Reduce The Amount Of Debt You Owe

Your , or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don’t close unused credit cards as a short-term strategy to raise your scores.

Don’t open several new credit cards you don’t need to increase your available credit: this approach could backfire and actually lower your credit scores.

Start A New Credit History

One strategy some people use to improve their payment history is to take out a credit card that is easier to qualify for, like a gas station or store card, and consistently pay off the balance each month. The good behavior can slowly put you in a better financial position. But be careful this strategy doesn’t backfire on you: you don’t want to take out new cards if you think you will be tempted to rack up more debt.

These Two Things Hurt Your Credit Score The Most

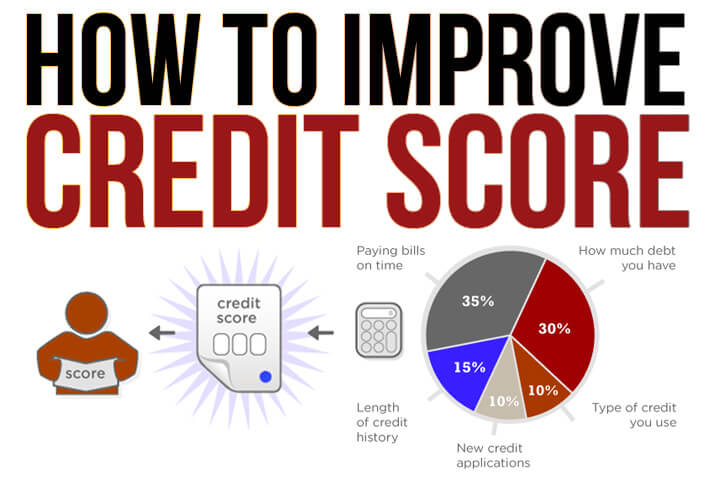

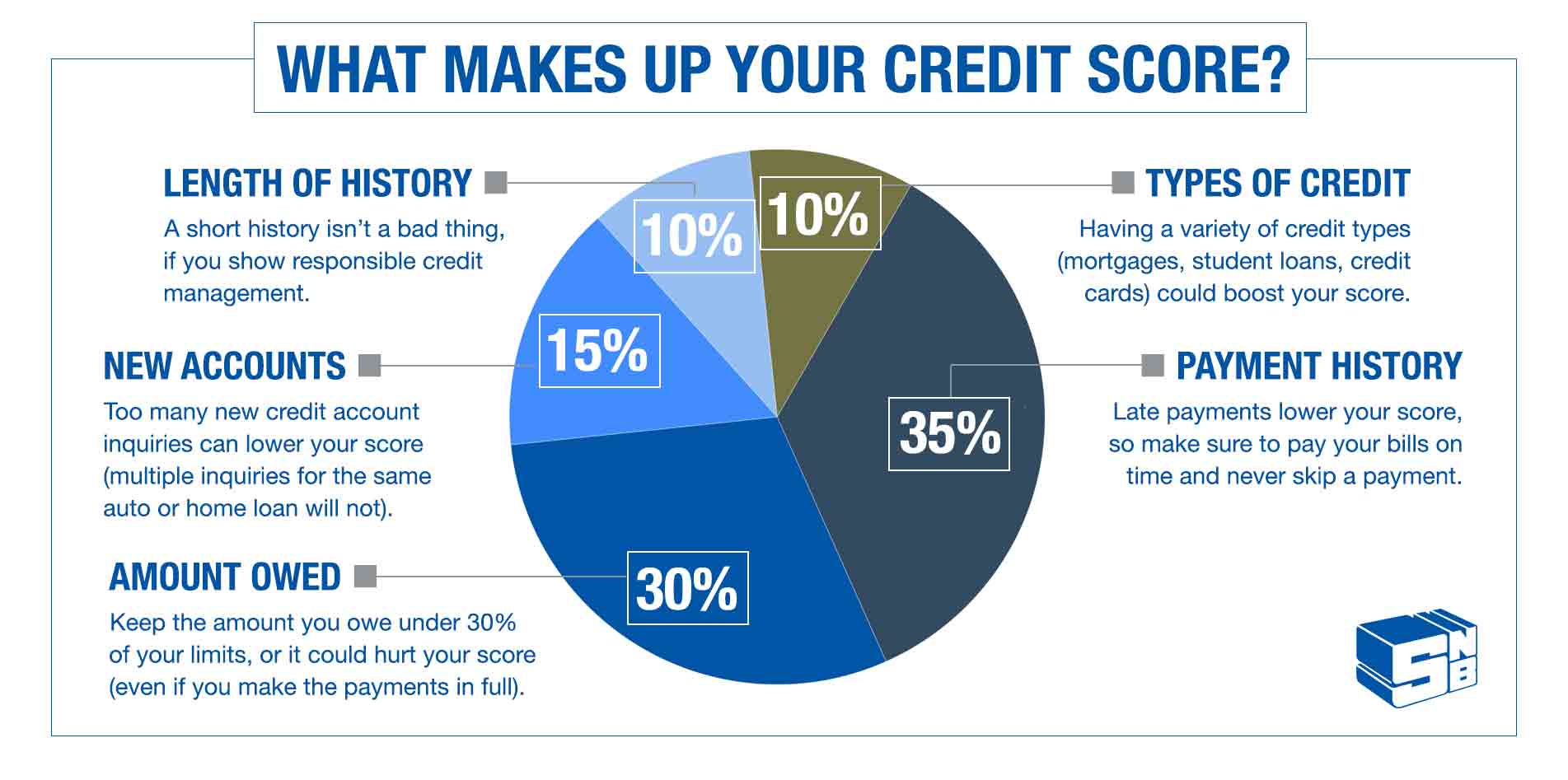

One of the most useful features of a credit card is the convenience of paying as well as getting the security. Thanks to these two factors, we have been witnessing a massive growth of credit cards. However, even though credit cards come with the convenience of buy now pay later, you have to make sure to be particular the repayments. A bad repayment history takes a toll on your credit score in a big way. Letâs understand how is your credit score calculated:

⢠35% – Payment History

⢠15% – Age of Credit History

⢠10% – Type of Credit

⢠10% – Credit Inquiries

All the aforementioned factors affect your credit score but the payment history and credit utilisation hamper your credit score the most. Let us now understand how credit cards impact these two factors.

It must be noted that improving your credit score take time and patience and it cannot happen overnight. You have to follow certain discipline and work towards your financial goals to achieve the desired credit score.

Recommended Reading: Speedy Cash Credit Check

Tips To Improve Your Credit Score

Coronavirus: Will Payment Holidays Affect My Credit Score

Payment holidays were introduced in March 2020 to help borrowers struggling with the impact of the coronavirus pandemic.

Applications for formal payment holidays were set to close on 31 October 2020, with banks agreeing to offer tailored support to borrowers who needed it thereafter.

But on 2 November 2020, the Financial Conduct Authority announced proposals to extend mortgage payment holidays. The following day, it announced plans to also give other borrowers affected by the coronavirus crisis further support.

In its proposals, the FCA says firms shouldnt report those in receipt of a payment holiday up until 31 January 2021 as having a missed payment on their credit record.

However, those who have already had two payment holidays and high-cost, short-term credit customers who have already had one would not be eligible for any additional payment deferrals;and must instead talk to their lender about getting tailored support.

This tailored support may be reported on a customers credit file, but lenders should always inform you as and when this is the case.

The deadline to apply for a payment holiday on your mortgage, credit card or personal loan has now passed, with one exception.;If you currently have a payment holiday in place, you can have it extended up until 31 July, as long as this doesnt take you over the six-month limit.

Tailored support will be available as standard to any customers in financial difficulties.

Why have I got a bad credit score?

You May Like: Does Zzounds Report To Credit Bureau

Get A Loan With The Help Of A Cosigner

Making on-time payments toward an installment loan, similar to making timely payments on a credit card, helps build credit history. Besides using a credit-builder loan, getting a traditional one such as a car loan can add positive information to your credit report and improve your credit mix.

If you can’t qualify for a loan on your own, a cosigner can helpbut make sure the cosigner knows what they are getting into. If you can’t afford to repay the loan, it becomes their responsibility. Also, as always, only seek out a loan if you really need it, not simply to improve credit. Potentially boosting your score should be an added bonus or motivation, not the central reason.

Do Coronavirus Payment Holidays Affect Credit Files

At the start of the coronavirus pandemic, lenders were offering coronavirus-related payment holidays on mortgages, credit cards, loans etc; to customers struggling to make repayments. You needed to have applied for a payment holiday by 31 March, and if you did, here’s how taking one might have impacted your credit file:

- The first six months of a payment holiday shouldn’t be reported as missed payments on your credit file. But even if the payment holiday’s NOT on your credit file, lenders can still find out about it in other ways; eg, they can see your mortgage balance isn’t going down; and can use that information to help their decision when you next apply for credit.

- Further help after a six-month payment holiday WILL go on your credit file.;Lenders are supposed to report any further ‘forbearance’ after you’ve had six months of payment holidays to credit reference agencies. Your lender should let you know if the support it’s offering you would affect your credit report.

For more information on the help currently available, and whether it’ll affect your credit file, see our;Coronavirus Finance & Bills Help;guide.

MSE weekly email

Also Check: Speedy Cash Late Payment

Limit Your Requests For New Creditand ‘hard’ Inquiries

There can be two types of inquiries into your credit history, often referred to as “hard” and “soft” inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you preapproved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because you’re facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Good Luck Moving Forward

On top of the list above, make sure you take advantage of the free consultations these credit repair companies offer.;

If you decide to work with them, it may speed up your credit rebuilding process, and if not, it’s a free credit analyzer.;

Also, make sure whoever you ask to co-sign and/or allows you to be an Authorized User has a 700 credit score or higher. They can have a lower score, but the better their credit the better your boost.

Overall, take all the action you can and utilize all the resources you have at your disposal.;

Don’t Miss: Is 779 A Good Credit Score

Check Your Credit Report

To get a better understanding of your credit picture and what lenders can see, check your credit report and learn more about how to read your Experian credit report. It’s also a good idea to order your free credit score from Experian. With it, you’ll receive a list of the risk factors that are most impacting your scores so you can make changes that will help your scores improve.

If you find information that is incorrect, you can file a dispute with the credit reporting agency on whose report you found it. You should also contact the lender that is reporting the incorrect information directly and ask them to correct their records.

Limit The Number Of Hard Inquiries

There are two kinds of inquiries that can be performed- a hard and a soft inquiry. A soft inquiry is when you check your own credit. When potential employer looks through your credit, or if any checks are carried out by financial institutions , these are called soft inquiries. Soft inquiries do not affect your credit score.

A hard inquiry is what happens when you apply for a credit card, or a loan. Hard inquiries that take place once in a while will not affect your credit score.

However, many of these within a short time span will affect your credit score. Banks will take this to mean that you require money because you have a facing financial problem.

You May Like: Does Paypal Credit Do A Hard Pull

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Check your credit report for errors that could drag down your score and dispute any you spot so they can be corrected or removed from your file.

How Are Credit Scores Calculated

Reading time: 4 minutes

Highlights:

-

Payment history, the amount of credit youre using, and the length of your credit history are factors included in calculating your credit scores

While your credit score is important, it is only one of several pieces of information an organization will use to determine your creditworthiness. For example, a mortgage lender would want to know your income as well as other information in addition to your credit score before it makes a decision.

Also Check: Why Is There Aargon Agency On My Credit Report

Check With Your Utility Company

The majority of utility providers only report derogatory information to the credit bureaus, but if you live in Detroit and you pay your bills on time, youre in luck. DTE Energy reports all payment histories, both positive and negative. Customers who pay their bills on time benefit from responsible management of this household expense.

Not in Detroit? Contact your utility provider to find out if it reports to the credit bureaus, and if so, put the bill in your name. If not, you can still use the positive payment history to your advantage. Most utility providers are happy to provide a letter of reference for an account holder in good standing.

What Is A Credit Report

A credit report is a detailed breakdown of an individual’s credit history prepared by a . Credit bureaus collect financial information about individuals and create credit reports based on that information, and lenders use the reports along with other details to determine loan applicants’ .

In the United States, there are three major credit reporting bureaus: Equifax, Experian, and TransUnion. Each of these reporting companies collects information about consumers’ personal financial details and their bill-paying habits to create a unique credit report; although most of the information is similar, there are often small differences between the three reports.

You May Like: What Credit Report Does Paypal Pull

Ask For A Credit Limit Increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip. Read up on how to ask for a credit limit increase.

Banks Score You Based On Products They’d Like To Sell You In The Future

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in the future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know.

You May Like: Why Is There Aargon Agency On My Credit Report

Don’t Ask For Credit Too Often

Getting a new card from time to time shouldn’t ding your credit, nor should taking out a car loan or mortgage. People who default on loans tend to rack up a great deal of debt before they default, so lenders keep an eye on how many times you ask. New inquiries are 10 percent of your FICO score.

Lenders will pull your credit report when they are considering making a loan to you, and this type of inquiry is called a hard inquiry. Hard inquiries stay on your credit report for about two years. Lenders look at a cluster of hard inquiries as a sign of financial trouble.

“Soft inquiries are when someone looks at your credit as a background check an employer, for example, might pull your credit report if you’ve applied for a job. And sometimes lenders will pull your report to see if you’re a good candidate for a new credit card. Soft inquiries don’t affect your credit score.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

Also of Interest

Please leave your comment below.

You must be logged in to leave a comment.

Featured AARP Member Benefits

Payday Loans Can Kill Mortgage Applications

Some payday lenders disingenuously suggest that taking them out and repaying on time can boost your credit score, as it starts to build a history of better repayment. This is true to a very minor extent for those with abysmal credit histories though using a;;correctly is generally both more effective and far cheaper.

If you’re getting a mortgage though, by definition you’ll need a far better than abysmal credit score. So you should avoid payday loans like the plague. Not just because they’re hideously expensive see the;Payday Loans;guide but because some mortgage underwriters have openly said they simply reject anyone who has had a payday loan, as it’s an example of poor money management.

Many people were mis-sold payday loans they couldn’t afford to repay. If that happened to you, you can reclaim £100s or even £1,000s and request that any poor payment records on loans deemed to be ‘unaffordable’ are removed from your credit file. See our Reclaim Payday Loans for Free guide.

You May Like: Why Is There Aargon Agency On My Credit Report

Can You Pay To Have Your Credit Fixed

If your credit file has information you feel is incorrect, credit repair companies may offer to dispute the information with the credit reporting agencies on your behalf. Credit repair companies typically charge a monthly fee for work performed in the previous month or a flat fee for each item they get removed from your reports. However, Experian does not charge consumers or require any special form to dispute information, so this is something you can do on your own at no cost.

If you’re on a monthly subscription, the cost is typically around $75 per month but can vary by company. The same goes for paying a fee for each deletion, but that option typically runs $50 each or more.

That said, it’s important to keep in mind that credit repair isn’t a cure-alland in many cases it crosses the line into unethical or even illegal measures by attempting to remove information that’s been accurately reported to the credit bureaus. While these companies may try to dispute every piece of negative information on your reports, it’s unlikely that information reported accurately by your lenders will be removed.

And again, credit repair companies can’t do anything that you can’t do on your own for free. As a result, it’s a good idea to consider working to fix your credit first before you pay for a credit repair service to do it for you.