Most Important: Payment History

Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid. So a 30-day late payment might have a lesser effect than a 60- or 90-day late payment.

How much a late payment affects your credit can also vary depending on how much you owe. Dont worry, though: If you start making on-time payments and actively reduce the amount owed, then the impact on your scores can diminish over time.

If youre having trouble making payments at all, you could also wind up with a public record, such as a foreclosure or tax lien, that ends up on your credit reports and can hurt your scores. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

Using The Credit Karma App

If you love to access your financial information on your phone, you can use the Credit Karma App. The mobile app is free to download for iOS and Android users. The app has tools and features that allow you to stay on top of your finances and check your credit score for free.

You can also file your state and federal tax returns with Credit Karma tax and put away cash with Credit Karma Savings.

With the app installed on your phone, you will have the ability to receive credit alerts if the company gets a crucial change to your credit reports from either Equifax or Transunion.

For example, if your credit card bill got paid off. Their free credit monitoring tool helps you keep up to speed on your finances and any unwelcome surprises.

Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

Also Check: When Do Creditors Report To The Credit Bureaus

Does Using A Credit Score App Lower My Credit Score

You may have heard that anytime someone checks your credit report, it lowers your score. So, it’s easy to believe that using Mint or Credit Karma, which both get your credit scores frequently, will continually lower your score. That’s not accurate. The system is a little more complicated. When you use Credit Karma or Mint, those credit reports are considered soft inquiries. Soft inquiries do not affect your credit score or report. When individuals want to check their own credit reports, those are soft inquiries. Other examples of soft inquiries are when a bank pre-approves you for a loan or a credit card. When you actually apply for a new account, that’s a hard inquiry, which does affect your credit report and score.

I asked Paperno why people sometimes get pre-approved for an account, but then at the point of hard inquiry, they’re denied. He gave a number of reasons.

Everything I just explained is relevant, because it leads to the question, “Do you need to check your credit score every single week?” which is the frequency that Credit Karma advertises. The answer is… it depends. For most people, the answer is no. Paperno confirmed that big changes in your credit score take months or years to attain. But as mentioned, smaller fluctuations can happen daily . There may be cases in which people need to know their credit score more frequently than that, but then they would have to consider whether tracking their FICO score would be a better option.

If You Want To Improve Or Maintain Good Credit

Lets say your credit score isnt in bad shape but you want to increase it. Here are some tips to help:

- Check your credit report annually: and dispute any errors that you come across quickly.

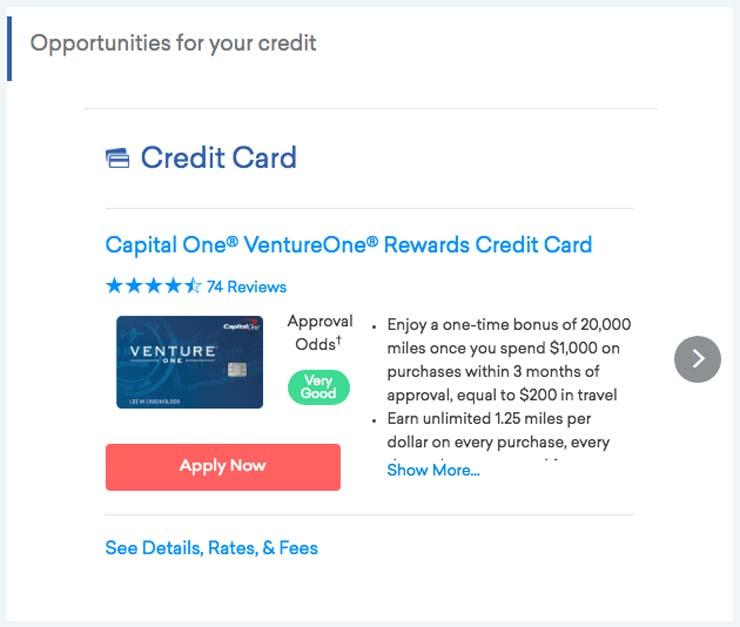

- Apply for a : doing so will decrease your credit utilization, which, remember, makes up 30% of your score.

- Pay all your bills in full and on time: this will continue to demonstrate that you can handle credit responsibly and help you avoid acquiring debt in the process.

- Pay off your debts: by keeping a low-to-zero balance on your debts you maintain a great credit history for lenders to view.

Some may worry that increasing your credit limits is counterintuitive to paying off debt.

Just remember that if you increase your credit limit, you shouldnt increase your balance. Otherwise, youve done nothing to improve your credit utilization or your credit score.

Recommended Reading: Does Carmax Work With Bad Credit

How Credit Scores Work

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Does Checking Credit Karma Lower Your Credit Score

lower your credit scoresyour credityouryour scoresyour credit scores

. Also asked, does checking credit karma hurt your score?

Doesn’t Hurt Your Credit Score, and Here’s Why. is a free online service that allows consumers to check their for free. Checking your credit on not hurt your credit score because it’s a self-initiated soft inquiry.

Subsequently, question is, why does your credit score drop when you check it? A soft inquiry has no effect on your credit score. In contrast, a soft inquiry or soft pull occurs when you or a creditor looking to preapprove you for a loan or card checks your score. So, if you apply for several cards close together, you might see a significant drop in your credit scores.

Also to know, is it bad to use credit karma?

Yes, is safe. In fact, the notion that it’s a scam is laughable. Not only is a real website with a solid reputation, but its services are also free to consumers, with no card required. But that’s to be expected of a company that deals in free scores and consumer data.

How often should I check my credit score on credit karma?

Checking your reports at least once a year is recommended to monitor for errors and help reduce your risk of identity theft. However, keeping more-regular tabs on your is smart.

Read Also: What Is Syncb/ppc

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Will Credit Karma Work If I Have No Credit

4.5/5You’vegethave no credit

Hereof, can I use credit karma if I have no credit?

You’ve just signed up for to get your free scores, but there’s one problem: You have no credit scores. Because your scores are based on information in your reports, your reports might not contain enough history for the bureaus to score.

Similarly, can you get a mortgage with no credit history? Borrowers without a strong often use FHA mortgages, backed by the Federal Housing Administration. FHA loans allow lenders to use nontraditional histories to qualify borrowers. Successful applicants must be able to show at least one year of: No delinquency on rental payments.

Similarly, it is asked, what is your credit score if you have no credit?

No credit, on the other hand, means you haven’t had any recent activity that the bureaus can use to generate a . No one actually has a of zero, even if they have a troubled history with . The FICO scoring model, for instance, ranges between 300 and 850.

Why do I not have a credit score?

In a nutshell: If you don’t have a credit score, it’s usually for one of two reasons: 1) you don’t have a credit history or 2) your history is too old. reference agencies don’t usually disclose under 18’s reports, either. accounts include current accounts, cards and loans.

So read on and find out the best credit cards to get if you don’t have any credit.

Don’t Miss: How To Fix A Repo On Your Credit

Are Credit Karmas Credit Scores Accurate

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

Donât Miss: Does Klarna Report To Credit

Why Your Credit Karma Credit Score Differs

There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find.

This is mainly because of two reasons: For one, lenders may pull your credit from different , whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your t is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models exist across the board.

As it states on its website, Credit Karma uses the VantageScore® 3.0 model. VantageScore may look at the same factors that the other popular FICO scoring model does, such as your payment history, your amounts owed, your length of credit history, your new credit and your credit mix, but each scoring model weighs these factors differently.

For this reason, VantageScore and FICO Scores tend to vary from one another. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

If you plan on applying for credit, make sure to check your FICO Score since there’s a good chance lenders will use it to determine your creditworthiness. FICO Scores are used in over 90% of U.S. lending decisions.

Editorial Note:

Read Also: Does Affirm Report To The Credit Bureau

Less Important: Recent Credit

Creditors may review your credit reports and scores when you apply to open a new line of credit. A record of this, known as a , can stay on your credit reports for up to two years.

Soft inquiries, like those that come from checking your own scores and some loan or credit card prequalifications, dont hurt your scores.

Hard inquiries, when a creditor checks your credit before making a lending decision, can hurt your scores even if you dont get approved for the credit card or loan. But often a single hard inquiry will have a minor effect. Unless there are other negative marks, your scores could recover, or even rise, within a few months.

The impact of a hard inquiry may be more significant if youre new to credit. It can also be greater if you have many hard inquiries during a short period.

Dont be afraid to shop for loans, though. Credit-scoring models recognize that consumers want to compare their options, so multiple inquiries for certain types of loans, like mortgage loans, auto loans and student loans, may only count as one inquiry. You typically have 14 days to shop for these kinds of loans. And though it could be longer depending on the scoring model, you may want to stick to getting rate quotes within those 14 days since you probably wont know which model is being used to generate your score.

How Credit Scores Are Created

Your credit reports include information about your and activity. The credit bureaus rely on credit scoring models such as VantageScore and FICO to translate all this information into a number.

While each credit scoring model uses a unique formula, the models generally account for similar credit information. Your scores are typically based on factors such as your history of paying bills, the amount of available credit youre using and the types of debt you have .

Federal law prohibits credit scores from factoring in personal information like your race, gender, religion, marital status or national origin. That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Read Also: How Does Walmart Affirm Work

Why Is My Credit Karma Score Different From Experian

Credit Karma generates a Vantage Score while Experian issues the FICO score.

The most influential elements in the calculation of a Vantage score are the persons payment history and the age and type of Credit. Other elements are the amount consumed from the credit limit, the current debt, recent credit inquiries and available Credit.

Vantage Score is different from the FICO score, which requires a calculation based on more than one account and six months. Vantage Score is updated weekly and can use data from one month. The Credit Karma website issues Credit reports belonging to TransUnion and Equifax bureaus. Credit Karma, however, doesnt issue the FICO score. Credit Karma also does not give Experian Credit reports.

- New credit: 10%

Delayed Reporting From Credit Bureaus

A major credit bureau like Experian and TransUnion may have tens of millions of customers with very complex credit reports and credit scores. As such, it is not very easy for a major credit bureau to constantly update information about your credit. Furthermore, most lenders only report the information about their borrowers to the credit bureaus once a month.

Overall, this means it can take a while for the credit bureaus to report your information. Typically, it can take 30-60 days for the credit bureaus to update your information. Once this information is updated, it can take another seven days for Credit Karma to have access to it and to report it to you.

This means that if you just paid a loan or credit card balance off, it could take up to 9 or so weeks for that information to finally show up on Credit Karmas website. This is very frustrating, but it is the way of the world for credit reporting and it is not likely to change very soon.

You May Like: Does Balance Transfer Affect Your Credit Score