How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that aren’t negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you weren’t already delinquent.

Identifying Mistakes On Your Credit Report

A study conducted by the Federal Trade Commission found that 20% of consumers had mistakes on their credit reports that were corrected after being disputed.

If mistakes go unchecked, they can drive up interest rates and reduce your ability to buy a home, refinance your mortgage, request an auto loan or even land a job.

And repairing bad credit can take time, even with the help of the best credit repair companies.

When reading your credit report, look out for:

- Incorrect late payments

- Addresses you dont recognize

- Accounts youve never opened

- Account limits that are higher than they should be

- Requests for new credit you dont recall making

- Any bill incorrectly marked as unpaid

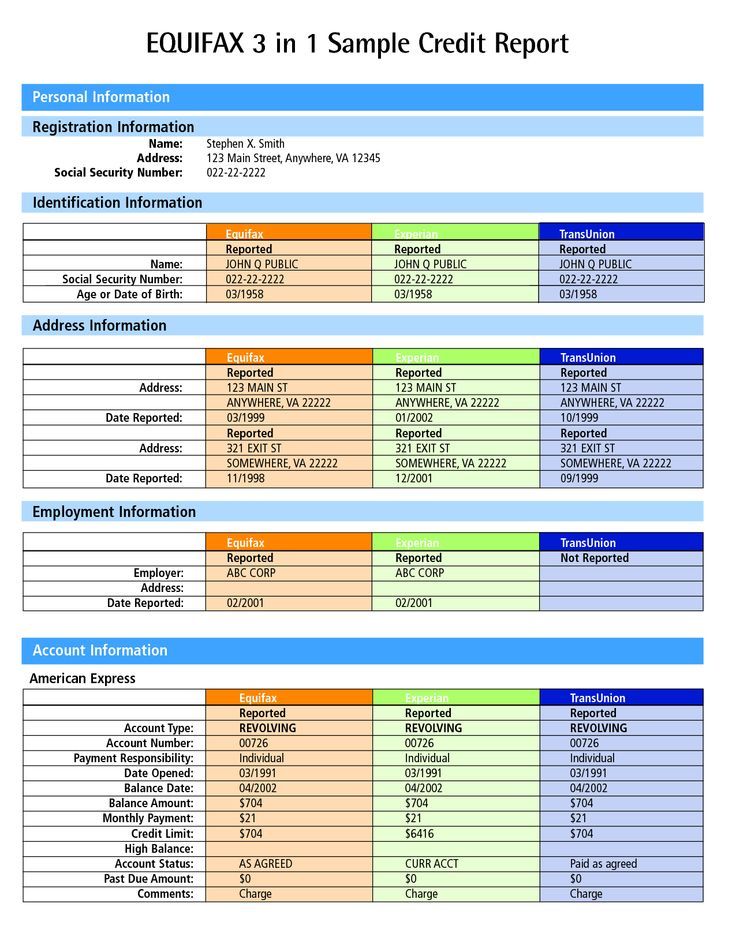

Why Does Information Differ Between Credit Reports

When you check your credit reports with each bureau, the information listed may vary between reports. A side-by-side comparison may show more inquiries on one report versus another, or different balances listed. This can happen since creditors aren’t required to report your account to any or all bureaus. However, most creditors report to at least one bureau.

For instance, a creditor may check your credit with Experian. This results in an inquiry on your Experian credit report, but may not appear on your Equifax or TransUnion reports.

Learn more: Keeping track of your credit report doesn’t have to be a manual process if you sign up for a credit monitoring service. CNBC Select ranked the best free and paid credit monitoring services that automatically provide daily alerts for new information on your credit report, access to your credit score and more.

Recommended Reading: How To Unlock My Experian Credit Report

Remove Abnormal Entries From Your Credit Report

Deviating Mentions on Your Credit Reportsuch as 30-day late payments, 60-day late payments, collections, and more can seriously hurt your credit score. Is there a way to remove derogatory items from your credit report so that your score can bounce back? Lets find out.

Disclaimer: The views and opinions expressed in this article are strictly those of John Ulzheimer and do not necessarily reflect the official position or position of Tradeline Supply Company, LLC. Tradeline Supply Company, LLC does not sell trading lines to increase credit scores and does not guarantee score improvements. Tradelines can in some cases cause credit scores to drop.

What Are The Ways To Resolve A Credit Report Dispute

Under the Fair Credit Reporting Act, the reporting company and the information provider are responsible for correcting any credit report disputes.

However, they must first be made aware that you have credit report disputes. A person can report and correct errors in their credit report by following two easy steps.Step one is to report your error to the consumer reporting company in writing and make them aware that you have a credit report dispute. Make sure you include all your personal information like your name, address, and a list of each credit report dispute that have.

Read Also: What Is Syncb Ntwk On Credit Report

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Don’t Miss: Carmax First Time Buyer

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Why Is A Credit Report Important

Your credit reports are what your credit scores are based on. You have three reports, one for each of the three major credit bureaus — Equifax, Experian, and TransUnion. While these reports are more or less the same, some lenders only report information to one or two of the bureaus instead of all three, so there can be some variation.

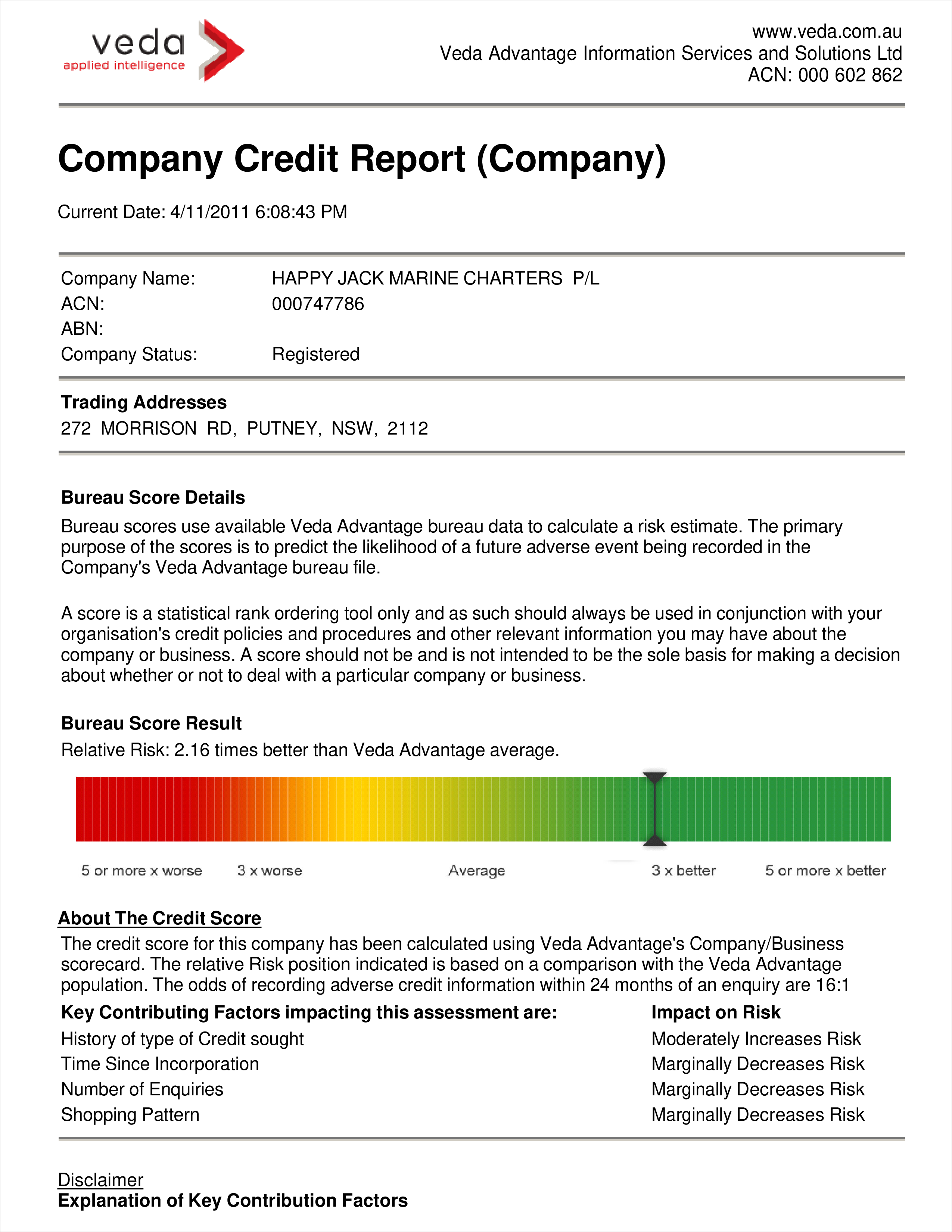

Your credit score is a three-digit number that’s based on the information in your credit reports. Think of it like a grade of your financial responsibility. Lenders use your credit reports and scores when deciding whether they want to work with you. A good credit score and a report without any concerning information will get you the best interest rates and increase your odds of getting approved. Conversely, a bad credit score and a report with several black marks is more likely to get you denied. If lenders do work with you, they’ll probably charge you higher interest rates to hedge their bets.

An increasing number of companies, apart from banks and financial institutions, are also starting to look at credit reports as a way of measuring a person’s responsibility. Some employers pull credit reports on prospective employees, especially if that employee will be working in a role managing company or customer funds. Some landlords look at credit reports for prospective tenants before approving them, and even some cell phone and cable providers run a quick credit check when you sign up for their services.

Also Check: Comenity Capital Bank Credit Score

How Your Credit Report Works

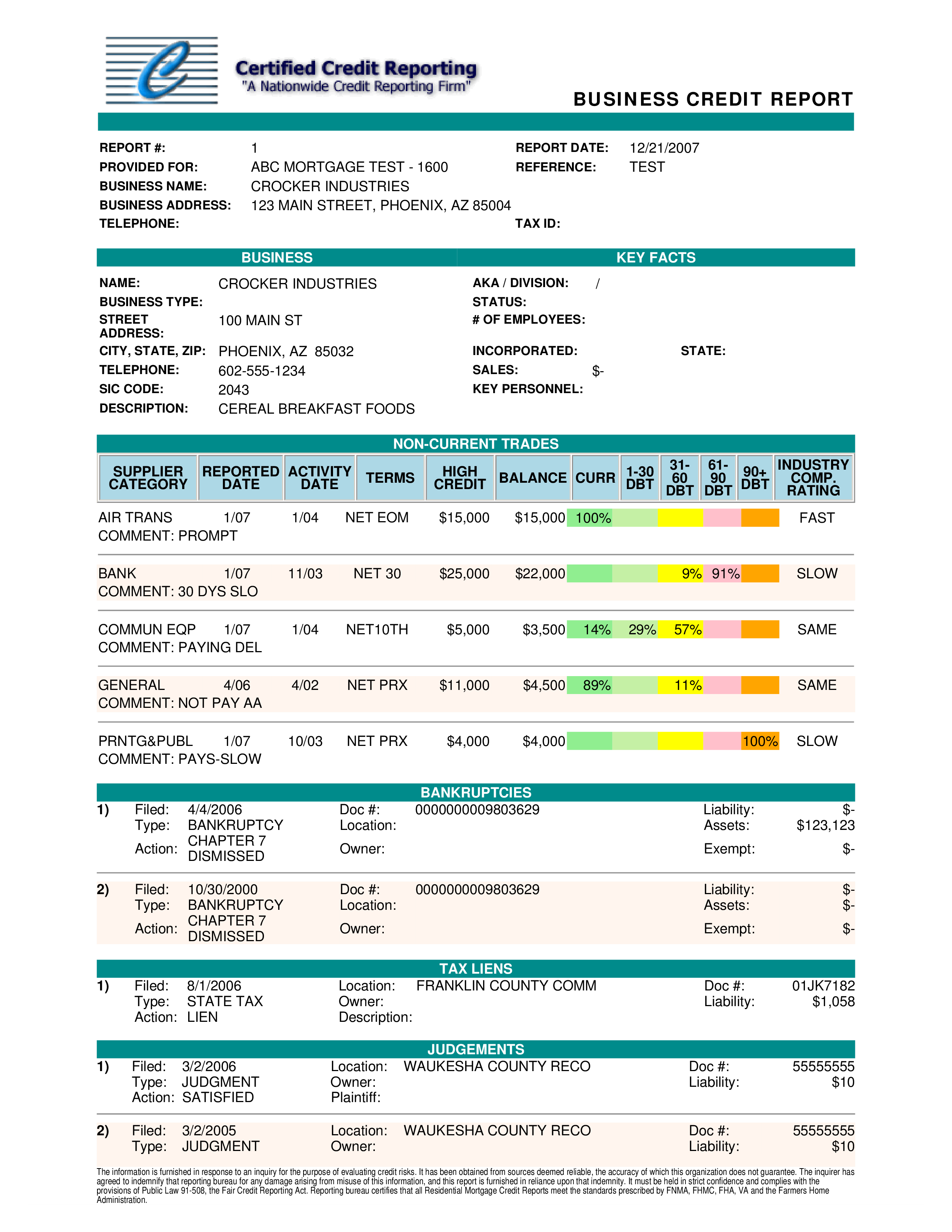

Your is primarily a record of your payment history on your various credit accounts. These accounts include , car loans, mortgages, student loans and similar debts. Credit reports also include reports on things like bankruptcies and tax liens, and can even include rent or bill payments.

Essentially, your credit report encompasses everything reported to the consumer credit reporting agencies, from payments made to requests for new credit. The three principal credit reporting agencies are Equifax, Experian and TransUnion.

The information in your credit report is used to come up with your credit score. Without a credit history, theres no credit score. However, your creditors arent required to report your payment history to every credit reporting agency. Thats why a credit score can vary depending on which credit reporting agency provides the score.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

You May Like: How To Print Credit Report From Credit Karma

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

How To Check Your Credit Score

You can order a copy of your free credit report from the Canadian credit bureaus, Equifax and TransUnion. You may consider ordering reports from both bureaus because they each may have slightly different information on how you have used credit.

Its a good practice to order your report at least once per year. When you order your report from the bureaus, it will not affect your credit score.

You have the option to order your Equifax credit report or TransUnion credit report by mail, telephone, or online. You will need to pay a fee if you order your report online and want to see the results right away. TransUnion allows you to order your report online once a month for free.

For more information on how to order your credit score, visit the Government of Canada website here.

Read Also: How Bad Is A Car Repo On Your Credit

When Does Info On Credit Reports Get Updated

We regularly get questions from readers who are curious about when a new account will show up on their credit reports and how often lenders report information to the bureaus. As a result, we reached out to a selection of the largest credit card issuers for answers. You can find information about their policies below.

| Within 30 days of approval | Monthly |

Fair And Accurate Credit Transactions

The Fair and Accurate Credit Transactions Act provides you with better access to your credit information. Under FACTA, consumers are entitled to one free credit report every 12 months from each of the three credit bureaus . Reviewing these reports allows you to correct any errors in your credit history and protect your credit identity. Learn more about identity theft on the Federal Trade Commission website and in the OCC’s “Answers About Identity Theft.”

To order your free credit reports,

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281

Do not contact the three nationwide consumer reporting companies individually.

Don’t Miss: Does Snap Report To Credit Bureaus

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

For Other Third Parties

A third party that is permitted to receive credit reporting information from a credit reporting body must comply with any relevant obligations set out in Part IIIA.

An entity commits an offence if the entity obtains credit reporting information from a credit reporting body and the entity is not an entity to which the body is permitted to disclose the information, or an access seeker for the information.

More information about third party access to your credit reporting information is available here.

To download a sample consumer credit report, visit MoneySmart

Also Check: What Is Syncb/network On My Credit Report

What’s Not In Your Credit Report Information

There are a lot of misconceptions about the information your credit report contains and which factors affect your credit score. Here are a few things that don’t appear in your credit report or impact your score in any way:

- Your race

- Your age

- Your salary

- Your occupation or employment history

- Your level of education

- Your bank account balance

- Your shopping habits

The information in your credit report is strictly related to your history of credit management and does not contain any information unrelated to credit, apart from the basic identifying information outlined above.

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

Read Also: Aargon Agency Inc Las Vegas

How Does Credit Work

Your ability to borrow money or use credit depends on several factors including the availability of money, your previous experience borrowing money, and your history of repaying credit obligations. Availability of money is determined by general conditions in the economy. Rising interest rates generally lead to less money for individuals and businesses to borrow. This means that individuals will not only pay higher interest rates, but it takes a better credit history to qualify for loans.

Often, people do not know what their credit report says until they are turned down for credit. You may not get a loan because of negative information reported in your credit file. Or you might be turned down for a variety of other reasons such as not employed long enough or new to an area. If you have always paid cash for purchases and havent borrowed money before, you have no history or proof to indicate the type of credit risk you would be. Lenders have fewer clues in deciding whether to give you a loan. They may take longer to decide to approve a loan, charge you higher interest rates, or turn down your loan application altogether.

How Information In Your Credit Report Affects Your Credit Scores

Except for your personal information, everything listed in your credit reports has the potential to affect your credit scores, with payment history and credit utilization being the two most important factors.

Lenders like to see a healthy combination of well managed accounts, such as credit cards, an auto loan and a mortgage, so a good credit mix can positively affect your credit score as well.

Your credit report can help you understand information that affects your credit scores, and can be the basis of a plan for credit-score improvement.

Recommended Reading: Is 626 A Good Credit Score

When To Request A Credit Report

Anytime you are considering a major purchase that will require a loan, such as a home mortgage, car loan or home improvement project, you should start by requesting and reviewing your credit report.

The interest rate you receive from any lender is based on your credit score and the information contained in your credit report. If there are mistakes, it could affect the interest rate you receive and cost you thousands of dollars.

A recent government survey says that 20% of consumers found at least one error on their credit report that makes them look riskier than they are. Thats one reason its so important to check your credit report regularly.

Another is to see if you are the victim of identity theft. A survey from Javelin Strategy and Research says that a record 16.7 million Americans were victims of identity theft in 2017, resulting in $16.8 billion stolen. Over 5.5 million were victims of credit card fraud and about two million were victims of bank fraud.

Applying for a job is another reason to review your credit report. A study by the Society of Human Resource Management said that 47% of employers look at a candidates credit report. If there is incorrect information there, it could impact your hiring.