How To Repair A 649 Credit Score

The first steps to repairing a credit score of 649 include addressing any of the more serious risks to long-term financial health. These issues can include loans in default, repayments due to collections agencies, and bankruptcy.

Avoiding significant marks against your credit record will help set a foundation for eventual credit score increases.

Often, repairing a credit score of 649 means shifting financial habits. To lower total debt, improve payment history, and prioritize other factors like credit age that can help to improve a Fair credit score, borrowers need to practice fiscal discipline.

This means fewer impulse purchases per month, and a commitment to frugal spending that reserves more money specifically for credit repayment.

If you notice errors in your credit report, dont hesitate to reach out to a credit repair company before your credit score decreases. The best credit repair agencies;can even communicate with lenders and credit companies on your behalf and will help you rectify any inaccuracies in your account.

Capital One Spark Classic For Business

Our pick for: Small business

The rewards rate on the Capital One® Spark® Classic for Business isn’t going to wow anyone, there’s no sign-up bonus and the APR is high. What makes this card valuable is that it’s available to business operators with fair or “average” credit, who don’t have a lot of options in business credit cards especially with no annual fee. Read our review.

What Is A Good Credit Score In The Us

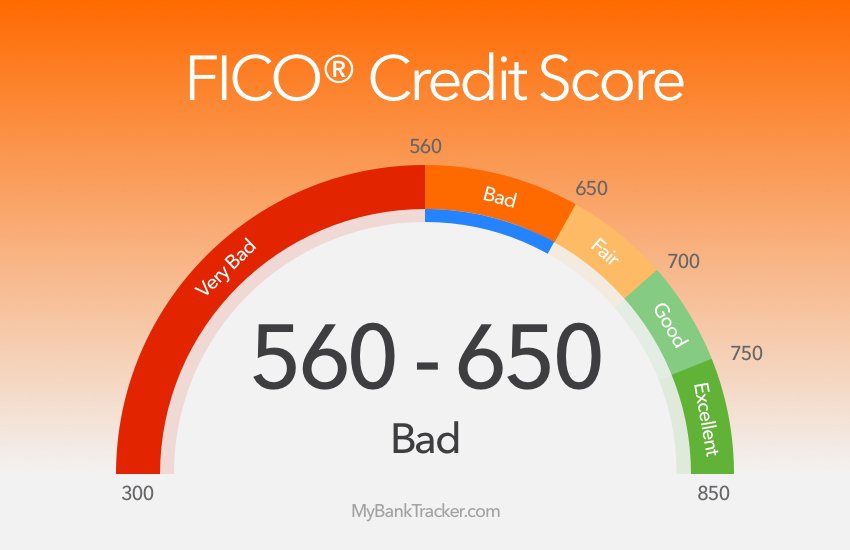

The most widely-used credit scoring model that helps lenders determine your creditworthiness is the FICO® Score. This model has scores ranging from 300 to 850. 800 or above is considered to have exceptional credit score. 740-799 are considered very good credit scores. 670-739 are considered good credit scores. 580-669 are considered fair credit scores. 579 is considered a poor credit score.

Most lenders consider a FICO® score of 703 good. In the second quarter of 2019, around 21% of Americans registered a score that was over 670 and only around 58% and had a FICO® score of 703 or higher.

Also Check: Does Speedy Cash Report To Credit Bureaus

What It Means To Have A Credit Score Of 650

A credit score is a number that indicates to a lender your worthiness of borrowing money for a car, home or other lines of credit. It is a 3 digit number that is determined by looking at your credit history. The following chart shows what is taken into account when calculating your credit score.

The can be anywhere from 350-850; anything below 350 means that you have no credit history. So where does your 650 credit score fall in the scheme of things? According to credit.com to have a rating of excellent credit your score would fall between 750 850. This is difficult to achieve, but the benefits are worth the work. Good credit is considered to be a score of 700-749. A 650 credit score falls on the low end of the fair range. 650-699 is a fair credit score, while 350-649 is the poor range.

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

You May Like: Aragon Collection Agency

Top Auto Refinance Rates

Say you have a credit score of 640 or 649. You can qualify to refinance with this score!

If you had a lower credit score when you took out your car loan or if you financed your car through a dealer and didnt get a great deal, you could save money by refinancing.

Do not apply for a refinance car loan if your credit score is lower than it was when you got your original loan.

Refinancing may be able to lower your monthly payment and put that extra saved interest right into your pocket.;

If you refinance with a longer term you could lower your monthly payment considerably. You will pay more in interest and you may end up owing more than your car is worth.

Refinance rates are usually the same as rates for a loan taken at the time of sale, so the figures quoted above will apply.

on AutoCreditExpress.com

How We Came Up With This List

We started by isolating the cards known to be available to those in the 600 to 649 credit score range. From there, we considered the features that would make it most valuable to people in that credit score range, based on different credit factors.

Those factors include:

- The issuer reports to all three major credit bureaus TransUnion, Experian and Equifax giving you an opportunity raise your credit score with all three

- Secured or unsecured credit cards secured may be necessary for those at the lower end of the fair credit score range

- Low or no annual fee

- Offering the ability to increase your credit line as your payment history warrants.

- Card features, like rewards and other benefits, if offered

Also Check: Does Paypal Working Capital Report To Credit Bureaus

What Is Considered Fair Credit

Fair credit, sometimes called “average” credit, is a step up from bad credit but a notch below good credit. It typically means your credit scores fall somewhere between 630 to 689, on a range of 300 to 850.

Credit scores indicate your level of risk to potential lenders and are based on several factors, including your payment history, the amount of;available;credit that youre using, how long youve had credit, and more.

There are good credit cards designed for people with fair credit, but you’re unlikely to get approved for;the best credit cards;until you can improve your credit.

Get your credit score for free

» MORE:;

Can I Get A Mortgage & Home Loan W/ A 649 Credit Score

Getting a mortgage and home loan with a 649 credit score is going to be difficult. Can it be done? Maybe, but thereâs a few simple steps you can take to guarantee less headaches and higher chance of success.

The #1 way to get a home loan with a 649 score is repairing your credit.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Recommended Reading: 779 Credit Score

New Car Interest Rates

Auto loans are secured: your vehicle serves as collateral for the loan. If you default, the lender can repossess the car. That makes your loan less risky, so interest rates are lower than they are for most unsecured loans.

The interest rate you are offered will depend heavily on your credit score. Heres what youll pay, on average, with different credit scores. Well assume a new car costing $30,000, a $3000 down payment, and a 48-month loan term.

| $1,349.28 |

Data from NerdWallets Car Loan Calculator

As you can see, your credit score has a huge impact on the interest rate youre offered and on the cost of your loan. With a score of 640 to 649, you are squarely in the middle of the range.

If your score is 645, you might consider trying to bump that score up a little before applying for a car loan. A 16-point gain could save you almost $40 per month; over $1800 over the life of the loan!

Discover It Secured Best For Cash Rewards And Building Credit

Card features:

- Rewards?: 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter.

Why Discover it® Secured is a good option for those with fair credit

The will tend to be more forgiving of bad credit than unsecured cards. You will start with a minimum credit line of $200, but the exact amount is based on the amount of your security deposit.

The Discover it® Secured also takes top honors for cash back, with 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter. That can come to $20 per quarter, or $80 per year. Youll then earn unlimited 1% cash back on all other purchases.

If that isnt enough, theyll match all cashback earned in the first year. Just as important, this card has no annual fee. Also, your account will be automatically reviewed for a move to unsecured status after eight months of on-time payments.

How to use Discover it® Secured

The combination of generous cash rewards and a low annual fee will enable you to earn money on this card IF you pay your balance in full each month.

Why you might not want to consider Discover it® Secured

The risk with cashback cards is the very real potential they have to incentivize spending just to get the benefit of the cashback.

If you have fair credit, cash back is nice to have, but keeping your balance low, and making your payments on time each month need to be the primary goal.

- Rewards?: N/A.

How to use the Indigo® Platinum Mastercard®

Don’t Miss: Opensky Billing Cycle

How Credit Scoring Works

Many creditors use the popular FICO scoring system, which combines financial data collected from major credit bureaus Equifax, Experian and TransUnion. Those credit bureaus also have their own scoring system, VantageScore, which bases ratings on internal financial data.

Your credit score is tied directly to the financial decisions you make, such as paying your loans or on time.

Factors That Influence Credit Scores

To use credit scores as part of the tenant screening process, you dont necessarily need to know what factors influence credit scores. Understanding what goes into the score, however, will help you see the bigger picture of what these scores really represent.

Some of these factors will matter more to you as a landlord than others. If a tenant can explain their below-average credit score as a result of factors that dont affect your business, you might be able to work with tenants who may otherwise seem like the wrong fit.

Remember, each credit bureau uses a different formula to determine credit score, so each factor considered will likewise vary.

You May Like: Does Paypal Credit Affect My Credit Score

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that;can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans.;Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of;TransUnion Canada;explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at;TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

How Long Does It Take To Get A 649 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Don’t Miss: Zebit Report To Credit Bureau

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

How To Establish Or Maintain A Good Score

If you’re trying to build credit from scratch, there are a few ways to get started. The first, and most common, is to open a credit card. That can help you establish an official line of credit and begin building a good credit history, which is reported to the three credit bureaus.

If you’re just getting started, you may not be allowed to open a new card on your own, in which case you could, with permission, use someone else’s. This process is called credit card “piggybacking” and involves becoming an authorized user on someone else’s card: The primary cardholder agrees to add you as a secondary user so you can reap the benefits of good credit.

The card’s payment history then becomes part of your own credit report, NerdWallet explains: “So, even if you were 19 years old and couldn’t qualify for credit on your own, you could have a credit card.”

This method is useful if your goal is to gain experience using plastic, or if you lack enough credit history for a specific goal. It isn’t intended to dispel or rehabilitate poor credit.

Another option: Getting a , which is intended to teach young adults and children good credit habits by allowing them to use a card connected to an adult’s account.

Any misstep on behalf on the junior cardholder is reflected on the adult’s account, though. And charge-offs, late payments and debts sent to a collection agency remain listed for seven years.

You May Like: How To Get Credit Report Without Social Security Number

Personal Loans With A 649 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Best Credit Cards For Fair Credit Of September 2021

ALSO CONSIDER:;Best credit cards of 2021;||;Best unsecured cards for short credit histories ||;Best starter cards for no credit ||;Best rewards credit cards

Credit cards for fair or average credit are aimed at those in the 630-689 FICO score range.;It’s an underserved market, so the list of such products is fairly short, and those that do exist lack the big sign-up bonuses you’d get with a card requiring;excellent credit. But they may still offer rewards.

These cards can help you if you’re just starting out with credit or are working to get back on track.;A;hallmark of cards for fair credit;is high interest rates. That’s important to keep in mind as you work to build a positive credit history, especially if you carry a balance.

ALSO CONSIDER:;Best credit cards of 2021;||;Best unsecured cards for short credit histories ||;Best starter cards for no credit ||;Best rewards credit cards

Credit cards for fair or average credit are aimed at those in the 630-689 FICO score range.;It’s an underserved market, so the list of such products is fairly short, and those that do exist lack the big sign-up bonuses you’d get with a card requiring;excellent credit. But they may still offer rewards.

- Deserve® EDU Mastercard for Students: Best for International students

Recommended Reading: Paypal Credit Soft Or Hard Pull

Credit Score Mortgage Loan

Keep in mind that only a few lenders give loans to borrowers with fair credit. This is because many lenders see it as a greater risk. Nonetheless, there are numerous lenders who will accept scores in the low 600s. Note that the interest rates charged will probably be higher. Before you apply, identify lenders that will work with fair credit scores. There is no point in applying for a mortgage if you know your score is below the Lenders credit threshold.;

Charge No More Than You Can Easily Repay When The Bill Comes In

Youve probably heard of this before, but a credit card should never be used as an extension of your paycheck. If you make $3,000 per month, a credit card shouldnt be used to enable you to spend $3,500. Thats unsustainable, and a major reason for fair and poor credit scores.

Use your credit card as a tool to improve your credit score. Make small charges that you can easily repay when the bill comes due. That will avoid both interest charges and an ever-increasing credit card balance.

You May Like: What Is Cbcinnovis On My Credit Report