Five: Dispute Any Errors

If you come across any inconsistencies in any of the steps listed aboveeven if its as seemingly small as an incorrect zip code on an old addresscontact the credit bureaus and the company that authorized the line of credit and ask how to fix the error.

Correcting more serious errors, like accounts that are wrongfully reported as past due or delinquent, will require filing an official dispute letter.

Since negative information can hurt your ability to qualify for a credit card, the loan amounts or credit limits you get approved for, youll want to get this sorted out as soon as possible. Heres a guide on how to do exactly that.

Negative Information If Any

The negative information;section will;list;accounts that haven’t been paid as agreed, collections and public records such as bankruptcies.;Negative information generally stays on your credit report for seven years, with the exception of Chapter 7 bankruptcies, which stay on your report for 10 years.

In this section, youll want to make sure any negative information is accurate. If you see incorrect accounts or collections or if something is being listed after it was supposed to have dropped off, dispute the entries immediately to have them removed from your report.

Take Any Advice Or Pointers

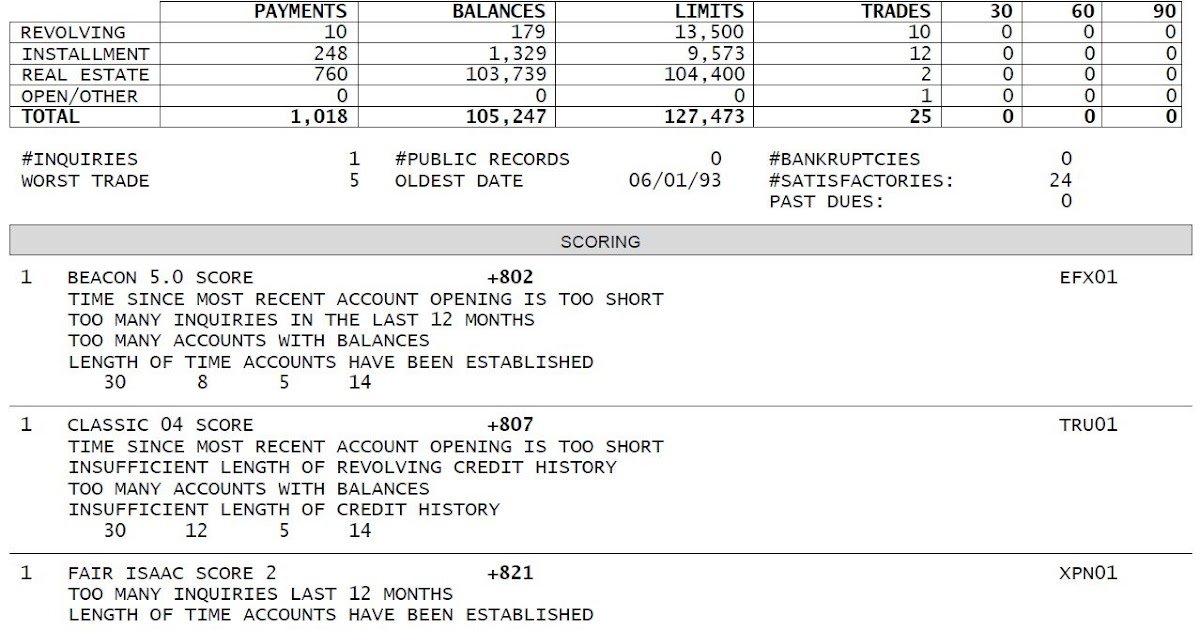

Your credit report, right below your credit score, will outline precisely whats dragging your score down. It will list three factors in order of importance to guide you on what you can do to improve your ranking. Read this section carefully.

Some examples of pointers include: Missed payments in the past two years, accounts going into collections, abusing your credit utilization ratio, opening too many accounts, or even not opening enough. There are hundreds of potential reasons that the report could generate.

Dont be too discouraged if your credit score isnt perfect. Keep in mind, your financial institution and creditors arent focusing solely on the number. They work in other internal factors, too, such as your client history and their own risk algorithms.

Also Check: Does Paypal Credit Report To Credit Bureaus

Where To Order A Credit Report

There are many different websites and services you can use to generate credit reports.

In the United States, three giant credit reporting agencies collect the financial data used in most credit reports:

Personally, I use Cozy. It has a downright idiot-proof way of requesting reports from tenants and borrowers .

The best part is that the system actually requires;the applicant to pay for the report, so it doesnt cost me anything to do this essential piece of homework on the people Im considering working with.

Experian provides the credit reports from Cozy. Luckily,theyre some of the most user-friendly credit reports Ive ever seen. And Ive seen a lot of them in my time.

That said, I think the average person could still benefit from a little bit of hand-holding. I put together this short video to walk you through one example.

Note:;Some of the links throughout this blog post are affiliate links that will generate a small commission for the REtipster Blog at no additional cost to you. If you feel Cozy will help achieve your goals and you decide to use these links, your support is very much appreciated!

How Many Credit Inquiries Are You Making

Whenever you ask for a loan or a new credit product, the potential lender will pull your credit report to see how trustworthy you are. These requests for your credit report will show up in this section itll detail the date, the requestors organization and their contact information.

Nothing should look unfamiliar in this section. If your credit report is being pulled without your knowledge, this could be a red flag for fraud.

Don’t Miss: Paypal Credit Soft Or Hard Pull

Dispute Credit Report Errors

Experian, TransUnion and Equifax all accept online disputes. You can easily fill in your information online or dispute by mail or over the phone.

- Equifax:;You can dispute online or by mail to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256. Dispute over the phone at 349-5191.

- Experian:;You can dispute information online or over the phone using the toll-free number included on your credit report. Dispute by mail at Experian, P.O. Box 4500, Allen, TX 75013.

- TransUnion:;Call the toll-free number 916-8800, dispute online or by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016-2000. Make sure to complete and include the request form on the website.

Collections And Public Records

Hopefully this section of the credit report will be empty. However, if you’ve had accounts that have been sold or turned over to a collection agency for non-payment, this is the section where they will appear on your report.

A collection account on a credit report should contain the following information:

- The name of the collection agency

- The original creditor’s name

- The balance on the account

Currently the only public records included on credit reports are bankruptcies.

If you do have collection accounts or bankruptcies on your reports, they’re likely having a negative impact on your credit scores. Thankfully, as negative items grow older, any impact on scores lessens over time. Best of all, after seven to 10 years, federal law requires most negative information to be deleted from your credit reports entirely.

Don’t Miss: Does Zzounds Report To Credit Bureau

How To Read A Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Regularly reviewing your credit reports;lets you check for errors that might be lowering your credit scores, and it can tip you off to potential identity theft. You can use the dispute process to get;mistakes removed, which may help you qualify for credit or get better terms.

Why Is My Credit Report Important

Your credit report tells lenders, employers, and insurance companies everything they need to know about your financial responsibility.

A poor credit history signifies that youre a high risk of default. A good credit history shows that youre financially responsible. If you fall somewhere in between, youre average, and thats a good thing.

Youll use your credit report a lot. Lenders pull it every time you apply for new credit. New employers often check it to see your financial history. Insurance companies use it to determine your premiums. Youll even use it to check for errors and dispute them.

Don’t Miss: Is 584 A Good Credit Score

What Is A Credit Report

A credit report is kind of like a report card for your credit history. It can be used by potential lenders to determine your risk, which is basically just how likely you are to pay your monthly payments on time. A credit report all about you can tell them:

-

The date you opened any credit accounts or took out any loans

-

The current balance on each account

-

Your payment history

-

The credit limits and total loan amounts

-

Any bankruptcies or tax liens

-

Your identifying information

A credit bureau or credit-reporting company like Equifax, Experian or TransUnion will provide your information to whatever company may be considering giving a loan or credit account. These bureaus all operate independently, so their reports on you may contain slightly different information depending on the credit-reporting company they used.

Who Can See My Credit Report

Most people cant legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If youre worried at all, do some research and find out what the law is where you live.

Also Check: Is 524 A Good Credit Score

Study Your Accounts Closely

The meat of your credit report lies in your accounts and the stories they tell. Your credit report will list all of your accounts and your payment history, as reported to TransUnion and Equifax by your creditors.

Each account is listed, along with the type of credit it is. Revolving accounts, for example, are credit cards and lines of credit. Installments could be car loans and Open means accounts, such as cell phone accounts and utilities, in which your monthly bill isnt a fixed amount.

Your report also states whether your account is an individual account youre solely responsible for, if youre a co-signer or if youre sharing a joint account.

Zero in on your payment status. You want this section to say Paid as agreed. If youre missing payments, make sure its not a mistake on your creditors end. And try to rectify the issue by getting back to making payments on time.

This part of your report may point to banking information but there will only be data here if you have an overdraft account thats gone delinquent or into the hands of a collection agency. Your credit report will never state how much you have in your bank account.

Accounts reported to these agencies will stick around on your record for years Equifax, for example, holds onto records of accounts for six years. If you have a credit card debt thats five years old, for example, it may be better to leave the account untouched than to pay the debt and let it linger for another six years.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Read Also: Can You Get A Credit Report Without A Social Security Number

How To Clean Up Your Report

Improving your credit score and cleaning up your credit report isnt as simple as paying missed bills and becoming debt-freealthough that can help. Paying your bills on time and consistently, never missing a payment, holding various credit accounts, and apply for credit only when you need it, can increase your score.

However, poor credit choices and bad financial decisions can stay on your report for upwards of six years, if not longer. That is why starting on the right foot, with a good understanding of your credit report and how it can affect your future financial choices is vital for reaching your goals.

Reviewing your credit report at least once a year can help you catch and report errors. If you think an item on your report is an error, first, contact both Equifax and TransUnion and notify them of the mistake. If the error is in your personal information, you should ask that the details be corrected. If the item is suspected to be fraud, request an alert on your credit report. Also, inform the Canada Anti-fraud Centre.

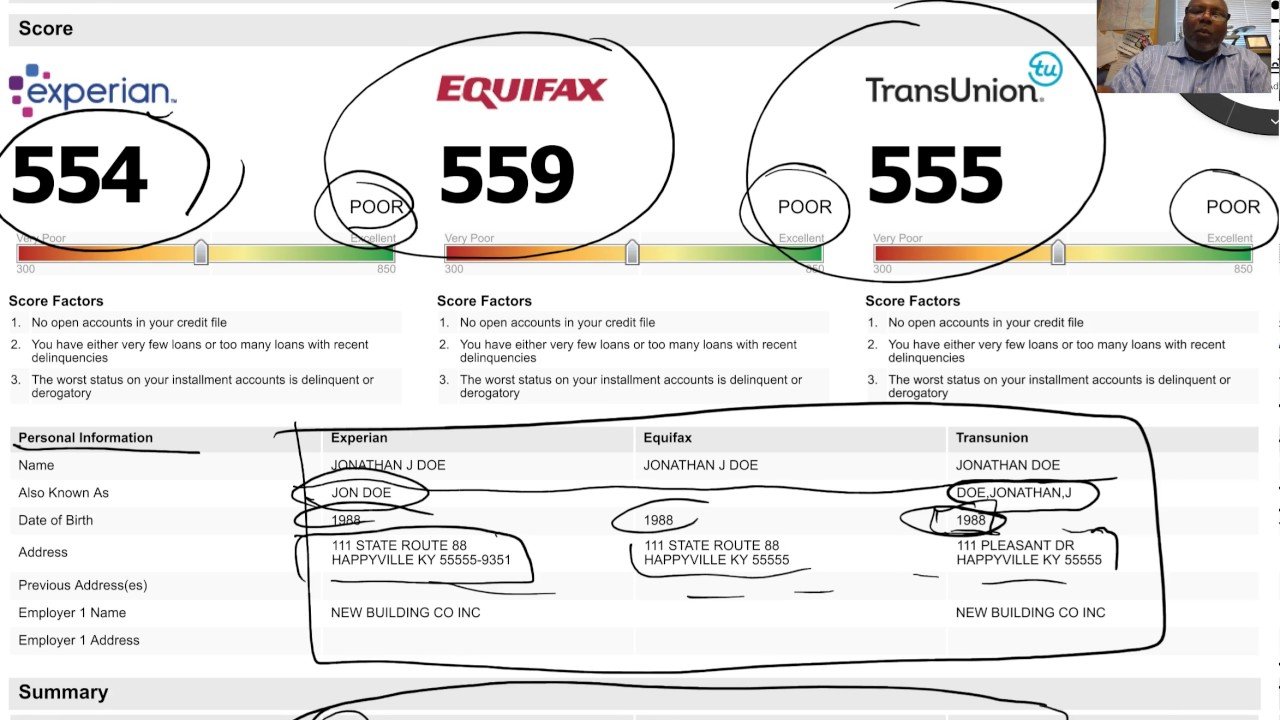

Personal Information On Your Credit Report

The personal information included in your report is used to identify you. It contains basic information like your name, address, and place of employment. Previous addresses and employment might also be included.

Its not uncommon to have variations or misspellings of your name. Most leave these variations to maintain the link between your identity and credit information.

Having different variations of your name and old addresses won’t hurt your credit score as long as it’s actually your information. Check this section to make sure personal information is identifying you and not someone else.;

You May Like: How To Get Credit Report Without Social Security Number

Will A Bad Credit Message Stay On My Report Forever

Bad credit on your report can lower your score. If you miss payments or make partial payments, or if there’s been an error, it can leave you with a bad credit message or note. These messages can linger on your credit report not forever, but for years. Bankruptcies and consumer proposals;stay on your credit report;for up to seven years from the date of discharge for your first occurrence, and even longer for subsequent bankruptcies.

If you think there’s an error on your report or you have the opportunity to fix a situation that’s hurting your credit, ask the lender to report it to the credit bureau. They may be able to help raise your credit sooner.;

How To Understand Your Credit Score

A combination of factors make up your credit score, the single number that holds all the weight in your credit report. The factors include:

- Payment history: ensuring you have a steady habit of making payments on time

- Utilization ratio: the amount of credit you use divided by the amount of credit available to you

- History of accounts: longstanding accounts are valuable as they show a lengthy history of being a good borrower

- The number of inquiries youve made: seeking credit too often may make you look like a risky candidate

You can find out more about the key factors that are used to calculate your credit score. However, its good to be aware that your credit score can vary between credit bureaus and financial institutions. This can be because each credit bureau may have different information about your debts and because each bank often creates its own proprietary credit score that it requires its employees to follow when lending money. At the end of the day, though, all of these credit scoring systems are fairly similar. Each one just puts a little more or less emphasis on certain aspects of your credit history.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

If You Find Errors Dispute Them

If you find incorrect or outdated information on one of your credit reports, you can file a dispute with the credit bureau to get it updated. Mistakes happen and its important to catch them as incorrect information can affect your credit score, as well as any application processes that consider your report.

Get In The Habit Of Monitoring Your Credit

Check your credit often. If you dont, check out our list of the best credit monitoring services.

Check your credit report for any errors made on your credit report. It affects your financial future. For example, if a lender reports your mortgage payment late for 30 days, thats a big hit on your credit score. Plus, it looks bad to new lenders.

The longer incorrect information sits on your credit report, the more it hurts your credit score. Monitoring your credit often ensures you catch these issues right away.

Don’t Miss: Does Klarna Affect Your Credit Score

Accounts With Adverse Information

If you fail to make timely payments or an account falls into collection, it will show up in this section.

What To Look For:

Look at the names of the accounts listed in this section to be sure you recognize them. If youve been the victim of identity theft, a fraudster may have opened an account in your name.

While you cant dispute negative information in your credit report just because its negative, you can dispute accounts that are inaccurate or the result of fraud.

How This Impacts Your Credit Score:

Missed payments are a major credit score factor. Adverse information will typically remain on your credit report for up to 7 years.

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Read Also: Aargon Collection Agency Bbb

Four: Scan For Negative Information

The negative information section, sometimes listed as public records, is a running tab of everything that can lower your credit score. These include red flags like bankruptcies, foreclosures and repossessions.

All of this data listed here has the potential to ding your score, but most bad marks go away after seven years. The exception is Chapter 7 bankruptcy, which will stay on your credit report for 10 years.

A list of all your credit inquiries will also appear on your credit report, since hard inquiries can act as a signal to lenders that you want or need more credit, which is another red flag.

Soft inquiries come from checking your own creditwhich many banks allow you to do for free from their website or appor when you authorize someone else to do so, like a potential landlord. These types of inquiries also appear on your credit report, but they dont impact your score.

Who Can See Your Credit Report

Any potential lender or creditor can ask to see your credit report. They use the information contained in your credit report, mainly your credit score and any possible black marks or past financial issues, to evaluate your credit worthiness. People with higher credit scores and fewer financial issues tend to have better or more appealing credit reports which means theyre more likely to get approved for the credit and loans they want.

While its less common, employers and landlords can also request to see your credit report. They are typically looking for a sense of your reliability, they work under the assumption that people with good credit scores and attractive credit reports tend to be more reliable in general.

Finally, you can request a copy of your credit report. Keep in mind though that a copy of your credit report will not include your credit score.

Also Check: Mprcc On Credit Report