The Three Credit Reporting Agencies And Different Types Of Credit Scores

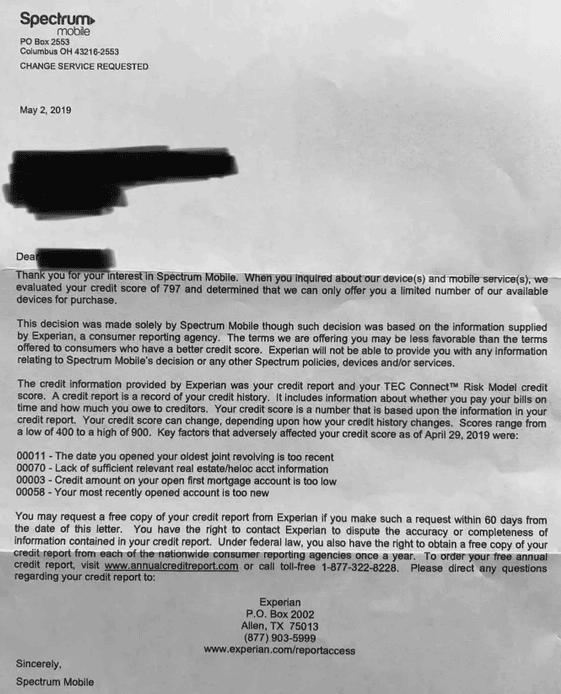

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 797 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Take Our Quiz: The Truth About Credit And Debt

- Look for cards that reward your spending patterns. If you buy a lot of gas, for example, a card that pays 5% cash back on fuel purchases will serve you well. Cash-back cards often let you use the rewards you’ve accumulated as a statement credit toward purchases, lowering your bill. A card that carries an annual fee may be worthwhile, but first do the math to decide whether the rewards you earn will outweigh the fee. Some cards waive the annual fee for the first year, giving you time to determine whether the card works for you.

If you are just getting started with credit , a secured card, which requires you to make a deposit as collateral, can help you build a credit history and score. Retailers may offer you enticing discounts if you sign up for their store credit cards, and retail cards are often easier to obtain than other cards. But keep in mind that both cards often come with low credit limitsmeaning that your credit utilization could easily push past the recommended 30% mark when you use the card to make purchases.

Is A 797 Credit Score Good Or Bad

Find out what score ranking are available with a 797 credit score. Learn the things you can do to get a low interest loan and discover how to improve your credit score of 797

Your credit score is what largely determines whether you get credit or not and if the interest rates offered to you will be high or low. A credit score is a number that is calculated from the information contained in your credit report using a mathematical algorithm. The resulting number has three digits and ranges from 300 to 850.The information in the credit report is collected from the credit bureaus Transunion, Experian, and Equifax.

The credit scoring system was introduced in 1989 by Fair, Isaac, and Company, currently known as FICO. Since then, the FICO model has been adopted by a majority of credit grantors and banks.

According to FICO, 90% of the most reputable and respected lenders today are making decisions based on this credit scoring system.

The following companies are the most popular companies that that measure credit scores: FICO, VantageScore, PLUS Score, TransUnion, Experian National Equivalency Score, Equifax, CreditXpert, and ScoreSense.

Don’t Miss: What Is Thd Cbna On Credit Report

Ask Your Current Creditor For Better Terms

If you have a revolving credit account with a good payment history, then consider contacting your creditor and asking for better terms, such as a higher credit limit or lower interest rate. Highlight your strong payment history and loyalty as a customer. Some creditors are willing to make accommodations to keep you from looking elsewhere for better terms.

In addition to helping your finances, this can help improve your credit score. For example, getting an increase in your credit limit will automatically reduce your credit utilization rate, as long as you dont start spending more.

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Was this helpful?

- Check your credit score frequently

- Use a credit card to have lengthy credit history

15. What is the difference between a credit report and credit score?

16. How long will it take to improve your credit score?

17. Can I get a loan or credit card with a credit score of 500?

Don’t Miss: What Credit Score Is Needed For Amazon Prime Visa Card

Monitor Your Credit Score

Make sure to check your credit score regularly. Many popular provide you with an updated credit score every week, along with an analysis of why your score might have changed. Learn what is likely to raise your score and what is likely to lower it, and avoid anything that might bring your credit score down.

How Your 797 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

You May Like: Can Closed Accounts Be Removed From Credit Report

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues you should always contact a local attorney for legal advice regardless of your use of any other service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

Check Your Credit Report

You should check your credit report for problems since it is what is used to calculate your credit score. If you see any errors listed on your credit report, such as incorrectly listed late payments, you should file a despite with the credit bureau to get the situation rectified and fix your credit score. Checking your credit report also helps you guard against fraudulent activity such as someone opening an account in your name fraudulently. Also, if you incorrectly entered some information, such as a wrong address, this is your chance to fix it before it becomes an issue.

Being thorough never hurt anyone, and it makes more sense to make sure that your credit report is perfect at this point. Look for any fraudulent activity, errors that you can dispute and any incorrect information you may have submitted that can end up harming your credit score.

- Details

Recommended Reading: Does Overdraft Affect Credit Score

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

What Does A 750 Credit Score Mean For Your Wallet

A 797 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

Don’t Miss: How To Remove Delinquency From Credit Report

How To Get A 797 Credit Score

Theres no secret for getting a 797 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 797 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 797.

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

Read Also: Does Loan Me Report To Credit Bureaus

Keep On Going Your Very Good Credit History

Utilization rate on revolving credit: Your utilization rate is a measure of how close you are to maxing out your credit card accounts. You can calculate it for each credit card account by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits . Most experts recommend keeping your utilization rates at or below 30% in order to avoid lowering your credit scores. The closer any of these rates get to 100%, the more it will hurt your credit score. The utilization rate is responsible for nearly one-third of your credit score.

Late and missed payments have a serious impact. The presence of late or missed payments on your credit history can have a significant negative impact on your credit score, accounting for more than one-third of your total score. However, you can help to improve your credit score by making a habit of paying your bills on time. Prompt payment of your bills is one of the most important factors in maintaining a good credit score, so it’s worth making the effort to stay on top of your payments.

Nearly 158 million Social Security numbers were exposed in 2017, which is more than eight times the number that was exposed in 2016.

How Can You Improve Your Credit Score

Remember, your credit score is not fixed. It is calculated based on what information is available at that point in time, Equifax explains. Therefore, it can fluctuate as new information is added to your file. Negative entries will also drop off your credit file after a certain period of time.

If youre looking to boost your credit score, here are a few things you could do:

- Make sure you make credit repayments and pay bills on time steps such as creating a to manage money coming in and out, and scheduling automatic payments for bills and other repayments, could help with this.

- Limit new applications for credit or loan products where possible.

- If appropriate, consider lowering the limit on any credit cards you have.

- Regularly check your credit report and make sure the information is correct if it isnt, you can ask to have it changed, or for comments to be added to your report. Its free to update your credit report or remove an incorrect listing.

The comparison table below shows some of the savings accounts on Canstars database for a regular saver in NSW. The results shown are based on an investment of $100,000 in a personal savings account and are sorted by Star Rating , then provider name . For more information and to confirm whether a particular product will be suitable for you, check upfront with your provider and read the Product Disclosure Statement or other terms and conditions before making a decision.

Main image source: Valiantsina Halushka/Shutterstock.com.

Recommended Reading: How To Raise Credit Score Without Credit Card

Make Your Payments On Time

Missed payments definitely arent a huge problem for you if you have an 800 credit score. However, the best way to continue working toward that perfect 850 score is to stay on top of all your payments. A single missed or late payment can seriously throw off your score.

If you add a new credit card or loan to your account, make sure that you write down your payment due date. You can also enable autopay, which deducts your minimum payment from your bank account on the day its due.

How To Keep On Track With A Very Good Credit Score

To achieve a 797 credit score, you’re probably disciplined in your financial habits, with solid debt-management skills. You can still increase your score, however, and of course you’ll want to avoid losing ground. To those ends, it’s a good idea to keep an eye on your score, and avoid behaviors that can bring it down.

Factors that affect credit scores include:

. To determine your on a credit card, divide the outstanding balance by the card’s credit limit, and then multiply by 100 to get a percentage. Calculate the utilization for all your cards, and then figure out your total utilization rate by dividing the sum of all your balances by the sum of all your borrowing limits . You probably know credit scores will slip downward if you max out your credit limit on one or more cards by pushing utilization toward 100%. You may not know that most experts recommend keeping your utilization rate below 30% for each of your cards and for all your revolving accounts overall. Credit usage is responsible for about 30% of your FICO® Score.

Timely bill payments. This may seem obvious, but there’s no greater influence on your FICO® Score: Late and missed payments hurt your credit score, and on-time payments benefit your score. Payment history accounts for as much as 35% of your FICO® Score.

. The FICO® scoring system generally favors borrowers with a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Also Check: How To Build My Credit Score Fast

The Benefits Of An 800 Credit Score

So what exactly do you gain by having an 800 credit score? Is this something you should strive for? Here are three benefits of having an 800 credit score:

- You’re more likely to have your applications approved. Remember that credit scores indicate your creditworthiness. Along with your other financial information, your credit score helps lenders predict whether you’ll repay the money you borrow. With a high credit score, lenders see you as a less risky borrower, increasing the chances that they will approve your credit.

- You’re more likely to qualify for lower interest rates. Your credit score is a major determining factor in the interest rate on loans. Having an 800 credit score will help you qualify for lower interest rates and will save you thousands of dollars over the life of your loan. You’ll see the biggest impact with larger loans that you repay over a longer period of time, such as mortgage and auto loans.

- You’ll receive better credit card offers and pay less in interest. Regardless of credit score, everyone can avoid paying credit card interest by paying their credit card balance in full each month. An 800 credit score can help you qualify for credit cards that offer a 0% promotional rate on purchases and balance transfers. Having one of these credit cards in your wallet gives you the flexibility to carry a credit card balance and pay it off over time while avoiding finance charges on your balance.