Capital One Savor Cash Rewards Credit Card

Disclaimer The information about the Capital One® Savor® Cash Rewards Credit Card has been collected independently by MoneyUnder30.com. The card details have not been reviewed or approved by the card issuer.

The Capital One® Savor® Cash Rewards Credit Card is great for those who love to dine out. It offers 4% cash back on dining and entertainment, 2% at grocery stores, and 1% on all other purchases.

Read our full Capital One® Savor® Cash Rewards Credit Card review.

comes with no shortage of enticing perks: no annual fee, the opportunity to earn a $200 cash bonus after spending $500 in the first three months, 5% on travel booked through Chase Ultimate Rewards®, and 3% cash back on dining, including takeout and eligible delivery services.

Youll also get an additional 3% cash back on drugstore purchases, and 1.5% cash back on all other purchases, plus 0% Intro APR on Purchases for 15 months and 0% Intro APR on Balance Transfers for 15 months.

Read our full review of the Chase Freedom Unlimited®.

How To Get A Free Credit Score Online

Category: Credit 1. Free Credit Report Experian Experian offers free credit reports, credit scores, and daily monitoring. Check your updated credit report and always know where your credit stands. Credit Report Assistance You may already know that there are multiple ways you can get a free credit report. You

Wells Fargo Cash Wise Visa Card

The is a simple, reliable cash back credit card for borrowers with good to excellent credit. While the card doesnt come with quite so many bells and whistles as a luxury rewards credit card, theres plenty to like about this straightforward cash back card.

The Wells Fargo Cash Wise Visa® card earns an unlimited 1.5% cash back on all purchases, with no category restrictions or quarterly activations required. Theres an attractive introductory APR of 0% for 15 months on purchases and 0% for 15 months on qualifying balance transfers. After the introductory period, theres a 13.99%-25.99% APR based on your creditworthiness. The Wells Fargo Cash Wise Visa® card also has no annual fee, and comes with other perks like 24/7 fraud monitoring, zero liability protection, and cell phone protection.

Read our full review of the Wells Fargo Cash Wise Visa® card.

Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter that you activate. The categories will change every quarter. This card also offers 5% back on travel booked through Chase Ultimate Rewards® and 3% cash back on dining and drugstore purchases. Cardholders will also earn unlimited 1% cash back on all other purchases.

See more recommended credit cards if your FICO score is between 700 and 749 or 650 and 699.

Recommended Reading: Remove Transunion Inquiries

Lower Credit Score Okay

If you do enough research you can find plenty of data points of people getting approved with credit scores below 720. In fact, many people have been approved with credit scores in the 600s, so you definitely dont need a perfect credit score.

If you already have a long-standing relationship with American Express then you probably wont need as high of a credit score when you apply.

But if this is your first application with Amex and your score is in the 600s, youre likely facing an uphill battle. For those reasons, I would generally recommend that you focus on improving your credit score if its in the 600s.

Winner: Amex Simplycash Preferred

- Annual fee: $99

- Earn 2% cash back on all purchases

Despite being a premium rewards card â with an industry-leading 2% cash back on everything you buy and premium perks like comprehensive travel insurance â the Amex SimplyCash Preferred doesnât come with any specific income requirements. For context, most comparable Visa and Mastercards demand applicants earn an annual income of at least $60,000 or $80,000 respectively.

The Amex SimplyCash Preferred also sets itself apart for its below-average annual fee of $99 and not charging extra fees for secondary cardholders.

If youâre not interested in perks or donât suspect youâll earn enough cash back on the card to offset its annual fee, consider the Amex SimplyCash â a no fee alternative that earns an accelerated 1.25% cash back on all purchases.

Read Also: How Long Does It Take Opensky To Report To Credit Bureaus

Centurion Card From American Express* Vs The Business Platinum Card From American Express

The Business Platinum Card® from American Express has a $595 , which seems like a bargain only when compared to the Centurions $5,000. Some benefits, such as airport lounge access and hotel and car rental statuses, are the same with both cards. However, the Centurion offers Hilton Diamond, Delta Executive Platinum, and Hertz Platinum, which the Platinum does not.

While the Centurion may offer much in the way of statuses, the American Express Business Platinum grants significantly higher rewards: 5 Membership Rewards® points per dollar on flights and prepaid hotels through American Express Travel, 1.5 points per dollar on eligible purchases in key business categories, as well as on purchases of $5,000 or more everywhere else. Cap applies. Earn 1 point per dollar on all other eligible purchases.

Winner: American Express Cobalt

Card details

- Annual fee: $155.88 .

- Welcome Bonus of 20,000 Membership Rewards points when you spend a total of $3,000 in purchases on your Card in your first 3 months of Cardmembership

- Earn 5 points per $1 on groceries and dining

- Earn 2 points per $1 on travel, gas, and daily transit

- Earn 3x the points on eligible streaming subscriptions in Canada

- Earn 1 point per $1 on all purchases

- Transfer points 1:1 to several frequent flyer and other loyalty programs

The American Express Cobalt is one of the highest-earning rewards cards out there, offering up to 5 points per dollar on groceries and restaurants. Points are worth up to 1.75 cents each when redeemed for travel via Amexâs Fixed Points Rewards chart or 1 cent each if you want to keep things simple and use Amexâs straightforward Flexible Points program . The card has no specific income requirements, and when you apply online, you can get instantly approved in minutes if you qualify.

Also Check: Credit Check Without Social Security Number

How To Get Approved For Amex Platinum

The American Express Platinum has long been the premium travel reward card.

Surprisingly, for a luxury card with a $695 annual fee , the average cardholder credit score isn’t quite as high as you would expect.

Read on to learn about Amex Platinum and what it takes to get approved. See if you qualify.

We’ll explain more below. But first, let’s highlight the current American Express Platinum promotions.

American Express Credit Cards Faq

Comparing american express credit cards can be tough. But youve got the knowledgeable WalletHub community on your side. We encourage everyone to share their knowledge while respecting our content guidelines. Please keep in mind that editorial and user-generated content on this page is not reviewed or otherwise endorsed by any financial institution. In addition, it is not the financial institutions responsibility to ensure all posts and questions are answered….show moreshow less

Also Check: What Credit Score Do I Need For Amazon Visa

How American Express Calculates Your Charge Card Limit

American Express determines spending limits based upon your reported annual income and your payment history with their cards.

More specifically, a reader speculated:

Typically, your AmEx spending limit is three times your highest paid-in-full balance over the last six months. They are also pretty good about allowing you some flexibility if you call them ahead of time to inform them of pending charges .

I havent had an American Express card for long, and this is the first time I have used it for business expenses, so its no surprise the amount of charges seemed high.

To avoid this situation, expect to have a low credit limit when you start using a no pre-set spending limit card. Charge a bit to it the first month, pay on time, then charge a bit more each consecutive month.

If you want to make a large purchase with such a card, for example to earn rewards points, you can call them ahead of time to ask if it will be approved. Additionally, you can increase the charging power of your card at any time by making payments more frequently than once per month.

If you have excellent credit, you are more likely to get a large credit limit with a regular old credit card like any of these.

Continue To Monitor Your Credit After Approval

After you’ve gotten approved for a new credit card, avoid the urge to ignore your credit until the next time you want to apply for a credit card or loan. You can get a free credit report annually from all three credit bureaus through AnnualCreditReport.com. Though April 2021, reports are available once weekly, which can help you keep a close eye on any changes.

Additionally, you can use Experian’s to stay on top of your credit. Experian provides free access to your FICO® Score powered by Experian data and access to your Experian credit report. You’ll also get real-time alerts when new information is added to your report, including inquiries, accounts, personal information and suspicious activity.

Finally, if you notice something is amiss on your Experian credit report, you can file and track disputes directly through the Experian platform.

Fortunately, monitoring your credit doesn’t take as much work as actively working to improve your credit score, so it’s a good idea to keep an eye on where you stand, so you can address potential problems as they arise and help ensure you’re credit-ready the next time you want to apply.

You May Like: Navy Federal Personal Loan Approval Odds

How Does The Blue From American Express Card Compare To Other Cards

Comparing the Blue from American Express® card to most no-annual-fee American Express rewards cards is like comparing apples to oranges. This card is best for people who dont have perfect credit and so dont usually qualify for the most generous cards from American Express. But if you can get a hold of a higher-tier card, such as the The Amex EveryDay® Credit Card from American Express or the Blue Cash Everyday® Card from American Express, youll typically be better off.

Heres a closer look at some other cards you might consider.

How Hard Is It To Get The American Express Platinum

If you have the credit score needed for The Platinum Card® from American Express, you will enjoy some of the best travel rewards when you are approved.

For those that dont mind the $695 annual fee on the Amex Platinum card but dont want an Amex card, the Chase Sapphire Reserve® is a good premium travel rewards credit card option.

Chase Sapphire Reserve® purchases earn up to 10x Ultimate Rewards. Cardholders can earn unlimited:

- 10x total points on hotels and car rentals purchases through Chase Ultimate Rewards

- 10x total points on Chase Dining purchases with Ultimate Rewards

- 5x total points on flights when you purchase travel through Chase Ultimate Rewards

- 3x points on other travel worldwide

- 3x points on other dining at restaurants, including eligible delivery services, takeout, and dining out

- 1x points for all remaining purchases

You will not receive rewards points on your first $300 in annual travel purchases as the annual travel statement credit reimburses these purchases.

You get a $300 travel credit, passes to airport lounges, and a fee credit for TSA PreCheck or Global Entry.

This card is full of Visa Sapphire Reserve benefits as well. You will need an excellent credit score for this card.

Here are a few other highlights of The Platinum Card® from American Express that you can enjoy.

Related: Best Premium Credit Cards

Recommended Reading: How To Get Inquiries Off Credit Report

Amex Gold Credit Score Needed Get A Good Credit Score First

American Express doesnt publicly disclose the minimum credit score range or the secret formula to qualify for the Gold Card or the other best American Express Cards.

But we do have the benefit of accessing online data points from the testimonies of recent applicants. These reports can give potential applicants with a similar credit background an idea of whether they will get instant approval or may need to wait for a secondary review.

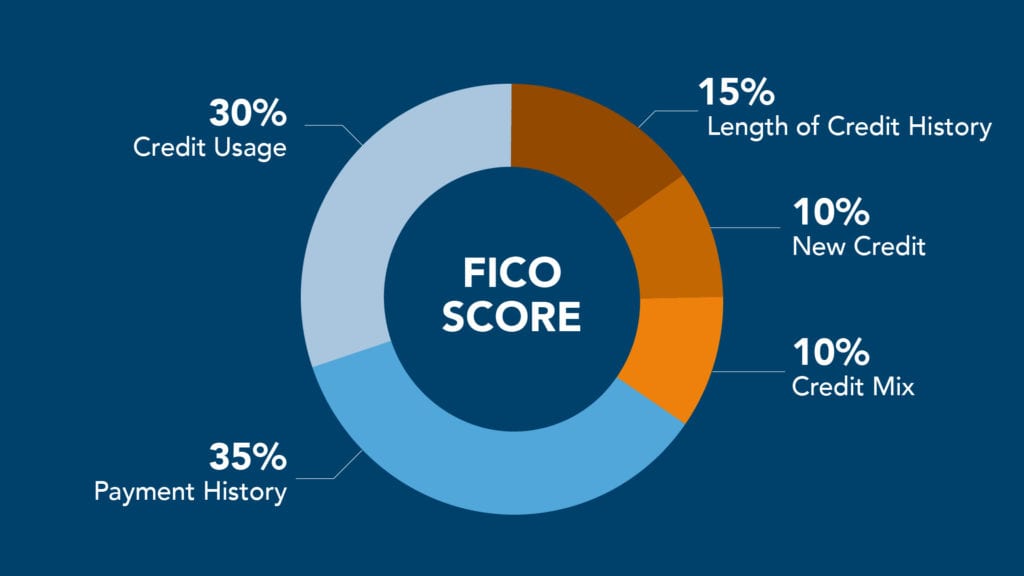

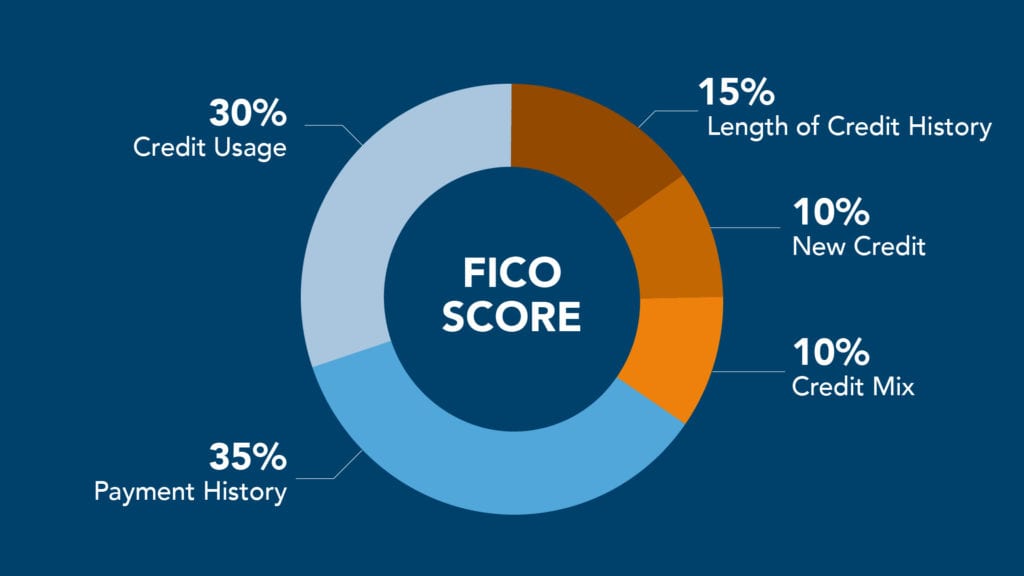

Its best to try for the Amex Gold with a minimum 680 FICO score . This credit score is the start of good credit.

A similar credit score can be necessary for the business version of this card, the American Express® Business Gold Card. Check out our in-depth American Express Business Gold Card review, also one of the best American Express business cards to have, to learn more.

Have A Low Credit Score Compare Credit Cards For Bad Credit

If you have no credit or bad credit and cant meet the minimum credit score for credit card approval of typical cards, you still have options. There are things you can do to help build up your credit rating and some forms of credit that youll still be eligible for in the meantime.

You May Like: Is A 524 Credit Score Good

Understand How Welcome Offers Work

Like many other credit card issuers, American Express provides upfront incentives called welcome offers to new cardholders. These initiatives allow you to earn a bonus when you meet a minimum spending requirement in the first few months.

With the Blue Cash Everyday® Card from American Express, for example, you can earn $200 back after you spend $2,000 in purchases on your new card within the first 6 months of card membership. Terms apply.

However, American Express only allows you to earn a card’s welcome offer once. This means that if you’ve had a certain American Express card before and canceled it, you can’t get its welcome offer ever again.

Other card issuers may have similar restrictions, so make sure you do your research before applying.

Faqs About Minimum Credit Score Requirements

-

What’s considered a good credit score?

Most credit agencies agree a score of around 650 is considered good enough to be able to qualify for most forms of credit. Learn more about good credit scores in our guide.

-

Why was my application denied when I have a good credit score?

Your credit score is just one of many factors credit card companies use to assess your eligibility for a card. So your application could be denied if you dont meet certain other criteria, like:

- Minimum age

- Proof of stable employment

- Citizenship or residency status

Find out what other reasons can cause your credit card application to be denied, and what you can do about it, in our guide here.

What can I do if my credit score is too low?

The most important way to rebuild your credit is to make all of your payments on time. Even one missed payment can damage your credit score.

Where can I find out my credit score?

The most reputable credit bureaus in Canada are Equifax and TransUnion. You can use these 2 bureaus websites to apply for your credit score. Or you can use services like and the to stay on top of your score and find out where you need to improve.

Don’t Miss: How Does Qvc Payments Work

What To Do If Youre Rejected

One of the worst mistakes people make is giving up when theyre rejected for a credit card.

If you receive a rejection letter, the first thing you should do is look at the reasons given for your rejection. By law, card issuers are required to send you a written or electronic communication explaining what factors prevented you from being approved.

Once youve figured out why youve been rejected, call Chases reconsideration line. Tell the person on the phone that you recently applied for a Chase credit card and you were surprised to see that your application was rejected and you would like to speak to someone about getting that decision reconsidered. From there, its up to you to build a case and convince the Chase agent on the phone why you deserve the credit card.

If you were rejected for too short of credit history, you could point to your stellar record of on-time payments. If you were rejected for missed payments, you could explain that those were a long time ago and your record since then has been perfect. Of course, theres no guarantee that this will work, but Ive had about a third of my rejections reversed on reconsideration. At the end of the day, its worth spending 15 minutes on the phone if it might help you get the card you want.

Related: Are there any long-term problems if you get declined for a credit card and what you can do about it?

How To Get A Good Credit Score

Of course, theres always the option of taking a step back from that American Express credit card application and working on your score before you try to get a new account.

This is probably the financially savviest way to go, since improving your score does more than get you the credit card you want.

The actions you take to raise your score can benefit other areas of your financial life.

First, you need to ensure you make all payments on balances, bills, and anything owed on time. You also need to make a full payment, not just a partial one.

Doing this over time will raise your score. But it can also help your cash flow right now since you wont get hit with fees for late or missed payments.

Youll also keep interest at bay if you pay off charges immediately instead of carrying balances, which saves money too.

Knocking down existing debts and reducing credit card balances will give your credit score a boost.

And from a big financial picture, reducing debt means reducing liabilities. It also frees up more money to put to better use instead of paying down debt, you can start saving or investing.

You can also keep an eye on how much of your available credit you use each month.

If you have a $1,000 credit limit, keep charges to $300 or less each statement cycle. This keeps your credit utilization low exactly what you want to get a good credit score over time.

Signup today:

Ask a Question

Don’t Miss: Will Klarna Build Credit