in to your Credit Karma account once a week to understand where your credit score is at. If Credit Karma is not updating don’t worry, it can sometimes take up to 30 days for things to be reported to the large banks. From there it can take another two weeks for the lending institution to make the additional edits to your account.

The nice thing about Credit Karma updating the score every 7 days is that it allows you to keep a close eye on your score and the changes. You will see your current score and the update from past weeks, months, and more. With the weekly updates that Credit Karma offers you have a great opportunity to spot any potential problems before they arise.

In your account, your score will be updated and you will likely see the reasons as to why as well.;

Additionally, Credit Karma does a great job keeping you updated as to when things were ‘last reported.’ Meaning they will show you when they received their;most recent bit of data and made changes to your account.

One of the best features of the Credit Karma app is that it will alert you to any potential problems with your credit or credit score. Every time something happens or is reported to one of the credit bureaus Credit Karma is able to send out an alert to the user to alert them and ensure it is a recognized activity.;

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

If youre ready to use Credit Karma to monitor your credit score, check out its website by clicking below.

You May Like: Does Having More Credit Cards Help Your Credit Score

Thats Not What Credit Karma Said

Working in a branch, we have a lot of members that come in and are taken aback when we pull their credit score. They were diligent in monitoring their score through online services like Credit Karma or through scores given by their credit card provider, but when they came in to apply for a loan or credit card, their score is not what theyd expected. This is because the idea that each person has one true credit score is a fallacy. Credit scores and credit reporting can be complex, so lets break it down.

Disclaimer: The opinions expressed in blog posts are the personal opinions of the writer and do not necessarily reflect the views of Del-One FCU. Any reference to other sources of information, or links to other websites does not imply a recommendation or endorse the views expressed in those sources.

Whats In My Credit Reports

Your are records of your past dealings with creditors and other credit history. They include information such as your name, addresses, employers, the history and status of various credit accounts, and inquiries from companies checking your reports. If applicable, youll also find information from public records, such as bankruptcies, tax liens and civil judgments.

Also Check: Is 666 A Good Credit Score

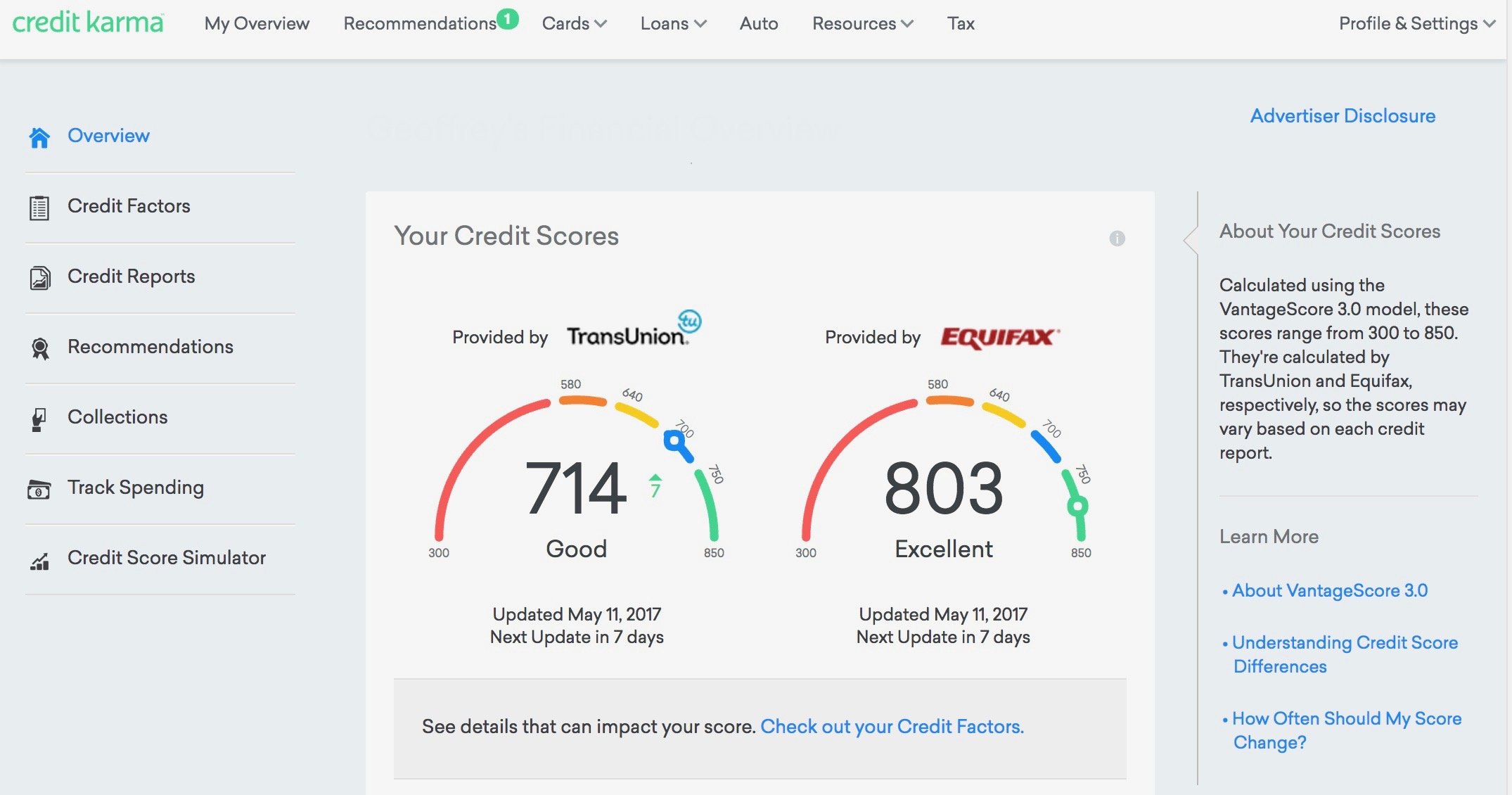

Why Are My Fico Scores Different For The 3 Credit Bureaus

In the U.S., there are three national credit bureaus that compete to capture, update and store credit histories on most U.S. consumers. While most of the information collected on consumers by the three credit bureaus is similar, there are differences. For example, one credit bureau may have unique information captured on a consumer that is not being captured by the other two, or the same data element may be stored or displayed differently by the credit bureaus.

A predictive FICO scoring system resides at each of these credit bureaus from which lenders request a FICO Score when evaluating a particular consumer’s credit risk. The FICO scoring system design is similar across the credit bureaus so that consumers with high FICO Scores on bureau “A’s” data will likely see a similarly high FICO Score at the other two bureaus. Conversely consumers with lower FICO scores at bureau “A” will likely get low FICO Scores at the other two bureaus when the underlying data is the same across the bureaus.

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference. However, there can be score differences even when the underlying data is identical as each of the bureau’s FICO scoring system was designed to optimize the predictive value of their unique data.

Keep in mind the following points when comparing scores across bureaus:

Estimate your FICO Score range

More Credit Karma Services

But, besides this free service, Credit Karma has other related services, including a security monitoring service and alerts for new credit checks on you. Outside of Credit Karma, many of the best credit monitoring services provide similar alerts and services.

And, once it has your personal information, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won’t pop up in your credit report on Credit Karma or anywhere else. A standard section of credit reports is “inquiries,” which lists requests for your report from lenders you’ve applied to for a loan.

You May Like: Does Closing A Credit Card Hurt Your Score

Is It Possible To Get An 850 Credit Score

Getting an 850 credit score is possible, but uncommon. Only about 1% of all FICO scores in the United States are 850, according to Experian. Those with credit scores of 850 generally have a low credit utilization rate, no late payments on their credit reports and a longer .

But keep in mind that having perfect credit scores isnt necessary. You can still qualify for the best loan rates and terms if your credit scores are considered merely excellent .

Ok But What About My Other Credit Scores

FICO Scores are just the tip of the iceberg. You may have dozens of other credit scores youre not aware of.

The other main scoring model youll run into is the VantageScore. The three major credit-reporting agencies Equifax®, Experian® and TransUnion® teamed up in 2006 to create the independently managed firm VantageScore Solutions, which just released the fourth and latest version of its credit scoring model, the VantageScore 4.0.

We know this is a lot to take in, but dont panic. While each of these credit-reporting agencies calculates your credit scores differently, they all focus on how responsible you are with the money you borrow.

Recommended Reading: Is 739 A Good Credit Score

Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

Telling Credit Karma About Your Loans

Before you can use Credit Karma’s tools, you need to enter information about any loans you have beyond credit cards. If you have an auto loan, for example, you provide details about the year, make, model, and current mileage of your vehicle. The site creates a page for that vehicle that displays its current estimated value, as well as links to insurance and loan refinance options. You can also search for a new car and sell or trade your existing one. Credit Karma partners with Carvana for that last capability.

Home loans work similarly. If you supply information about any mortgages you’ve taken out, youll see your estimated home value and loan balance. If Credit Karma thinks you could get a better deal, it displays refinancing opportunities that might be attractive. Due to low interest rates, mortgage lenders are apparently swamped right now. You can turn on the new Refinance rate tracker and get notifications when Credit Karma finds a better rate. Similar tools are available for personal loans.

Two years ago, Credit Karma introduced what it calls a High-Yield Savings Account called Credit Karma Money. Of course, in these days of almost nonexistent interest rates, that yield amounted to 0.13% APY on the day I checked it. The account has no fees, and there is no minimum to open it. You can link one external account to your Credit Karma savings account by providing your online banking username and password.

Don’t Miss: Does Opensky Report To Credit Bureaus

Credit Score: Is It Good Or Bad

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score.

17% of all consumers have FICO® Scores in the Fair range

.

Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range. Lenders focused on “subprime” borrowers, on the other hand, may seek out consumers with scores in the Fair range, but they typically charge high fees and steep interest rates. Consumers with FICO® Scores in the good range or higher are generally offered significantly better borrowing terms.

How Many Points Off Is Credit Karma

The only possible answer is, a few if any. Your credit score can vary every time it is calculated depending on whether the VantageScore or FICO model is used, or another scoring model, and even on which version of a model is used. The important thing is, the number should be in the same slice of the pie chart that ranks a consumer as “bad,””fair,””good,””very good,” or “exceptional.”

Read Also: How Much Does A Hard Inquiry Affect Credit Score

Borrowell Vs Credit Karma Canada: Which One Is Better

In the past few years, credit scores have been available to regular folk for free in Canada with fintech providers like Borrowell and Credit Karma.; Prior to this, you would have to pay for your credit report, or be applying for a loan to be able to access your credit score.; There are two major credit score companies providing this for free in Canada, and these are Borrowell and Credit Karma.; Which one is better?; Heres whether you should sign up to have your credit score regularly monitored with Borrowell vs Credit Karma.

Knowing your credit score is useful because if you are applying for a loan you will want a good or excellent credit score.; If you dont know what your score is, you wont know if it is good or excellent unless you pay for the credit report or unless you are applying for a loan.; And then it might be too late to improve your score, should you find out that your credit score is not up to snuff.

This post may contain affiliate links.; Please see genymoney.cas disclaimer for more information.

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO, for Fair Isaac Corp. They are the two biggest competitors in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

You don’t have a credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

Also Check: Does Debt Consolidation Affect Your Credit Score