Exploring The Fico Score

If you’re wondering which credit score is the most commonly used and most familiar to the general public, then that would be the FICO score. Formulated by the Fair Isaac Corporation around 30 years ago, the FICO score is the credit score that most lenders use when assessing your creditworthiness. Even some other organizations, such as insurance companies, consider this score when examining your financial standing.

A FICO score usually ranges from 300 to 850, where anything 800 and over would be considered exceptional credit and anything below 580 indicates you’re a risk to lenders and have a poor credit history. Fair FICO scores range from 580 to 669, and falling within this range could mean you do get approved for credit, although probably with a higher interest rate. Good FICO scores range from 670 to 739, while very good ones fall between 740 and 799. For the best chance of getting a mortgage or prestigious credit card, you’d want to at least fall within the good FICO score range.

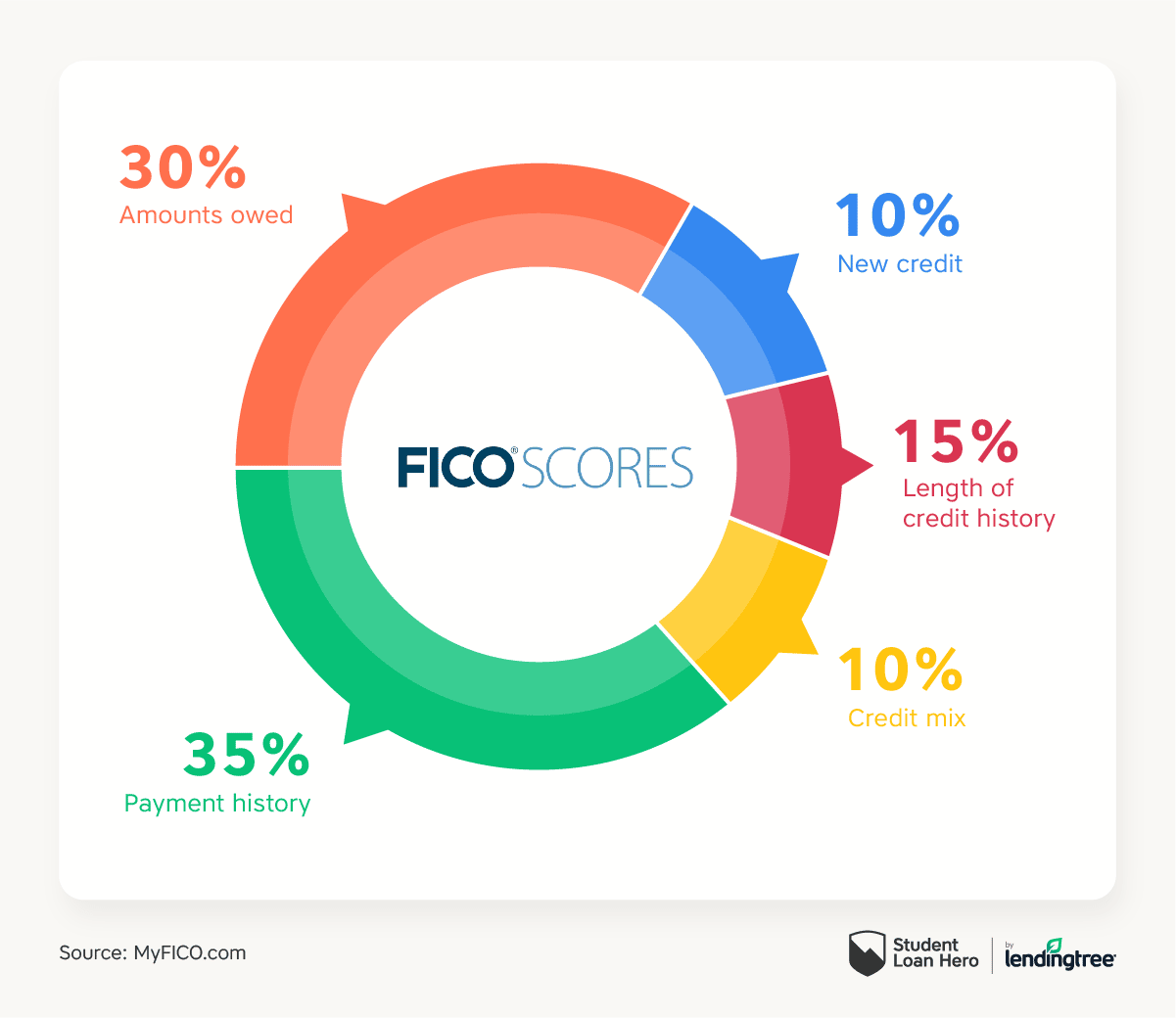

Different versions of the FICO score exist for purposes such as mortgage approval, auto lending and basic credit assessment, and they can give different weights to considered credit report factors. However, the standard model of the FICO score assigns the highest weight to your payment history and amounts owed on the accounts . Your credit history length has a moderate impact of 15 percent, while both your recent hard credit pulls and your overall credit mix get 10 percent each.

Which Credit Score Matters The Most

While there’s no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

While that can help you narrow down which credit score to check, you’ll still have to consider the reason why you’re checking your credit score. If you’re accessing your credit score simply to track your finances, a widely-used base score like FICO® Score 8 works. This version is also helpful for gauging which credit cards you qualify for.

If you plan to make a specific purchase, you may want to review an industry-specific credit score.FICO lists the specific scores that are used for various financial products. FICO® Auto Scores are ideal if you want to finance a car with an auto loan, while it’s good to check FICO® Scores 2, 5 and 4 if you plan to buy a house.

Dont miss:

Whats A Credit Report

A credit report includes information about your past and existing credit agreements, such as credit card accounts, mortgages, and student loans, and lists inquiries about your credit history. It outlines how much you owe creditors, how long each account has been open, and how consistently you make on-time payments. Credit reports also list related public records, such as collections or bankruptcy filings.

Read Also: Does Credit Karma Affect Credit Score

How Are Credit Scores Created

Our FICO Score vs Credit Score article also explores the five factors of how a credit score is defined, including:

-

Number of Accounts

Lenders and creditors want to know how many types of accounts you have, to determine if youre able to successfully manage said accounts. If you have multiple credit accounts that are maxed out, for example, your credit score will more than likely be affected.

-

Types of Accounts

A credit score takes into consideration the different types of accounts you have in relation to revolving debt and installment loans .

Lenders check to see if youre staying within your credit limit means, which would demonstrate responsible behavior. Your available is the amount of your limit you can still use for purchases.

-

Length of Credit History

The length of your credit history demonstrates how long different accounts have been active. Credit score calculations are indicators of how long your oldest and most recent accounts have been open.

-

Payment History

An individuals payment history reveals a lot about a persons creditworthiness. Such history, for example, may include credit card utilization, retail department store accounts, auto loans, student loans, or mortgages. How long it took you to repay these loans would affect your current credit score.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

You May Like: How To Fix A Bad Credit Score

How Do I Access My Credit Report

The Fair Credit Reporting Act allows consumers access to one free credit report annually from each of the three major credit reporting agencies through AnnualCreditReport.com. By viewing your credit reports, you will be able to know what lenders will see when you apply for a loan. The free annual credit report will not contain your credit score.

What Is A Credit Report

A is a comprehensive record of a consumers credit history that includes outstanding and past lines of credit, payment histories, third-party collections, lender inquiries and public records such as bankruptcies and repossessions. Every consumer has three reportsone compiled by each of the three major credit bureaus. Notably, however, credit reports do not include the consumers credit score.

Don’t Miss: Is An Eviction On Your Credit Report

What Is Fico Score

FICO is the short form of Fair Isaac Corporation that prepares credit rating models. It is a United States company-owned brand and proprietary credit scoring model that assesses the creditworthiness of any aspiring or existing borrower applying for a loan from a financial institution. It is a three-digit number like any other that assesses the risk in lending money. Credit agencies compile this score from the borrowers credit reports and credit history.

FICO scoring model is based on five different parameters payment record , balance loan amount , credit age , loan mix , and recent loan applications . Almost 90% of all the major lending institutions utilize the scoring before approving a loan.

FICO gives a varied output of scores depending upon the type of score the lender check and the type of credit bureaus use. Moreover, the higher FICO scores depict the exception , and the lower score depicts the worst credit record of a borrower. As a result, a higher FICO score enables an individual or business to get faster loan approvals by lenders and vice versa.

The most generally used FICO® Score versions, along with their uses, are the following:

- Most commonly used is FICO score 8.

- For credit card approval, FICO Bankcard Scores 2, 4, 5, and 8 plus FICO score 3 are used.

- FICO Auto Scores 2, 4, 5, and 8 are used for auto loans.

- FICO scores 2, 4, and 5 are used for mortgage lending.

Types Of Credit Scores: Vantagescore Vs Fico Score Vs Credit Score

Understanding your credit score can be hard. And to make things even more confusing, you may have heard that there are different types of credit scores.

No matter what credit score model you use, its important to understand what your score means and how it is calculated. Use this guide to learn the difference between credit score, FICO Score, and VantageScore.

Read Also: How To Raise Credit Score Without Credit Card

What Are Fico And Credit Scores Used For

Three main loans are common with both FICO and credit scores in evaluating creditworthiness:

- Personal Loansloans that you receive from a lending institution for personal usages, such as medical bills, education, etc.

- Mortgagesloans taken out to buy property or land.

- Auto Loansloans from lending institutions for the purpose of buying a vehicle.

Is A Fico Score The Same As A Credit Score

A FICO credit score is a type of credit score. The difference between them and other credit scoring models is that FICO specifically develops FICO scores. The FICO credit scoring system uses a proprietary model to generate consumer credit scores based on five factors: payment history, credit utilization, credit age, credit mix, and credit inquiries.

You May Like: How Long For Things To Fall Off Credit Report

Did You Know That Not All Credit Reports Are The Same

That’s because both fico and vantagescore . Its used as a way of measuring your ability to repay a loan in full so it needs to be accurate or you will miss out on the interest rate Credit karma uses what’s called vantage score. Breaking down fico and vantagescore Instead, they use a vantagescore 3.0.

Berita terbaru

Are Fico Scores And Vantagescore Different

Reading time: 3 minutes

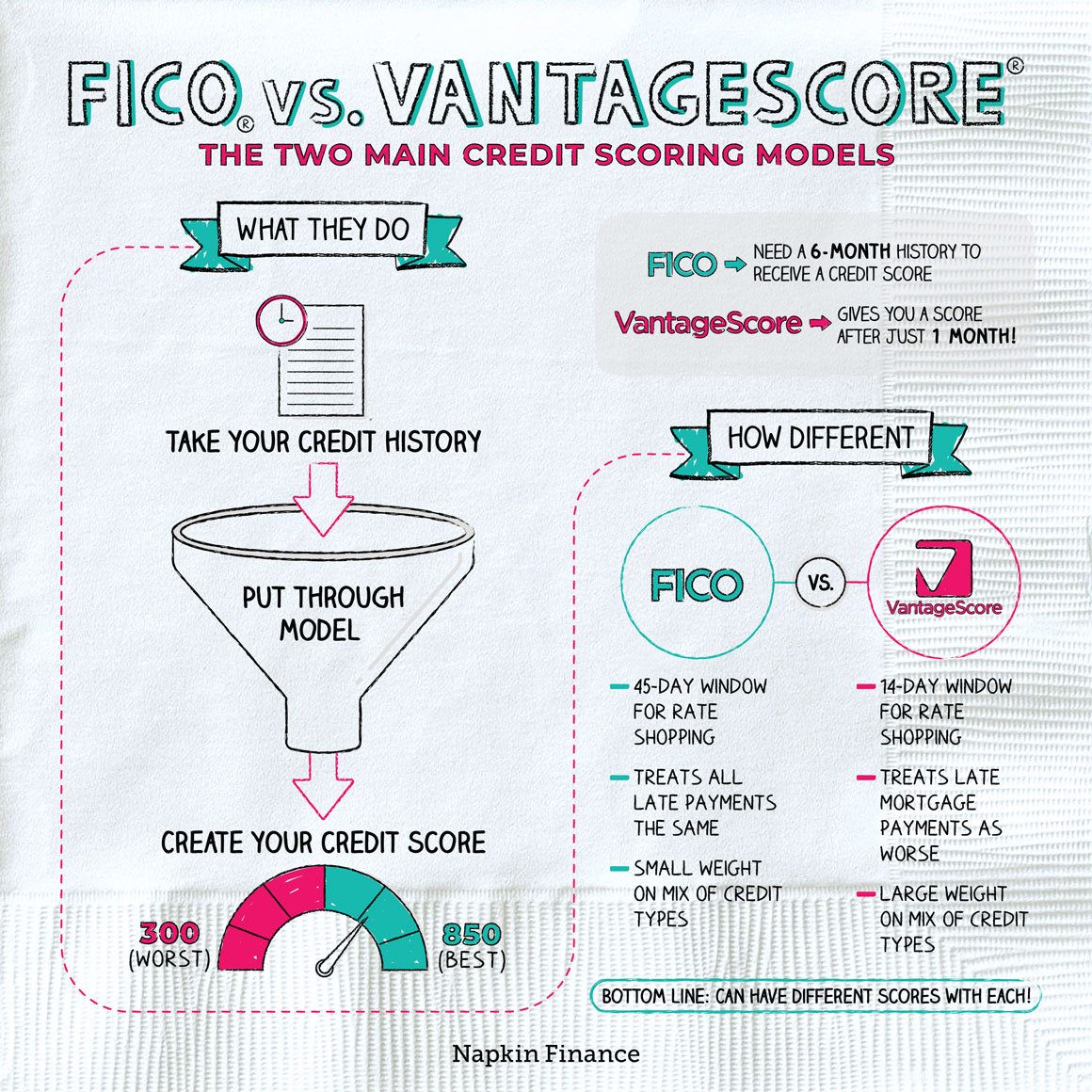

- FICO and VantageScore are two different companies

- Both companies create credit scoring models

- Their models give different levels of importance to different information in your credit reports

Did you know you dont have only one credit score? There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Credit scores are calculated based on the information in your credit reports.

Depending on which model, or even which credit bureau furnishes the information used in calculations, your credit scores may vary. Lenders and creditors may use your credit scores to help determine whether to approve your application for credit. Before approving you, they want to know: Whats the likelihood youll pay your bills on time? Lenders generally also have their own lending criteria, which may include other factors, such as your income.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation, or FICO, and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus Equifax, Experian and TransUnion.

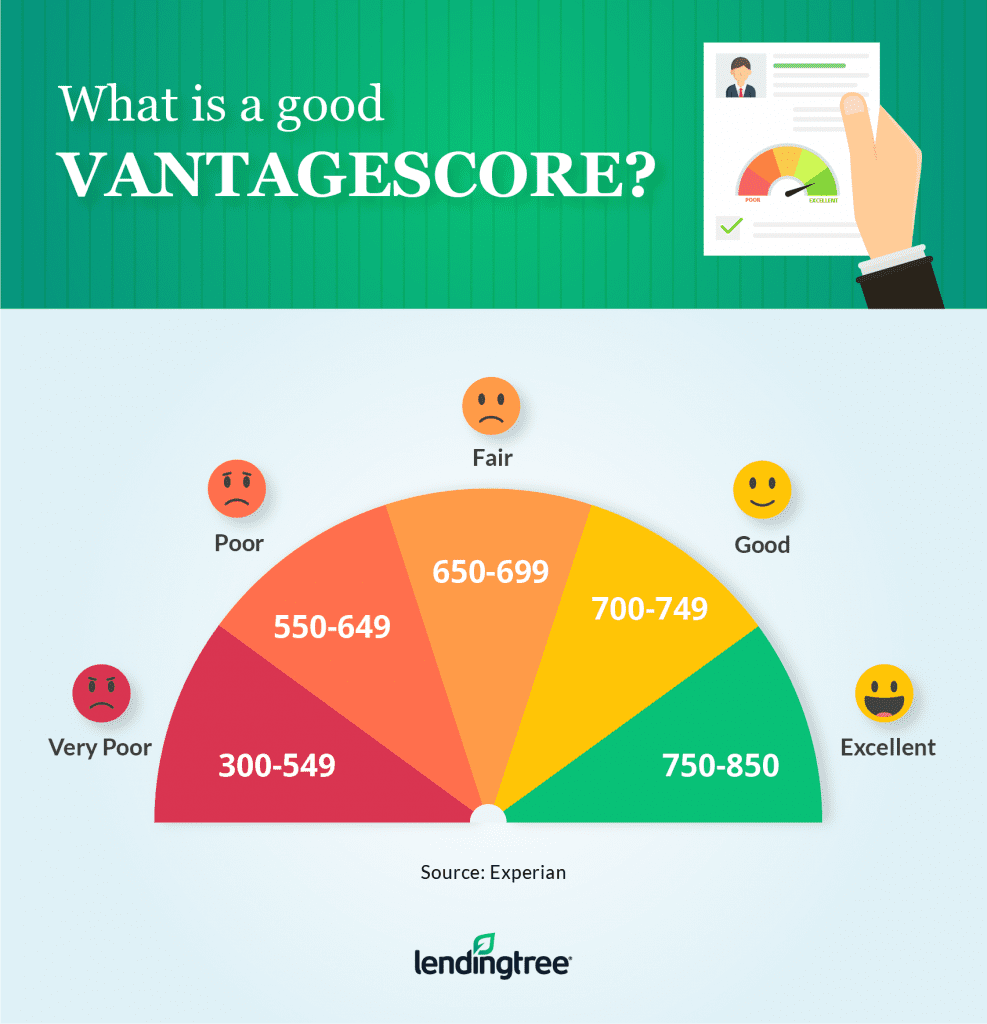

Both FICO and VantageScore assign higher credit scores to consumers deemed as lower-risk borrowers, and both currently range from 300 to 850.

FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each:

You May Like: What Is Erc On My Credit Report

Fico Score Vs Credit Score: Which Is Better

Whether a FICO credit score is better than another credit score depends largely on how the scores are calculated and how they’re being used. Again, FICO scores focus on payment history, credit utilization, credit age, credit mix, and credit inquiries to give lenders an idea of how likely you are to pay back the money you borrow. Other credit scoring models may consider different factors to make the same determination.

VantageScores, for example, break down like this:

- Extremely influential: Credit usage, balance, and available credit

- Highly influential: Credit mix and experience

- Moderately influential: Payment history

- Less influential: Age of credit history

- Less influential: New accounts

Like FICO scores, VantageScores range from 300 to 850 while assigning different weights to payment history, credit usage, and other activity. So in terms of which score is better, a lender might prefer to use FICO scores if they want to gauge how likely someone is to repay their debt. But if they’re more interested in how much debt someone has and their credit utilization, they may use VantageScores instead.

Fico Score Vs Credit Score: Differences

FICO and Credit Score Checking Tools

Learn in detail about FICO score vs. credit score to manage your financials appropriately and always stay on the green side when it comes to personal borrowings, credit card applications, or mortgage requests.

No single credit rating agency provides a for an individual valid throughout the world. Lenders contact various credit rating companies for credit reports to make the final decision of granting the funds.

Don’t Miss: Is Fico The Same As Credit Score

Can Your Credit Scores Be Different On Your Credit Reports

When a lender performs a hard credit inquiry on a borrower, they can choose which credit report to pull information from. Your creditors might not report all of your information to all three credit reporting agencies, so your score could vary based on which credit report is used. For example, you could have different FICO scores based on information from Experian. vs. your Equifax credit report.

What Is A Credit Score

A credit score is a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.

So where do credit scores come from? They’re generated by companies like Equifax, Experian, and TransUnion based on information that’s included in your credit reports. A is a collection of information about your financial life, including:

- Existing credit accounts

- Public records, including judgments, liens, or bankruptcy filings

- Inquiries about you from individuals or organizations that have requested a copy of your credit file

Credit reports are maintained by . Equifax, Experian, and TransUnion are the biggest in the U.S. These companies compile credit reports based on information that creditors report to them as well as information that’s available as part of the public record.

Don’t Miss: How To Raise Credit Score With Credit Card

Fico Score Vs Credit Score What Is The Difference

FICO score or not, all measure your credit risk. A healthy score can open doors, help you purchase, sell, and do a lot of other things without spending a fortune on premiums. Beware of a poor credit score because it may make it difficult to access the finances you may need to fuel your dreams.

But not all credit scores are alike. Two major credit systems are used to determine creditworthiness VantageScore, and FICO. Well show you why it matters and how to calculate them.

Do Lenders Use Fico Scores Or Other Credit Scores

When you apply for loans or lines of credit, it’s likely that a lender will check at least one of your credit scores. The majority of lenders rely on FICO credit scores but it’s possible that a lender may use an alternative credit scoring model when determining whether to approve you for a loan or line of credit.

Also Check: What Does Dt Mean On Credit Report

Checking Your Credit Scores

If you want to get an official FICO score, you’ll need to look into certain sources, because you otherwise risk getting an educational score or VantageScore. You can get an official FICO score through the websites for myFICO, Equifax and Experian, usually for a fee, as well as through a variety of access partners that may allow customers to have access to a free FICO score. For example, some banks, credit unions and creditors that offer access include Citi, Bank of America, Barclaycard, American Eagle Financial Credit Union, Bankers’ Bank, Discover and KeyPoint Credit Union.

You can get your VantageScore through banks and the credit bureaus TransUnion and Experian, as well as numerous online financial websites. For example, Credit Karma, Credit Sesame, myBankrate, NerdWallet and WalletHub are some free online providers. If you’re a customer of Capital One, US Bank, Chase or OneMain Financial, you can also get your VantageScore free online through these financial institutions.

When you’re simply looking for credit scores for educational purposes, you can turn to websites for the credit bureaus alongside numerous sites that offer free . For example, you can use Credit.com to get an Experian-specific credit score for educational purposes. Regardless of where you find a credit score, read closely to see if it identifies the source or model as well as the range so that you have a good idea of how to interpret it.

Fico Score Vs Vantagescore: The Most Popular One

FICO score has been in the financial lending system for longer than the VantageScore. Hence, it has naturally gotten much more exposure than its competitor. Also, government-sponsored home loan securitization enterprises like Freddie Mac and Fannie Mae have only approved the FICO score to be the determining factor when issuing retail home loans.

Now that youve gone through the theoretical basics of credit score, FICO score, and VantageScore, find below some online tools that will help you:

Also Check: How To Get A 700 Credit Score In 90 Days

Top 3 Reasons You Should Choose Fico Scores Over Non

“For years, there has been a lot of confusion among consumers over which credit scores matter. While there are many types of credit scores, FICO Scores matter the most because the majority of lenders use these scores to decide whether to approve loan applicants and at what interest rates.” The Wall Street Journal1

So why choose FICO Scores over other scores? Here are just a few reasons:

2.You can make more informed financial decisions. With FICO Scores, you’re better prepared to know when to apply for credit because you’re viewing the scores used by 90% of the top lenders.

Remember, non-FICO credit scores can differ by as much as 100 points. Other credit scores may vary from your FICO Score by several points. This variance could cause you to overestimate your likelihood of getting approved. According to a recent Consumers Union report, “score discrepancies can give consumers the false hope that they qualify for credit or low-interest rates when they do not. Consumers can face higher interest rates than expected, or be denied credit.”2

On the flip side, non-FICO credit scores can lead you to underestimate your creditworthiness, keeping you from purchasing a much-needed family car or refinancing a mortgage that could save you thousands in interest.