Does An Eviction Appear On Your Credit Report

While good rental payment history may be shown in your , eviction information will not be provided. Eviction records may be discovered in a separate rental history report acquired from a tenant screening firm.

After you have been evicted, your landlord or leasing company may sell your outstanding debt, such as overdue rent and associated fees, to a collection agency. A collection account would show on your credit record if the collection firm that bought the debt reported to the three major credit bureaus.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

What Happens If My Attempts At Removal Are Not Successful

Have you exhausted all options with a public record entry on your credit report? Does it just not look like youre going to succeed?

There are things you can do to improve your credit score. The first thing to do is develop a financial strategy. That will help you prevent any future judgment or any other types of delinquencies on your credit report.

You can cut expenses like cable, data plans, dining out, and other non-essentials. You can seek to increase revenue by taking on overtime or a second job. Anything you can do to get your revenue and expenses into a healthy balance will help you in the long run.

Its OK to borrow money within reason, since lenders want to see successful borrowing history. But you should avoid taking on loans that can hurt you if you run into temporary financial trouble like a lost job or medical emergency.

Make sure you make all your loan payments and credit card payments on time, and again, you need to do whatever it takes to satisfy any unpaid judgments or tax liens.

If it starts to feel overwhelming, you might want to consult with a reputable credit repair company, tax attorney or bankruptcy attorney. When it comes to public records, it often makes sense to leave the legal and technical challenges to the experts who have devoted a lifetime to solving these kinds of problems. You can think of it as an investment in your financial future, and it can help you avoid even more stumbling blocks down the road.

About Rick Miller

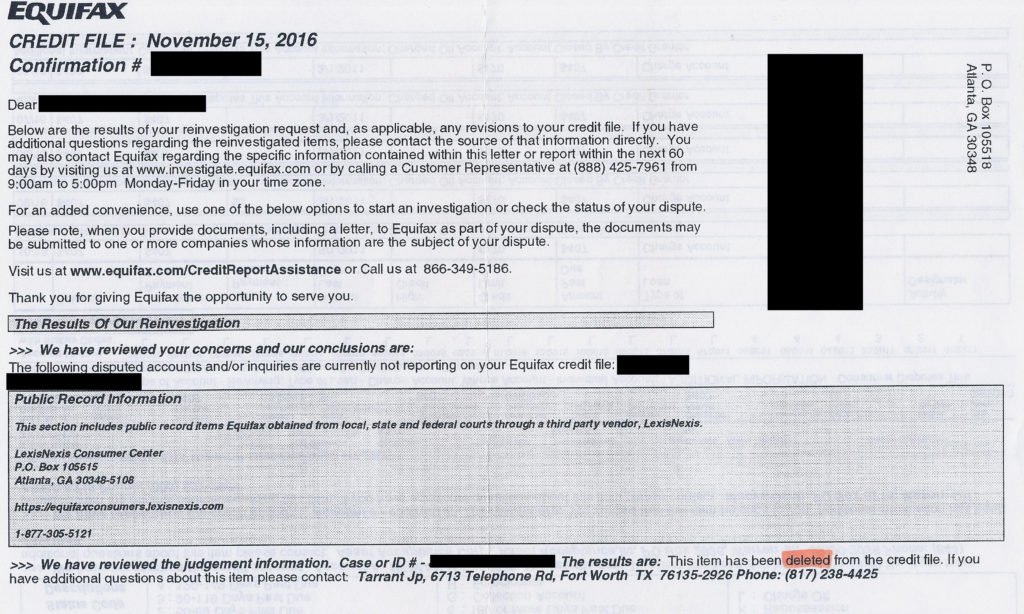

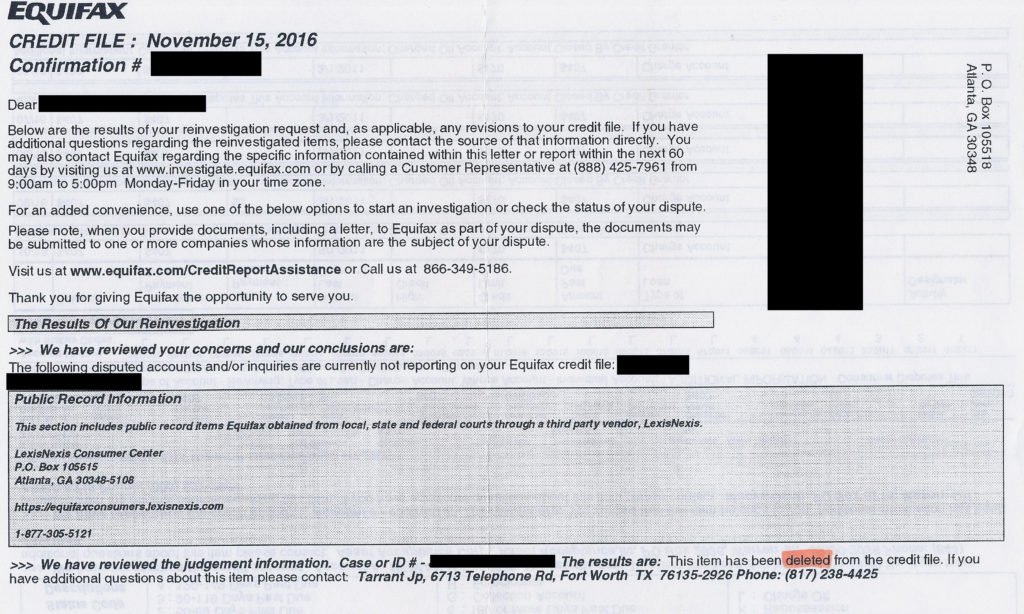

How Can I Remove An Inaccurate Civil Judgment

Your civil judgment may remain on your credit report and public record even if it is inaccurate. This may be due to a number of factors, including clerical mistakes or disagreements that were misplaced in the mail.

If you find a civil judgment on your record that should not be there, you must correct it. It is critical to correct errors that have a negative impact on your credit score, ability to rent, and capacity to apply for new credit.

Contact the county and/or credit bureaus on your own to get the civil judgment removed. You may also seek legal counsel and help. Call now to find out how we can assist you in removing incorrect marks from your credit report.

Read Also: Does Zzounds Report To Credit Bureau

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

Getting A Court Judgment Removed From Your Credit Report

The life time credit cycle of a debt that goes unpaid looks like this:

Don’t Miss: Is 524 A Good Credit Score

How To Remove A Tax Liens On Your Credit Report

They say that of all the lenders in the world, the one you least want to owe money to is the government. And considering that unpaid tax liens can stay on your credit report indefinitely, that wisdom certainly seems to ring true. If youve got unpaid tax bills from a state, local, or federal agency, the very first step to take is to pay them in full immediately.

However, whether the tax lien on your credit report is paid or unpaid, you can file an IRS Form 12277, which is an application for the withdrawal of a federal tax lien. There is space on the form to explain to the IRS why youre filing for withdrawal. If you mention the financial hardship caused by your low credit score, it may incentivize them to give you a break in the future.

Be sure to specify that you do wish for the IRS to contact the credit bureaus directly on Form 12277 when you file it. Keep in mind that outstanding debt will still remain on file at the courthouse and must be paid.

Why Did You Deny My Credit Card Request

TransUnion does not make the decision to grant or deny credit. We supply credit history to entities that evaluate the information when making a decision.

A denial, cancellation or decrease in credit limit may be due to several factors based on creditors’ different lending policies. Only the creditor can inform you of the reason for denial, cancellation or decrease in credit limit. You may wish to contact your creditor for an explanation of the decision.

Also Check: 524 Credit Score

Dont Ignore Your Debt Problems

Although tax liens and judgments might not appear on your credit reports today, there are still plenty of reasons to avoid them.

Its true you probably didnt wake up one morning and decide you were no longer going to pay your bills. Thats not the way financial and credit problems start for most people.

Still, even if youre struggling with bills you cant pay, you can avoid many tax liens and judgments simply by communicating with the agency or company to whom you owe the debt. The IRS, for example, offers payment plans for taxpayers who cant afford to pay their tax bills in full. Your creditors might be willing to settle your debt for less, as well.

One fact is clear. When youre in over your head financially, ignoring your problems isnt the answer.

Talk to your creditors or consider getting legal help or credit counseling. In extreme cases, bankruptcy might be your best option. Whatever financial challenge youre facing, youll be far better off to face it head on and deal with the consequences, rather than ignoring your problem and allowing it to grow.

The Life Cycle Of Credit Damage

After missing payments on unsecured , your account may take on some additional qualities after charge off.

5. If a debt collector/debt buyer has the account and reports it as a collection on your credit report, with a balance due, the charge off from the original creditor remains, and the new negative will be reporting a balance due them, not the original creditor.

6. If you are sued for collection and judgment entered in the court, the judgment can turn up in the public record section of your credit profile.

Most of the negative credit impact from missing bill payments does not get to #6. One through 5 has a 7.5 year shelf life from the date you missed your first payment. There are some shenanigans that occur with credit reporting and debt collection accounts being reported with more recent dates, and even instances of multiple entries showing up for the same debt and more than one reporting a balance due, which is not right because you cannot owe the same debt to more than one place.

I am pointing out the above as a brief outline for later readers of this page. A little perspective of what happens to credit reports along the way when a bill remains unpaid is a good foundation for what I have to share about getting a judgment removed from credit reports.

Don’t Miss: Syncb/ppc Closed

How Can I Rent If An Eviction Is Still On My Public Record

You can still rent if you have an eviction on your public record, but itll be more difficult. There are a few things that may improve your chances of getting a rental agreement.

- Explain the eviction: Be honest and upfront. If the landlord understands what happened, they might give you a better chance. If youve rectified the situation with your previous landlord, make sure the new landlord knows that.

- Provide references: To show youre a trustworthy renter, offer references in addition to the background check.

- Offer to pay more upfront: Consider paying the security deposit, first months rent and even second months rent at the time of signing a rental agreement.

- Get a co-signer: A co-signer reassures the landlord that you have someone legally and financially backing you.

- Improve your credit: A good credit score can be evidence of your ability to pay bills on time.

- Show youre financially viable to pay your rent: Provide proof of income and other successful payments, like payments on an auto loan.

Once youre accepted as a tenant, continue to prove yourself with timely payments and by properly caring for the property. You can rebuild your rental history and make it easier to rent in the future.

Public Records That Won’t Appear On Your Credit Report

Fortunately, you don’t have to worry about certain kinds of public records showing up on your credit report.

The credit bureaus only include records that stem from a debt, which means things like probate records, divorces, income tax, and welfare benefits won’t appear on your credit report. The credit bureaus also don’t report on things like unpaid traffic citations. ;

Also, changes in federal law mean that bankruptcies are really the only public record you’ll see on your credit report as of April 2018.

Also Check: How To Check Credit Score Without Social Security Number

Can I Rent If I Have An Eviction On My Public Record

If you have an eviction on your public record, you may still rent, but it will be more difficult. There are a few things you can do to increase your chances of obtaining a rental agreement.

- Justify the eviction: Be straightforward and truthful. If the landlord realizes what occurred, he or she may offer you a second opportunity. Make sure the new landlord is aware that you have resolved the issue with your prior landlord.

- Refrence prior rentals: In addition to the background check, provide references to demonstrate that you are a trustworthy tenant.

- Offer to pay extra in advance: Before signing a rental agreement, consider paying the security deposit, first months rent, and perhaps second months rent.

- Obtain a co-signer: A co-signer guarantees the landlord that you have legal and financial support.

- Raise your credit score: A high credit score demonstrates your capacity to pay your obligations on time.

- Demonstrate that you have the financial means to pay your rent: Provide evidence of income and previous successful payments, such as car loan payments.

Once youve been approved as a renter, continue to demonstrate your worth by making on-time payments and taking appropriate care of the property. You can reestablish your rental history, making it simpler to rent in the future.

Confirm Any Information From The Court

If you do receive information back from the court verifying the details of your civil judgment, take the time to make sure that its all accurate.

All of this information goes through so many different touchpoints that theres a good chance some of it was reported inaccurately.

Everything must be error-free. That includes your name, balance, account numbers, dates associated with the account and judgment, and your account and payment statuses.

If you find anything thats incorrect, you can send a dispute letter to the credit bureaus and request that the judgment entry be updated or removed altogether.

Don’t Miss: Can You Have A Credit Score Without A Social Security Number

How Do I Contact The Other Two Credit Reporting Companies Experian And Equifax

TransUnion does not share credit information with any other credit reporting company. To obtain your Experian or Equifax credit report, you must contact them directly. For your convenience we have provided their addresses and telephone numbers below.

Equifax Credit Information Services, Inc

P.O. Box 740241

Why Public Records Are Different From Other Credit Report Items

Public records arent added to credit reports in the same way as other types of accounts. With most accounts, such as credit cards or auto loans, your lender sends information to the credit bureaus when you open an account.

From there, your lender updates your payment and balance history with the credit bureaus on a monthly basis. The credit reporting agencies then updates your credit reports each month with the new data.

Its worth noting that the credit reporting process is voluntary. No law makes your creditors report information to the credit bureaus. Likewise, no law forces firms like Experian to add information from a creditor to your report. However, both creditors and credit reporting agencies have to obey the Fair Credit Reporting Act if they choose to include any information on your credit reports.

With public records, however, there is no data furnisher sending information about you to the credit bureaus. The IRS, for example, doesnt send Experian, TransUnion and Equifax a list of everyone who has a tax lien filed against them. Instead, the credit reporting agencies proactively add public record data to credit reports.

Public records, as the name suggests, are available to anyone. By using services like PACER , the credit bureaus can obtain public record information and add it to their databases.

Don’t Miss: Does Paypal Credit Affect Your Credit Score

New Public Record Policy

In the past, there were three types of public records that could appear on your credit report: bankruptcies, judgments and tax liens. In recent years, however, there have been major changes that have reduced the number of public records added to credit reports to one.

While its still common today to find bankruptcies on credit reports, you typically wont find a judgment or tax lien.

The reason judgments and tax liens have gone missing from credit reports is because of new policies adopted by the three major credit reporting agencies Equifax, TransUnion, and Experian stemming from a 2015 settlement between the CRAs and 31 state attorneys general.

The landmark settlement resulted in the creation of the National Consumer Assistance Plan , an initiative designed to make credit reports more accurate and make it easier for people to fix any errors.

As part of the consumer-friendly changes, the credit reporting agencies agreed to implement new standards related to public records. Namely, for any public record to be included on a credit report, it has to satisfy the following criteria:

- The public record has to contain, at minimum, the consumers name, address, plus a Social Security number or date of birth.

- The public record information must be updated/verified at least once every 90 days.

Bankruptcy records already met these stricter requirements. Many tax liens and civil judgments, however, did not .

The Legal Process Of Removing Bankruptcy Errors

You can challenge any error you find on your credit history or bankruptcy filings. They must be removed if the credit bureau or reporting agency cannot prove they are legitimate.

To prove there is a mistake, you need to follow these steps:

Proving bankruptcy fraud can be drawn-out and time-consuming. A legal advocate can help reduce stress and save time throughout the process.

Recommended Reading: Aargon Collection Agency Bbb