How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Things To Consider Before Calling A Credit Repair Service

You can call a credit repair company for a consultation at any time, but remember that credit repair can only remove incorrect or illegitimate listings. Keep these factors in mind before moving forward with a credit repair service:

- Expenses. Weigh up the costs of credit repair against the possible value of the service. For example, the long term benefit of a home loan with favorable terms outweighs the short term costs of hiring a credit repair specialist but the benefit depends on the service being successful.

- No guarantees. The agency will investigate your listings but cannot by law offer any certainty of removing them.

- Time factor. When studying your negative listings, also take note of when they will expire. Most credit black marks disappear from your credit file after seven years, so in some cases it may be worth waiting it out if youre not planning on utilizing credit in the near future.

Consider your credit report carefully and what may be realistically achieved through a credit repair agency before you take on the expense of this service.

Are Closed Accounts On Your Credit Report Bad

Closed accounts on your credit report are not inherently a bad thing. In fact, they can often be a good thing, as we will elaborate on below.;

Closed accounts on your credit report, unless they are derogatory, are not bad for your credit. In fact, they are probably giving your credit a boost.

However, derogatory closed accounts can definitely have a negative impact on ones credit.

For example, if you had a credit card closed due to delinquency, meaning the creditor closed the account because you had stopped paying it, the account likely still has a balance owed.

Having a closed credit account with a balance on your credit report could really hurt your credit. According to some sources, closing a credit account removes its credit limit, so a credit card account closed with a balance would be considered maxed out or over-limit.

However, other sources say that a closed account with a balance will be treated as an open account until the balance is paid off, at which point you can expect some damage to your score, especially if you have balances on your other credit cards.

The specific way that closed accounts are treated may depend on which is used to calculate your score as well as other variables in your credit profile.

Also Check: Does Opensky Report To Credit Bureaus

What Happens When You Close An Account

When you close an account, it’s no longer available for new transactions, but you’re still required to pay off any balance you still have due by paying at least the minimum due each month by the due date

After the account is closed, the account status on your;credit report gets updated to show that the account has been closed. For accounts closed with a balance, the creditor continues to update account details with the credit bureaus each month. Your credit report will show the most recently reported balance, your last payment, and your monthly payment history.

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

You May Like: How Long A Repo Stay On Your Credit

Write A Goodwill Letter

A goodwill letter is a formal request to a creditor asking for a negative item to be removed.;

Although creditors are not required to remove negative items upon request, they may be willing to do so if you have a long history with them or if there were special hardships that led to the negative item.;

However, goodwill letters are generally useful only for late or missed payments rather than collections, repossessions or other more significant negative items.

In addition to goodwill letters, you can also request that an account is removed using a pay for delete letter. These letters can lead to an agreement with a collection agency to remove an account in exchange for a set payment. That said, the collection agency may decide not to remove the account, and the original account that went to collections may remain on your report.;

Closed Accounts And Credit Utilization

Use our tradeline calculator to calculate your credit utilization ratios.

Now that you know what a closed account is and why an account may be closed, you may be wondering what a closed account on your credit report means for your credit.;

The main impact of closing an account on your credit is the effect on your utilization ratio. By closing an account, you are reducing your total available credit limit, which could increase your overall utilization ratio if you have balances remaining on your other accounts.

Therefore, if you have balances on any of your other cards, you probably dont want to close an account that is helping to keep your overall utilization down, as well as improving your ratio of low-utilization to high-utilization accounts.

On the other hand, if you pay down all your other credit cards to 0% utilization, you can safely close an account without impacting your credit utilization.

Try using our tradeline calculator to calculate your individual and overall credit utilization ratios and see how closing one of your accounts could affect your utilization rate.

Read Also: Aargon Collection Agency

Look For Negative Information In Your Credit History

You may not even know if you have a derogatory account in your credit history. So you should start by getting your free credit report.

You can get your from many different services. But by law, each of the three major reporting bureaus has to give you a free credit report each year. And during the coronavirus pandemic, consumers are entitled to free weekly reports through April 2021, via AnnualCreditReport.com, the official U.S. government website.

When you open your credit report, you can find a list of all derogatory accounts. These include any account with a late or missed payment.

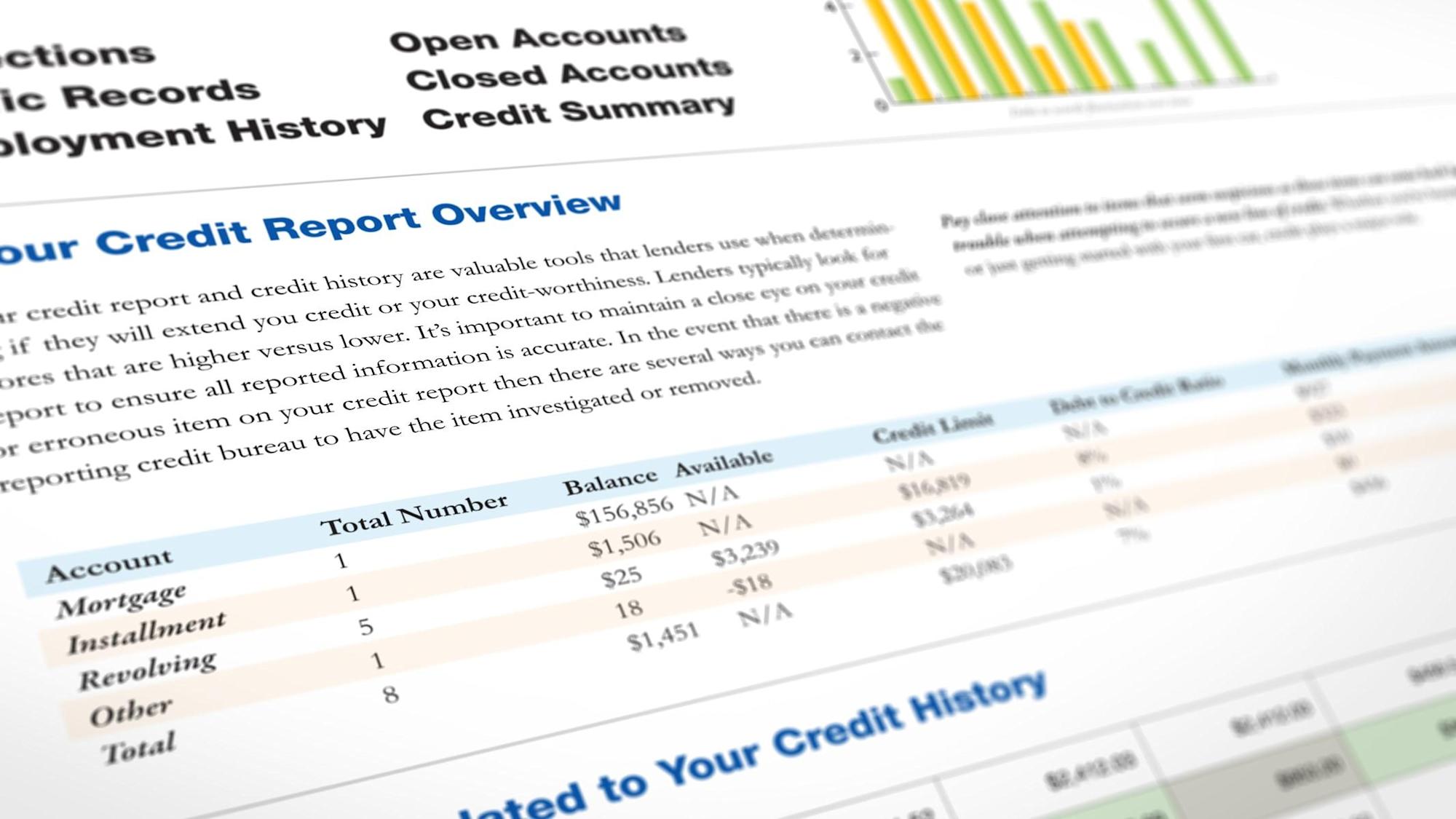

Below is a sample screenshot showing a credit card account that has a 30-day late payment from July 2011. You can see that its a derogatory item from the color some reports show yellow and red boxes and we know that it is a 30-day late payment because the box says 30 in it.

Image: Eric Rosenberg

Look through your credit report and make a list of all negative information. Then compare to your records to make sure everything there is accurate.

If its not accurate, getting it removed is imperative. And if it is accurate, its harder to remove, but still possible.

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Also Check: Open Sky Unsecured Credit Card

Removing A Closed Credit Account Online

She can start this process online using the credit bureaus dispute forms, which you can find at:

- To dispute TransUnion, use the TransUnion dispute form

Once she fills out a dispute form for each of the three major credit bureaus, theyll each contact the agency related to the reported misinformation. In this case, the credit bureaus would ask Citibank to verify that the consumers credit card account had actually been closed. After the information has been verified or disproved, shell receive the results of her dispute .; Results can be sent by mail or email, depending on which credit bureau is handling the dispute.

Closing a credit account online is generally the easiest method since most of our users manage their finances digitally. But, if youd consider yourself more analog, you can also get rid of closed accounts on your credit card by phone or by mail.

Send A Goodwill Letter To The Lender

If you feel like going directly to a credit bureau isnt the right attack, then you can send the lender a goodwill letter directly.

This letter is a polite way to ask if a lender will remove the settled account from your credit history.

This differs from a dispute because you are asking nicely to have the settled account removed and not stating any inaccuracies.

Sending a goodwill letter is ideal for people that defaulted on a loan due to personal injuries or illnesses.

Keep in mind that creditors will look at the history of the account and try to see if you made any attempts to get caught up after one of these circumstances.

They may use this information to make a decision on your account.

At this point, you can offer to make the full payment or try to find amiddle ground.

With the lender by settling on an amount that is less than whats owed.

After finding a way to pay in full or at least some, the lender should remove the account from your credit report.

Keep in mind the negative effects of the account will be removed since it is considered to be paid, but the ragged payment history will still be available on your account.

Read Also: Mprcc On Credit Report

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

How To Remove Derogatory Items From Your Credit Report

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

*; ; ; ; ; *; ; ; ; ; *

You May Like: Aargon Agency Inc Phone Number

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

You May Like: Is 524 A Good Credit Score

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

How Long Does My Repayment History Last

When assessing a credit application, we may look at how youve made repayments over the last 24 months.

If youve missed a few payments in the past, your credit history wont be impacted forever because repayment history information is only on your credit report for 24 months.;

Each time you make your required minimum repayment, this will have a positive impact on your credit report. Your credit score may be improved by getting back on track with your minimum repayments.;

Read Also: What Credit Report Does Comenity Bank Pull

Closed Accounts May Stay On Your Credit Reports For Up To 10 Years

One of the factors used to calculate your credit scores is length of credit history the longer the better. Old accounts in good standing remain on your credit reports for up to 10 years, which may increase the average age of your accounts and improve your scores.

But when the account falls off after 10 years, the length of your credit history may decrease, which could cause a temporary drop in your scores.

On the flip side, if you have a closed account with a negative history, such as delinquencies, the derogatory information in many cases will remain on your reports for seven years. While its there, it will negatively affect your credit history, but the impact on your scores can diminish over time.

What Does A Closed Account Mean On A Credit Report

A closed account in bad standingIf you stop paying your debts, after a period of time the lender usually closes the account for further payments, writes it off and sell it to collection agencies or files a law suit against you.

When this happens, the account status changes to Closed. The account balance stays unchanged and reflects your remaining debt balance. The account becomes inactive, and you can no longer make payment to it.

That doesnt suggest that the debt is erased. While the original creditor is no longer trying to collect it from you, he may sell the debt to collection agencies, in which case the same debt will re-appear as a new collection account and will further damage your already damaged score. The Collection agency or the original creditor may even file a law suit against you.

Either way, a closed account in bad standing is considered a serious delinquency and will have huge impact on your credit score up to 100 points!

A closed AND charged-off account will remain on your credit report for 7 years and will impact your score whether paid, settled, or unpaid.

A closed account in good standingWhen you finish paying off a loan or close a credit card, the account is closed and the balance is set to $0. This is called a closed account in good standing.

Closed accounts in good standing appear on your credit report with a status Closed and a $0 Balance.

More about the effects of closing credit card accounts here.

Also Check: Is 779 A Good Credit Score