What Might Cause Your Credit Score To Drop

There are many things that can cause your credit score to drop. If youve been under the impression that your credit score was fine, and then you check it and see that it is lower than you expected, consider the following possibilities:

-

You missed a payment or paid a bill late.

-

You made a big purchase with your credit card, driving up your utilization rate.

-

Youve undergone bankruptcy, foreclosure, or delinquency on one of your debts.

-

Youve closed a credit card account.

-

Youve recently applied for multiple new lines of credit.

What Is Considered A Good Credit Score

According to the Fair, Isaac and Company , the creator of the three-digit score used to rate your borrowing risk, the higher the number, the better your credit score. The FICO score ranges from 300-850. MyFICO.com says a good credit score is in the 670-739 score range.

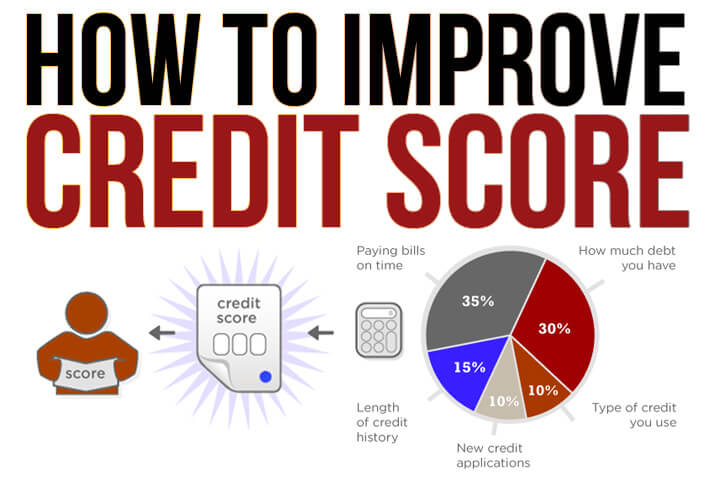

Your credit score is made up of five different factors.

5 categories that make up your credit score

- 35% Payment history: This is a record of your payments on all accounts for the length of the account history. Think of this as a report card for your finances.

- 30% Amounts owed: This is what makes up your credit utilization ratio. To determine your utilization ratio, take the amount of outstanding balances on each account, add them up and divide that by your total credit limit. So a credit card with a $5,000 credit line that has $3,000 in used credit would be a 60% credit utilization ratio not so good.

- 15% Length of credit history: This considers the number of years you have been borrowing. The longer your credit history of positive payments and responsible account management, the better.

- 10% Credit mix This includes all types of credit, such as installment loans, revolving accounts, student loans, mortgages, etc.

- 10% New credit: Every time you apply for a new credit card or loan, a hard inquiry is reported on your credit report.

Raising Your Score Depends On Your Starting Point

Your credit score isnt just a judgment call its determined through a formula considering five different factors. Listed in order of importance, each of the following factors can raise or lower your :

- Payment history

- New credit

With a history of consistent payments being the most influential factor, a great opportunity is offered to those new to credit cards. Every month you pay your cards bill on time will bump your credit score up, so set a routine and you can grow your creditworthiness quickly as long as you can avoid missing a credit card payment.

Your credit utilization ratio is how much of your total credit limit you use. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing. Opening up new card accounts or getting a credit limit increase can help build credit by decreasing this ratio, but that isnt all it takes. By making the effort to pay off your outstanding balances youll help your credit utilization, thus improving your credit score.

The length of credit history is fancy-talk for the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit. There are cases where canceling a credit card account is the right move, but as a general rule youll benefit from keeping old ones open.

Learn more:How to check your credit score

Also Check: Does Paypal Credit Report To Credit Bureaus

Apply For A Secured Credit Card

Getting a secured credit card is another great way to start building your credit from scratch. Youll typically deposit around $200 cash into the secured account or pay an annual fee. Each month, youll be responsible for making timely payments. After the account is closed in good standing, youll get that security deposit back and your credit rating may go up.

Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

Also Check: How To Remove Repossession From Credit Report

Tips For Making A Career Change From Someone Who Has Done It

Is it better for your credit to pay off your credit card in full each month or keep a small balance?

“Paying off a debt in full every single month is like fairy dust on your credit score. It’s like you paid off a mortgage. It’s like you paid off a car,” Aliche says. It doesn’t matter how big or small your balance is. The credit bureau just likes to see that you pay off your balance, in full, every month. It’s the habit that counts.

You might have heard it’s good to keep a small balance, but Aliche says that’s a misconception.

“Only the credit card companies want you to keep a balance, because if you don’t keep a balance, what are they going to charge you? There’s no fees when you pay off in full.”

What about asking for a credit limit increase? Can you ask for it? Will that hurt your score?

When you ask for a credit limit increase, Aliche says, the credit card company will either do a “hard inquiry” or a “soft inquiry.” A “hard inquiry” is when you give someone permission to “to see all of your grades and then they make a decision whether they want to lend to you.” That inquiry can impact your credit score.

Before you ask for an increase, ask your credit card company if it’s a hard inquiry. If it is, you need to ask yourself if it’s worth the potential credit score hit. There’s no way to know if you’ll be approved for the increase, Aliche says, but if you have strong credit , you’re more likely to be approved.

Now, here’s some credit score 101:

For more Life Kit, .

Request Credit Limit Increases

Periodically, request an increase to your credit limit. Each credit card company will have a different process but its typically very easy and very quick. Most credit cards will let you do this online.

Two things to keep in mind when doing this. First, dont request an increase on a new card. Many companies will not increase your limit if its new.

Next, when you request an increase, you want to make sure you do it in a way that doesnt require a hard inquiry on your credit report. If you request a relatively small increase, the company will usually approve it automatically.

If you ever request an increase and the company wants to ask for more information, decline the request. You dont need the increase and so it doesnt make sense to take the credit score decrease from a hard inquiry.

You can usually request an increase every six months.

Recommended Reading: Does Opensky Report To Credit Bureaus

Higher Fico Scores Equal Better Mortgage Rates

Youre eager to buy a home. But youre worried about getting a mortgage loan with a preferred interest rate. You fear that your credit is less than perfect. And you want to know how to raise your credit score fast.

Raise your FICO 100 points in 2018 and save big on everything

Its true that having a higher credit score will lead to better loan offers. While it can take months to overcome some derogatory events like missed payments, and years to build an excellent track record and ultra-high FICO, you can raise your score quickly with a few tricks.

Learn the facts. Being proactive early may result in you getting the loan and home you want.

Interested In A Personal Loan

| Lender |

|---|

Read Also: Why Is There Aargon Agency On My Credit Report

The Basics: How Credit Works

Your credit reports and score are a reflection of how you’ve managed debt in the past. Your credit reports contain information reported by your creditors that’s used to calculate your score. The three-digit scoreâwhich typically ranges from 300 to 850âevaluates the risk you pose as a borrower. Lower scores mean more risk, and vice versa.

Your credit becomes important when you ask a potential lender to extend you some type of credit. This can happen for small thingsâfor example, your credit reports may be checked if you finance a new cellphoneâand is also required for large purchases, such as taking out a mortgage for a home purchase.

Good credit is something you earn as you show you can manage your debt obligations well. And there are rewards for managing your debts responsibly. When you apply for additional credit with a good credit score, it’s more likely you’ll be approved and may get favorable terms from the lender.

Clever Ways To Improve Your Credit Score Fast

Playful girl biting credit card, thinking of doing online shopping, standing over yellow background

getty

Your credit score is a critical piece of your financial life.

If you want a good rewards credit card, youll need a good credit score. If you want to get a low mortgage interest rate, youll need a good credit score.

There are also other non-obvious places where a good credit score can help – like when you want to get a new cell phone or when youre getting car insurance.

Building credit can be a long process where good behavior helps increase your score gradually. Achieving good credit can take years but there are a few steps you can take to give your score a boost.

These wont work for everyone because many solve specific problems but review the list to see if you can take advantage of any of these ideas.

Recommended Reading: What Credit Score Does Carmax Use

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

Don’t Miss: How To Unlock Experian Account

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

Payment History: Correct Errors And Dispute

This can be the easiest way to boost your score of 10 points. Most peoples credit reports are filled with errors.

Incorrect information needs to be addressed and removed from your credit history for you and for creditors. Grab your credit report and scan them for erroneous info: inaccurate names, addresses, amounts, etc.

Getting a few of these knocked off your credit report can easily raise your score a few notches. All it takes is some searching and writing.

Or, you can hire credit repair professionals to do it for you. They can pull up your credit and begin removing items.

Also, depending on your financial situation, you can pay down your debts – bring everything current and get your boost there.

Related: Pay-For-Delete

Need to clean up errors on your credit report? to use this form to ask a creditor to take the necessary steps in order to clear up errors on your credit report.

Also Check: Does Removing Authorized User Affect Their Credit

How Long Does It Take To Improve Credit Score

The answer depends on the conditions of your debt and overall payment history. If your FICO score took a hit when you opened a new credit card or maxed one out that can usually be resolved within a few months.

But if youve made a habit of missing payments, you may be looking at a couple of years of making steady payments to get your credit score back on track. No matter where youre at on that scale, theres a lot you can do to improve your credit score quickly.

Monitor Your Bill Closely And Pay Your Secured Card Off Frequently

To make sure youre utilizing your new secured credit card, youll want to keep close tabs on your growing bill.

If your card offers online account management, this task should be fairly easy. If it doesnt, you may need to keep track of your purchases and charges manually.

Either way, this step is crucial since staying debt-free is the best way to keep your credit in tip-top shape.

Read Also: How To Report A Death To Credit Bureaus

Only Apply For Credit You Need

Every time you apply for a new line of credit, a hard inquiry is pulled on your report. This type of inquiry lowers your score temporarily. Applying just to see if you get approved or because you received a pre-qualified offer of credit is not a good idea.

If its a single hard credit pull, the drop will be slight. However, a string of hard inquiries could signal to lenders that you are taking on too much debt. The effects of a hard credit pull on your score, according to a representative of TransUnion, can last up to 12 months.

If you do need to apply for new credit, research your likelihood of approval to ensure youre a good candidate before applying. If possible, get a pre-approval or pre-qualification, as in many instances these result in a soft rather than hard credit pull. Soft pulls dont affect your credit score You dont want to risk lowering your score for a denied application.

You should also refrain from applying for several credit cards within a short time frame, or before taking out a large loan like a mortgage.

When you shop for a mortgage, auto, or personal loan, you can keep hard inquiries to a minimum by making rate comparisons within a short time period. Applications for the same type of loan within a designated time frame will only appear as a single hard inquiry. According to FICO, this span can vary from 14 to 45 days.

File A Credit Report Dispute If Errors Are Present

If you find any issues, be sure and contact the credit reporting agency immediately and work with them to file a dispute. If there are charges you dont recognize, it may be necessary to place a freeze or block on your social security number.

When youve got ID Theft coverage with American Family Insurance, well help you file your fraud claim and our team will help you manage the issue, which can be quite time-consuming and costly.

Don’t Miss: Is Creditwise Accurate

Is Your Credit Score In The Doldrums

Is your credit score in the doldrums? If you’re in the market for a loan, you need your score to rise fast.

Good news: You may indeed be able to give your score a quick lift, depending on why it’s sagging in the first place. A large amount of credit card debt, for example, may be more easily and speedily resolved than an account that’s in default.

Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. Take a look.

Ways To Boost Your Credit Score Fast

Your financial security might soon depend upon the strength of your credit score.

Like it or not, your credit score dictates everything from whether youre approved for a credit card to what interest rate youre offered on a mortgage or other loan.

So, you would be wise to get your credit score in tip-top shape ASAP. Your financial security might soon depend upon the strength of your score.

Here are some of the fastest ways to increase your credit score.

Recommended Reading: How Many Authorized Users Can Be On A Capital One Credit Card