How Creditwise Stacks Up

Compared with other free credit-monitoring;products, CreditWise favors depth over breadth. It offers only one credit score, from TransUnion,;but its credit simulator is among the most comprehensive weve seen.

With the credit simulator, you can choose from any combination of 17 credit-influencing;events. For example, you could see what might happen to your score if you canceled your oldest card. Or;you could see what might happen to your score if you canceled your oldest card;and charged $517 to another account;and were 30 days delinquent on a payment. It’s unusual to see a credit simulator that’s so customizable.

People wanted to see how certain decisions were going to affect their credit, Solomon says. When designing the app, we really wanted to demystify what goes into credit scores.

Like many free credit-scoring services, CreditWise;doesnt offer FICO scores, which most lenders use, but it offers VantageScore 3.0 scores, which are based on similar factors. VantageScores are;used by seven of the 10 largest banks, according to the VantageScore website.

The;CreditWise app’s biggest;drawback is that it gives you only one credit score from one bureau. If you want to know your FICO scores or your Experian or Equifax VantageScores, you’ll have to look;elsewhere.

I’ve Used Creditwise In The Past Why Do I Need To Re

Your CreditWise credit score and credit report was previously provided by Equifax, and it’ll now be provided by TransUnion. Re-registering makes sure we have up-to-date information for you, to match you correctly with your credit report.

We’ve also made changes to our terms and conditions, and privacy policy, so please check you’re happy with those, before you start using the service.

What Do Credit Monitoring Services Do

Rather than having to constantly check new reports for new information, you can let that information come to you with credit monitoring, said David Blumberg, the senior director of public relations at TransUnion. He noted that some services also help you protect and limit access to your credit report in case you suspect someone has stolen your identity or is trying to get credit in your name, and dispute items listed on your report that may not be accurate or complete.

Depending on the service, they may also notify you of changes to your credit score, allowing you to review new activity and determine whether it was fraudulent or includes any errors. A credit monitoring service can look at the following:

- New account openings, which include credit cards and loans

- Name or address changes in your credit file

- , including court dates and bankruptcies

- Unpaid accounts sent to collections, as well as balances and other payments

- Hard credit inquiries, including submitted credit card and loan applications

Read Also: Aargon Collection Agency Reviews

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

The Good About Capital One Creditwise

Whats awesome is you get your credit score and credit report for free. You dont have to enter a payment method to gain access and you wont be charged for it at any time.

Whats even better is your score and credit report are updated on a regular basis, not just once per month.

You also get access to a credit score simulator to see how potential changes could impact your score.;

You May Like: Opensky Billing Cycle

How Many Points Off Is Credit Karma

The only possible answer is, a few if any. Your credit score can vary every time it is calculated depending on whether the VantageScore or FICO model is used, or another scoring model, and even on which version of a model is used. The important thing is, the number should be in the same slice of the pie chart that ranks a consumer as “bad,””fair,””good,””very good,” or “exceptional.”

What Is Creditwise Credit Score

How repeatedly do you Look at your banking account? When you control a business together with its money transactions, you surely want the frequent specifics of your banking account. Its important to check the the latest transaction and ensure any transaction that you simply didnt realize. On your facts, each bank features a responsibility to arrange the document of each and every shopper about their bank transaction with the earlier thirty day period. Meanwhile, you are happy to ask for it for your personal applications. At the present time, we are going to go over about creditwise credit score. It contains creditwise credit score Format, the uses and also the steps how to get a creditwise credit score. Appreciate reading!creditwise credit score is actually a lawful summary on the economic transaction arising in just particular timeframe for every checking account which can be held by a business or an individual having a money establishment. This assertion can be a authorized doc which is ready through the fiscal establishment on a regular basis in particular time period, normally inside a thirty day period. It is made up of the applicable info with the account such as the overall quantity of the payable with the specified time, the modern bank account harmony plus the transactions history.

Don’t Miss: Paypal Working Capital Phone Number

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. As you know, a good credit score can help you get approved and get better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and based on the credit youre applying for. There are also different scoring models, so a good score may vary depending on what product or services you use to see your scores. That said, read on to learn what a good credit score range is when you check your score with TransUnion.

Re: How Accurate Is Capital One Creditwise

The CapOne Creditwise score is a TU Vantage 3.0 score and it tracks the Vantage 3.0 score I see on Credit Karma perfectly. As for accurate, the Creditwise TU Vantage 3.0 score can only be compared to another of the same so date of the score would be the only variable.

For me, my TU Vantage 3.0 score lags my FICO TU score 8 by 11 points: 783 TU FICO 8 v 772 TU Vantage 3.0 but differences should be expected because they’re different score models.

Fico 8 Scores Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It’s taken a few years but credit scores are now good after starting in the high 500s back in 2011

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

Why You Get More With Identityiq

IdentityIQ is a great alternative to Capital One CreditWise. They offer accurate credit reporting from all three bureaus as well as comprehensive identity protection including:

- $1 million in stolen funds reimbursement

- Coverage for personal expense compensation

- Dark web monitoring

- US-based ID restoration services

They even provide you with a credit score simulator to help you create a plan for improving your credit score.

Is Credit Karma Safe

Based on the information available, Credit Karma is safe to use. The service is absolutely not a scam to steal your information or charge your credit card.

The only piece of information that might be difficult for you to pass along to Credit Karma is the last four digits of your Social Security number. Although it is likely engrained that you should never give out your Social Security number, Credit Karma will need this in order to find your credit report. Unfortunately, there is no other effective way to accurately obtain your credit reports.

Personally, Ive been using Credit Karma for the past two years without any issues. Of course, there is always the threat of a data breach on any website that you work with. However, Credit Karma seems to have a good record of keeping its users data safe.

In my experience, the only negative part of Credit Karma is the number of emails they send to you about your credit score. At first, they send you a barrage of emails. However, you can go in and adjust your email preferences to avoid that in the long term.

If they do notice that your credit score has changed, they will send you an email to let you know. That is a helpful feature because most of us dont make time to check out our credit score every single month.

You May Like: Cbcinnovis Inquiry

Is Credit Karma Accurate Yes But With Limitations

However, if youre gearing up to apply for a loan or mortgage, you might want to seek additional information. Track down your FICO scores and monitor them alongside your Vantage 3.0 score.

That way, you wont have to wonder how accurate Credit Karma is. Youll have the fullest picture of your financial profile as you work to improve your credit score.

Is Capital One Credit Wise Accurate

Yes, this service provides accurate information. However, they use a VantageScore 3.0 from TransUnion, which isnt the most common score used by lenders to make lending decisions.

While Capital Ones data is accurate based on the scoring model they offer, there are other versions of your credit reports and scores you need to be aware of, too.

You have two other credit reports and scores from the other bureaus, Equifax and Experian.;

What questions do you have after reading our Capital One Credit Wise review free credit score program? Let me know in the comments and Ill address them the best I can.

You May Like: Is 524 A Good Credit Score

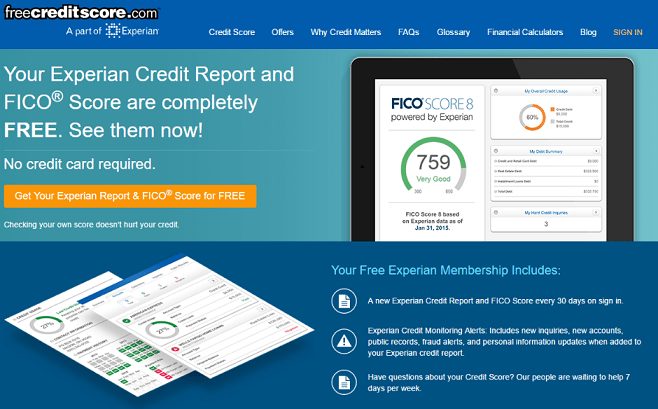

What Is A Good Experian Fico Score

A good Experian FICO score is considered to be 670 or better when looking at the FICO 8 scoring model. The chart below shows the ranges of credit scores from poor to excellent.

Its important to know your credit score and what a good credit score is because having a poor or fair Experian credit score could cost you lenders may be reluctant to give you a loan or approve you for a credit card, or you may pay a higher interest rate than a borrower with a good credit score.

Why Should You Check Your Credit Score

A healthy credit score can make a big difference to your life. The better your credit score, the more likely you are to be accepted for different types of credit. Using CreditWise can help you understand and improve your credit score. You can see what’s holding back your credit score and what’s going well. You’ll even get tips on how to improve your financial health. It also means you can spot any mistakes and get them sorted so they don’t count against you.

Read Also: Open Sky Unsecured Credit Card

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Which Credit Score Matters The Most

While there’s no exact answer to which;credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

While that can help you narrow down which credit score to check, you’ll still have to consider the reason why you’re checking your credit score. If you’re accessing your credit score simply to track your finances, a widely-used base score like FICO® Score 8 works. This version is also helpful for gauging which credit cards you qualify for.;

If you plan to make a specific purchase, you may want to review an industry-specific credit score.FICO lists the specific scores that are used for various financial products. FICO® Auto Scores are ideal if you want to finance a car with an auto loan, while it’s good to check FICO® Scores 2, 5 and 4 if you plan to buy a house.

Dont miss:

Recommended Reading: Experian Boost Paypal

Fico Vs Vantagescore: Which Is Better

VantageScore and FICO are both software programs that are used to calculate credit ratings based on consumers’ spending and payment history. FICO, for Fair Isaac Corp., is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer credit agencies, Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most-often-used base model, and which of its many versions is used.

The key point is, your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.;

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Read Also: Check Credit Score Without Ssn

What To Know About Your Free Credit Score

Capital One gives you a free VantageScore 3.0 credit score based on your TransUnion credit report. This credit score ranges from 300 to 850 and is categorized as follows according to Capital One:

- 761 to 850 Excellent

- 621 to 700 Average

- 300 to 620 Below Average

Since Capital One uses a soft pull to gather this information, it will not impact your credit score or hurt your credit score in any way.

You can update your credit score weekly using the service, but you must log in once per week for this update to occur.

If you dont log in once per week, it will automatically update your score monthly. This is nice because it gives you a history even if you dont log in on a regular basis.

In addition to your credit score, Capital One shows you the six main factors impacting your score and whether your factors are excellent, good, average or below average in each category.

The categories include:

- Percent of available credit used

- Number of recent inquiries in the past two years

- Number of new accounts in the past two years

- Your amount of available credit

Should I Use Credit Karma

Many folks are afraid to use Credit Karma because it requires things like a social security number to sign up. This is totally personal preference if someone is comfortable with giving out personal information in exchange for a convenient way to track their credit score. Without a social security number, it would be impossible for anyone to know what your credit history is like.

Many folks who are considering a home purchase will be giving their social security number to their mortgage lender to run their credit score. When the mortgage lender runs the credit score it will count as a hard inquiry on your credit report. When you give;Credit Karma your social security it will not count as a hard inquiry as you are only using the Credit Karma service to gather information.

For;all home buyers monitoring your credit is essential to your ability to buy a home. First-time homebuyers especially since they likely have not had the opportunity to build up as much of credit history as someone who is older.;

At the end of the day, if you’re looking to monitor your credit score you should sign up for Credit Karma.

Don’t Miss: Is 524 A Good Credit Score

Like This Article Pin It

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we aren’t able to cover every product in the marketplace.

For example, Wise Bread has partnerships with brands including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, and Amazon.