Keep Your Balances Low On Revolving Credit Such As Credit Cards

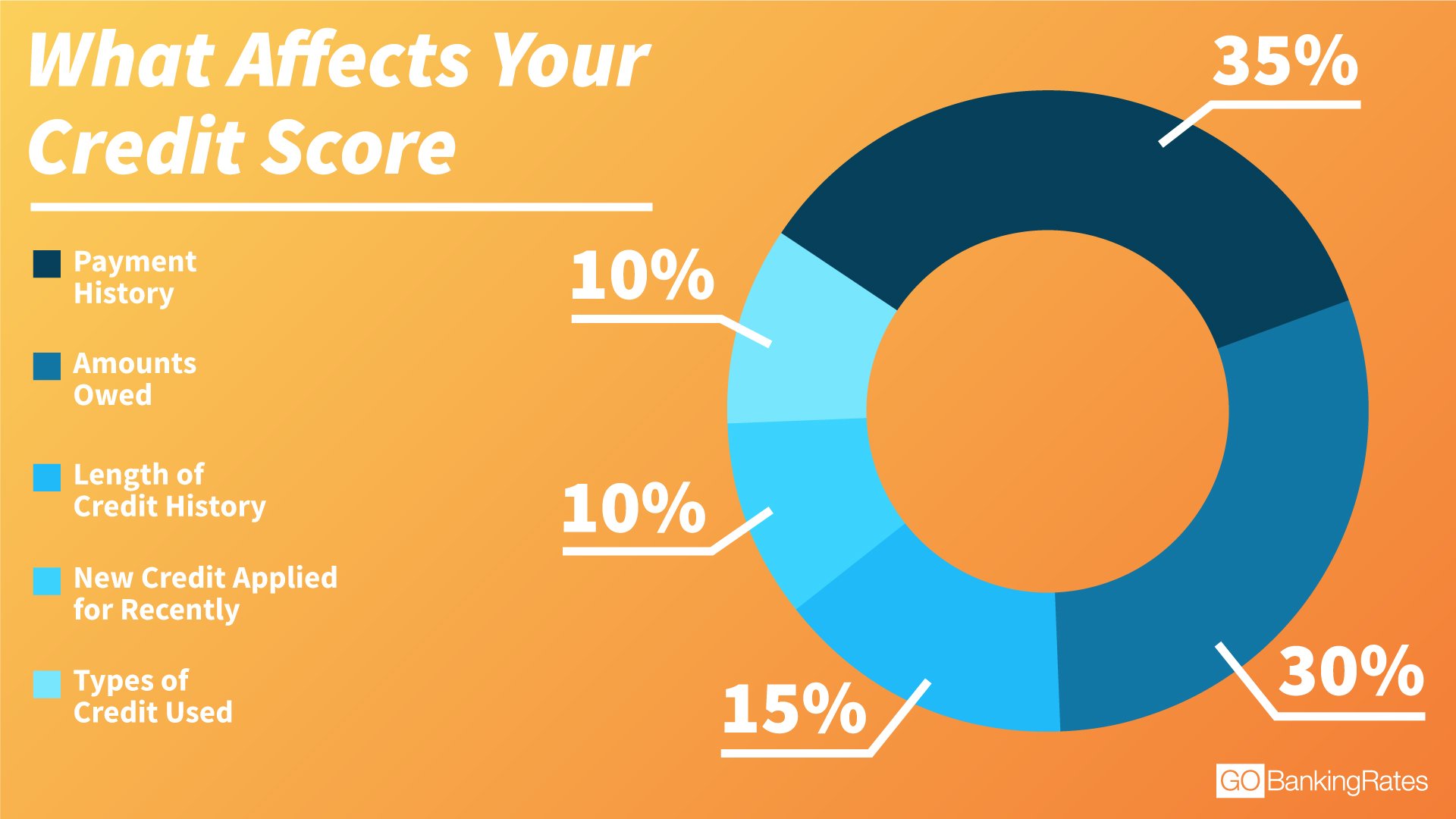

How much of your available credit you actually use is called your credit utilization ratio, and it makes up 30% of your credit score. For example, if you have a credit card with a $12,000 line of credit and youve charged $9,000 in purchases recently, that means your credit utilization on that one card is 75%. That kind of ratio is going to have a negative impact on your credit scores, because, according to Experian, it can be seen as a flag to potential lenders or creditors that youre having trouble managing your finances. Experts generally agree that its best to keep your credit utilization below 30% if at all possible.

Keep in mind however, that if you pay your balances in full each month meaning, you arent paying interest charges your credit utilization will remain low no matter how much you borrow month to month.

Can I Buy A House During Debt Settlement

For many people, buying a house represents the largest and most important purchase and investment that they will make over the course of a lifetime. Regardless of when it takes place, the commitment to own property often comes with the financial responsibility of a mortgage, anchoring an owner to a specific property and location, often for many years.

Under any circumstances, buying a house and taking out a mortgage requires an abundance of planning and thought. But what about for those who have undergone or are in the midst of debt settlement is it possible to apply for a mortgage? The good news is that It is possible to apply for a mortgage and buy a house during and after debt settlement. However, a healthy credit score might be required first in order to qualify.

How Debt Settlement Affects Your Credit If Youre Delinquent

If youre between 30 and 120 days late on your credit card payment, it is unlikely that a credit card company will agree to a debt settlement proposal. Creditors typically wait until consumers default or get close to the 180-day delinquency mark before even considering debt settlement.

Now, this information might be contrary to what a debt settlement company has told you. Thats an extremely important contradiction because while debt repair services often promise delinquent consumers miracle fixes, theyre really leading you toward credit score devastation.

All that a debt settlement company will do if you hire them when delinquent is simply ask you for a payment and then hold onto it until you default ruining your credit in the process. Only then will they negotiate a deal with your creditor or the debt collector that assumed your debt once the original lender wrote it off its books.

Don’t Miss: How High Can A Credit Score Go

Become An Authorized User

You may want to consider talking to a close friend or family member about the possibility of adding you as an authorized user to one of their longer established credit cards. This can help you gain some positive credit history that you lost. But you may not want to do that until all your settlements are complete.

Related article: Can being an authorized user on someone elses credit card help build your credit?

How long it takes to rebuild your credit after debt settlement depends on a number of factors. Theres no quick fix, but settling your debts wont hurt your credit nearly as much as not paying them at all with the added bonus of lifting the weight of the debt-related stress youve likely been experiencing.

How To Get Extra Help With Debt

Debt payoff can seem overwhelming and complicated, but there are many resources that can guide you. A good place to start is, again, a nonprofit credit counseling agency, where you can receive a free initial consultation and get help with budgeting and debt reduction strategies. If you’re not only dealing with debt collectors but you’re also involved in a lawsuit related to your debt, a lawyer experienced with consumer debt issues is the best person to work with; you can find free local legal assistance through the Legal Services Corporation’s search tool.

If you’re feeling burdened by debt and you’re unable to pay for basic needs, call 211 to connect with services in your area that may offer rent, mortgage, utility or medical bill assistance. Other types of financial assistance may be available from the federal or state government, and you can take a look at the programs you qualify for at Benefits.gov.

Don’t forget to engage with organizations that work with specific populations you might be a part of, such as Military OneSource, which serves military families and offers financial and legal resources.

You May Like: How To Get A Bankruptcy Off Your Credit Report

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still;report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

Rebuilding Your Credit Score After Debt Settlement

For seven years, your settled accounts are reflected on your credit report. This means that for those seven years, your settled accounts will affect your creditworthiness. Lenders usually look at your recent payment history. There is a high probability that you will be affected for a couple of months or even years after settling your debts. However, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little.

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement. Some needed years before they could get a new or loan. It varies case by case and it is difficult to determine the exact timeframe required to improve your credit score. The time it takes to repair your credit score will depend primarily on your credit history.

Don’t Miss: What Is A Good Credit Score For My Age

If I Settle Debt How Long Will It Take For My Credit Report To Be Good Again

I am now behind in paying 3 credit cards with 3 different banks. I have 2 options – bankruptcy and debt settlement. I qualify for chapter 7 bankruptcy but do not want to do that if I can avoid it. I estimate I can come up with about half of the balances I have now in about 12 months with a loan I have already confirmed I can get from family when the time comes to settle my credit card debts.

Your article on your blog about the effects to my credit report with bankruptcy or debt settlement was very informative. With the detail I am giving you, what do you think will happen to my credit if I settle my debt in a year or less?

If I settle debt how long will it take for my credit report to be good again?

Vega

Thanks for reading the blog. I am glad you found some of the posts informative. I have questions about your credit history before I can weigh in with how long it could take for your credit score and credit report to recover from settling debt.

What is showing on your credit report right now can make a difference in what happens to your credit score and future access to credit.

Do you have a mortgage you are current on? If not, have you had one in the past?

Do you have a car you are paying on? If not, have you had one in the past?

I am asking these questions to get a sense of your credit depth.

How Debt Settlements Work

As you know, your is a snapshot of your financial past and present. It displays the history of each of your accounts and loans, including the original terms of the loan agreement, the size of your outstanding balance compared with your credit limit, and whether payments were timely or skipped. Each late payment is recorded.

You can negotiate a debt settlement arrangement directly with your lender or seek the help of a debt settlement company. Through either route, you make an agreement to pay back just a portion of the outstanding debt. If the lender agrees, your debt is reported to the as “paid-settled.”

While this is better for your report than a charge-offit may even have a slightly positive impact if it erases severe delinquencyit does not bear the same meaning as a rating that indicates that the debt was “paid as agreed.”

The best-case scenario is to negotiate with your creditor ahead of time to have the account reported as “paid in full” . This does not hurt your credit score as much.

Also Check: Why Did My Credit Score Drop 20 Points

Calculating The Time Needed To Rebuild Your Credit Score

6 Months or Less: There is a possibility that if you have successfully paid off most of your debts and have settled accounts, creditors may still consider you a good debtor who can pay debts on time. If you still have open accounts after debt settlement with good records, this may help you get a credit rebound and improve your credit score. Even if you have a settled account the total assessment of your credit history can outweigh this by demonstrating that you have strong, positive credit, and your credit score could improve within the next six months or less.

12 – 24 Months: If your credit history reflects that you are a delinquent debtor, you have not paid off any part of your debt, there were a lot of late payments, or if it takes you years to settle your old debts you will have an extended period to wait before your credit score improves. A poor credit history tells creditors that you are a risk, and it will probably take 12-24 months for you to improve your credit score.

Remember that as your settled accounts age, their effect on your credit report will diminish even if they are still apparent. Take the initiative not to incur new debts, and your credit score will slowly improve. It will not improve overnight, so relax and do your best to become a wise debtor during this time. Avoid obtaining new debts while you are in the period of rebuilding your credit score.

Is It Better To Pay Off Debt Or Settle It

It is always better to pay off your debt in full if possible. While settling an account won’t damage your credit as much as not paying at all, a status of “settled” on your credit report is still considered negative.

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as “settled” or “account paid in full for less than the full balance.”

Here’s what you need to know about the credit impact of settling debt.

Also Check: Does Checking Your Credit Score Affect Your Credit Rating

What Does Satisfied Mean

If you see satisfied against any items on your credit report, it indicates that your creditor has marked a default. You may have missed several payments as previously described, but an unexpected advantage is that this entry should disappear from your credit file sooner than the settled debt.

It remains for six years, but this timescale begins from the date of default rather than the date when the account is closed. If the creditor accepted an offer of final payment, i.e. less than the full amount owed, again this will be marked as partially satisfied.

As you can see, missing the occasional loan or credit card payment doesnt automatically mean that your credit score will be affected, but any diversion from paying your debts in full can damage your ability to obtain credit and other borrowing in the future.

If you want to find out more about the status codes in your credit file, and what they mean for you in the long term, Scotland Debt Solutions can help. We work solely on behalf of Scottish residents in debt, and can;arrange a free same-day;meeting at any of our five offices.

Debt Settlement Is The Process Of Negotiating With Your Creditors To Pay Less Than The Full Amount You Owe

Theres nothing worse than being burdened by debt. Fortunately, there are methods that might help reduce the amount you owe.

If you find yourself deep in debt and unable to meet your financial obligations, debt settlement, as opposed to bankruptcy, is an option to consider.

Whether working with a debt settlement company or negotiating on your own, the goal of debt settlement is the same: to get creditors to mark a debt as paid in exchange for a partial payment. Most lenders would rather receive a partial payment than no payment at all.

Debt settlement can give you some relief and shorten the road to rebuilding your credit. However, debt settlement will also negatively impact your credit score and , so be sure to understand how it works and the pros and cons before proceeding.

We have the tools to help you fix your credit. Give us a call for a FREE credit report consultation

Read Also: Does Debt Consolidation Affect Your Credit Score

How To Deal With A Debt Collector

If youre dealing with a debt collector, make sure you fully understand the debt. You need to know who you owe, how much you owe and how old the debt is. Then come up with a realistic repayment or settlement plan.;

Finally comes the negotiation phase. If your debt has been sold to a third-party debt collector, youll have to contact the new debt owner, or the collection agency theyre using, in order to resolve the debt. Be clear about your financial situation. If they know you cant afford to pay much, that could make them more willing to accept a lower settlement offer. Before you send them any money, get your agreement in writing.

I Have Seen Credit Bounce Back From The Affects Of Debt Settlement In A Matter Of Months

If your credit file is skinny and contained only the three credit card accounts that are going to go bad as part of the debt settlement process, then it will likely take a couple years for your credit to recover .

The best thing for your credit report would be to settle all 3 credit card accounts before charge off.; This would mean negotiating with the banks collection departments, getting the settlement letters, and funding the offers within 6 months of delinquency. Your comment about being able to do this in 12 months reflects calculating 50% of the current balances. What if you did not need 50%? Depending on the banks your 3 credit cards are with, you may actually be able to get this done quicker. What if some of your credit card balances could be settled for 40%? What if you settled in month 5 of your late payments and got 3 months to pay the settlement off?

If you have not read the post: Debt Settlement in Michigan I recommend you check it out. The CRN member who was the focus of the Detroit Free Press article I blogged about would be a good example of how credit report depth and quick debt settlements combine to provide the rapid credit score bounce back that I referred to above.

You May Like: Does Opensky Report To Credit Bureaus

Debt Settlement Is A Service Offered By Third

Although it may be tempting to use a debt settlement service to reduce your debt, its important to keep in mind that you could end up deeper in debt or with a negative impact to your credit.

Heres some key information you should know about how debt settlement works, its pros and cons, and how it could affect your credit.

Does One Time Settlement Of Loan Affect Cibil Score

Life is unpredictable and sometimes, it brings you on the path which was not planned by anyone. You have taken a loan with a certain plan for repayment, but with the changed situation, you find it difficult to meet your repayment commitment. This will definitely impact your credit score negatively and may restrict you from taking loans in future.

But if you approach the bank and inform them about your inability, they might offer you a choice of one-time settlement. The lender or the bank will offer you this option after 6 months of non-payment of dues, only if they find that payment was delayed due to some genuine reasons such as accident, job loss or any serious medical condition. The bank authorities sit down with the borrower and access the genuineness of his situation and the amount due to them.Although you may find it a beneficial option, this settlement can cost you your CIBIL score. Yes, your CIBIL score is affected by this settlement and this settlement is viewed as negative credit behaviour.

If you have settled a loan with your banker or lender, then you should ask for a no-dues certificate from your lender. This will ensure that they are not imposing any interest on the outstanding amount that was not paid for settlement.

Don’t Miss: How To Get Credit Report With Itin Number