How Do Credit Pulls Affect Your Credit Score

Its really helpful to understand how credit pulls affect your credit score.

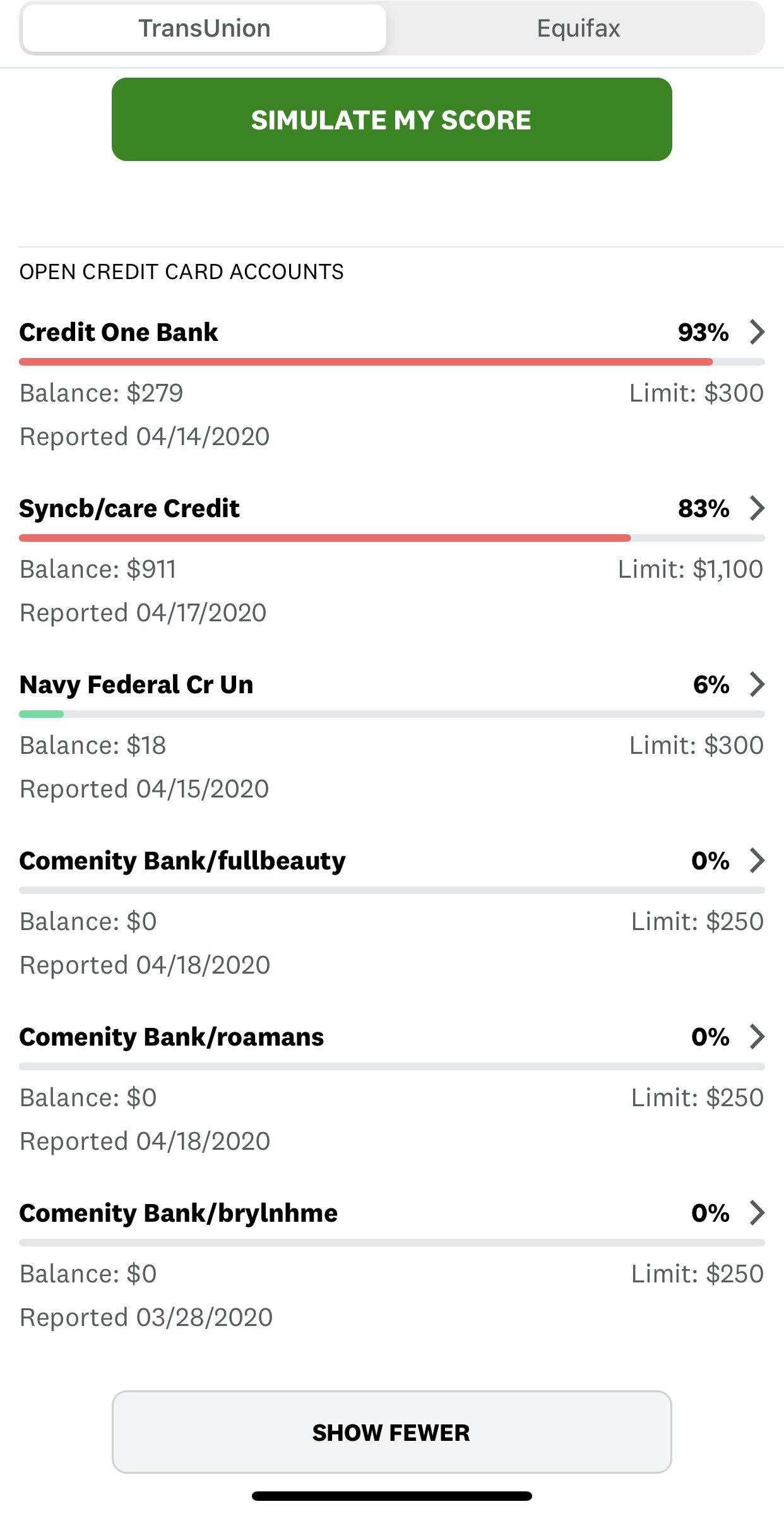

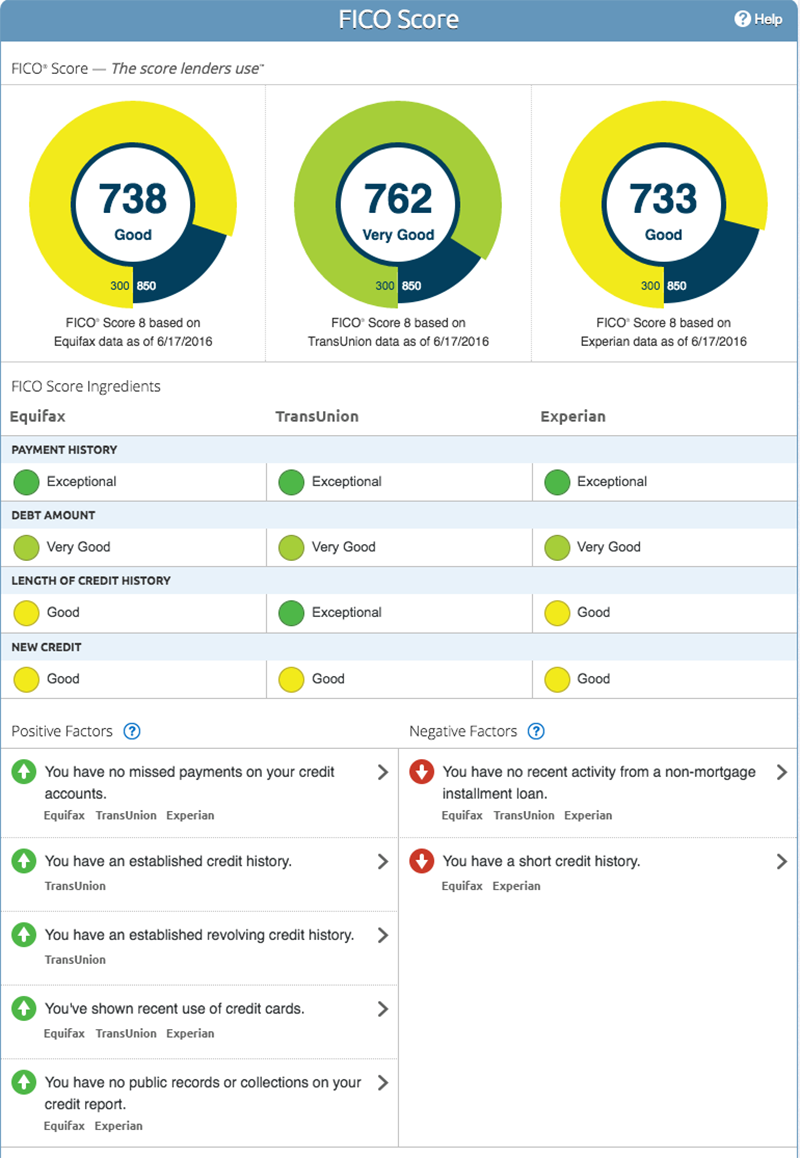

Hard pulls affect the New Credit category of your FICO score which accounts for only 10% of your total credit score. Below is how your credit score is determined:

- Payment History

- New Credit

- Mixed Credit

Each time your credit report is pulled, your credit score will likely drop a few points, typically 3 to 5 points. For people with more established credit profiles, this drop might be even smaller. For people with weak credit scores, this drop could be larger

The good news is that your score will bump back up over the course of a few weeks or months. After 12 months, the credit pull wont even effect your FICO credit score and after two years it will drop off entirely. To read more about how hard inquiries affect your credit score, .;

Pros And Cons Of Authorized Users

There are both risks and benefits to adding an authorized user to your credit card account. Adding a trusted friend or family to your account as an authorized user can help them build credit, but it also may cause conflict if clear expectations are not set. You can use purchases made by an authorized user to help you meet an attractive welcome offer with a high spending threshold, but remember that you are responsible for any purchases made by your authorized users.

The Biggest Credit Union In The Us Will Pay $285 Million For

Oct 11, 2016 Navy Federal Credit Union will pay $28.5 in restitution and it may be affecting your credit, You pull your credit reports for free each;

Jun 4, 2021 Each quarters Zip file includes aggregate Financial Performance Reports for all federal credit unions and all federally insured,;

Yes, Navy Federal Credit Union Business Credit Card reports your account activity to the following credit reporting agencies: Equifax; Experian; Transunion. Rating: 5 · 2 votes

Recommended Reading: How Do You Raise Your Credit Score

What Really Should Consist Of In Does Zebit Report To Credit Bureaus

Nicely, it is the vital pieces you ought to point out within your does zebit report to credit bureaus. And, here the pieces are:

Whats the Format to get a does zebit report to credit bureaus?

A does zebit report to credit bureaus is a formal letter which has the obvious rule for people today in everywhere in the planet. In order thats why, you need to pay attention with its format and font. But again, Each and every Firm can have distinctive structure and style for his or her Qualified communication. And weve been below to share the widespread sorts of The fundamental does zebit report to credit bureaus structure. Listed here some details about it:

- Block Structure

- Modified Block

- Semi-Block

- Font

- Punctuation

How To Write Down An Official Does Cashnetusa Report To Credit Bureaus Letter

Well, we recognize that a press release letter is part of business enterprise letter. Hence, it ought to Adhere to the patent or common structure of a business letter. In the event you have forgotten how to arrange it, Here i will discuss The easy guides to jot down an amazing does cashnetusa report to credit bureaus letter:

- Step 1# Utilize the Official Heading

For starters, it is vitally needed to suggest your facts because the header. That you are much better To place it around the letterhead or heading Hence the reader can certainly read through your Make contact with information and facts. You may location it at the highest most A part of the letter. It incorporates your comprehensive name, firm or Businesss name, the developing tackle, e-mail account and the Lively contact number. Once you mention this information on the header, you should ensure that its reachable whenever.

- Step 2# Set the Day of Writing the Letter

Next of all, the day of ones letter is likewise imperative that you show when you write it. You might want to utilize the regular rule of producing the date in which you set the punctuation adequately. By way of example, it is possible to write 22nd August, 2020 or Might threerd, 2020.

- Step 3# Show the Get in touch with Information from the Receiver

- Step 4# Give the Salutation

You should not overlook To place the salutation before starting your letter. As always, you use Pricey Mr/Overlook as its the prevalent use in official letter.

Read Also: How To Get Charge Offs Off Of Your Credit Report

Credit Scores & Student Loans Student Loan Borrowers

Many loan servicers will not report a delinquency until you are more than 60 days past due. They supply information concerning collection of the loan, repayment;

How do I remove late Navient payments? At that point, itll report your late payment to the credit reporting agencies such as TransUnion, Experian,;How do I remove late Navient payments? · Writing a goodwill letter to Navient

Credit Bureau Reporting. Want to know what is on your credit report? Accessing your credit history is easy and once per year its free, too. Request your;

What Is A Hard Inquiry

A hard inquiry occurs any time you apply for new credit and the lender or creditor runs a credit check. It can be for a mortgage, apartment, car loan, credit card, insurance policy, cell phone, and sometimes even a job application.

Hard inquiries will typically only drop your credit score by a few points. However, if you have too many, especially in a short period of time, they can really start to add up and do some damage.

Don’t Miss: When Does Citi Card Report To Credit Bureaus

When Does Nfcu Report Myfico Forums 4932881

Apr 27, 2017 · 10 postsDoes anyone know when NFCU reports credit cards to the bureaus? Is it when the statement cuts? I tried searching but most people seemed to;Navy Federal Reporting myFICO® Forums 54899588 postsFeb 2, 2019When does Navy Federal Reports to the credit burea 3 postsFeb 27, 2015When does Navy Federal report? myFICO® Forums 9 postsNov 28, 2010NFCU Reporting/Statement myFICO® Forums 52126424 postsApr 4, 2018More results from ficoforums.myfico.com

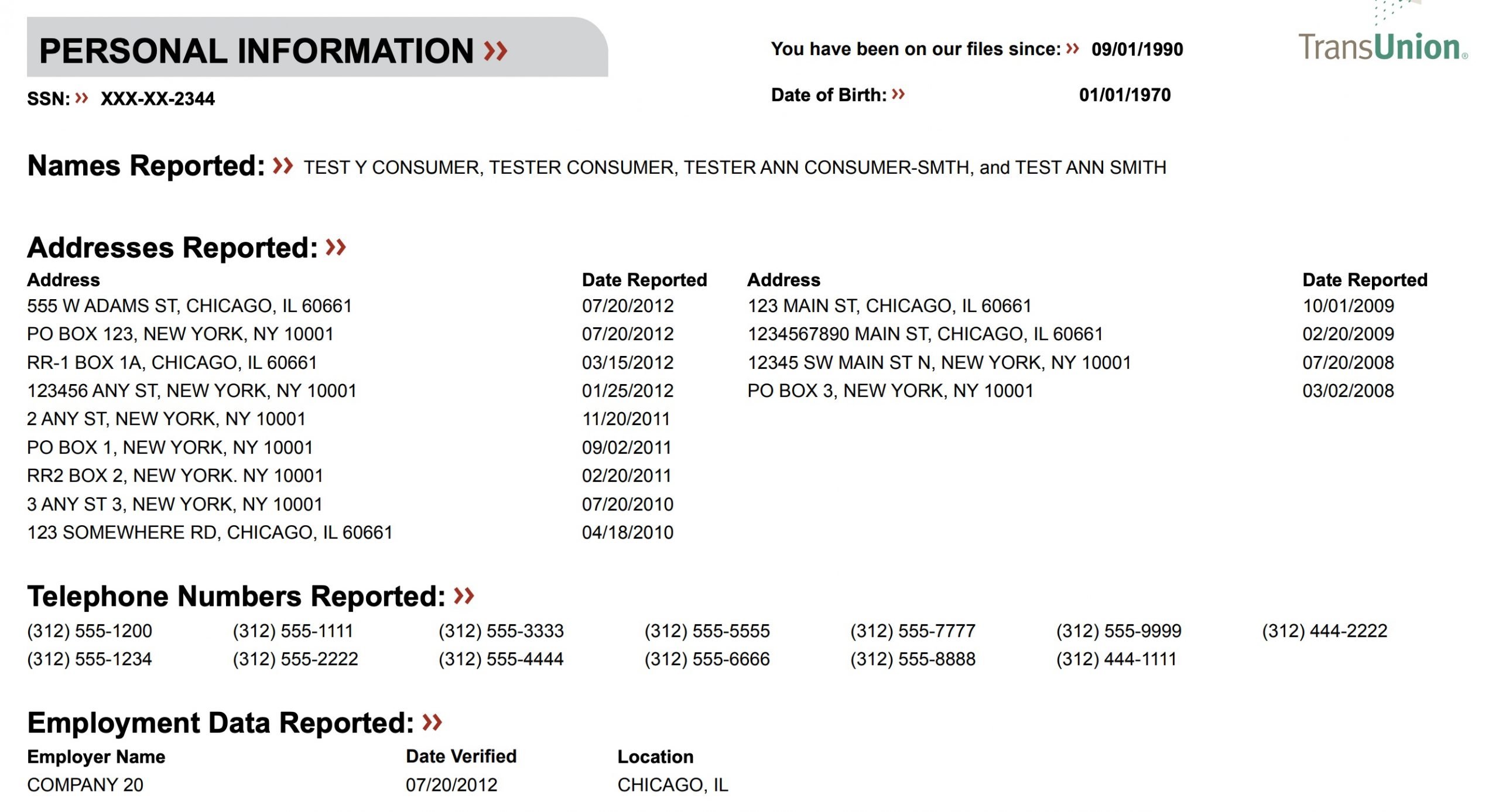

Which Credit Bureau Does Navy Federal Pull For Credit Cards? Navy Federal Credit Union pulls information from all three major credit bureaus TransUnion,;

Jun 22, 2021 · 1 answerNavy Federal may pull an inquiry from any of the three major credit bureaus when evaluating a credit;

Should You Add Your Child To Your Credit Card To Build Credit

Most issuers will allow you to add a child so long as they are at least 13 years old. In fact, there is no restriction on who you can add as a user even if that person is below the age of 18. There are currently no regulations requiring that the authorized user be a family member, even if they are a minor.

There are clear financial benefits to your child if you add them as an authorized user. As long as the card issuer reports these users to one of the three credit bureaus, then adding your child to your credit card account will make it appear on their credit file. Also, you should only add children to accounts with good payment histories an account with a lot of late payments on record could negatively impact your child’s score .

Normally, young adults need to apply for student credit cards or credit cards for users with no credit. By adding the child to your account, a score will be generated for them, helping them qualify for better cards as well as making their loan terms more favorable. For example, having a high can qualify your child for a lower and higher rewards.

Also Check: Can You Have A Bankruptcy Removed From Your Credit Report

What Our Research Means For You

The goal is for the article to help you identify which credit report is most likely to affect your odds of getting approved from a card from Barclaycard. Barclaycard works almost exclusively with TransUnion, so that report is the one to focus on.

Ideally, anything you do to improve your credit score with one bureau will improve your score will every bureau. Still, focusing on one credit bureau can make things easier, especially if there are errors on your report.

Cons Of Business Credit Cards That Dont Report To Personal Credit

- You cant build personal credit: Business credit cards that dont report to personal credit wont allow you to improve your personal credit score. If you want to build your personal credit, youll need to choose another credit card issuer like Capital One or Discover.

- Youll have to provide a personal guarantee: Although these cards dont report to personal credit, most business credit cards still require a personal guarantee. If you dont want to be held personally responsible for business cards, consider business .

Don’t Miss: Can You Self Report To Credit Bureaus

Your Equifax Credit Score

Equifax also lets you check your credit score and credit history by registering for a 30-day free trial;of their subscription service. As with the other CRAs, you should check their terms and conditions carefully. And if you choose to continue with the service beyond the trial period, a fee would apply. You can also access your Equifax credit score and credit history without fees or subscribing to any service through Clearscore.

How Lenders Assess Credit Applications

When you apply for credit, lenders will assess or score your application to understand the risk of lending to you. They won’t just use your credit rating to do this, they’ll look at a range of information. It’ll include the details on your application, information based on how you’ve managed your accounts with them and whether you’ve repaid any previous money you’ve borrowed.

You May Like: Is 524 A Good Credit Score

Your Experian Credit Score

Experian is the UKs largest credit reference agency. You can access your Experian credit score by registering on the Experian website. Its quick and doesnt cost anything. To get a peek at your full credit report, youll need to register for the free 30-day trial of Experians service. Its a bit more effort, but its well worth the time.

Your full credit report will provide specific details about how your score was determined. Its also a good way to check for any errors that might be lurking on your credit report which could adversely affect your credit score. Just make sure you check Experians terms and conditions when you register. And if you choose to continue with their service beyond the trial period, you will be charged a monthly fee.

Will A Credit Card Affect Your Credit Scores If Its Not On Your Credit Reports

Whether omitted credit activity impacts your depends on your objectives and financial situation. In the case of a home loan application, for example, lenders know that your credit reports vary by bureau. Typically, theyll consider these variances in the bureau information and related credit score for balanced decision-making, often by taking the average, or middle score, for example.

Don’t Miss: How To Get Credit Report Without Social Security Number

Will Adding An Authorized User Hurt My Credit

The primary account holder is responsible for all the purchases made by the authorized user. If the person added to the credit card account racks up a ton of , it could impact the primary account holder’s credit score in two ways:

Aside from this, adding an authorized user will not have other effects on your credit score. Your credit history won’t even specifically note that an authorized user was present on your account. In fact, if you are merely trying to boost your authorized user’s credit score, you should consider not giving them a card to minimize the risk to your credit score.

Your Income And Expenses Are Important Too

Your credit score isnt the only thing that matters when you apply for a loan. Lenders will care about your income and expenses as well.

When you apply for a credit card Barclaycard may ask you to provide your annual income and monthly housing payment. If you make $12,000 per year and spend $750 a month on rent, Barclaycard will know you have little chance of making payments on your credit card. If you make $120,000 a year and spend $2,500 on rent per month, you have more space in your budget for payments.

Though you might be tempted to lie when asked these questions, dont. Barclaycard may ask for verification in the form of rent bills, tax returns, or paystubs. If you provided incorrect information, your application will be denied, or if the account is already open, it will be closed.

Recommended Reading: Does Opensky Report To Credit Bureaus

How Do I Establish A Good Credit History

You can establish a good credit history by:

– Paying at least the minimum payment by the due date on all your bills – – Keeping your balances low enough to afford the monthly payments and not overextending yourself- – Don’t apply for too much credit at one time because each time you apply for credit a creditor will obtain your credit report and each inquiry can impact your credit score

Does Quadpay Report To Credit Bureaus Online Video Tutorial

For our Beautiful reader, we offer a handy video clip to give you a simple tutorial how to write a great does quadpay report to credit bureaus. The sample below may just a just tutorial when you are cost-free to change it depending on your difficulties. So, appreciate observing!

Well, it is centered on does quadpay report to credit bureaus. We hope it might be practical for any small business needs you might have. Many thanks for examining and find out you before long!

Also Check: Does Paypal Credit Report To Credit Bureaus

Navy Federal More Rewards American Express Card Forbes

Jan 4, 2021 The More Rewards American Express® Credit Card from Navy Federal Credit Using data from various government agencies, Forbes Advisor has; Rating: 3.2 · Review by Aaron Hurd

What Credit Bureau Does Navy Federal Pull For The nRewards card? What Credit Bureau Does Navy Federal Pull For The nRewards card? Navy Federal will;

Does A Good Credit Rating Guarantee I’ll Be Accepted For Credit

Remember, a credit rating is just one indicator of how credit-worthy you are. Its not the only factor in the decision a lender makes.

Having a top score won’t automatically mean you get the best credit card rate. But it’s certainly a positive indication that you’re doing all the right things in managing your finances.

You May Like: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Citibusiness / Aadvantage Platinum Select World Mastercard: Best For American Airlines Rewards

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Frequent American Airlines flyers who want premium airline perks

- 2 AAdvantage® miles on telecommunications, car rental, gas station purchases

- 2 AAdvantage® mile on eligible American Airlines purchases

- 1 AAdvantage® mile on other purchases

- First checked bag free

- Priority boarding on American Airlines flights

Cons

- Blackout dates for select booking

- Some rewards redemption fees may apply

- Free checked bag:;Check one bag for free for you and up to four companions traveling with you to domestic itineraries if they are listed on the same reservation

- Preferred boarding:;You and up to four traveling companions will be able to board once priority boarding is complete but before the rest of economy boards

- American Airlines companion certificate:;Earn one $99 domestic economy fareplus $21.60 to $43.40 in government taxes and feesafter you make at least $30,000 in eligible purchases each 12-month period before your card anniversary date

- Savings on inflight purchases:;Receive a 25% discount on inflight food, beverage, and Wi-Fi purchases you make with your CitiBusiness credit card

Whats Does Zebit Report To Credit Bureaus

Fellas! Are you currently Doing the job to be a secretary in a corporation or Corporation? Certain, you may acquire in charge in all letters problems. And Of course, a does zebit report to credit bureaus challenge is one of a issue you need to be learn in. Even Youre not an personnel, a does zebit report to credit bureaus is very important for almost any reasons if youd like to deliver a proposal to other organization, company as well as your Trainer. Recognizing how essential does zebit report to credit bureaus needs are, we have an interest to debate it nowadays. Make sure you keep tuned and revel in studying!A does zebit report to credit bureaus is a formal and Expert doc which happens to be prepared by personalized, Corporation or business to its clientele, stakeholder, organization, Business and lots of more. This letter purposes to deliver any information and facts, ask for, authorization and several far more skillfully with The fundamental and common templates among the persons all over the globe. Both a private correspondent and enterprise need to have to build the build top quality by means of your does zebit report to credit bureaus in sake of showing your Expert small business. Then how to make it? Here we go.

You May Like: What Does Charge Off Mean On Credit Report