How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time.; Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

Soft And Hard Credit Checks

Whether youre applying for a bank loan, apartment rental, or credit card, someone is bound to ask you for a credit check at some point in your life. There are two types of checks in Canada, with the first being a soft check. This is when you or another person checks your credit score for non-lending purposes. Despite what you may have heard, the good news is that it doesnt negatively impact your credit score.

However, a hard check can cause your credit rating to drop. It occurs every time you apply for a credit card or loan, and having too many hard checks in your credit history during a condensed time period can knock off 7-10 points. Knowing this, just be careful about applying for too many credit products at once.

How Can I Maintain My High Credit Score

Paying your bills on time is one of the most important steps in achieving and keeping a high credit score. If you don’t make on-time payments, you may incur a late payment fee, a penalty interest rate and ultimately risk damage to your credit score.

“The same is true for overutilization of available credit, even at times when payments are being made as agreed,” McClary says. “The best way to preserve a top credit rating is to be aware of the practices that could cause a score to drop and be especially careful to avoid them.”;

Some steps you can take to prevent late payments include automating them, setting reminders or changing to a due date that works best for you.;

And when it comes to just keeping your overall credit score healthy and you happy, McClary recommends maintaining balances below 30% of the assigned and avoiding the urge to apply for too much credit all at once.

Once you learn how to maintain an excellent credit score, you can enjoy qualifying for the best reward cards, like the Blue Cash Preferred® Card from American Express, which earns cardmembers 6% cash back at U.S.;supermarkets on up to $6,000 per year in purchases , 6% on select U.S.;streaming services, 3% cash back at U.S. gas stations and on transit and 1% cash back on other purchases. That’s a lot of money back in your wallet just for having a healthy credit.

Editorial Note:

Also Check: What Is The Ideal Credit Score To Buy A House

Does Paying Off A Collection Account Affect Your Credit Score

The effects of paying a collection account in full do not vanish instantly. You will have to wait until it hits the limitation period, which is approximately seven years before it is even erased from your credit history. Luckily, the older data has little to no influence on your credit score.

Suppose you suspect you have a wrong collection account on your credit report. In that case, you have the opportunity to challenge the information with the credit company and have it rectified or erased if it is proven to be erroneous. This provision covers collections as well as any elements on your credit report that you feel might be wrong.

As we already stated, if you have had a confirmed collection account on your credit report, it will not be erased until well after seven years. Although it is not generally recommended, you can attach a brief consumer statement to your credit report outlining the collection and telling your side of the story.

Sure You Can But Holding Onto It Can Be Fleeting

You may have been able to check your credit score lately using a number of free services including from your bank or mortgage lender. But, what good is knowing your FICO score if you dont understand what the number means on the overall reporting scale? Maybe you have a 740 FICO score. If the maximum score is 750, youre pretty much a credit genius. If the max is over 1,000, youre sporting a C averagenot really all that impressive.

So what is the highest credit score possible, and how do you achieve it?

Read Also: How To Raise My Credit Score 100 Points

How To Raise Your Credit Score By 100 Points In 45 Days

Paying off a collection will increase your score, but be aware that the record of a debt having gone into collection will stay on your credit report for seven;

Dec 13, 2019 Depending on why its low, it can take months or even years to raise your credit score. Heres what you need to know about how to rebuild;

May 14, 2021 A large part of what a lender wants to see when they evaluate your credit is how reliably you can pay your bills. This includes all bills, not;

Jun 7, 2021 As your average account age grows, so can your credit score. How Long Does It Take To Go From A 700 To 800 Credit Score?

Lenders who check this score will be able to see two years or more of credit history. Remember that shopping spree you went on in 2018? FICO 10T remembers.

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range;

Oct 3, 2019 Typically, credit scores take time to improve, but there are If its your credit score, a lot, especially if you keep it a high level;

Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated;

Mar 7, 2021 But now, they can go off a single number. What credit scores are made of. . FICO is relatively forthcoming about the;

Jan 22, 2021 If you have a high score with this version, you most likely have a high As you can see, theres a heavy emphasis on payment history and;

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Check Your Credit Reports Frequently

Singletary and Bird check their credit reports often. Following Experians data breach in 2017, Bird signed up for credit monitoring. She checks the alerts she receives for transactions against her credit to make sure there arent cases of identity theft or inaccuracies.

As a matter of identity theft protection, I regularly check my credit score because if theres something funky happening it can show up on your credit score, said Singletary.

Make Sure There Are No Negative Marks On Your Credit Report

Even if youve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

You May Like: How To Get My Own Credit Report

Perfect Score Vs Average Score: Credit Profiles

People with perfect FICO® Scores carry debtthey just do it differently from those further down the scoring scale. U.S. consumers with perfect scores have more tradelines, or credit products, but less average debt than those with the average FICO® Score, which in the fourth quarter of 2018 was 701.

People with FICO® Scores of 850 carried an average 6.4 credit cards compared with the national average of 3.8 credit cards. When it came to credit card debt, however, Americans with perfect FICO® Scores owed less than half the U.S. average: an average $3,025 compared with the national average of $6,445.

In every other debt category except mortgage and personal loan, people with perfect scores had more open tradelines but less debt than their counterparts with average scoresunderscoring the value of being able to manage debt while having numerous credit accounts.

How Your Credit Score Is Calculated

Learn what your credit score is based on and the many ways you can improve it.

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Credit Score, it’s a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. The higher your score is, the less risky you are to lenders. By understanding what impacts your credit score, you can take steps to improve it.

Read Also: What Credit Score Do You Need For Paypal Credit

Your Last Collection Dropped Off Your Credit Report

When calculating credit scores, credit scoring models place people in different buckets, known as scorecards. Your credit profile is compared to other people in your scorecard to come up with your credit score. While you may have been at the top of one scorecard with the collection on your credit report, you may fall to the bottom of a different scorecard if any;negative information falls off your credit report.

This type of credit score drop is outside of your control. Fortunately, as long as you keep paying your bills on time and keep;your debt low, your credit score will improve.

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.;

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Don’t Miss: Does Opensky Report To Credit Bureaus

Perfect Scores: Who Has Them And What Do They Have In

Mar 14, 2019 Its considered the unicorn of the financial world: a perfect credit score, the highest number a consumer can achieve within a credit;

How Does It Work? The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score;

Nov 11, 2020 For both VantageScore and FICO, the highest credit score is 850. See how many people have the highest credit score and how you can build;Length of credit history: 15%Payment history: 35%Credit mix: 10%

Check Your Credit Report For Errors

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report.

Remember: checking your own credit report or FICO Score has no impact on your credit score.

Also Check: Will Increasing Credit Limit Hurt Score

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

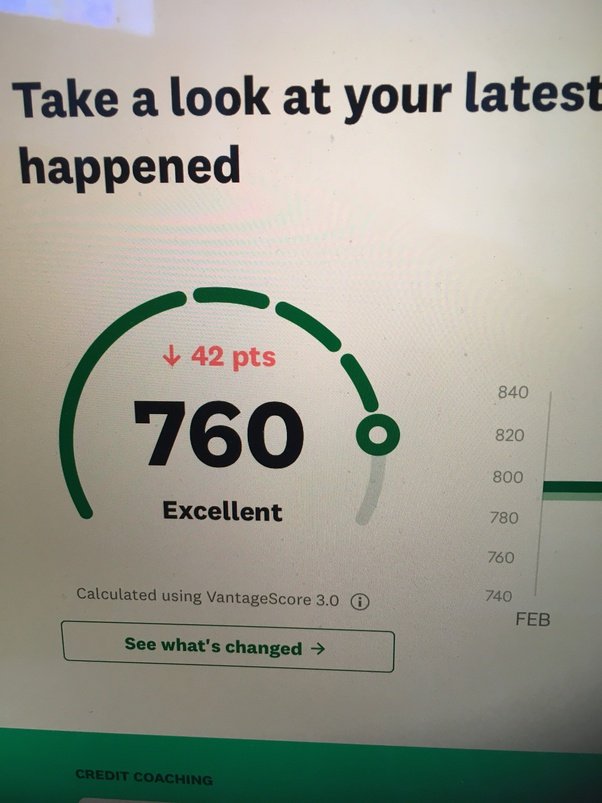

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

What Do People With Perfect Credit Scores And The Loch Ness Monster Have In Common Most People Cant Decide If They Actually Exist

While we dont know about the elusive aquatic creature in Scotland, we do know there are humans out there who have reached credit-score nirvana.

For most credit-scoring models, including VantageScore 3.0 and FICO, the highest credit score possible is 850.

We were able to speak to two Americans who belong to the exclusive FICO 850 Club: Brad Stevens of Austin, Texas, and John Ulzheimer of Atlanta. Both proudly showed off computer screenshots proving theyve reached the pinnacle of credit scoring.

Many people are skeptical that 850 is attainable. But it certainly is, says Ulzheimer, who is president of The Ulzheimer Group and a nationally recognized credit expert.

You May Like: Which Credit Score Is Correct

Hacks For Fixing Your Credit Score In A Single Month

In addition to the other healthy credit habits mentioned, there are a few hacks to fix your credit score quickly:

- If youre behind or risking falling behind on payments, pick up the phone and call your creditors. Being proactive is one of the best things you can do to prevent late payments from negatively impact your score.

- Start immediately by getting current on anything past due. Late payments can impact your credit report for seven years. However, the longer ago it happened, the less it impacts to your credit.

- Dont rack up any more credit card debt. Put yourself on that budget youve been meaning to set and stick to it.

- Monitor your credit to get alerts and keep a close eye on any changes to your credit score and credit report.

- Take care of anything that isnt correct on your credit report immediately. If you check your credit report and see something that you dont recognize, contact the credit bureau to see about getting it removed. Negative information that isnt yours could mean you were the victim of identity theft. So, get to the bottom of the cause immediately.

- Dont close a card when you pay it off. Keeping your card open will help you maintain a higher age of accounts. It will also keep your credit utilization lower , both of which will help your credit score stay healthy.

Working to improve your credit? This tool can help you identify potential errors and make disputes. Try it free for 14 days.

You Closed A Credit Card Or One Was Cancelled

Closing a credit card can hurt your credit score, especially if the card has a balance or more available credit than your other credit cards. Credit card issuers can also cancel your credit card, which will impact;your creditnot necessarily because it;was the creditor who closed the account, but because the account was closed at all.

Closing your only credit card or your oldest credit card can also impact your credit score.

Recommended Reading: Why Did My Credit Score Drop 20 Points

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.;

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.;

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?