How A New Auto Loan Can Impact Your Credit

Does it actually matter whether your new loan shows up on your credit report? It might. If youre building or rebuilding your credit, a new auto loan can help you out in a few ways.

First, it adds to your . A car loan is considered an installment loana loan with fixed monthly payments and a predetermined payoff periodwhich is a different type of credit than a revolving credit card account. Having a car loan appear on your report shows creditors that you have experience managing diverse types of credit. It may also boost your credit score: Credit mix accounts for 10% of your FICO® Score, the scoring system used most commonly by lenders.

Your credit score will also benefit from having timely monthly loan payments show up on your credit report. Payment history is the most heavily weighted factor in calculating your score, so you want your monthly payments to count.

What are some typical reasons your new auto loan might not appear on your credit report?

Read Also: Aragon Collection Agency

How Do I Access My Credit Report

The Fair Credit Reporting Act allows consumers access to one free credit report annually from each of the three major credit reporting agencies, through AnnualCreditReport.com. By viewing your credit reports, you will be able to know what lenders will see when you apply for a loan. The free annual credit report will not contain your credit score.

Personal Credit Scores Are Key To Getting Approved

While a business credit card is for business purposes, a personal credit score is still a key qualifying factor across nearly every major business credit card. For business owners with great credit, this is awesome news you dont have to worry about establishing a business credit score, submitting business tax returns or financial statements, or getting someone to believe in the vision of your business as youd need to do for other business financing options. A great credit score helps power approvals and opens up a plethora of options for the applicant to choose from. However, if you have a bad personal credit score or not enough data to produce a credit score a major problem for the small business community, as Nav noted in its study a few years ago on credit ghosts it can prove extremely problematic. Since businesses are already viewed as riskier borrowers from the lenders perspective, credit requirements for business credit cards are sometimes even tighter than the personal credit card realm. There are just a handful of options from the major business credit card issuers for business owners with bad or no credit.

Note there are exceptions:

Recommended Reading: Bankruptcy Removed From Credit Report Early

How The Wells Fargo Business Secured Credit Card Works

Once you apply for the card and get approved, you will need to transfer an amount from your current Wells Fargo business bank account to serve as the security deposit for the card’s credit line. You won’t be able to touch the amount until you close the card. It will serve as a backup in case your company doesn’t pay its credit card bill.

You can request up to 10 employee cards and use the Wells Fargo Business Secured Credit Card the same way you’d use other credit cards. It’s important to spend wisely and make your payments on time for a couple of reasons. Wells Fargo will report your usage to the Small Business Financial Exchange to establish a credit history. Plus, the bank will periodically review your business accounts and card activity to determine if you’re eligible for an unsecured business credit card. If you’re offered an unsecured credit card, it may take about 30 days to receive your security deposit back.

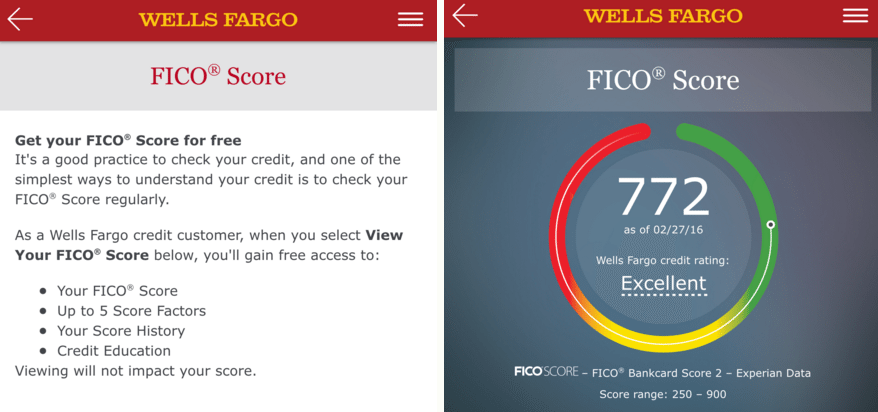

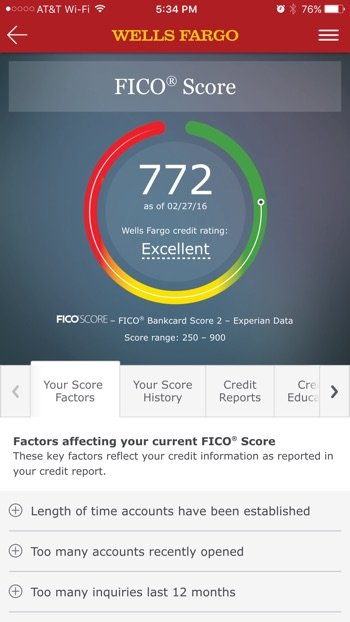

Does The Fico Score Im Seeing Reflect My Most Recent Payments

Scores reflect data from your Experian® credit report at the time it was calculated and may be from a previous period. All lenders have their own reporting schedule, so you should allow 30-60 days from the time of any payments or other activity for that activity to be reported in your credit report and then reflected in your FICO® Score. If you believe your FICO® Score is incorrect or doesnt reflect your most current activity, the first thing you should do is check your credit report. You can check your credit report from each of the three consumer reporting bureaus once per year for free at annualcreditreport.com. If you see an error or a particular lender has not reported your latest activity to the credit bureau, follow each bureaus instructions on how to dispute the information or contact the lender directly. If you see an error associated with a Wells Fargo account, call us at 1-855-329-9605, Mon Fri, 7:00 a.m. 7:00 p.m. Central Time.

Read Also: How Does Getting Married Affect Credit Score

A Few Key Considerations Startups Should Make When Choosing A Business Credit Card:

- How much working capital do you need?

- If youre in a partnership or have a co-founder, whose name will be on the application?

- Who will need access to the card?

- How will it impact your personal and business credit scores?

Heres Navs pick for the best credit card for startups:

Capital on Tap Business Credit Card

With no time in business requirement, and credit limits ranging from $1,000 up to $50,000, the Capital on Tap Business Credit Card can be a great business credit card for startups. Business owners with fair credit may qualify, and applying will place only a soft inquiry on your personal credit file. Like most small business credit cards, a personal guarantee is required.

It also offers rewards of:

Capital One Spark Cash Select For Business

For a no-nonsense cash back reward card, the Capital One® Spark® Cash Select for Business is a popular pick. Part of the impressive line of Spark business cards from Capital One, it offers a $0 annual fee with a simple rewards structure. Use the cash back for whatever you want, with almost no restrictions on how and where you can earn. If youre a fan of Capital One and its business-friendly credit model, this is a pick you can be proud to carry. While the card isnt heavy on travel perks, it does have some benefits, including emergency card replacement to get a new card or even cash 24/7 and auto rental damage waiver service. The purchase protection is a nice benefit, too, giving you 90 days of replacement, repair, or reimbursement for select items you buy with the card it also doubles the manufacturers warranty on items you buy. A $0 annual fee gives this card an extra boost, and frequent welcome offers can give you cash to pay down your account balance, or to spend on whatever you want. Rewards dont expire as long as you keep your account in good standing.

Note:

You May Like: What Is Syncb Ntwk On Credit Report

Tips For Keeping Your Student Loans In Good Standing

There are many things that impact your credit score. Your student loans may help you establish good credit and increase your credit scoreor they may lower your credit score if they are not kept in good standing. These four tips will go a long way toward helping you keep your student loans current.

- Monitor your account. Set up your account so you can receive important information about your loans. You can see current info about your account, such as your due date, monthly payment amount due, and current balance. Log in to your account regularly to monitor and make sure you keep your account current.

- Keep Nelnet updated. Make sure you keep Nelnet informed of any changes to your address, phone number, email address, or name. Even if you dont receive notifications about your account, youre still responsible for it. Dont miss important updates!

- Make your monthly payment. Making timely monthly payments keeps your account current, and may have a positive impact on your credit score. Making early payments can reduce the amount of interest you pay or lower the current balance on your loan.

- Note: If you are in an income-based repayment plan, be aware that you may have a monthly payment amount that is less than your monthly interest accrual. In this case, you may want to call us at 888.486.4722 before making early payments so that you dont increase your balance or negatively impact your credit score.

Costco Anywhere Visa Business Card By Citi

Costco club members enjoy a $0 annual fee with their paid warehouse membership. A competitive cash back rate on fuel makes this card a top pick for business owners who drive often: 4% cash back on eligible gas for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and eligible travel purchases, and 2% cash back on all other purchases from Costco and Costco.com.Rewards are paid out annually and can be used on in-store merchandise, with the balance given out as cash upon request. Other spending categories range from 1-2% without the need to enroll in bonus spending promotions. There is no limit to rewards, and your credit card doubles as your Costco membership card. Show it at checkout to get great deals on Costco merchandise, charge your purchase to your account, and build those rewards for an unlimited payout when your reward certificate is issued in February. This card has a lower rate than some other retail and warehouse club cards, so use it for your in-store purchases, online at the Costco website, and wherever you shop. Youll be getting points for all your business purchases, and team members and employees who are issued cards can be added to your account for even faster reward earnings.

Also Check: 888-826-0598

The Best Bank Of America Business Credit Cards

Bank of America has over 4,600 branches and close to 16,000 ATMs across the U.S., making it one of the largest banks in America and positioning it well to serve small business customers, especially those who already have a consumer banking relationship with BofA. Bank of America has business credit cards on both the Mastercard and Visa payment networks, which are extensive in the U.S. and abroad.

Why Timing Is Important

This is why understanding when the information on your credit card usage shows up on your credit report is important.

The reason your score has dropped in the suggested scenario is a high the balance you carry on your credit card compared with that cards credit limit. This ratio is expressed in a percentage and considered the second most influential factor in credit scoring after payment history.

Its generally recommended to utilize less than 30% of your credit to avoid damage to your scores. Ideally, you want to keep the ratio in the single digits.

Reported drastic changes in credit utilization can affect your credit score immediately and significantly. For example, if you havent been carrying a lot of credit card debt and then maxed out a credit card, your scores could take a hit. On the other hand, if your credit issuer has reported that you paid down a large part of your debt, you may see immediate positive results.

Fluctuations in your credit score can also be crucial when youre shopping for a loan, such as a mortgage or car loan. If your credit score is close to a FICO score threshold, even a small negative change can push you into a higher credit risk profile, which could increase your interest rates or even hurt your approval chances.

Also Check: Does Credit Limit Increase Hurt Score

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

Does Wells Fargo Cash Wise Visa Card Have A Cash Back Or Rewards Program

No, it does not offer a rewards program. This is a cashback card. This means you earn a percentage of your purchases as cash back rewards. You will receive 1.5% cash back on travel, dining, groceries, drugstore purchases, or any other purchase. For example, if you buy a $1,000 laptop, you will receive $15 back in cash.

Don’t Miss: Paypal Credit Score

Wells Fargo Auto Loan: In

Jul 31, 2020 But it does offer flexibility that other auto lenders dont, including direct financing you could use to buy a vehicle for your business or a

Aug 9, 2021 Theres a special credit score lenders use when approving you for an auto loanheres how to check it. Checking your FICO Auto Score can

Re: Carvana Experiences Interest Rate Credit Hit Etc

Id be spending $1000-3000 cash money on a car and would never ever recommend someone take out a vehicle loan at 20%. If you can get your score up 100 points even youd have a much better shot at sub 5% interest rates. I grabbed a 3.6% when I had a 619 so it is possible, might take some determination even then though.

Also Check: Does Paypal Credit Report To Credit Agencies

Why Did Wells Fargo Reverse Its Decision

Wells Fargo didn’t immediately respond to CNET’s request for comment. Previously, a Wells Fargo spokesperson said the bank’s decision to close personal lines of credit came down to simplifying its product offerings in order to “better meet the borrowing needs of our customers through credit card and personal loan products.”

The bank has had a tumultuous few years of federal investigation. In late 2017, the Federal Reserve imposed a cap on the bank’s assets — essentially preventing it from growing its balance sheet. The move came after an investigation revealed that Wells Fargo employees had opened checking and savings accounts without customers’ knowledge. Account holders were also forced to pay millions in credit and mortgage fees. In February 2020, the bank agreed to pay a $3 billion settlement to the US Securities and Exchange Commission and the Justice Department, and the asset cap remains active until the compliance issues tied to the fake account scandal are completely addressed.

Amid the pandemic in 2020 and due to limitations set by the Federal Reserve, the bank halted new home equity lines of credit and announced it would no longer provide auto loans to most independent car dealerships, CNBC reported.

What Are The Differences Between Carmax And Carvana

The biggest difference between CarMax and Carvana is that CarMax has physical lots spread out across the country. That means that you can shop local inventory in person and even test drive cars.

On the flip side, it also means CarMax has more overhead than Carvana, which could translate into higher prices.

The process for selling a car is also different. If Carvana wants your vehicle, they will make you an offer online then come to you to inspect the vehicle. If your car passes, they will cut you a check.

If CarMax is interested in purchasing from you, they may ask you to bring your car into the closest store for inspection. If your vehicle is up to their standards, they will buy it from you there.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

A Few Key Considerations You Should Make When Choosing A Business Credit Card For Bad Credit:

- Whats the APR for purchases?

- Is there a penalty APR if I pay late?

- Whats the annual fee?

- How much working capital do I need?

- Would a no-personal-guarantee business credit card be a better option for my needs?

- Will this card help me build my personal and business credit so I can access better financing down the road?

Because business credit cards for bad credit are very limited, Navs pick here is a personal credit card with a flexible credit score requirement:

How To Apply For A Small Business Credit Card

The process of applying for a small business credit card is very similar to that of applying for a personal credit card. Often that means applying online. Youll provide information about yourself and your business, and a decision can typically be made almost instantly.

It is a good idea to have an Employer Identification Number before you apply. If one of your goals is to build business credit, it is also a good idea to make sure your business has a D-U-N-S number from Dun & Bradstreet before you apply. As part of the CDD regulation to prevent money laundering and other types of fraud, the applicant for the business credit card isnt the only one who needs to provide information on the application. If you have any business partners who own more than 25% of the business or are a beneficial owner , they will likely need to provide personal information to make sure they are actual persons and not on a government watch list.

Pro Tip:

Now, on to the top business credit card selections!

Recommended Reading: Does Paypal Credit Report To Credit Bureaus