What To Do After Auto Loan Refinancing

Once youve refinanced your car loan and accepted a temporary decline to your credit score, prove that youre a responsible borrower by establishing a good payment history. Fortunately, it only takes six months to do so. So you wont have to wait forever to see results.

To build a strong payment history, make your car payments on time. Dont forget that even one missed payment can hurt your credit. If youre worried youll forget a monthly payment, enroll in automatic payments with your lender or set up reminders in your calendar. Work hard to make your car loan payments on time and your credit score is likely to go back to where it was before you refinanced. Believe it or not, it may even improve!

Note that while your auto refinance will stay on your credit report for two years, itll only affect your score for the first 12 months. Therefore, you may want to wait at least a year before you apply for a mortgage or another type of loan. By waiting, you can increase your chances of landing a lower interest rate.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Does Paying Off Collections Improve Your Credit Score

Paying off an account in collections may or may not help your credit score. The impact depends on a variety of factors, including the credit-scoring model being used. Older credit-scoring models will reflect that a collection account has been paid and now has zero balance, which can positively impact your score, says Block. Newer credit-scoring models, however, will ignore the zero-balance status on a collections account.

The total number of accounts you have in collections also factors into your credit score. If the collection event is recent and is the only one of its kind, then it may be advantageous to your score to resolve it, says John Cabell, director of banking and payments intelligence for J.D. Power. However, if you have many debts in collections, then you may not see much improvement. Conversely, if the collection event is several years old, it may not actually be playing much of a role in your credit score anymore anyway.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Know How Much You Can Afford

While you want to negotiate with the car dealer based on the sticker price of the vehicle, its important to know how much of a car payment you can actually afford before you apply for an auto loan.

Factors like the interest rate you qualify for, the length of the loan, your down payment and even the amount youll get for trading in an older vehicle can all affect your monthly payment.

Our auto loan calculator can help you determine how much youll pay out of pocket and your monthly payments before you apply for an auto loan so youll know what to expect.

How Leasing Can Improve Your Credit Score

If youre looking to improve your credit score by leasing a car, good news: a lease can improve your credit score .

Auto loans and leasing are both installment loans a type of loan with a set monthly payment over a set period of time. Installments loans can really help build a good credit score because they affect your credit in multiple ways. But you have to keep up on the monthly payments.

Here is how your FICO credit score is calculated:

- 35% Payment history

- 15% Length of credit history

- 10% Credit mix

- 10% New credit

Payment history makes up 35% of your total FICO credit score, which is the biggest piece of the pie. A few years of good payment history could give you a nice boost to your credit score.

Although it can vary, a lease term is typically two to three years long. Good marks usually remain on your credit reports for up to 10 years, whereas missed or late payments can remain for seven to 10 years and negatively impact your score. So, even though your lease term is only a few years, how you handled the payments stays on your credit reports for quite a while.

You May Like: Why Has My Credit Score Dropped

Your Credit Score Has Increased

Your credit score may have been lower when you took out your original car loan than what it is today. If youve earned a substantially higher credit score in the year or so after you took out your car loan, you may want refinance. Chances are youll be able to lock down a car loan with a much better interest rate.

What Credit Score Is Needed For A Personal Loan

As mentioned earlier, credit scores range between 300 and 850. The higher your credit score, the more likely a lender is to approve your loan application and offer more favorable terms, such as a lower interest rate. While each has its own criteria, in general lenders view scores above 670 as an indication that a borrower is creditworthy.

FICO scores fall into five categoriespoor, fair, good, very good, and exceptional. Here is a breakdown of the ranges:

- Poor : Below average and lenders will consider you a risky borrower

- Fair : Below average, but many lenders may still approve loans with this score

- Good : Near or slightly above average and most lenders view this as a good score

- Very Good : Above average and shows lenders that you are a very dependable borrower

- Exceptional : Well above average and lenders will view you as an exceptional borrower

In 2020, most Americans had a credit score of good or better, according to Experian, one of the credit rating agencies. The average credit score was 710, a record high.

Also keep in mind that while your credit score plays a crucial role in helping you qualify for a personal loan, lenders also consider other factors such as the amount of income;you earn, how much money you have in the bank, and how long you have been employed.

Don’t Miss: Will A Sim Only Contract Improve Credit Rating

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Could Getting A Car Loan Hurt My Credit Score

On the other hand, there are a few ways a car loan could potentially hurt your credit score, including the following scenarios:

1. Submitting multiple car loan applications:

Each time you apply for credit, the loan provider will run a credit check which is recorded on your credit file as a hard enquiry. If you submit multiple car loan applications at once, or in close succession, you could risk damaging your credit score.

2. Missing payments:

Forgetting to make your car loan repayments, or paying them after the due date has passed, could be detrimental to your credit score. Generally, the longer overdue the payment, the more serious the event will likely be considered, and the bigger impact it could have on your credit score.

But keep in mind, while a late payment of one or two days might not pose the biggest risk to your credit score, its likely youll still be hit with a late fee.

3. Paying off your car loan:

This one could seem counterintuitive, but its worth noting that reaching the end of your car loan term and making your final repayment could cause your credit score to dip initially. The main reason for this is because it will no longer be listed as an active account on your credit file, so if its your only form of credit or your longest held account, the length of your credit history will be shortened.

Recommended Reading: When Does Citi Card Report To Credit Bureaus

How Does Buying A Car Affect Your Credit

The new-car smell. The wind in your hair. The envious glances from passersby. Buying a car delivers plenty of thrills, but can it also help improve your credit? Auto loans can negatively or positively affect your credit depending on whether you make your payments on time and repay the loan in full as agreed.

Your payment history plays a big role in your , accounting for 35% of your FICO® Score, the credit model used by most lenders. On-time payments reflect positively on your creditworthiness. Getting a car loan might also diversify your credit mix , which can improve your credit score.

Whenever you apply for new credit, such as a car loan, lenders make a hard inquiry into your credit report. Too many hard inquiries in a short time can hurt your credit score. However, don’t let concern about hard inquiries keep you from shopping around for the best auto loan. As long as all of your auto loan inquiries take place within a certain time frameaim to submit all your applications within a two-week periodcredit scoring models count them as one inquiry when determining your credit score.

Your Car Is Retaining Value

Before you go ahead and refinance your car loan, figure out your cars resale value. Sources like Edmunds.com, Kelley Blue Book, and the National Association of Auto Dealers can give you an idea of whether your car is retaining its value or upside down. If you find that you owe more on your car than its worth, its in your best interest to stay clear of refinancing.

Don’t Miss: How To Get My Own Credit Report

What Credit Score Do You Need For An Auto Loan

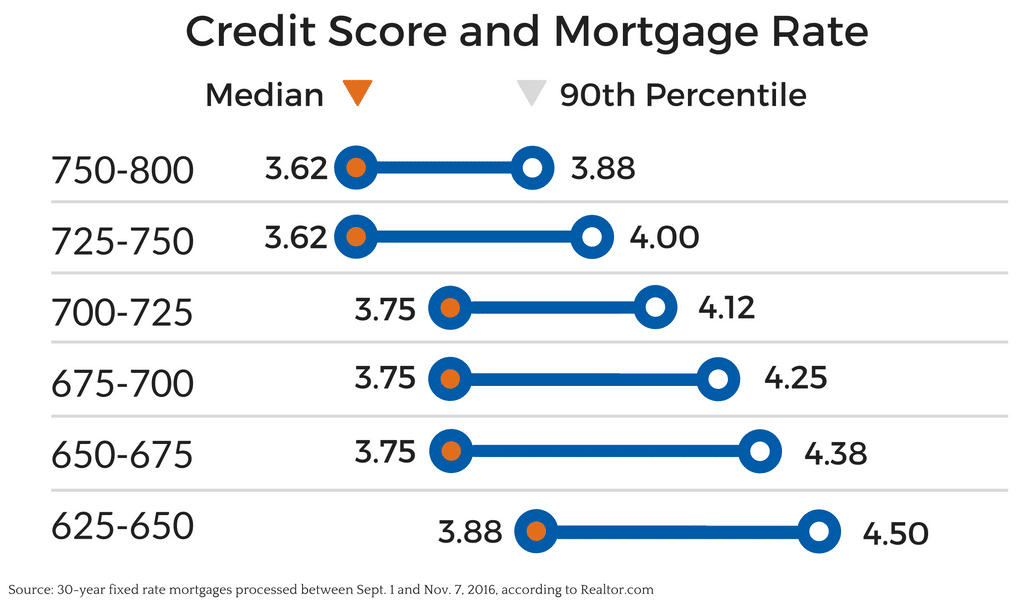

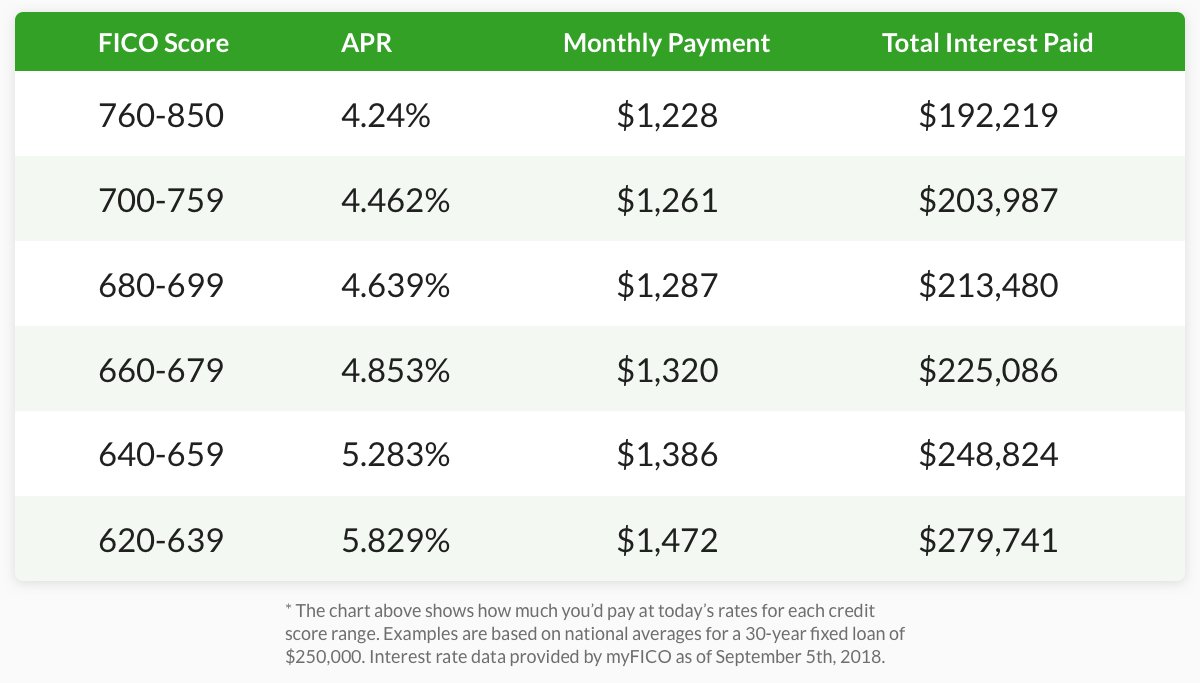

Everyone knows that cars are expensive , but rarely do people know how their credit score affects the final price they pay. Affording a new ride often requires us to find financing, usually through a lender in the form of auto loans. The interest rate attached to the loan could cost you thousands of dollars extra. What determines your interest rate? Your credit score.

How Can I Prepare For Or Offset Those Effects

Plan Ahead.

Palanjian advises preparing as much as you can before making your purchase and taking out the loan. If you are planning to buy a house, dont buy a car until home purchase is complete. Pay off any other debt you may have to lower your revolving balance, and dont plan on making any other large purchases soon after your car purchase.

Too many inquiries in a short period of time can have a negative impact on your credit score. In the case of a car loan, you could be offered a higher APR based on that lower credit score. When the average financing period can stretch up to 72 months, that change in APR can make a big difference.1

Be Diligent With Payments.

Making payments on time will also help offset any negative effects, Freeman advises. If you make regular payments on time it helps to boost your credit score. The faster you pay down the car loan, the quicker you reduce your credit utilization, which will increase your credit score.

If your credit score is mostly based on rolling lines of credit , the addition of a car loan can actually help you in the long run. A diverse credit portfolio helps bolster your score by demonstrating that you are consistently reliable. It also shows that youre not dependent on the type of credit you receive. However, this strategy will only work if you keep up with your regular payments.

References

Recommended Reading: Can You Self Report To Credit Bureaus

How Paying Off A Car Loan Could Affect Your Credit Score

With the categories of FICO information in mind, there are a few reasons why paying off yourcar loan could adversely affect your score.

The “amounts you owe” category is the biggest one that is affected. Specifically, your loans never have as much positive impact on this part of your credit score than when theyre almost paid off. In other words, if you only owe 1% or 2% of your original balance, its a major positive factor . After you pay the loan off, you lose this positive factor — the status changes to “paid loan” on your credit report.

Your length of credit history category could also possibly suffer, especially if your car loan was originated more than a couple of years ago. After all, paying off your loan can eliminate an established account from the calculation. Among other things, this portion of your score considers the average age of all of your reporting credit accounts, so if a paid-off loan causes your average to decrease, it could certainly be a negative factor.

Can You Refinance An Auto Loan With Bad Credit

If your credit scores have dropped significantly since you took out your original car loan, it may be difficult to find refinancing that saves you money because lenders typically charge higher interest rates to applicants with lower credit scores. If your refinancing goal is lower monthly payments, however, you may be able to find an auto lender that specializes in borrowers with less-than-ideal credit. You may qualify for a new loan with a longer repayment period that’ll cost more over time than the original loan did, but the extra expense could be worth it if it means you can pay today’s bills more easily.

If you’re at risk of missing a payment on your original car loan and having difficulty finding refinancing options, reach out to your lender as quickly as possible to explain the situation. While they are not obligated to do so, some lenders will work with you and may even modify your original loan terms to give you lower paymentsin exchange for a higher interest rate and potential fees.

Also Check: How To Read A Transunion Credit Report

Fico Credit Score Factors And Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| 10% | The different types of active credit lines that you handle | |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily.Learn more about FICO credit score |

As you can see, payment history and amounts owed are the two biggest factors in determining your overall credit score.

The other three factors – length of history, new credit, and types of credit used – combined only affect 35% of your FICO score.

What this means is if you open too many new accounts at once, pay late, have a high debt-to-credit ratio, or dont have a credit history, your credit score is likely to be low.

Theres no defined line for good vs bad credit, but generally over 700 indicates a good score, according to Experian, one of three major credit bureaus.

Both credit cards and loans affect your credit score in different ways. Credit cards are revolving credit, whereas loans are installment credit. The difference between these two types of credit determine how they affect your credit score.

What Factors Into Your Credit Score

To understand how taking out a personal loan affects your credit score, you must know how the score is calculated. The most widely used credit score by lenders is FICO, which was created by the Fair Isaac Corporation. FICO scores range between 300 and 850.

The scores are calculated based on five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. The exact percentages may vary among the three major credit rating agencies, but here is a breakdown of how much weight each factor has in the calculation, according to FICO:

- 35% is based on your payment history

- 30% is based on the total amount of your outstanding debt

- 15% is based on the length of your

- 10% is based on any new debt or newly opened lines of credit

- 10% is based on credit mixthe number of that you have open

The three major credit reporting bureaus in the United States that lenders turn toEquifax, Experian, and TransUnionprovide similar scores on your creditworthiness, but there can be small differences.

Don’t Miss: Does Annual Credit Report Affect Score

How Car Loans Affect Credit

Getting a new car loan has two predictable effects on your credit:

-

It adds a hard inquiry to your credit report, which might temporarily shave a few points off your score. Refinancing a car has a similar effect on your credit.

-

It adds to your credit history, which has a positive impact, assuming you pay on time, every time.

If you pay as agreed, the credit score points you temporarily lose when you applied should be more than offset by the ones you gain from a history of on-time payments.