Is A Business Line Of Credit The Same As A Business Loan

Business loans and business lines of credit are similar in the sense that they are both designed to cover the financial needs of businesses. However, its important to note that business lines of credit and business loans are not the same thing. While a business loan comes in the form of a lump sum payment, all of which you will be required to pay interest on and repay by the end of the loan period, a business line of credit only requires you to repay or pay interest on the amount that you have actively borrowed from the line of credit.

Best Business Lines Of Credit In 2022

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Business lines of credit offer flexible financing for small businesses. They let you borrow what you need , repay what you borrowed, and borrow again, paying interest only on the money you use. That makes LOCs a good way to deal with cash flow problems, take advantage of time-sensitive opportunities, and otherwise handle working capital needs.

After scoring dozens of lines of credit from both traditional banks and online lenders, we found Lendio has the best business credit lines. It offers the best combo of borrower requirements and interest ratesplus, it lets you shop around. But weve found other lenders that can work equally well for your business.

So lets look at the top LOCs.

Data as of 5/10/22. Offers and availability may vary by location and are subject to change.

When Using A Company Card Hurts Your Credit Score

There are a few scenarios in which using a company card can have a direct impact on your personal credit score, which many people don’t realize.

Business owners who take out small business credit cards in their name could be putting their own credit score at risk since the lender most likely reviewed your history and score before issuing you this line of credit for your business.

Because of this, “whatever happens on that credit card will be reported to the credit bureaus,” Harrison says. A small business credit card acts the same as a personal credit card in this way.

For example, if you are a small business owner who likes earning cash back with the Capital One® Spark® Cash for Business but one busy month you miss a bill payment, this shows up on your personal credit report. Or if you charged work travel expenses on your Ink Business Preferred® Credit Card and need to carry a balance, it’s your personal credit that will reflect the higher .

The same goes for employees of a company who have been added as an on their employer’s small business credit card. The impact on your credit is similar to being an authorized user on someone else’s personal credit card.

However, the damage will likely be minimal. According to the credit bureau Experian, “Some credit reporting agencies, including Experian, do not include negative payment history in an authorized user’s credit report. But others may.”

Also Check: Will Credit Card Companies Remove Late Payments Credit Report

Uses For Lines Of Credit

Did we mention personal lines of credit can be used for almost anything, but failing to repay them on schedule can precipitate lasting financial trouble? Still true.

Home improvement projects are the most common use for personal LOC, but there are other situations where the interest rate and flexible repayment options make lines of credit worth considering.

Some of those options include:

- Projects with funding challenges: Your daughters marriage comes at the same time the roof needs replacing. A line of credit could meet the challenge of paying for both.

- People with irregular incomes: You are self-employed or work on commission and the next paycheck isnt coming for another month. Drawing from a line of credit allows you to pay your regular monthly bills until the next paycheck arrives.

- Emergency situations: Tax bill comes the same time the credit card bills are due along with college tuition for your child. Consolidate your debt with a line of credit.

- Overdraft protection: If you are a frequent check writer with unstable income, a LOC can serve as a backup when you need overdraft protection.

- Business opportunity: A line of credit serves as collateral if you want to buy a business, or spark growth through advertising, marketing or participating in trade shows.

Worth repeating: As with all cases of borrowing, make sure you have a strategy for repaying the money with interest and fees before you take a loan.

How To Improve Business Credit Using A Business Loan

A sole proprietorship can use a business loan to improve the owners personal credit score even though they use their SSN to report taxable earnings.

Because sole proprietors use their own credit rather than business credit when applying for a business loan, they can improve their personal credit score when they establish and maintain a good credit history.

They do this by making payments on time and paying off loans and credit cards.

As their personal score improves, they are better positioned to open vendor accounts, apply for a business card, and qualify for future financing for higher loan amounts at better rates.

Don’t Miss: Does Afterpay Affect Your Credit Score

A Line Of Credit Gives You Access To Money On Demand And Can Help You With Expenses Like A Home Project Or Unexpected Car Maintenance

A line of credit is typically offered by lenders such as banks or credit unions, and, if you qualify, you can draw on it up to a maximum amount for a set period of time.

Youll pay interest only when you borrow on the line of credit. Once you pay back borrowed funds, that amount is again available for you to borrow. Flexibility is the key here: You can choose when to take out the money, pay it back and repeat as long as you stick to the terms, including paying off what you borrow on time and in full.

Read on to learn how lines of credit work and when one could be a good option for you.

What Happens If You Dont Pay Back A Credit Or Loan

Once the lender reports to credit agencies, an immediate result is that your business credit score and possibly personal will plunge.

Usually, a lender isnt concerned about one missed payment, but 3 or more alert them of a problem.

#DidYouKnowLenders will notify late payments in your business credit report.

Negative activity on your credit history prevents you from getting approved for future loans making it harder to obtain working capital when needed.

In the worst cases, some lenders will try to collect whats owed by hiring a collection agency or bringing a lawsuit against your business.

If you offer collateral as part of the loan agreement, the lender can legally take possession of your personal property .

When you cant repay a loan, your best approach is to work closely with your lender. Be honest with them about your financial situation. Then, you may be able to resolve the issue without ruining your credit and businesss reputation.

Recommended Reading: How To Remove Hard Inquiries From My Credit Report

How To Check If A Company Card Is Impacting Your Credit Score

If you’re unsure whether or not your company credit card affects your credit score, pull your credit report to see if it shows up.

“Now is a great time to do this since the credit reporting agencies are offering free weekly credit reports,” Roger Ma, a certified financial planner at lifelaidout® and author of“Work Your Money, Not Your Life,” tells CNBC Select. Normally, you are only able to get one free credit report per agency per year.

To spot whether or not your company card shows up on your personal credit report, Danielle Harrison, a certified financial planner in Columbia, Missouri, suggests looking to see if an inquiry was made for opening the card or if the card is listed as being in your name.

“If the answer is ‘no’ to these questions, then the corporate credit card will not impact your credit score,” Harrison says.

Best Business Line Of Credit For Poor Credit: Credibly

- Loan amount: Up to $250,000

- Rates: Starting from 4.80% interest rate

Why we like it: Getting approved for a business line of credit can be difficult if you don’t have great credit. Credibly offers multiple line-of-credit products through its lending partner network â some lenders require only a minimum personal credit score of just 560.

Drawbacks: You may be required to pay an origination fee for your business line of credit, but it is possible to negotiate with the lender to have the fee waived. Credibly doesn’t specify its maximum interest rate, but if you have poor credit, you should expect higher interest rates, as it is common practice to charge borrowers with poorer credit a higher interest rate. Credibly specifies terms of 26 weeks on its website, but there are other terms available, according to a Credibly representative.

You May Like: How To Get A High Credit Score

Business Line Of Credit Terms Rates And Fees

When you borrow funds from a business line of credit you typically have a set length of time to repay what you owe. These are called repayment terms which can range from longer time periods of 12 or 24 months and up to five years, to shorter terms, like 12 to 24 weeks. Some lines of credit renew annually.

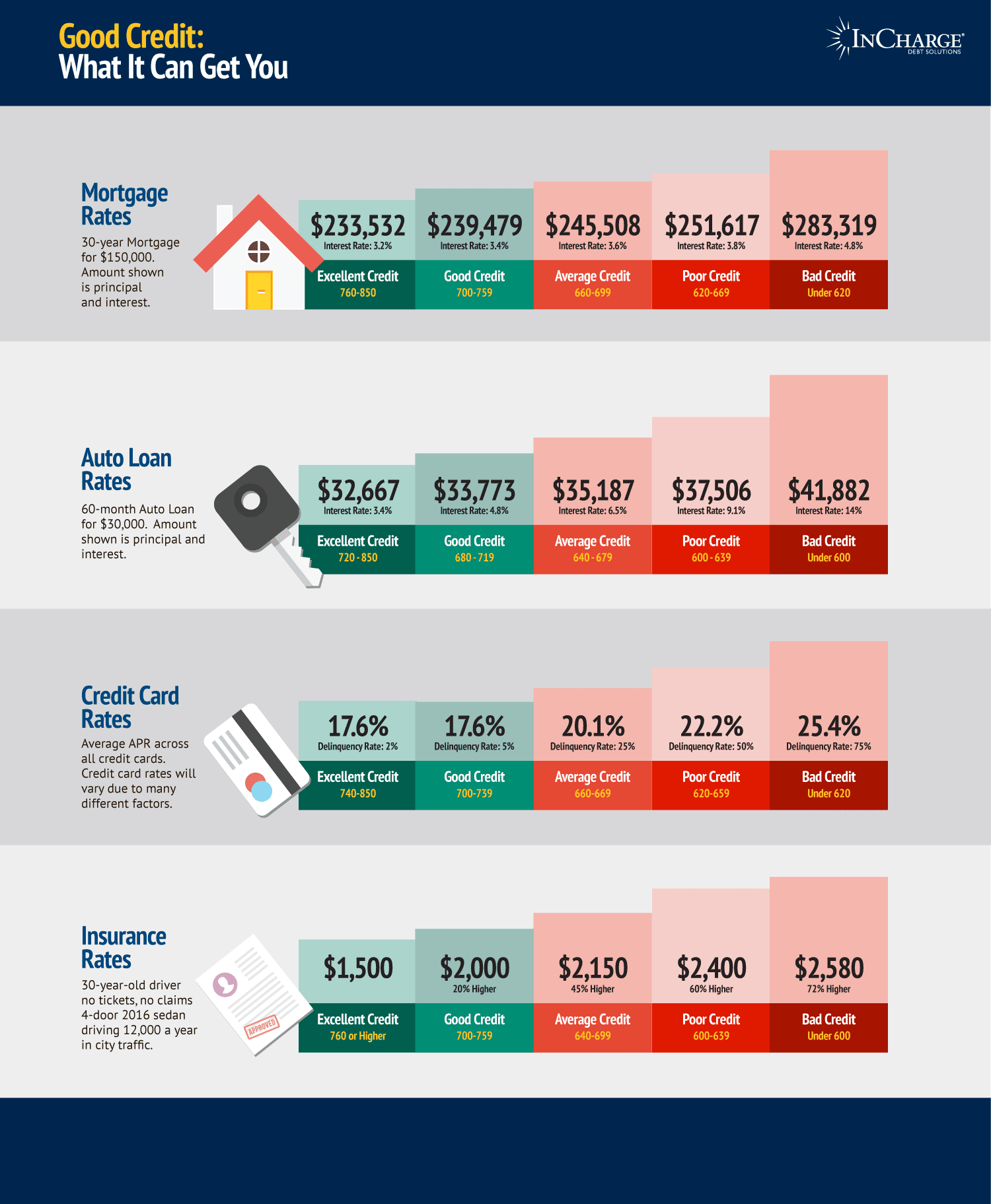

The interest rates for business lines of credit will likely vary with each lender but usually depend on the amount borrowed and the term length along with your credit score. Typically, these rates can range anywhere between 4% up to 60% APR but can also be higher.

In addition to interest, here are some common fees you can expect with a line of credit:

- Origination fee: $0 to 0.5% of a line of credit that reaches over $250,000

- Maintenance fee: Monthly or annual fee but can be waived depending on withdrawal amount and time of withdrawal and if your business is a startup

- Annual fee: $0 to $175

- Draw fee: 2% or less of the withdrawn amount

- Late fee: 5% or less of any past-due amount

How Do You Get A Business Tradeline

A business tradeline can be obtained by opening a credit account with a company that reports to at least one of the business credit reporting agencies. If you arent sure if a company reports, you can contact them and ask.

You can also ask your current vendors or suppliers to report your account to one or more credit bureaus. As discussed above, however, they may be reluctant to spend resources on reporting.

Have trouble getting approved for a loan, line of credit, or trade credit account? Try contacting the companys credit department. Hopefully, they will be able to clear up the requirements and the reason theyre denying your application.

Your business may need to be at least six months old to qualify for trade credit, or you may need to have established tradelines elsewhere.

Sometimes, it will be easier to qualify for trade credit after placing several orders and showing youre a good customer.

Recommended Reading: How To Remove Late Payments From Credit Report Sample Letter

Secured Lines Of Credit

One option if youre looking to take out a secured line of credit is a home equity line of credit, or HELOC.

HELOCs allow you to borrow against the available equity in your home and use your home as collateral for a line of credit. They typically come with a variable interest rate, which means your payments may increase over time.

Generally, the bank will limit the amount you can borrow to up to 85% of your homes appraised value, minus the balance remaining on your first mortgage. When banks set your interest rate, other factors besides your credit scores come into play, including your credit history and income.

If youre not a homeowner or dont want to use your house as collateral, you may be able take out a line of credit thats secured against a savings account or certificate of deposit.

The downside for a secured line of credit? If you cant make the payments, the lender may take the asset that secured the line.

How Do I Use A Line Of Credit

A line of credit is convenient for financing your short-term needs. It certainly varies depending on your business model. But typically, were talking about the supplies you need to make and sell your products, says Brassard.

He gives the example of a distribution company that buys $200,000 worth of inventory. The company takes this amount from its line of credit until it receives the merchandise and sells it. Lets say two months go by.

The company will have paid $200,000. But depending on its profit margin, it may have gotten $250,000 by reselling the inventory, says Brassard. The company will therefore put $200,000 back into its line of credit and keep the $50,000 profit to pay its fixed costs and reinvest in its working capital. Its goal will be to eventually have enough working capital to buy inventory without using its line of credit.

Recommended Reading: What Is A Social Credit Score

Business Line Of Credit Requirements: What You Need For An Loc

Listen To This Article

This post was last updated on 2022 to include the latest information about business line of credit requirements.

Do you need a ready source of working capital for your business? A revolving line of credit can be the buffer you need when cash flow isnt sufficient to cover expenses. Its the most reliable back-up, whether youre facing an emergency or seasonal slowdown. Find out what the business line of credit requirements areand how this flexible financing option can help you.

What Is A Business Credit Score

Now that we see how important business credit scores are, lets define them: A business credit score is a number, representing the likelihood your business will be approved for funding.

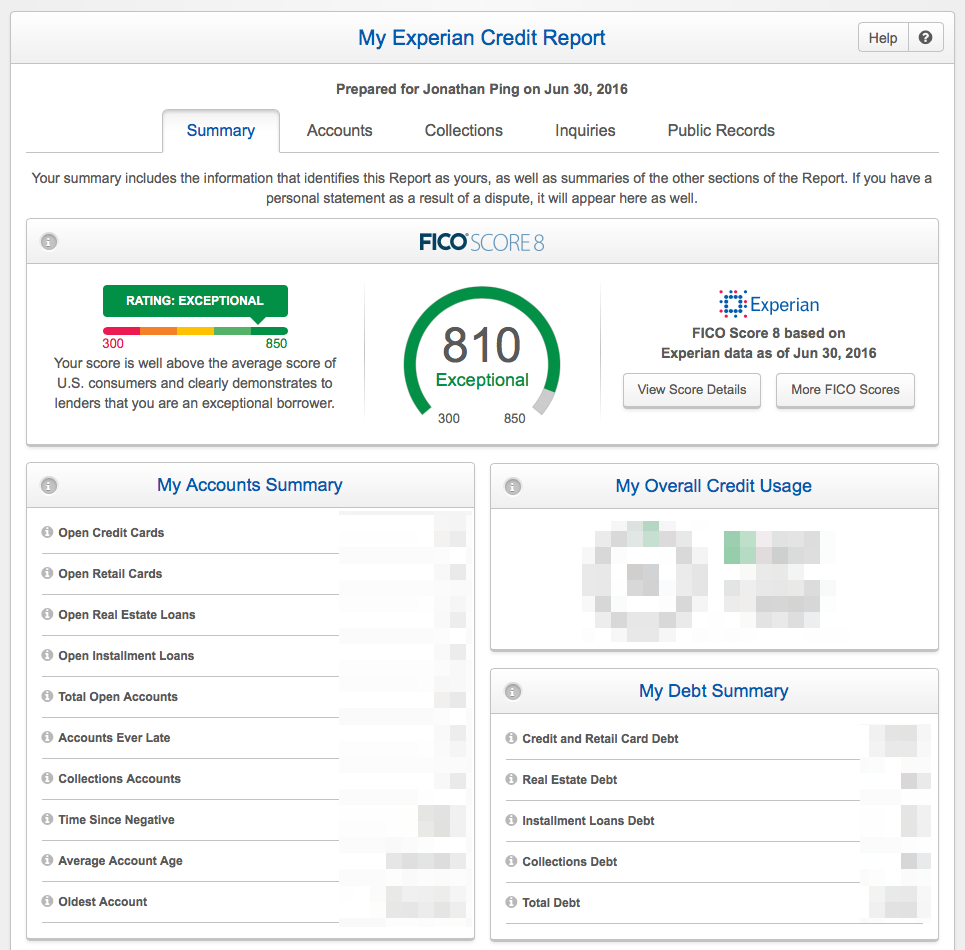

This is similar to, but not the same as, a personal credit score or personal FICO score. Most people are familiar with the concept of personal credit scores. There are a few key differences between these and business credit scores. For personal credit scores, the ratings range from 300 to 850, with most lenders requiring a minimum score of at least 600 for a personal loan.

Business credit scores range from zero to 100 and most small business lending companies require a minimum business credit score of 75. The Small Business Administration , banks, suppliers and other business lenders rely heavily on business credit scores and FICO scores when providing lines of credit or extended payment terms.

Don’t Miss: What Credit Report Does Mortgage Companies Use

Choose The Proper Business Structure

As a sole proprietor, your business and personal credit will be one and the same, says attorney Garrett Sutton, author of Own Your Own Corporation and founder of CorporateDirect.com. Choosing a company structure that separates business and personal finances may offer some benefits. Small business owners should talk to a business organization lawyer or CPA to find out what might work best for their situation.

Things You Should Know About Business Tradelines

Running and growing your business may require the use of credit. However, there are a few things you should know about tradelines in particular.

1. Not all businesses report tradelines to a business credit bureau

Taking out a business loan, opening a line of credit, or opening a trade credit account can help you build business credit, but only if that tradeline appears on your business credit reports.

Companies may not want to invest the time or money to create a reporting system and send updates to the credit bureaus, and they are not required to report your accounts or payments.

There are other business credit bureaus that dont let you manually submit trade references to try and build your credit history.

Fortunately, many companies report tradelines. Even then, you should check which business bureaus they belong to.

As a result, building your business credit with Experian is important, but it wont matter if you apply for trade credit with a supplier who checks your Equifax Business or D& B report.

2. Be cautious about buying tradelines or shelf companies

If youre looking for a fast way to build your business credit, youll quickly discover there are companies that sell tradelines. These are usually seasoned tradelines, meaning theyve been in business for quite some time.

Generally, the seller will authorize your business to use the tradeline. A shelf company is a company formed on paper that sits on a shelf until its sold.

4. You want more than one tradeline

Don’t Miss: Do Insurance Companies Report To Credit Bureaus

What Is A Business Line Of Credit And How Is It Different From Other Business Loan Types

A business line of credit can be seen as a cross between a business loan and a business credit card. Like a business loan, an unsecured line of credit provides business financing that can be used for general business expenses. However, with a line of credit, there is no lump-sum disbursement a business owner borrows only what is needed and only pays interest on the amounts borrowed.

Like a credit card, the amount of capital available to draw down and the payments are revolving and is usually subject to annual review. Interest begins to accrue only when money is drawn and interest only applies to those amounts. The funder will set a limit on the amount the business may borrow.

Get Started With A Business Line Of Credit

National Business Capital offers a flexible business line of credit for small businesses with at least three months of operating history and $120,000 or more in annual sales.

You dont need a stellar FICO score to qualify, and you can get access to your credit line in just a few hours. Credit limits range from $10,000 to $5 million.

You can link your bank account to learn your interest rate and repayment terms faster than ever, without ever submitting a credit report.

With no collateral requirement and the option to increase available credit as your business grows, Nationals true revolving line of credit can be tailored to your needs. Get started by applying now!

Recommended Reading: What Credit Score Do You Need For A Personal Loan