Your Lender Will Examine Your Credit Score

- Completely safe and secure

- Includes instruction on disputing inaccurate information.

- Make sure you get the interest rate you deserve.

There are several types of credit scores, but lenders often use the FICO score, which ranges from 300 to 850.

Your FICO score measures five key criteria and can vary slightly, based on which credit reporting agency issues the score. The information that shapes these criteria comes from your credit report and includes:

- Length of credit history

- Payment history on those credit lines

- Amounts owed on those credit lines

- New credit lines how many and over what period of time

Whose Credit Score Is Used On A Joint Auto Loan

There is a multitude of reasons why someone may choose to apply for a joint auto loan. Some of those reasons include having poor credit, limited credit history, or insufficient income to purchase a car individually. Regardless of the reason, one seeks a joint auto loan, there are several questions will come to mind.

How Can You Improve Your Auto Insurance Score And Your Credit Score

Because your credit score is a combination of many factors, understanding it can be a complicated process. Despite a long list of positive contributions, you may have a lower score because of one negative item. You might even have items on your reports that are unfair or inaccurate, resulting in a significant decrease in your score.

The first step to turning things around is to do an in-depth review of your reports. You can enlist the help of credit professionals to help you. They can work with creditors and reporting agencies on your behalf, so that inaccurate information can be taken off your reports. What remains are aspects of your score you can take control of: payment history, credit utilization, and new credit inquiries. There are several adjustments you can make to your financial habits that may help improve your score.

You May Like: Why Is There Aargon Agency On My Credit Report

How Does Your Credit Score Affect Car Buying Opportunities

The biggest impact your credit score has on your car buying options is the amount of interest you’ll have to pay on a loan. For example, according to data gathered by credit rating firm Experian in 2020, super prime customers paid on average 4.08 percent on auto loans for used cars, while deep sub-prime customers paid 20.67 percent.

There is even a considerable difference in average interest rates between buyers with prime loans and those with sub-prime loans. According to 2020 figures, a buyer with a prime loan would pay a total of $11,614 for a used car loan of $10,000 that has a term of 60 months. By contrast, a sub-prime customer would pay $15,164 for the same loan. This amounts to a difference of $3,550 in overall costs.

Financing An Auto Purchase Your Credit Score Might Look Higher Than You Thought It Was

Auto dealer inventories remain tight, but buyers are undeterred, with sales of both new and used vehicles at record highs. Many buyers finance their purchase, and that requires a credit check.

The standard FICO score ranges from 300 to 850. But for vehicle loans, lenders instead use the FICO Auto Score. The Auto Score ranges from 250 to 900.

It is the same fundamentals, like paying your bills on time, and keeping your debt low and that sort of thing. But for something like the FICO Auto Score, theyre going to put a little more weight on your history with car loans and leases, and also other installment loans, said Ted Rossman at .

There is a FICO Bank Card Score that more heavily weighs credit card behaviors. FICO is the main provider of consumer credit scoring, but there are a half dozen different versions of FICO scores that lenders use for different types of loans. While FICO is the most widely used, Bankrate says there are dozens of other credit scoring providers.

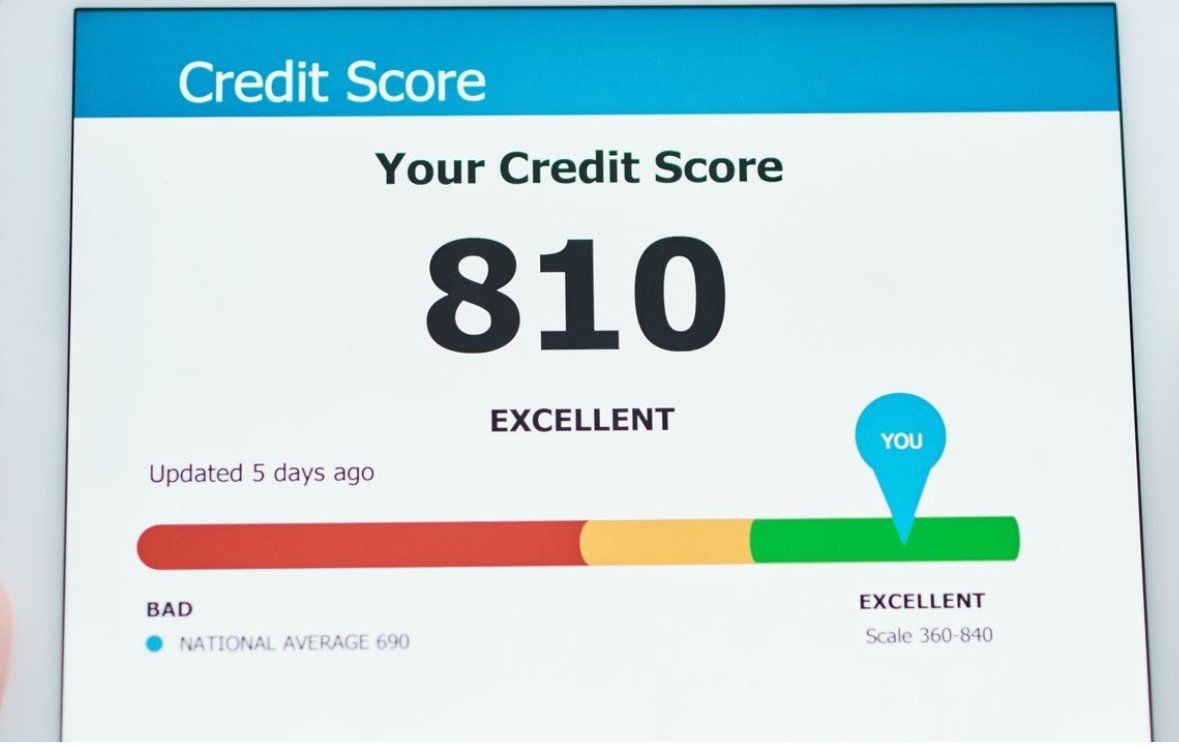

For good credit, consumers should strive to keep their FICO score at 670 or higher. The standard FICO score ranges from 300 to 850, though most consumers do not have credit scores above 800.

Only about 20% or about one in five Americans are in that 800-plus club. For the most part though, on the traditional score, anything above 740 is really viewed as basically interchangeable. It is really only bragging rights above that, Rossman said.

Don’t Miss: How Long A Repo Stay On Your Credit

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

How Do I Check My Auto Score

You can check your FICO® Auto Score by purchasing your credit reports and scores . However, there are also many ways to check your other credit scores for free.

While each score you receive will depend on the scoring model and the underlying credit report, knowing these other scores can give you a general idea of where you stand before you apply for an auto loan.

Some of the places you can look for a free credit score include:

- Banks and credit unions

- Online financial product comparison sites

- Experian gives you free access to a FICO® Score 8 based on your Experian credit report

- AnnualCreditReport.com offers one free report from each of the credit bureaus each year

Don’t Miss: What Is Cbcinnovis On My Credit Report

What Else Do Auto Lenders Look At Besides My Credit Score

Auto lenders look at several factors in addition to your credit history and credit score. According to the Consumer Financial Protection Bureau , theyll also consider how much income you have, your existing debt load, the amount of the loan you are applying for, the loan term , your down payment as a percentage of the vehicle value and the type and age of the vehicle you are purchasing.

The most important things car lenders consider when you apply for a loan, however, are your credit score and credit history. You can even get a car loan when you are unemployed, provided you have a down payment and money in the bank, said Nishank Khanna, chief marketing officer at Clarify Capital, a business lending firm in New York City.

Can I Remove A Joint Applicant Or Cosigner

If you improve your credit and financial situation, you can greatly increase your chances of getting an independent loan approval. You can re-finance auto loans and transfer to sole ownership if you meet the requirements to qualify for an auto loan on your own. Poor credit is not a lifetime sentence. There are several ways you can improve your credit history and credit score. The most important part is having the dedication to do what it takes.

Don’t Miss: When Does Paypal Credit Report To Credit Bureau

What Options Do I Have If Im A First

If you have limited or no credit history, and you havent taken out a car loan before, you might qualify for a first-time car buyers program. These programs can enable buyers to purchase a vehicle on a monthly payment plan. They also might decrease the APR and the amount of the down payment you have to make compared to other loan options.

For example, Ford offers a program you can apply to if you meet the following criteria:

- You havent had previous car credit

- There are no issues with your credit report

- Your income is $2,000 a month or more

Note that these programs will typically have an income and/or employment requirement, so youll likely need to demonstrate that you are either currently employed and earning above the required minimum or show a written job offer for a position you will be starting soon.

Why Your Fico Score Is Important

Lets answer first the question of which credit score is used to buy a car.

When buying a car youll have to work with lenders. More than 90% of car lenders use the FICO credit score. An individual FICO score results from an algorithm that factors in many aspects of your credit history, such as unpaid debts, the number and types of open loan accounts, and how long you have kept these accounts open. Then, there is the percentage of the total credit youve used, new credit requests, potential bankruptcy reports, foreclosure, and debt collections.

Weve mentioned the credit score first because every time you apply for an auto loan, a FICO score check will be performed to determine your creditworthiness. Credit bureaus are intrinsically important to the overall story. Still, as a potential car buyer, you should know your credit score beforehand.

Obtaining Your Credit Score

The most straightforward way is to go to myfico.com and ask for the 1B report. The service isnt free, but the good thing is that this report is very exhaustive: It includes 28 industry-specific scores, and one of them is the auto credit score you need.

Improving Your FICO Score

FICO scores go from 300 to 850. The higher your score, the better your chances of getting favorable loan terms. Good score ratings go from 670 upward, with most credit holders having a score between 600 and 750.

You May Like: Removing Hard Inquiries From Your Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Can I Do After Ive Signed My Loan And The Rate Is Sky High

The most important thing you can do is to make on-time payments for the next 6 to 12;months. You should also focus on repairing your credit score. Dont open new credit cards or apply for other loans: these things will be red flags on your credit report. After 6 to 12 months have elapsed, you should look into options for refinancing your car loan.

Recommended Reading: Can I Get A Credit Card With A 524 Credit Score

What Is The Recommended Credit Score To Buy A Car

MyFICO.com recognizes;720 as the preferred credit score when buying a car.

MyAutoloan.com also identifies a credit score of 720 or higher as the score you need to qualify for the best car loan rate.;

Clark agrees thats a good figure and one that should be a threshold for your decision making process on taking out a loan for a car:

You dont want to take out a loan if your credit score is below 720. The reality is, if you have a lower credit score, it means that you have a lot of financial heat in your life. Id like you to lower the temperature by eliminating having to make a vehicle payment.

But 720 isnt everyones idea of the ideal score.;According to Experian data from late 2020, youll need a to be eligible for the lowest interest rate on a car loan.;

If I Shop Around For An Auto Loan Wont Multiple Pulls Lower My Credit

Many people are nervous to shop around for auto loans since theyve heard that multiple credit pulls can negatively impact their credit score.

While there is certainly truth to this assumption, for the sake of comparing rates, the law states that all credit pulls that occur within 14 days must be combined into a single credit pull so that it doesnt negatively impact your credit score. So make sure to wait to compare loans and to have your credit pulled by a lender until you know you are ready to purchase a vehicle.

Starting April 20,2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through April 20, 2022 at AnnualCreditReport.com to help you project your financial health during the sudden and unprecedented hardship caused by COVID-19.

Don’t Miss: How To Get Credit Report Without Social Security Number

What Credit Scores Do Auto Lenders Use

FICO Score is the most common credit score that lenders use, with 90% of top lenders using it, according to FICO. Its a general-purpose credit score with multiple versions . There are also industry-specific scores, including one for the auto lending industry. Industry-specific scores also have different versions, such as the FICO Auto Score 10.

Each lender makes its own decision when it comes to the credit score model it uses. Unless you ask potential lenders which credit score they check, you wont know. Thats why its usually best to check your general-purpose FICO score if youd like to check your credit score before applying for a loan, which we recommend.

What Is The Lowest Credit Score To Buy A Car

Your credit score is always important when applying for new loans, but when it comes to buying a car, there is no minimum score needed to be approved. Having a higher score may improve your chances of getting a loan with low rates and more favorable terms, but it’s still possible to get an auto loan with a less-than-perfect score.

Read on to learn what scores are used by auto lenders and how you can improve your chances of financing a car even if you don’t have perfect credit.

Read Also: How To Get Credit Report Without Social Security Number

How To Check All Versions Of Your Fico Auto Score

If you want to finance a car with an auto loan, signing up for one of the FICO® Basic, Advanced or Premier credit monitoring services can help.

All three FICO Basic, Advanced and Premier plans offer access to 28 versions of your credit score so you can use it when applying for any type of credit, including auto loans, mortgages and credit cards. These three services will also alert you of potential fraud, such as someone opening a new loan in your name or a sharp spike in your credit card balance.

If all you want are the multiple versions of your FICO Score, sign up for Basic, the lowest tier, to save more money each month. Learn more about the differences between each FICO credit monitoring service.

-

$19.95 to $39.95 per month

-

Experian for Basic plan or Experian, Equifax and TransUnion for;Advanced and Premier plans

-

Yes, for;Advanced and Premier plans

-

Identity insurance

Yes, up to $1 million

Terms apply.

Raise Your Credit Score

Raising a credit score 100-150 points might seem daunting, but it can be done perhaps more quickly than you think. Clark.com has articles that explain the factors that go into;a good credit score;and;sneaky ways to improve your credit score.

A relatively new way to help get your score up is to participate in the Boost program from Experian. It takes into account your payment record on your utility bills which could help increase your score a few points.

And check out these ways to improve your credit score by 100 points in 30 days.

Read Also: How To Get A Bankruptcy Off Your Credit Report

Keep An Eye On Your Score To Know Where You Stand

It can be hard to save up enough money to buy a car outright. Thankfully, auto loans arent hard to qualify foreven if you have less-than-perfect credit. The better your credit, the lower your interest rate might be.

Dont spring for a subprime or non prime loan unless you have no other choice. Instead, improve your score and snag a better interest rate. You can take the first step by signing up with ExtraCredit, which includes Track It. View 28 of your credit scoresincluding the ones auto lenders seeto know where you stand and what areas you need to work on.

OpenSky® Secured Visa® Credit Card

For Fair, Poor, and Bad Credit

Annual Fee: $35

Please note that our comments are moderated, so it may take a little time before you see them on the page. Thanks for your patience.

Lowering Your Interest Rate

If youve got bad credit and want to purchase a vehicle, there are a few things you can do to lower your interest rate and pay a bit less. First, make sure youve got as many of your loans as possible paid down. Ensure theyre current.

Next, consider making a sizable down payment. Lenders will look more favorably at consumers that make large down payments.

Additionally, if you have incorrect or faulty information on your credit report, consider hiring a credit repair company or pursuing the DIY route towards fixing & improving your credit.

Finally, ensure youre getting into the right vehicle for your situation. Shopping around for both vehicles and financing options can help ensure that you get the car and loan that are right for you.

Don’t Miss: Aargon Debt Collector