Online Court Case Search

Another way to find out about a tenants eviction record is to go to your states court website or the website for the court located in the same city or county as the rental unit.

Because evictions are considered part of the public record in most states, the general public is allowed to have access to eviction cases.

Several states will allow you to look up case information online for free, such as Missouri, but youll need to know at least one of the following pieces of information:

- Name of tenant

- Name of landlord/property management company

- The case number

Typically, the tenant is the defendant in the case and the landlord is the plaintiff. Enter the information you have into the appropriate search fields.

Some states provide very little case information online, while others include the date the eviction order was issued, whether the tenant was ordered to pay any money to the landlord , the amount ordered, and whether the debt has been paid off.

Where Can I Get A Copy Of My Eviction Notice

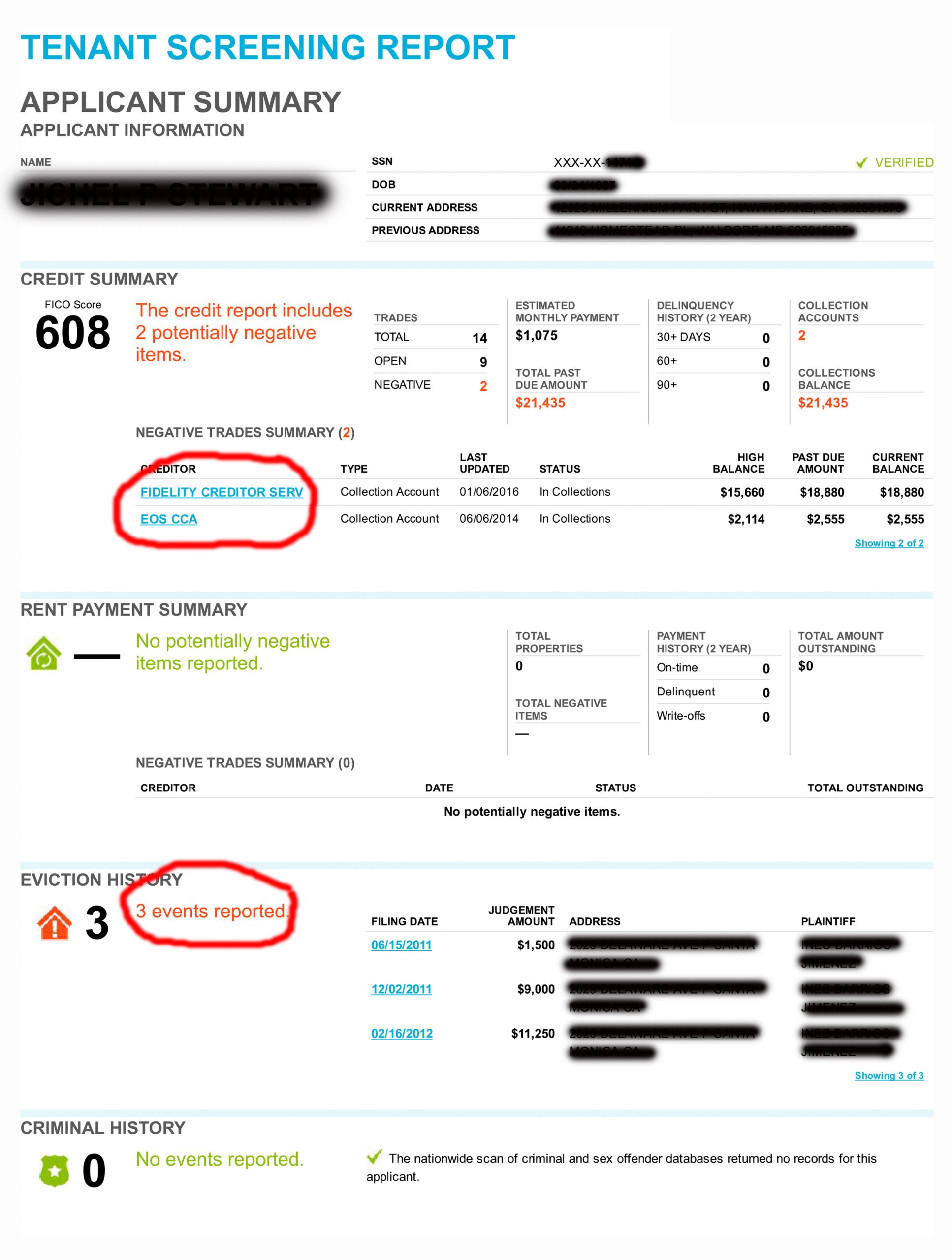

Most people dont look up court info. The most common place is to look in your credit report under the public records section. You can grab a copy of your credit report from AnnualCreditReport for free, which you are entitled to a free report. You can expect to see the eviction to pop up on your report 30 to 60 days after the judgment is made.

When Does An Eviction Go On Your Credit Report

The good thing is that evictions are not specifically stated on credit reports. However, unpaid debt prior to or following your eviction might prompt your landlord to hand over your account to a collection agency. And a collection status can drag your down by 100 or more points. So, while eviction itself cannot be seen on your credit report, eviction-related debt might be.

Furthermore, if the landlord has forced you out by obtaining an eviction judgment, evidence of the legal process will appear on your .

| Did you know that if you are extremely afraid to look into your credit report, you might be suffering from FOFO, or fear of finding out? This phenomenon is much more common than you would think. If you are also afraid to look at the results of your medical tests and youd rather not seek medical advice at all, this psychological barrier can even be life-threatening. |

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

Review Your Credit Report

First things first, you have to review your credit report to figure out exactly where you stand credit-wise. Thereâs a chance there is incorrect information on your report, so youâll want to dispute any discovered errors as soon as possible, especially if you plan to buy a home soon. To do this, file a dispute with the credit reporting agency that provided the report with errors you will also need to contact the lender who reported incorrect information to the credit bureau.

How Does An Eviction Impact Your Future Housing Prospects

Unfortunately, an eviction will almost undoubtedly hurt your ability to secure housing in the future.

Many landlords perform credit checks on prospective tenants. So, if your credit report contains debts owed through collection agencies or civil judgments, that will raise a big red flag on your application.

Even if a landlord cant tell that the collection debt is rent-related, theyll still question your ability or propensity to pay the rent on time each month.

Youll also have trouble getting approved for a mortgage, credit card, or personal loan during those seven years because your credit score will take a huge hit.

Don’t Miss: Can Public Records Be Removed From Credit Report

Can I Still File For Bankruptcy If I Have An Eviction On My Credit Report

Yes, if the eviction is recent, youll usually be able to file for bankruptcy. However, ensure that all of your debts are included in the petition, as exemptions may not apply if its an outstanding mortgage or other debt. Remember that filing for bankruptcy should always be considered a last resort option, so try to resolve this issue with your creditors first.

What Is Your Credit Score And Why Does It Matter

Its important to understand what your credit score is in order to understand the impact of an eviction on it. Your credit score, a number ranging between 300 and 850, summarizes your creditworthiness, and the higher it is, the better.

It is calculated based on your credit history and takes into account things like your overall level of debt, your history of repayment, how many accounts you currently have open, and other factors.

Your credit score matters because many landlords or property management companies will run a on prospective renters before agreeing to sign a lease. If your credit score is too low, a potential landlord may worry that you wont be able to pay your rent in a timely manner.

Recommended Reading: Qvc Card Credit Score

Eviction Reporting Time Frame

Eviction reports will remain on your credit report for a maximum of seven years. Under the terms of the Fair Credit Reporting Act, any eviction, collection action or judgment must be removed from a tenants credit history after that time. The only way to avoid this seven-year blemish is to make reparations with the landlord or vacate the property if problems exist. Do your best not to violate any terms of the lease and respond to any landlord notices immediately.

What Happens To Your Credit Score If You Get Evicted

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If you lease a property and violate the terms of your agreement, your landlord may decide to evict you. Aside from leaving you with no place to live, an eviction can seriously damage your , which can make it harder to eventually secure a mortgage or even get a credit card or car loan.

Though an eviction itself doesnt get reported to the credit reporting bureaus , the fallout from an eviction could be.

For example, if your landlord sells your debt to a third-party collection agency or files a civil lawsuit against you, those actions will likely appear on your credit report, thus impacting your credit scores.

A good credit score is key to securing new loans, some types of employment and even future rental properties, so anything that might negatively affect your credit report is cause for concern as that data is fed into an algorithm that makes up your credit scores.

Recommended Reading: How To Get Navient Off Credit Report

Can A Bankruptcy Remove An Eviction From Your Credit Report

No, a bankruptcy wont clear an eviction from your record. Bankruptcy doesnt remove past negative information on your credit report it merely re-negotiates old debt or removes an obligation to pay it. How can I check if I have evictions? Past evictions should be shown in the Public Records section of your credit report.

How Can I Avoid An Eviction

If you are worried that you will be unable to pay your rent, talk to your landlord. Try to work out a deal to avoid eviction. Your landlord may be willing to create a payment plan, temporarily lower your rent, accept delayed payments, or otherwise come up with a plan that works for both of you. Attorneys from Legal Aid of Northwest give tips on how to negotiate with your landlord in this video.

You can also look for local agencies and organizations that offer rent payment assistance. This aid is temporary, but it may be enough to help you avoid eviction while you get back on your feet. See the Texas Eviction Diversion Program article for a list of rent assistance programs near you. The Texas Eviction Diversion Program may also help you seal your eviction record so it does not count against you.

Recommended Reading: How To Dispute A Missed Payment On Credit Report

Where Can You Go For Help

Because eviction laws differ from state to state, its best to research the relevant laws where you live. If youre not sure where to start or think your landlord is mishandling the eviction process, look up your local Legal Aid chapter.

If you qualify under your chapters low-income guidelines, you can receive free legal assistance. Theyre likely to have specific expertise with eviction defense.

You can also try negotiating directly with your landlord. If you just need a bit more time to come up with your rent money, consider telling them about your financial situation.

Most landlords want to avoid lengthy and potentially expensive court proceedings. So if youve been a good tenant but are in a rough spot with your money, it cant hurt to try being open and working out an agreement.

What If I Dont Think This Will Work

Whether or not this works for your specific issue depends on the unpaid debt left behind by the eviction and the laws in your state. However, most all of the time, it will work for cases where financial hardship was the result.

If an eviction isnt showing up on your credit report, then there is a good chance that this works for you.

If not, then Credit Saint can help remove negative information from your credit reports with better results than if you did it yourself. Keep in mind that hiring a professional can always be more effective than going through the process of removing evictions or other negative items alone.

You May Like: What Is Syncb Ntwk On Credit Report

Does An Eviction Show Up On Your Credit Report

While positive rental payment history may be included in your Experian credit report, your report will not show eviction information. Eviction records can be found via a , which can be obtained through a tenant screening company or through Experian RentBureau.

Your landlord or apartment complex may also file a civil suit and win a judgment against you for the unpaid debt. Judgments are not part of a credit report, but they are a matter of public record and may be included in other kinds of consumer reports, so they could affect personal and business decisions.

Although your credit report will not show an eviction, it could include a collection account for any unpaid rent and fees, if the apartment complex felt that you owed them money and sold the past-due debt to a collection agency. The collection account should show the name of the original creditor who sold them the debt.

Collection accounts remain on your credit report for seven years from the original missed payment date that led up to the collection status. Collection accounts are considered derogatory and can have a substantial impact on credit scores, especially if left unpaid.

Although a paid collection account is still considered negative, some newer credit scoring models don’t include paid collection accounts in the score calculation, so paying off an outstanding collection account could help improve certain credit scores.

Hiring Professional Help To Remove An Eviction From Your Credit Report

If you are still having problems removing any negative items from your credit report, there is always the option of hiring a professional service to help with removing evictions! For instance, is a credit repair company that can help remove negative items from your credit history and reports.

While such as late payments, the eviction removal service is top-rated among clients due to the results associated with it. Not only can you get help removing your eviction case, but Credit Saint also offers protection against spam calls and texts, so you no longer have to deal with people trying to sell you things on your cell phone!

items from clients credit reports since 2014 and has received hundreds of great reviews from satisfied customers! So if you want to find out how to dispute an eviction on your credit report or need help removing negative information, visit Credit Saint by clicking on the link below.

Read Also: Does Balance Transfer Affect Credit Score

Why Should You Dispute The Eviction On Your Credit Report

If you arent paying your bills on time, the eviction will show up on your credit report for 7 years, just like any other negative account. Suppose you are trying to get back into the housing market after being removed from ones rental property, where rent is paid monthly. In that case, an eviction will have a negative impact to any potential landlords on your ability to get back in because of all the previous debts that were left unpaid before being evicted from properties.

Having an account with late payment history can affect your ability to get back into credit-related matters such as applications for new lines of credit at local bank branches or even apartment rentals!

To avoid having issues with creditors down the road when applying for a mortgage loan and other types of loans, its important to take steps towards understanding how to dispute an eviction on ones credit report.

Suppose youve been served with a lawsuit and your landlord sends the account into collections. In that case, it will be even more important that you understand how to dispute an eviction on ones credit report as opposed to disputing an eviction alone!

Furthermore, it helps to understand your credit and do everything you can to increase your credit score. Make sure you run a credit check on yourself . In many cases you can get a free report at no charge.

Can An Eviction Affect Your Credit Score

An eviction is a legal process wherein a landlord removes a tenant from a rental property. Generally, a landlord can evict you if you fail to fulfill your payment obligations. Though, evictions can still occur if you dont uphold or fail to meet the guidelines within your leasing contract.

Fortunately, an eviction doesnt always affect your credit score. This is because most landlords dont submit your payment history to the credit reporting bureaus. Unfortunately, an eviction can hurt your credit score if your landlord files the eviction in court. Because court judgments play a role in calculating your credit score.

In this article, well be taking a look at how an eviction can affect your credit score. And, by extension, your ability to qualify for loans and credit cards.

Recommended Reading: How To Unlock My Experian Credit Report

What Does Eviction Mean

Simply put, an eviction is the removal of a tenant from a rental property. A landlord may decide to evict a tenant if the tenant has broken the formal lease agreement by, say, damaging the property, not following property rules, or being severely delinquent. Landowners can also serve an eviction notice for reasons that have nothing to do with the behavior of the tenant, such as an intention to have the property renovated or demolished, to occupy it for personal use, or to turn it into a condominium.

| Did you know that of all OECD countries, the United States has the highest eviction rate, with 2.3% of all tenants having received a notice of eviction in 2016? Before the eviction moratorium, which was enacted due to the pandemic, the US states with the highest and lowest eviction rates were South Carolina and Maine, with 21.1% and 0.2% respectively. |

How Long Does It Take For An Eviction To Appear On My Record

If your landlord sued you for not paying rent and the landlord wins, you can expect the eviction to appear on your credit report within 30 to 60 days. The eviction will remain on your record for up to seven years and then it is usually deleted from public records. Every time someone pulls your credit report or rental history background check, the eviction will appear as long as the civil judgment remains in the public records. Additionally, don’t assume that the civil judgment will be erased automatically after seven years. There are plenty of examples of clerical errors causing evictions staying on record beyond seven years.

Also Check: How Long Does Repo Stay On Your Credit

Does An Eviction Show Up On My Credit Report

No, but an eviction can still make it difficult to rent in the future. An eviction case is a matter of public record. If an eviction case against you shows up on a public consumer report, any potential landlord may assume you were evicted. This is true even if you won your eviction case.

Also, any rent or court fees you owe may go to collections. This will appear on your credit report for seven years.

How Can An Eviction Affect Your Credit Score

Evictions can affect your credit score in many different ways. For one, an eviction will be reported to the major credit bureaus and stay on for at least seven years from the date it was enforced.

After seven years, the negative effects of eviction on ones credit reports go away, and the account is deleted by a creditor or creditor servicing agent .

Another consideration that you might want to consider when trying to understand how to dispute an eviction on ones credit report is that the civil judgment will also appear on your credit report for seven years.

However, if a creditor sends an item to a collection account, this can affect your file in many detrimental ways. This is why its important to make sure that you treat all creditors with respect and pay your debts off in a timely manner!

There is a direct relationship between your credit score and how well you pay your debts on time. In addition, if you have been evicted from one of your rental properties, the eviction will affect your ability to get back into the housing market during a tenant screening report after being removed from where rent was paid monthly. Past evictions can certainly hurt your ability to live in a desired location or may require a larger than usual security deposit for your new place.

This is why its so important to take steps towards understanding how to dispute an eviction on ones credit report before any issues arise with landlords!

Also Check: How Do I Unlock My Credit Report